What is KYC Remediation?

KYC remediation involves updating or correcting customer data to ensure compliance with regulatory requirements such as ID documents. For instance, The Corporate Transparency Act (CTA) implemented on January 1, 2024, requires US and foreign businesses in the US to report their beneficial owners to the government. Non-compliance would result in jail for 2 years and fines up to $10,000.

KYC remediation strategies will assist with settling any current issues or disparities. This process is significant for organizations to keep up with legal compliance and lessen the risk of financial crimes. However, if the company fails to verify the clients or violates the KYC rules, you will be subject to a remediation process as required by the law. This can appear as warning letters and fines of up to $2,500 per day until the company changes its rules and regulations.

KYC remediation can happen for many reasons, such as

-When regulations change,

-Suspicious activity occurs,

-The AML risk level assigned to your customers based on their information, or

-When customer data is found to be incorrect, missing, or expired

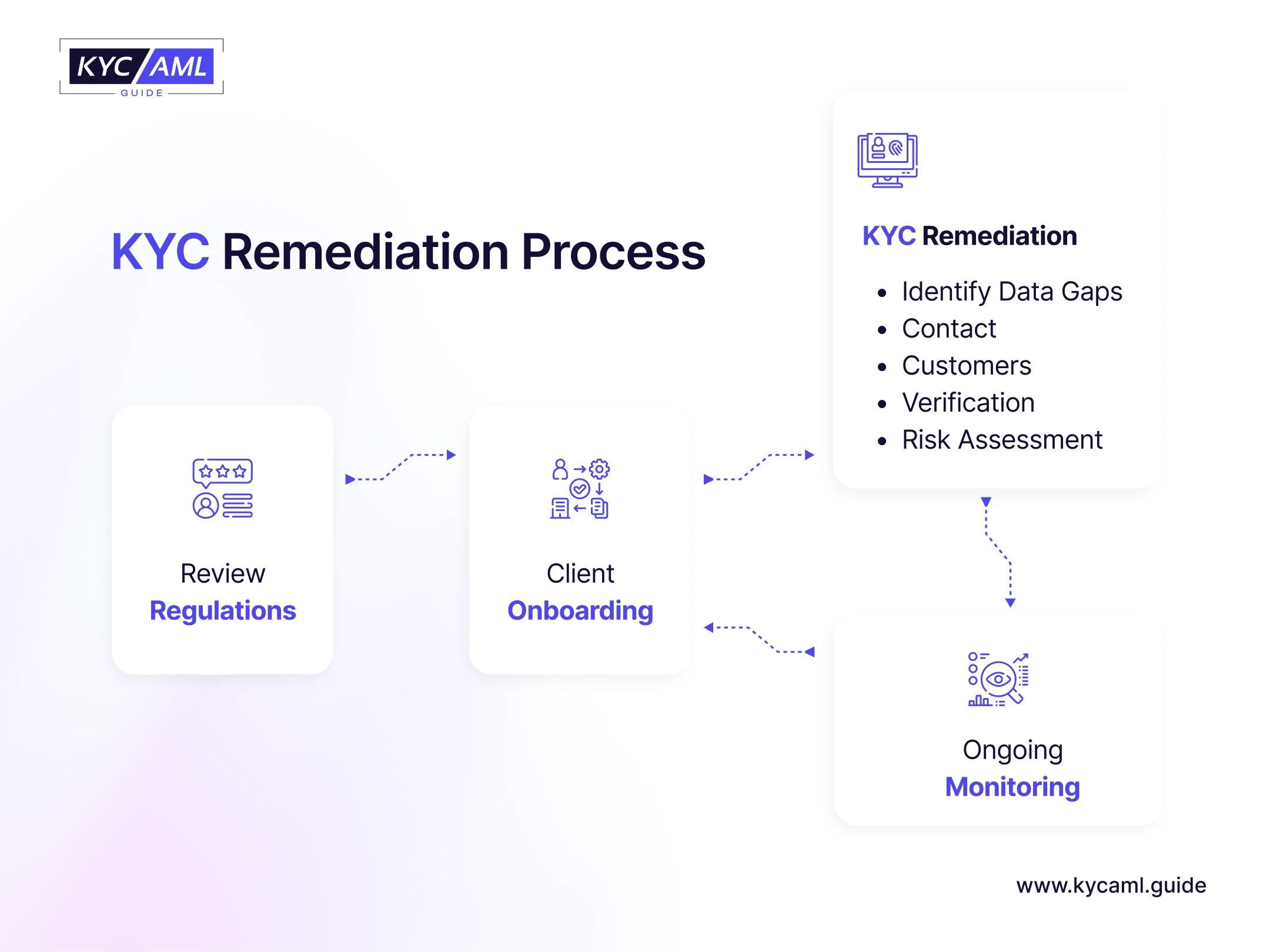

KYC Remediation Process

The KYC remediation strategies are an important part of the broader KYC lifecycle, and strategies vary from company to company. A common approach usually involves screening, verifying, and identifying customers. The most common strategy is risk-based methods. The purpose behind this is to determine the risk of terrorist financing and money laundering for high-risk clients who go through extensive remediation. Regulatory changes and client profile changes require KYC information to be refreshed, making the remediation cycle time-consuming and costly.

KYC remediation process can be done by manual or automated process. The main goal is to distinguish between high and low customer profiles and customer profiles that are the most vulnerable to money laundering. To better understand the KYC remediation process, it is discussed below

Step 1: Review new regulations and compliance

KYC and AML regulations are changing over time to keep up with fraudsters. For example, they update laws to prevent fraud such as identity theft, lying, etc. Therefore, the first step in the KYC recovery process is to check the latest AML or KYC laws and regulations in the country where you operate. For example, AML regulatory changes in the EU consist of

-AML Regulation (AMLR)

-The establishment of a new EU AML/CFT supervisory authority, known as AMLAR

-AMLD6

-A revision of Regulation 2015/847/EU on the transfer of funds, expanding its requirements to cover specific crypto-assets

-New rules for VASPs

Once you are aware of the changes, make sure you are still following the new rules. Is your organization the right one? Are there new customer documents you should ask about? Any changes in the way confidential information is stored?

Step 2: Adjust your KYC process

Now you can start your KYC process. To make your organization adapt to new changes, you need to do it as quickly as possible. Follow and update various methods to do KYC onboarding. Adapt and implement various measures to conduct KYC remediation strategies. In the meantime, you are onboarding new customers.

You can do this by following the new KYC regulations.

Step 3: Identify incomplete or outdated information

The first step in remediation is to identify older customers who have been out of business for a while. This could be because the customer is lost or does not contact your company. It is also important to know which of your customers have made more than one transaction. This will help you identify the customers who need to be protected first during the remediation process and whether they are at risk, as these types of customers generally require a high level of verification to ensure compliance with the law and KYC regulations.

Data remediation can also reveal data that no longer exists, such as inactive or closed accounts, or accounts of deceased people. It is very important to have a process for deleting this data that follows proper record-keeping rules. Storing redundant data increases business risk because it spreads the potential impact of a data breach. Deleting expired customer data limits the risk. Additionally, legal requirements such as GDPR and CPRA require data to be deleted when certain conditions are met, making compliance necessary to avoid legal fines.

Step 4: Contact customers

You may have customers who do not provide their name, date of birth, proof of address, occupation, source of funds, and social security number. You must contact the customer to collect this information before your company can update the customer’s information.

Step 5: Verification

Remediation of customer identity is the process of updating and verifying customer identity information to ensure accuracy and legal compliance. This step verifies the accuracy of the customer information against trusted sources like government databases or credit bureaus. In case of irregularities or issues during the verification process, other steps might be taken, for example, interviewing the customer or requesting additional documents.

Step 6: Risk assessment

Assessing a client’s risk profile based on updated information may include adjusting your risk assessment and evaluating the effectiveness of your program. This process may also include due diligence, especially for clients classified as high risk, to ensure they fully understand their obligations on a financial basis.

Step 7: Ongoing monitoring

The steps described above are repeated for each customer based on their risk. For example, many companies work as follows:

| Risk Level | KYC Remediation Period |

| Low level of risk | 24 to 36 months |

| Medium level of risk | 12 to 24 months |

| High level of risk | 6 to 12 months |

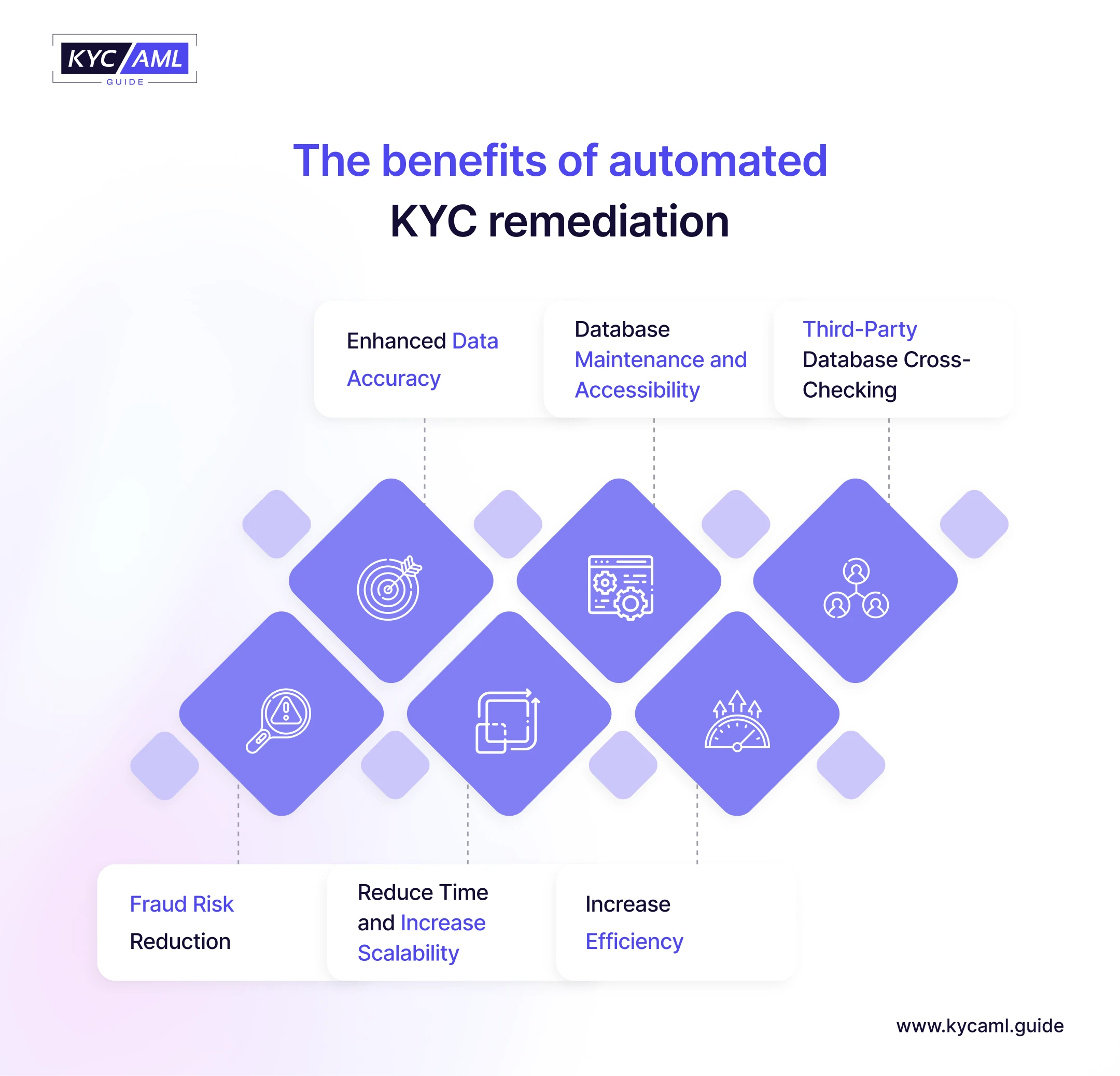

How Can You Automate Some Steps in Your KYC Remediation Process?

The manual KYC remediation strategies take a lot of time from your team and CDD staff to ensure that the data is up to date. This includes asking your customers to submit documents, checking documents, entering data into databases, and updating customer profiles. This is a time-consuming process that you must perform for each customer if you run out of data or information.

With modern technology and access to various software, you can automate some steps of the KYC remediation process. For example, your employees no longer have to manually send messages to their customers when they need to provide documents to update their information. Many email automation tools can do this for you by setting up rules. For instance, you can set up rules to send email reminders to clients 1 month before the expiry of ID documents.

Automation of KYC remediation is important to maintain compliance with KYC regulations. Automated processes can reveal inconsistencies or changes in customer profiles that require further analysis, streamlining the initial screening process and reducing manual work. It also reduces the chances of human errors and operational costs. Automated KYC remediation strategies enable customer experience by ensuring regular and timely updates.

Tips for Successful KYC Remediation Strategies

Here are a few tips to improve your KYC remediation strategies

A Leverage of Advanced Technology for Data Analysis:

Advanced technology and software can be used to manage and analyze large amounts of customer data use. These tools enable a risk-based approach to KYC compliance and address the need for enhanced due diligence. Advanced software automates the identification of missing or incomplete KYC profiles, automates data analysis, and reduces manual verification efforts.

B Create a Customer-Centric Program:

Develop a customer-centered KYC remediation strategy that prioritizes the client’s needs and minimizes negative consequences. Implement automation and verification of online biometric identification, such as selfies, voice recognition, and fingerprints, to improve security without compromising the customer experience.

C Establish Continuous Monitoring:

Set up a system for continuous monitoring of customer accounts by integrating it with KYC software and transaction monitoring systems. This allows you to quickly identify outdated information or changes to your risk profile while meeting changing standards. Regular updates, preferably annually or after significant events, as well as commercial monitoring for illegal activities, will help keep KYC data accurate and relevant.

D Promote Collaboration Across Departments:

Collaboration between compliance, legal, and customer service departments works together to gain a comprehensive view of customers and identify potential risks more effectively. Train staff in the KYC remediation process to ensure a uniform and transparent customer data management approach.

E Learn from Past Mistakes:

A successful remediation process also depends on the company learning from past mistakes. You need to analyze your data and determine when the remediation program is failing, whether customers are participating in the process, and who is not. Missed the early signs of an AML/KYC issue? How can you address these weaknesses in your current program?

Find ways to improve your KYC remediation program to reduce your business risks, prevent money laundering, and better protect your customers. For example, is your onboarding process perfect? Have you screened your high-risk clients for signs of an AML problem?

Conclusion

KYC remediation strategies are significant for banks and financial organizations to comply with AML/CFT guidelines and to fight money laundering. Thanks to technology, the remediation process has become more accurate and efficient. Now is the time to find an ideal KYC remediation solution that can assist you with the process mentioned above. You can start your journey with the KYC AML guide, as we can provide you with consultancy for choosing the best solution.