KYC has become a worldwide requirement for all transactions involving business ties. Everyone must first provide relevant KYC documents, such as proof of identity and proof of address, to banks, insurance companies, and councils, as well as legal and accounting organizations. Read on to learn about the common mistakes in the KYC document verification process as well as why KYC is a crucial layer of protection for businesses.

KYC authentication is used by businesses to verify the identity of their business partners and customers to comply with applicable laws and regulations. Failure to comply with the KYC process might result in significant fines for your company. As a result, to avoid costly KYC mistakes and be AML compliant, you must be alert and up to date on your KYC process.

Also Read: KYC Document Verification in Banks: Requirements & Best Practices

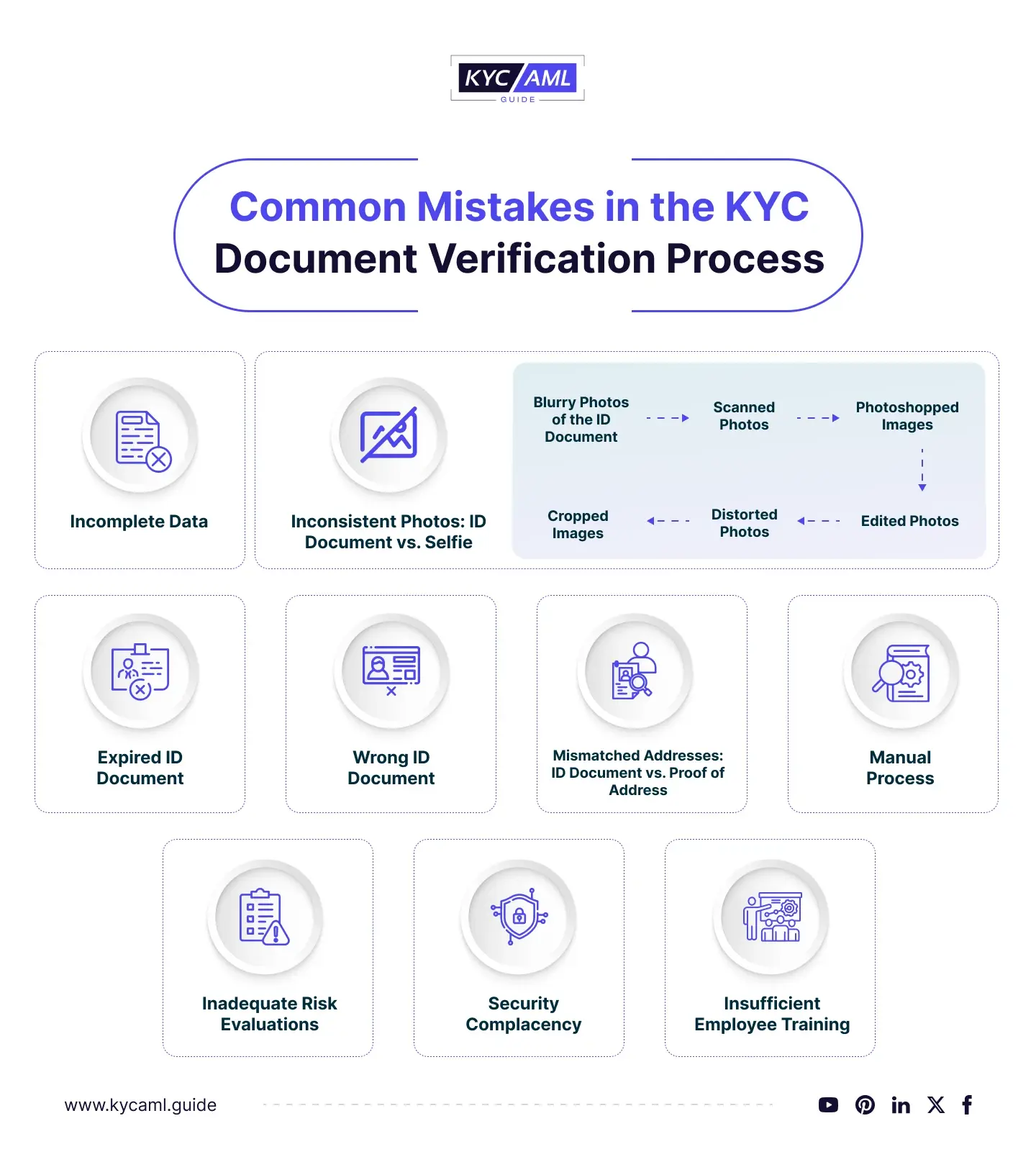

Common Mistakes in the KYC Document Verification Process

The following are some of the most typical mistakes that organizations make when doing the KYC document verification process.

Incomplete Data

It is critical to access the data and understand what to do with it. Internal data gaps can hinder compliance efforts and insights into client behavior, leaving them vulnerable to financial crime. Although the importance of data cannot be overstated, many financial organizations save and use incomplete client data files. Missing and/or incomplete data enables criminals to commit crimes by exploiting vulnerabilities or shortcomings in KYC and AML processes. Companies should prioritize enhancing internal and external database quality, integrity, and correctness.

Inconsistent Photos: ID Document vs. Selfie

Face verification is an essential part of identity verification. During the check, the consumer is required to submit a selfie in some KYC identity verification software. Images that have already been taken, cropped images, photos with filters, and edited photos are usually not allowed. The identity photo is matched with the photo on the government-issued ID document. If there is an inconsistency or mismatch for whatever reason, verification results are unfavorable.

Other pitfalls to avoid when uploading photos for the KYC document verification process are

Blurry Photos of the ID Document

The most common mistake in the KYC document verification process is shaky or blurry ID photos. Consumers often fail to upload clear images of government-issued ID documents, resulting in document rejection.

Scanned Photos

The acceptability of scanned images by KYC identity verification software is determined by its settings. Many KYC solutions, in general, accept scanned pictures for document verification. However, if the software detects forgery or tampering in scanned documents, it may reject verification. Additionally, pictures that are old, damaged, or do not accurately depict the person’s present appearance may result in verification failure leading to the loss of a customer for the company.

Photoshopped Images

Customers edit the photograph to increase its quality, and the system does not allow manipulated or photoshopped images. It is identified as a tampered ID document and onboarding will fail.

Cropped Images

Customers sometimes cannot provide the complete image of an identity document while uploading it. When uploading the document, sometimes the bottom of the document is not visible, or the user may have cropped the rainbow print resulting in a declined verification.

Distorted Photos

Photos uploaded for face verification must be clear, and distorted photos are one of the most common causes of verification rejection. This attempt is largely considered a spoofing attack.

Edited Photos

People prefer filtered selfies over their natural selves. These attempts, however, result in negative identity verification results. No filters, masks, or glasses are permitted in the face verification system. The photo must be clear and original to be used for face verification.

Expired ID Document

IDs that have been punched or are expired are not considered legitimate. Unfortunately, some users provide expired or fake IDs, rendering them ineligible for the KYC document verification process.

Wrong ID Document

Users can select the type of identity document they want. The verification fails if the user does not enter the ID chosen by the client. If the client has chosen a driver’s license as proof of identity and the customer uploads a passport, the verification will fail.

Mismatched Addresses: ID Document vs. Proof of Address

Address verification is another critical component of identity verification, particularly for e-commerce and fintech. A secondary identity document such as proof of address is uploaded for this purpose, and the address on the ID card is cross-referenced with the address on the proof of address. Any mismatch between the two will result in the authentication check being denied.

Using Manual Process

Typical errors in manual KYC document verification include data input issues, inconsistent formats in the documents, inability to identify forged images, and possible bias in judgment. These errors can lead to inaccuracies, compliance problems, and inefficiencies. Businesses frequently use automated KYC solutions to reduce these risks and improve the verification process.

Inadequate Risk Evaluations

KYC risk assessment is essentially a risk measurement, either of a single consumer or an organization. After collecting data from your customers, you must compile it. After that, you may examine the data and calculate a KYC risk rating for each customer. If the consumer has a risk score, you should keep a careful eye on them.

When risk assessments are inadequate it suggests that the risk connected with a customer or transaction has not been thoroughly or accurately assessed. This can lead to weaknesses, such as onboarding high-risk customers without conducting adequate due diligence, which could result in regulatory noncompliance or exposure to fraud and financial hazards.

Security Complacency

According to the UK government’s Cyber Security Breaches Survey 2023 report, 69% of big organizations recognized a breach or assault in the previous 12 months. It is the responsibility of the organization to store client identification documents and secure them from cyber threats. Customers demand data security when they provide their credentials to a corporation. Otherwise, the company’s reputation will suffer if consumers’ personal information is leaked.

Insufficient Employee Training

The KYC document verification process demands well-trained staff who can effectively understand and verify documents. Inadequate training can result in blunders and mistakes that have legal and reputational ramifications. Invest in training programs to guarantee that your team is ready to manage KYC processes.

Also Read: Why is KYC Document Verification Significant?

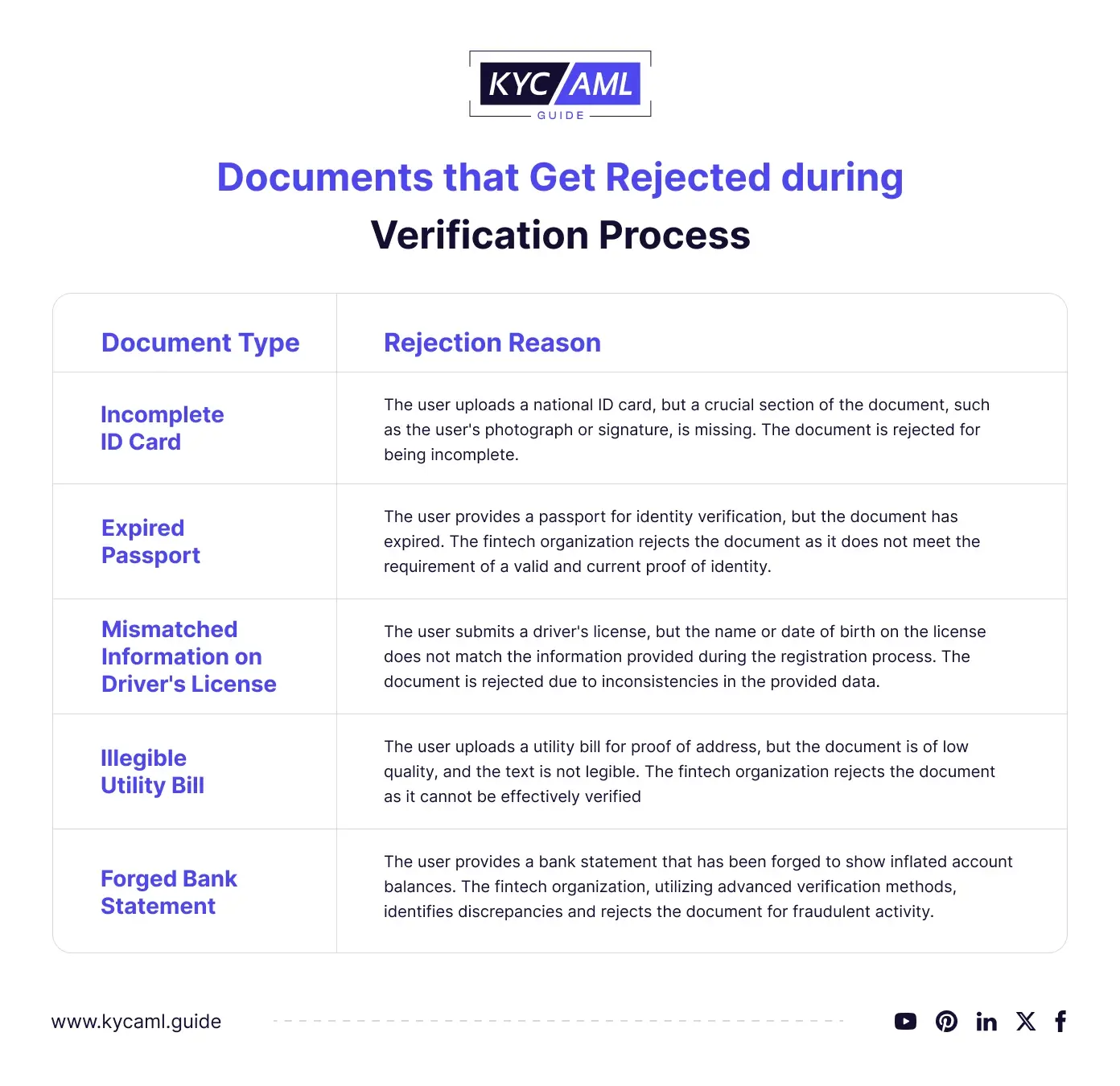

Document Rejections in the Verification Process

The following are some examples of documents that were rejected during the verification process.

KYC AML Guide: Tackling Mistakes in Document Verification

The KYC AML Guide is a research-based consultancy that provides knowledge to help with error-free document submissions. The guide specializes in providing research-driven KYC technology buying services in assessing whether the solution can effectively detect and understand the mistakes in KYC document verification. The guide aims to improve accuracy and compliance, resulting in a more seamless KYC/AML experience.

Conclusion

The KYC document verification process is an important measure for organizations, ensuring that they operate within the law while safeguarding themselves from fraud and financial hazards. By avoiding the mentioned mistakes, you may improve your KYC operations, maintain regulatory compliance, and develop client trust. To reap the benefits of a secure and compliant company environment, keep diligent, up to date, and prioritize accuracy in your document verification activities.