KYC Remediation

It is a process of organizing Customer data and information for Identification and Verification and removing all the inconsistencies found in it, then moving towards the next steps. It is a process that ensures that customers are not involved in any financial crime at any stage of the KYC process. Financial Institutions and firms need to perform the remediation process as a double-tier screening process. They can only initiate KYC remediation when the initial information of customers is collected and stored. Here, the Suspicious Activity Report (SAR) can be filed once risky customers are identified.

Importance of KYC Remediation

The Remediation process distinguishes between potentially risky customers and normal ones. Identifying risky customers is important when a KYC regulation is updated and to have to monitor customers closely. Firms mostly carry out screening, identification, and authentication continuously where internal compliance teams process the customer’s data manually or outsource it to a third-party data processing product. This process helps in providing a seamless experience, refining the data, monitoring, and screening it, and resolving false positives.

The Logic Behind Remediation – Stepwise Approach

Identifying Obsolete Data and High-Risk Clients

The first step of KYC Remediation is to identify outdated data and high-risk clients. The key to executing this step successfully is to address the risk posed by customers and not update every piece of information in the customer’s data files. Not every customer is risky, so identifying the highest-risk customers and allocating resources to them is a priority. In this way, firms can focus on important areas and manage the resources accordingly.

Data Cleaning

All the data collected needs to be identified and verified and returned as ‘clean data’ and then used for the business. Clean data is then added to the CRM systems.

Collecting Missing Client Identity

In the third step, the missing client identities or data are collected. A highly configurable API is a solution that classifies, organizes, and stores the missing data and client identities. It also fits the collected missing data into the relevant sections. The automated and cloud-based solution will efficiently verify customers’ data and documentation against multiple sources.

Ongoing Monitoring

Automated alerts and Red Flags are identified throughout the KYC Remediation since it is an iterative process. Continuous monitoring helps in avoiding more complexities and ensures due diligence all the way.

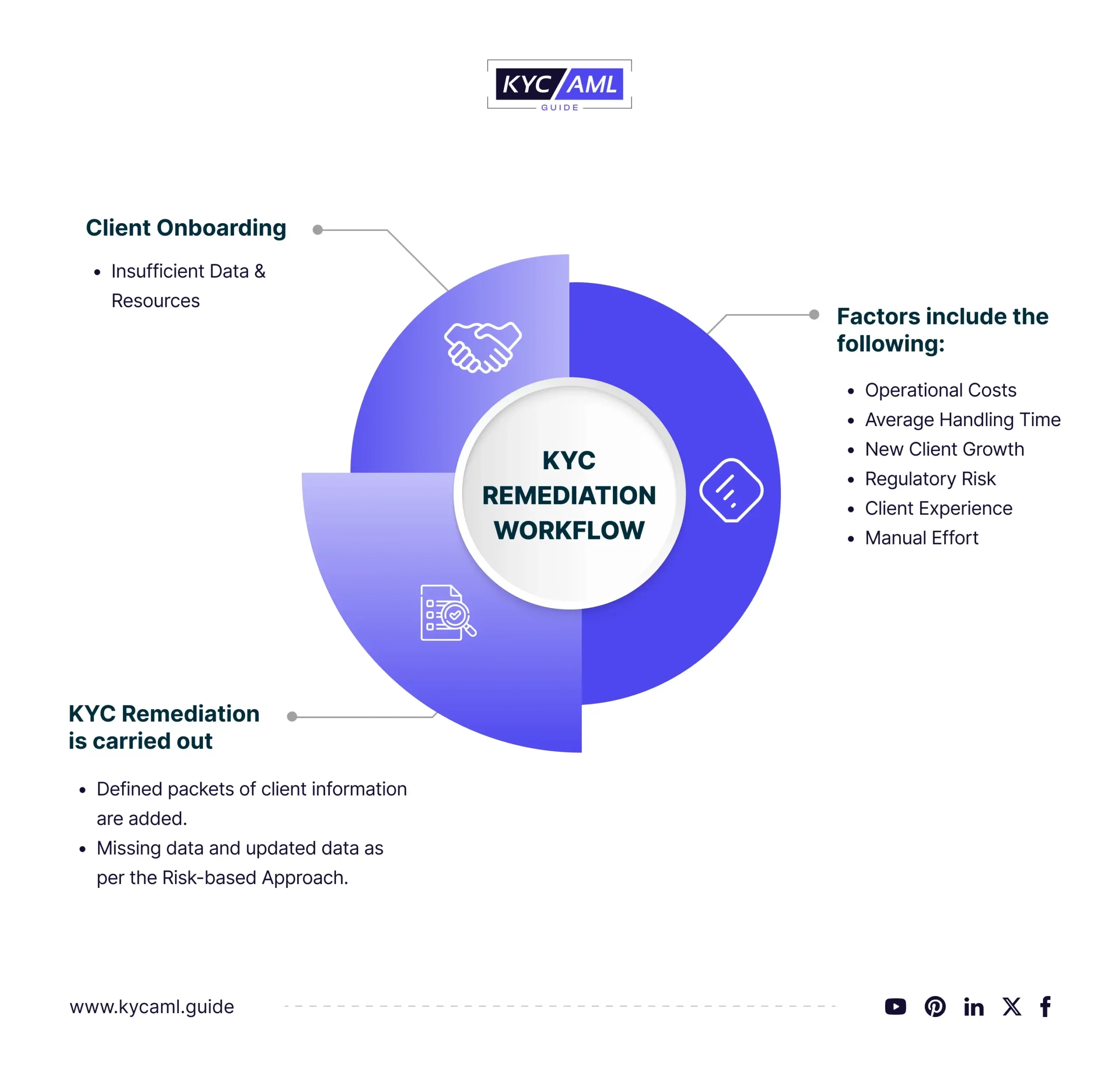

KYC Remediation WorkFlow – An Illustration

- A new client is onboarded & a client profile is generated and data is stored.

- Remediation is carried out where packets of client information are added including the missing data and updated data as per the risk-based approach.

- Factors include the following:

- Operational Costs

- Average Handling Time

- New Client Growth

- Regulatory Risk

- Client Experience

- Manual Effort

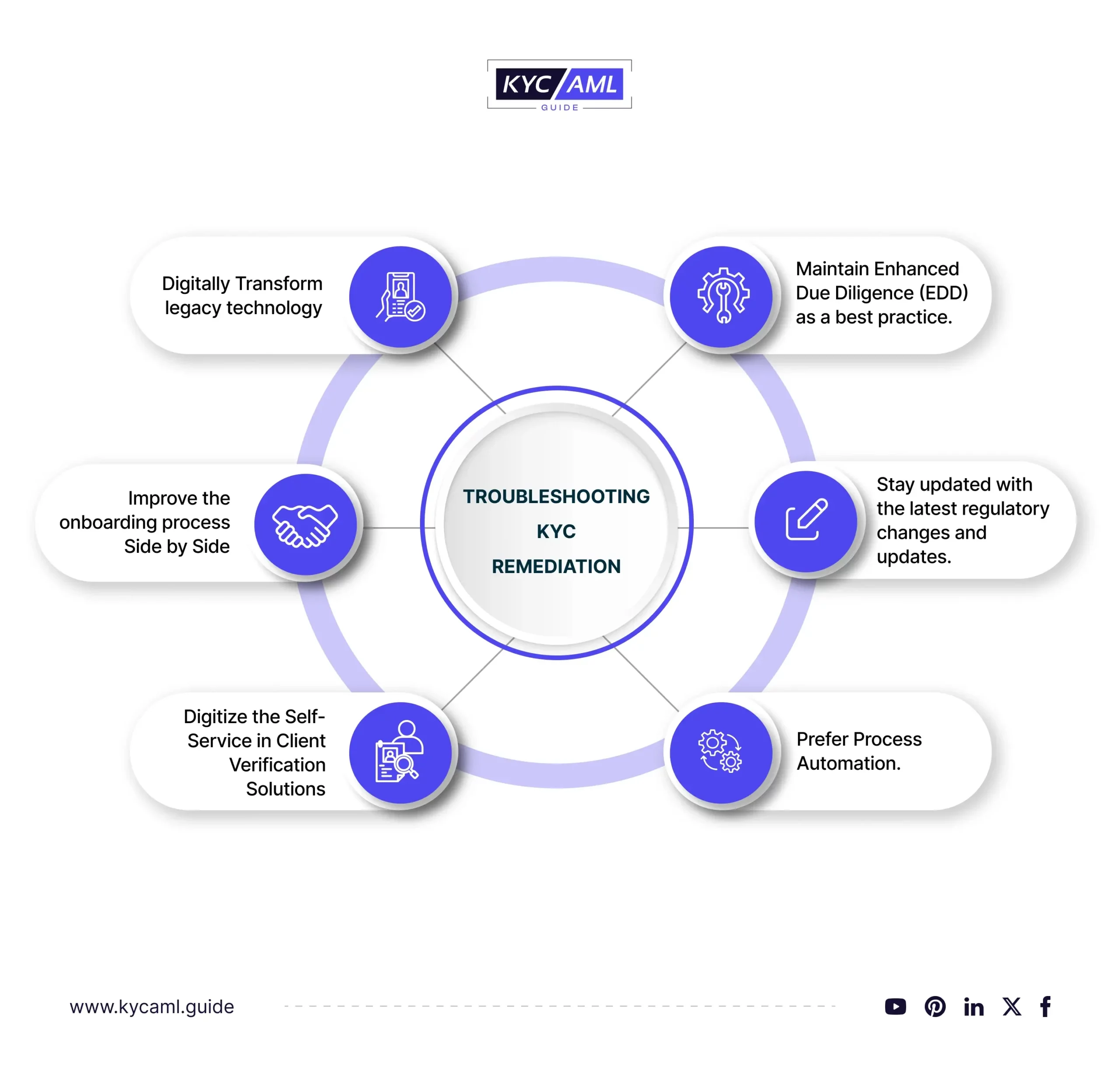

Troubleshooting KYC Remediation

Here are a few general tips to troubleshoot a KYC Remediation process:

- Digitally Transform legacy technology for KYC Tool and shift to a better option.

- Improve the onboarding process Side by Side and focus on enhancing User Experience.

- Digitize the Self-Service in Client Verification Solutions.

- Maintain Enhanced Due Diligence (EDD) as a best practice.

- Stay updated with the latest regulatory changes and updates.

- Prefer process automation at every step of the way.

How KYC Tool Providers can improve their Remediation?

KYC Tool Providers act as a backbone to the customer onboarding process and provide a base for the regulatory compliance infrastructure of a fintech firm. Here are a few basic steps that can help KYC Vendors in improving the remediation process of their KYC Tool.

- Enhance the KYC Document Verification by:

- Investing in OCR (Optical Character Recognition), MRZ Code Reading, AI, and other technologies to improve the data extraction from identity documents.

- Integration of Biometric Verification methods like facial recognition, voice recognition, and fingerprints can act as an added layer to Identity Verification.

- Regular updates and Ongoing Monitoring of customer data and documents will help in identifying new fraud patterns and new document types.

- User-friendliness can help in streamlining the User Journey for the KYC Remediation process.

What Fintech firm needs to implement the right KYC Tool?

KYC AML Guide is the solution to a pressing concern of saving on compliance costs especially when it comes to deploying a KYC Solution in a firm and/or improving the existing one. KYC Technology Buying Consultancy will direct your business to stay on top of the line as a compliant firm by bringing in informed decision-making through extensive research on the best available KYC Vendors.

Final Thoughts

KYC Remediation is an iterative process to ensure a risk-free customer onboarding experience. For seamless onboarding, the high-risk clients should be identified timely. This is to prevent Money Laundering and Terrorism Funding from hijacking the financial ecosystem. Dynamic Risk Assessment is the supportive activity in Remediation for KYC. Currently, the fintech firms are striving to achieve the highest level of compliance through KYC and Remediation in onboarding to filter out criminals and increase their trustworthiness.