The KYC Process

The KYC process focuses on gathering information about clients to verify them. The KYC process is critical to customer risk assessment and meeting regulatory requirements for anti-money laundering (AML) compliance. If the KYC procedure is done correctly, the customer’s identification, financial accountability, and the risk they pose must all be considered. The primary goal is to evaluate whether the customer’s funds are legal and at risk of money laundering.

To complete the compliance framework, there are 4 pillars of KYC. The KYC process steps are

- Customer Identification Program (CIP)

- Customer Due Diligence (CDD)

- Risk assessment and

- Ongoing monitoring.

Country-Specific KYC Compliance Requirements

Although there are common principles and parts of KYC regulation that apply globally, each country or jurisdiction has its own set of regulations. These jurisdiction-specific differences are essential in the context of AML finance. Some examples of KYC compliance requirements in specific countries

United States:

- Bank Secrecy Act (BSA)

- USA PATRIOT Act

European Union:

- Fifth Anti-Money Laundering Directive (5AMLD)

- Sixth Anti-Money Laundering Directive (6AMLD)

United Kingdom:

- Money Laundering Regulations (MLR)

- The Proceeds of Crime Act (POCA)

Canada:

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

- The Proceeds of Crime (Money Laundering)

- Terrorist Financing Act (PCMLTFA)

Australia:

- Australian Transaction Reports and Analysis Centre (AUSTRAC)

South Africa:

- Financial Intelligence Centre Act (FICA)

- Financial Sector Conduct Authority (FSCA)

New Zealand:

- The RealMe system in the country allows users to give identity verification for online services as well as simplified log-ins to access government services.

- The Reserve Bank of New Zealand

- The Financial Markets Authority (FMA)

- Department of Internal Affairs (DIA).

What is KYC End-to-End Process?

Laws, businesses, and people’s circumstances all change over time. As a result, one-time information used during onboarding cannot be used for effective KYC. Banks must adopt a comprehensive and continuous KYC system to avoid non-compliance and reputational damage. Banks were subject to $10.4 billion in fines from all over the world in 2020 alone for AML violations. A comprehensive KYC process can improve the customer experience. The KYC lifecycle process steps are as follows;

KYC Verification & Due Diligence:

Verification and Due Diligence validate the customer’s identification and estimate the level of financial crime risk during onboarding

KYC Remediation:

KYC Remediation refreshes redundant customer data over time to ensure that risk profiles do not change.

KYC Monitoring:

To discover transactions or occurrences that signal AML risk, continuous inquiry, and monitoring should be done.

Why Should Banks Streamline Their KYC Process?

KYC and AML screening and monitoring are critical protections for banks to control risk and avoid fines and personal liability. However, as KYC laws get more complicated, banks are faced with additional responsibilities that raise the time, expense, and pressure to maintain compliance. Banks are turning to RegTech and automation tools to streamline KYC onboarding, enforce compliance, and allow end-to-end KYC processes to avoid costly AML breaches and accelerate customer onboarding.

Onboarding Challenges:

A slow onboarding experience causes 89% of customers to switch to a competitor, making it a crucial component of the customer experience. An average of 32 days are needed to onboard a corporate client due to AML and KYC regulations. Critical customer due diligence (CDD) operations take up a large portion of this time, but delayed onboarding procedures can result in business loss and risk exposure.

Due to slow due diligence processes, 38% of UK firms purposefully gave up on their need for banking services last year. As per FSI 2023, organizations claim that a lack of resources (53%), a lack of funds (50%), and a lack of agreement on the best course of action (46%) prevent them from adopting innovative onboarding solutions.

Also Read: What is Digital Onboarding and How It Works?

Challenges of AML Regulation

The real owners of firms and other financial organizations must be more transparent, according to recent regulations like the EU’s Fifth Money Laundering Directive (5MLD). For compliance teams, this not only expands the depth, breadth, and volume of data that must be gathered on potential customers but also necessitates keeping them informed throughout the client lifecycle through KYC process steps like ongoing KYC or remediation.

Rising Complexity and Heightened Risks in Compliance

Teams must work harder to balance the effort of onboarding new customers with the increasing complexity of regulatory duties in the battle against financial crime. This could result in protracted delays and untenable workloads for teams with limited resources. In the first half of 2023, 97 fines totaling $189,098,690 were imposed by international financial regulators owing to non-compliance with Know Your Customer (KYC), customer due diligence (CDD), and sanctions violations.

Challenges of Manual KYC

Manual KYC is not sustainable for an end-to-end KYC process. Banks must now go past manual KYC processes if they want to sustain profitability and compliance. Legacy workflow reduces efficiency and negatively affects customer experience while exposing businesses to unnecessary risks for end-to-end KYC and AML compliance. The statistics are fairly illuminating; only 2% of organizations have been able to automate more than 90% of their KYC procedures while 28% of businesses still complete 41-60% of jobs manually.

KYC technology buying can guide clients by providing them with consultancy to select the right solution as per their needs.

Factors Affecting the End-to-End KYC Process

This section emphasizes the significance of KYC regulations at a high level in the banking industry. This comprises the findings of a KYC benchmarking research by McKinsey & Company that showed notable performance variations between banks with average and improved KYC practices. The following are the section’s primary conclusions

-

Performance Gaps:

The analysis found large performance disparities in the banking industry, indicating significant possibilities for growth. The most significant variations were observed in risk quality and efficiency, data management, and technology enablement.

-

Streamlined Processes:

Banks that streamlined their KYC processes by decreasing hand-offs between stages reported a variety of benefits, including higher risk effectiveness, a better customer experience, and increased efficiency. For instance, they decreased response times by 17%, cut down on the number of cases returned to the first line of defense by 61%, and cut down on the average case completion time by 38%.

-

Benefits of Automation:

Banks that increased end-to-end KYC process automation by 20% saw an improvement in security, customer satisfaction, and productivity. For example, customer outreach declined by 18% and the amount of information processed each month increased by 48%.

-

Business Benefits:

The banks that enhance their KYC procedures not only cut costs and enhance risk management but also deliver a better client experience, boosting customer retention.

-

Data Utilisation:

It also emphasizes how KYC process data is utilized for more general business objectives. Banks, for example, might use KYC data to find new product or service opportunities when a customer’s conduct shows they are entering a new market or sector.

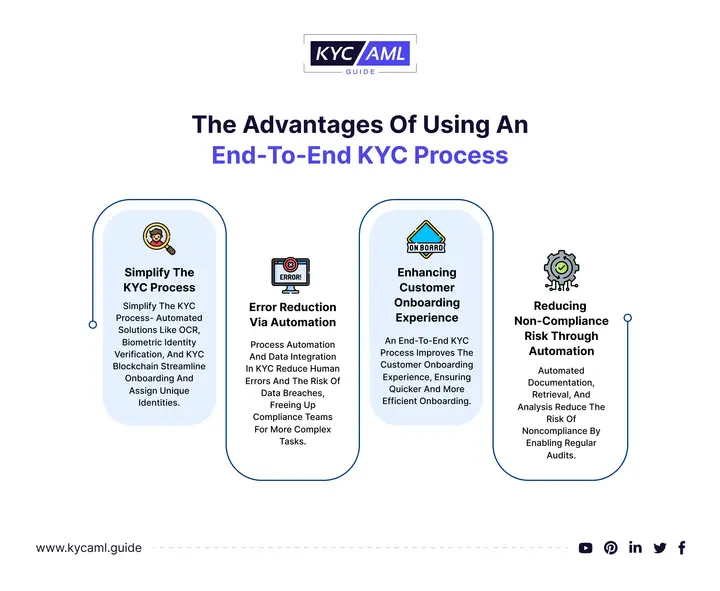

The Advantages of Using an End-to-End KYC Process

Many businesses still employ manual KYC processes. “We regularly identify cases where customer due diligence measures are not properly implemented or recorded,” according to the FCA’s finding. However, spreadsheets are heavily used, which do not effectively capture customers’ data and result in inconsistencies. Automation can cut the time spent retrieving, collecting, and analyzing KYC data and documents by up to 100%.

To implement an end-to-end KYC process, an automated solution that delivers comprehensive records and enhanced auditability is particularly advantageous. Consider some of the advantages KYC process steps can provide:

Simplify the KYC Process.

The end-to-end KYC process is a lengthy chain of events involving numerous participants. Automated solutions such as OCR, Biometric Identity Verification (facial recognition technologies and fingerprint recognition), KYC Blockchain technology, and others make onboarding easier and faster. The eKYC ensures that everyone who registers on the site is assigned a unique identity. The global e-KYC market is estimated to grow at a CAGR of 21.9% between 2023 and 2028.

pKYC encompasses the whole KYC life cycle and makes use of next-generation technologies like artificial intelligence (AI), machine learning (ML), and the cloud to update customer profiles to automate operations. As fintech continues to dominate financial services sectors around the world, the KYC technology market will grow at a 22% CAGR from $447.53 million in 2021 to 2029.

Visit the KYC AML Guide and learn more about the largest KYC Solution Directory

Error Reduction via Automation

In the KYC process, process automation, data integration, and smooth processes decrease unintended human mistakes. Verizon discovered that 82% of data breaches in 2022 featured the human factor, including social attacks, errors, and system misuse. At the same time, it considerably reduces the compliance team’s manual work. This frees up human resources for more difficult jobs that require manual intervention.

The global spend on regulatory technology (RegTech) is expected to reach $207 billion by 2028, urging banks to invest in automating their laborious KYC processes.

Enhancing Customer Onboarding Experience

The capacity to conduct due diligence in a timely and effective manner might mean the difference between winning and losing an important customer. An end-to-end KYC process streamlines the customer journey, allowing for quicker and more efficient onboarding.

Reducing Non-Compliance Risk through Automation

Companies can conduct audits at regular intervals using an automated documentation, retrieval, and analysis procedure, lowering the risk of noncompliance.

What’s next in KYC?

The KYC environment is not always simple. The way organizations approach KYC will be influenced by constantly changing crime patterns, rules, technology, and even internal reorganization. The COVID-19 epidemic transformed the KYC procedure for due diligence overnight as employees switched to remote work and the usage of solutions such as digital signature software surged. We frequently see an upsurge in financial fraud and AML investigations during times of economic hardship.

- To keep up with these quickly changing technology developments, banks and financial institutions must adjust their KYC processes. What should be kept in mind? In 2023 and beyond, keep an eye out for the following trends in KYC:

- Criminals are always developing new techniques, particularly in light of the present economic downturn and geopolitical conflicts such as the war in Ukraine. To handle these increasing risks, government authorities must update regulations

- As environmental, social, and governance (ESG) issues grow in the marketplace, organizations will need effective methods to analyze corporate clients’ ESG levels. Individual and overall ESG initiatives must be followed for compliance and customer relationship considerations.

- Increase the usage of machine learning (ML) and artificial intelligence (AI) to detect and reduce money laundering.

- As more businesses conduct business online, KYC standards are developing to include digital verification methods such as biometric authentication or blockchain-based solutions.

- Leading banks will aim to differentiate themselves by enhancing the customer experience and converting the KYC process into a profit center, allowing the organization to grow while remaining compliant and secure.

- The vast majority of US and Canadian financial institutions (73% and 86%, respectively) forecast an increase in AML compliance costs of 13.6% in 2022, with labor accounting for more than half of that increase. However, by improving client lifecycle management, you can transform KYC from a cost center to a profit center.

This blog gives an in-depth look at the end-to-end KYC process, emphasizing its significance, the KYC process steps involved, and the technology services that make it more efficient and safe. The best practices Businesses and individuals must keep up with and adapt to evolving legal requirements and succeed in a complex world, ensuring trust, security, and compliance in financial transactions.