What is Customer Risk Assessment?

Customer risk assessment also known as KYC risk assessment is an important process for businesses to assess customer risk levels and conduct appropriate checks to ensure a safe and compliant relationship. Money laundering, terrorist financing, politically exposed persons (PEP), and sanctions compliance/monitoring are all addressed in the assessment. It entails verifying the customer’s authenticity, comparing historical data, and verifying the identity.

The Financial Action Task Force (FATF) advises businesses to avoid entering into business relationships or to end them when they are unable to apply the proper level of CDD.

Dynamic Risk Assessment vs. Customer Risk Assessment

The two essential but different methods of risk management are dynamic risk assessment (DRA) and customer risk assessment (CRA). DRA is useful in dynamic industries because it focuses on real-time monitoring and adaptation to rapidly changing risk factors. Contrarily, CRA focuses on assessing the risk connected to particular customers, which is crucial in industries governed by KYC and AML regulations. These two strategies can work well together to develop a thorough risk management plan. Organizations can react quickly, ensuring both general risk mitigation and legal compliance, by combining DRA’s capacity for spotting emerging risks with CRA’s insights into customer-specific risks.

Regulations for Customer Risk Assessment

Businesses must adhere to many regulations. These regulations require them to verify user information to prevent frauds like chargeback rates, account takeover, and bonus abuse that could harm the company directly or indirectly. The regulations are

- The International Money Laundering Abatement and Counter-Terrorist Financing Act,

- The USA PATRIOT Act,

- The UK Proceeds of Crime Act 2002,

- JMLSG Guidance, and

- Third European Money Laundering Directive.

How to Conduct an Effective Customer Risk Assessment?

Consider yourself an admissions officer for a mid-sized fintech firm. Your company provides digital payment services, and you want to ensure that your customers understand and comply with anti-money laundering (AML) regulations. Here’s a step-by-step guide to conducting an effective customer risk analysis in your organization

1. Assemble your Risk Assessment Team.

Create a team dedicated to assessing customer risk first. Compliance officers, data analysts, and legal experts are examples of these members. Ensure that all team members understand your company’s AML policies and procedures.

2. Identification of Industry-Specific Risks

Determine the unique risks in the fintech industry. Consider the risks associated with digital payments in your situation, such as fraud, money laundering, and the use of cryptocurrencies. These risks may differ from those encountered in traditional banks or other industries.

3. Examine the Identified Risks

After you’ve identified the various industry risks, analyze them to determine their potential impact on your company. Investigate, for example, how fraudulent transactions or money laundering activities can harm your company’s reputation.

4. Gather Data and Set Key Performance Indicators (KPIs)

Collect key data or information relevant to the risk assessment of the client. This includes investigating the customer’s identity verification, business history, transaction monitoring, source of funds, and any red flags that could indicate suspicious activity.

Set KPIs that will allow you to effectively track and measure risk rates. You could, for example, establish KPIs for the number of high-risk customers identified, the percentage of transactions flagged for review, or the time required to complete due diligence.

5. Ongoing Monitoring and Behavioural Analysis

Maintain a constant eye on customer behavior and transactions through perpetual KYC. Keep an eye out for common behaviors that may necessitate a reevaluation of a customer’s risk profile. These are some of the behaviors for customer risk management:

- Frequent bank or financial institution changes in a short period

- A significant infusion of private funds from an individual running a cash-intensive business

- Requests for accelerated or unusually quick transactions.

- Complex ownership structures raise red flags

- The use of forged or fraudulent documents

- Different rates of business activity

- Involvement of a third-party financier who has no obvious connection to the customer

- Attempts to conceal a company’s true ownership

- A high number of cash transactions that are not consistent with the customer’s profile

- Transactions involving countries where there is a high risk of terrorist financing or money laundering

6. Use Technology and Machine Learning.

Consider using technology, such as machine learning algorithms, to improve data analysis and customer profiling. These tools can assist in automating the detection of red flags and ensuring that customer profiles are kept up to date. A better customer experience, real-time monitoring, increased efficiency, and improved accuracy are all advantages of technology in customer risk assessment. Big data analytics, the use of biometric data, and financial institution collaboration are important trends.

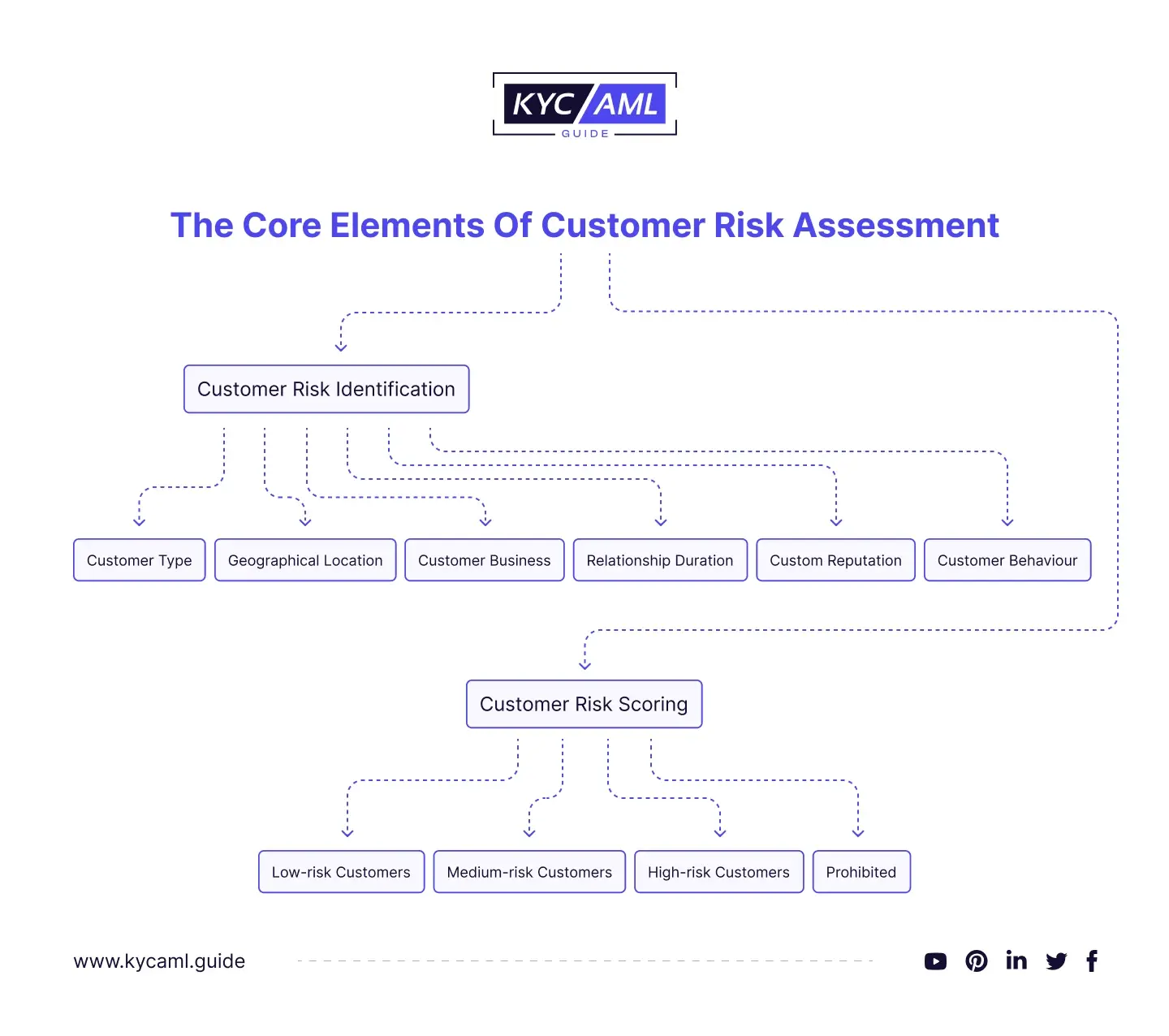

The Core Elements of Customer Risk Assessment

To conduct a thorough customer risk assessment, keep the following points in mind:

1. Customer Risk Identification:

The first step is to identify factors that may indicate a customer’s susceptibility to fraud or financial fraud. When determining a customer’s risk level, several factors come into play, providing a comprehensive picture of the risk they pose to your business. Let’s look at this

a. Customer Type

It is critical to identify the type of client you are dealing with before beginning the risk assessment process. Individuals and businesses are divided differently, with additional considerations for the latter.

Assume you work for an online investment platform. A new user created an account. During your research, you discover that the new user’s father is a well-known government official. The new user is treated as a political party (PEP) in this case due to her family’s affiliation with PEP. This categorization results in a higher risk assessment for the new user.

b. Geographic Location

When evaluating customer risk, geographic factors are important. The locations, country of residence, and IP addresses of your customers can offer useful information about potential dangers.

Consider managing a global e-commerce platform. A client “A” registered to live in a neighborhood with low crime rates. However, after conducting due diligence, you discover that the IP address used to launch ‘A’ company is from a high-risk nation notorious for financial fraud. This conflict prompts a more thorough risk assessment.

c. Customer Business

It’s critical to comprehend the client’s business or professional role. Some businesses pose a greater risk because they have a history of financial crimes.

As an illustration, your company specializes in offering financial services to businesses. Michael is a potential client of yours and he owns a business in the arms business. Due to its potential connections to money laundering and illegal activity, this area is recognized as one with a high risk.

d. Customer Reputation

The reputation of a client may influence how they evaluate risk. Investigate the customer’s reputation, check for mentions in adverse media, and review other pertinent sources.

You oversee compliance at a financial institution. You will encounter a client named John during routine checkups who appears in the bad news in adverse media related to money laundering. You adhere to guidelines that emphasize verifying the veracity of such claims to determine John’s level of risk. You will discover after conducting a thorough investigation that the allegation is unfounded and coming from unreliable sources. John is therefore considered a medium-risk customer.

e. Customer Behavior

Analyzing consumer behavior can produce insightful results. Important considerations include whether they give false information, participate in unusual transactions or board with excessive secrecy.

You are employed by an online payment gateway. Without a good reason, a customer named Lisa shows reluctance to provide crucial information needed for verification. Her actions raise questions about her motivations and intentions and point to a possible attempt to cover up her true professional nature. Lisa’s risk assessment therefore yields a higher-than-normal risk level.

f. Relationship Duration

The length of a business relationship may also affect KYC risk assessment. Even though there is typically less risk in long-term relationships, it is important to take historical trends into account.

Suppose John has been a devoted client of a real estate company for five years. But after looking over John’s past, you find a troubling pattern: every year, he engages in significant real estate transactions. While each of these transactions appears to be legal on its own, taken as a whole, they reveal a pattern that has a suspicious pattern. John’s risk assessment therefore finds a higher-than-normal risk.

2. Customer Risk Scoring:

Assign a risk score to the customer after analyzing the risk criteria. Typical customer risk rating methodology is:

- Low-Risk Customer: Those whose identities can be quickly verified and whose financial transactions are open and honest.

- Medium-Risk Customers: Persons or organizations with slightly higher risk profiles, frequently as a result of their residence or place of employment.

- High-Risk Customers: These clients demand thorough due diligence, particularly if their funding source is unknown.

- Prohibited: Your company should not do business with people or entities engaged in financial crimes.

Understanding Types of Customer Due Diligence (CDD)

Customer Due Diligence (CDD) is the cornerstone of a strong framework for customer risk analysis because it ensures that businesses have a thorough understanding of their clients and any potential risks they might present.

1. Customer Due Diligence (CDD)

A common practice used with many clients is CDD. Analyzing the customer’s identity, sources of income, and the nature of their business relationship with your company are all part of this process. If the given criteria support other forms of due diligence, this applies to a large number of customers.

2. Simplified Due Diligence (SDD)

When there is little potential for money laundering (ML) or terrorist financing (TF), SDD is used. Each jurisdiction may have different requirements for using SDD procedures, which could include:

- Public administrations or publicly owned businesses.

- Clients from low-risk countries.

- Few financial products, including e-money and life insurance.

- Pension funds or child trust funds.

- Companies listed on regulated markets.

- Companies with pooled account

3. Enhanced Due Diligence (EDD)

EDD is only used with high-risk clients or in particular circumstances as specified by applicable laws. It entails a more thorough evaluation of the risk profile of the customer. EDD may be necessary in some circumstances, including:

- High ML/TF risks

- Unusually difficult or large transactions.

- Transactions that don’t seem to have a clear economic or legal goal.

- PEP and Close relatives

- Relationships between businesses and parties in high-risk areas.

- Forged identity document

- A customer from a nation on the FATF Grey List or a region known for having a high risk of money laundering represents a greater risk to the company than a customer from a region with strict anti-money laundering laws.

Benefits of Customer Risk Assessment

Customer risk assessments provide several significant benefits:

Financial Loss Protection:

By thoroughly assessing the risks associated with new and existing customers, businesses can reduce their exposure to financial losses.

AML and KYC Compliance:

Using robust risk assessments helps companies comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, allowing them to avoid fines for noncompliance.

Reputation Protection:

Customer risk management reduces the risk of fraud and money laundering, protecting financial institutions’ reputations. As a result, customer trust is maintained

Increased Operational Efficiency:

Customer risk assessment solutions simplify compliance processes, increasing operational efficiency. Identifying and mitigating potential risks as soon as possible allows teams to reduce the amount of time and resources required to deal with incidents.

Customer Confidence:

These assessments give customers peace of mind and help them keep faith in the company’s commitment to security and compliance.

Bottom Line

In conclusion, customer risk assessment is essential to safeguarding businesses against potential dangers. It acts as the first line of defense against financial crimes and fraud, particularly in the context of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Companies can protect their integrity, financial stability, and marketability by meticulous KYC risk assessment.