What Is An Identity Verification Solution?

The identity verification process is automated by an identity verification solution or software tool. The software uses advanced technology and biometrics, government-issued identity cards, or even social media accounts. The global demand will fall by 20 percent in 2027 for individual identity verification technologies as all-in-one digital identity platforms become more popular, as predicted by Gartner.

The risk management strategy of any organization should ensure identity verification solutions for the right people at the right time. The fastest-growing crime reported in the U.S. is Synthetic identity theft increasing the global cost of cybercrime to $10.5 billion by 2025. The businesses are protected from cyber fraud by an online identity verification system. It helps improve operational efficiency, customer retention and acquisition, and reduces cost which is important in today’s competitive market. Furthermore, the right KYC identity verification solution enables firms to comply with data protection, regulatory standards, and privacy laws. It simplifies the process by replacing manual processes with automated software and onboarding new clients easily and promptly.

The article focuses on three KYC identity verification solution providers: Persona, Jumio, and Shuftipro. KYC AML guide worked with each solution provider to fully grasp their capabilities. Let’s look deeper at what each one offers and determine which would be the best fit for your organization.

Shufti Pro

Shufti Pro is a digital identity verification solutions provider offering KYC, KYB, and AML software tools. It is headquartered in London and launched in 201. It provides services in over 200 countries. The company offers on-site deployment for 17 different IDV products including facial recognition, liveness detection, and anti-spoofing techniques. They can validate personal documents worldwide in more than 150 languages. AI-powered AML screening collects user information to verify identity after transactions are completed and can be linked to an AML watchlist to flag high-risk identities. This screening process works with over 1,700 criminal watchlists, sanctions lists, and PEPs.

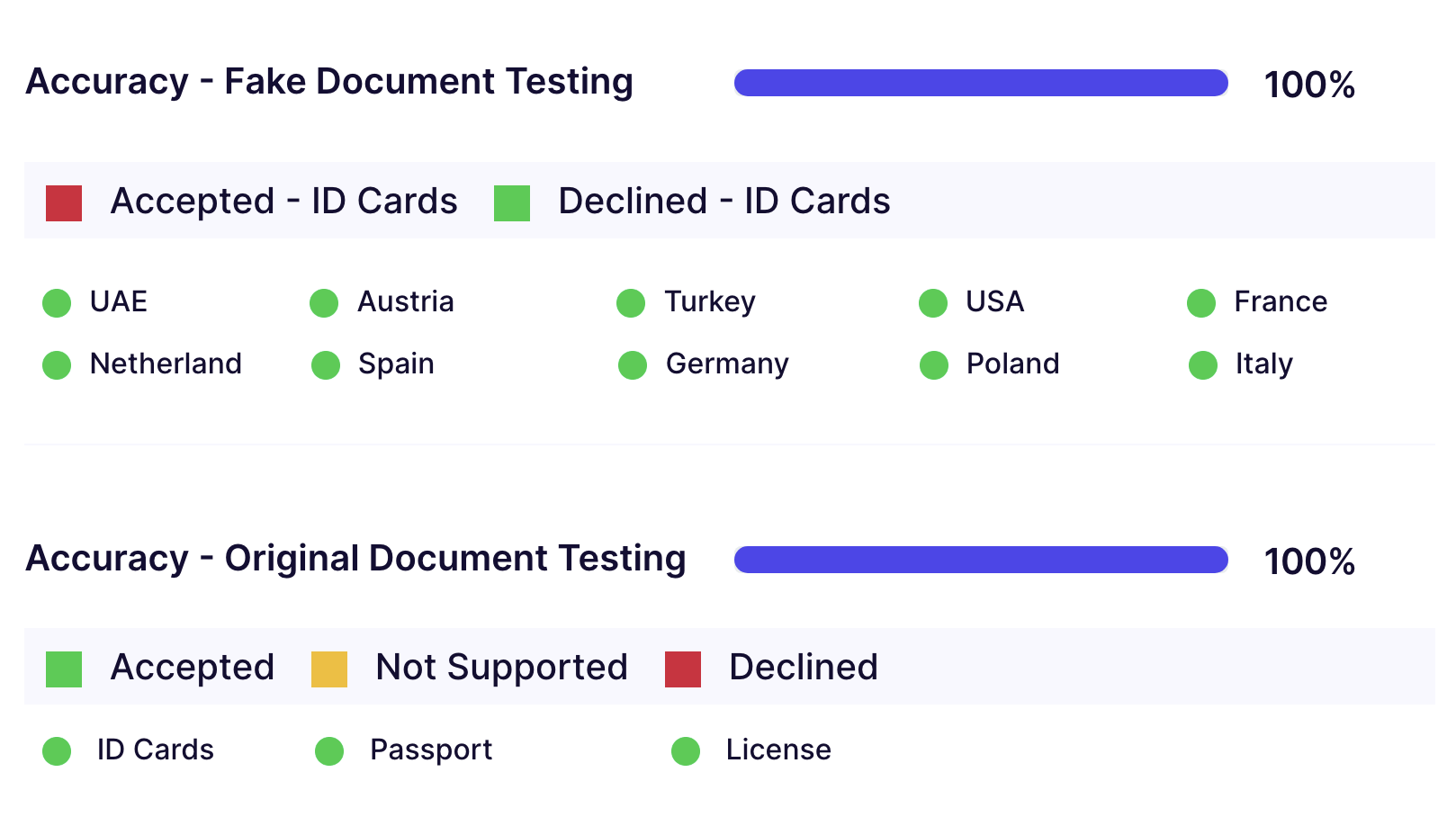

According to our research & analysis, these are Shufti Pro verification metrics for documents, countries, and languages.

Key Features:

- Shufti Pro uses AI and human intelligence to provide real-time identity verification, KYC compliance solutions, and AML screening

- It complies with important safety regulations and has excellent verification features.

- It looks clean and simple, with easy document uploading.

- The dashboard is easy to use and displays key information.

- It works quickly and verifies identities properly, helping to prevent fraud.

- It’s easy for users with facial recognition technology.

- The support usually comes back after 2-3 hours and you can speak to them directly.

- It supports most integration methods with SDK, PHP, Node, Javascript, etc. However, the documentation could make some minor improvements.

- It has flexible pricing options including pay-as-you-go and monthly subscription models.

- It’s super fast (8 seconds – 22 seconds) document processing time and very accurate with real and fake documents. Reports are detailed and easy to review.

Services

It provides many KYC, AML, and other Services

| KYC | AML | Other |

| Face Biometric Verification, Document Verification,

Age Verification, eID Verification, Video KYC, Liveness Detection, Perpetual KYC, and Address Verification |

AML for Business,

PEP Screening, Watchlists Screening, Adverse Media Screening, Risk Assessment, Sanctions Screening & On-going Monitoring |

Know Your Business (KYB),

Payment Fraud Prevention, OCR for business, ID Number Checks, ESign, 2FA Verification, NFC verification, Identity Access Management, Phone Risk Assessment, Email Risk Assessment and Regulatory reports |

Cons

However, according to our analysis, there are some disadvantages of Shufti pro

- In some places, integration measures are lacking

- The capture screen has no outline markings to guide the user.

- In accepting certain official documents it has limited flexibility

- Some users may find the dashboard and reporting tools less intuitive.

- There is a lack of clarity in the instructions

- The manual payment process is inconvenient

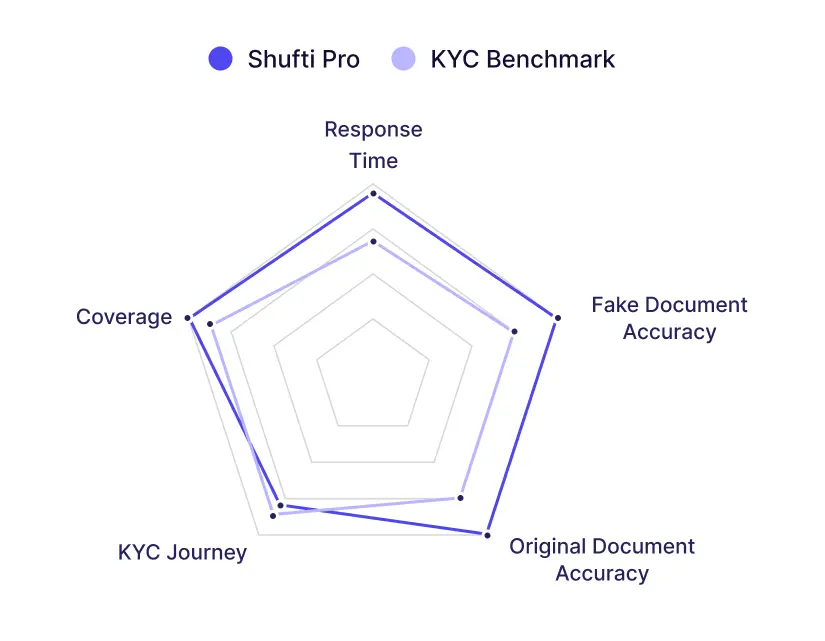

We rated Shufti Pro based on mobile and desktop traffic, customer response time, and a quick document review

KYC web analysis for Shufti Pro as per KYC benchmark

Persona

WithPersona is an identity verification solution founded in 2018. It assists businesses to verify the identity of their clients effectively and securely. It utilizes advanced innovations, for example, biometric verification, document verification, and liveness detection to guarantee that the individual behind the screen is who they say they are. WithPersona intends to provide a seamless user experience with quick verification processes. It also maintains a high level of security to prevent fraud and comply with regulatory requirements.

Based on our research and analysis, here are Persona metrics for document verification, coverage across countries, and supported languages.

Key Features:

- WithPersona is easy to use and has excellent community support.

- WithPersona has good verification and resolves issues quickly.

- It’s easy to set up and get started.

- It has strong features and helpful support.

- Persona offers three different pricing structures. It includes a free starter account that offers 500 free government ID and selfie checks per month, and a dashboard to view and manage verifications.

- The team is creative and collaborative in solving problems, especially those related to unique fraud risks.

Services

KYC Suite, AML, and other services include

| KYC suite | AML services | Other |

| Face Biometric Verification

Document Verification Age Verification Video KYC Liveness Detection Perpetual KYC Address Verification |

PEP Screening

Watchlists Screening Adverse Media Screening Fitness & Probity Checks Sanctions Screening |

Know Your Business (KYB)

Payment Fraud Prevention Phone Risk Assessment Email Risk Assessment |

Cons

Some of the cons of Persona are

- There is a lack of communication about unique changes to APIs or underlying systems.

- API integration requires overhead and manual configuration, which limits flexibility.

- Limited document options in the free tier.

- Lack of phone support

- The dashboard is not mobile-friendly

- Too new to identify potential mistakes.

Jumio

Jumio offers a complete identity verification solution and fraud prevention platform based on 500 million identities from over 200 countries. Jumio products are fully KYC/AML compliant. Identity verification features include machine learning for fraud detection and live video, biometric facial recognition, and barcode and NFC scanning.

From our research, here’s what we found about Jumio: they’re good at checking documents, work in many countries, and support various languages.

Key Features:

- Jumio combines biometric identity verification with comprehensive AML monitoring to provide solutions for online account opening, compliance, and fraud detection.

- It meets key compliance and security standards and has major verification features.

- Maintain good documentation and support only a few important integrations.

- High identity verification accuracy and high fraud detection experience.

- It offers flexible pricing, including transaction-based models and customized packages.

- Support usually responds within 2-4 days and is very knowledgeable about their product.

- Good design with clear instructions to help users.

- A quick verification provides almost immediate results, reducing manual inspection and speeding things up.

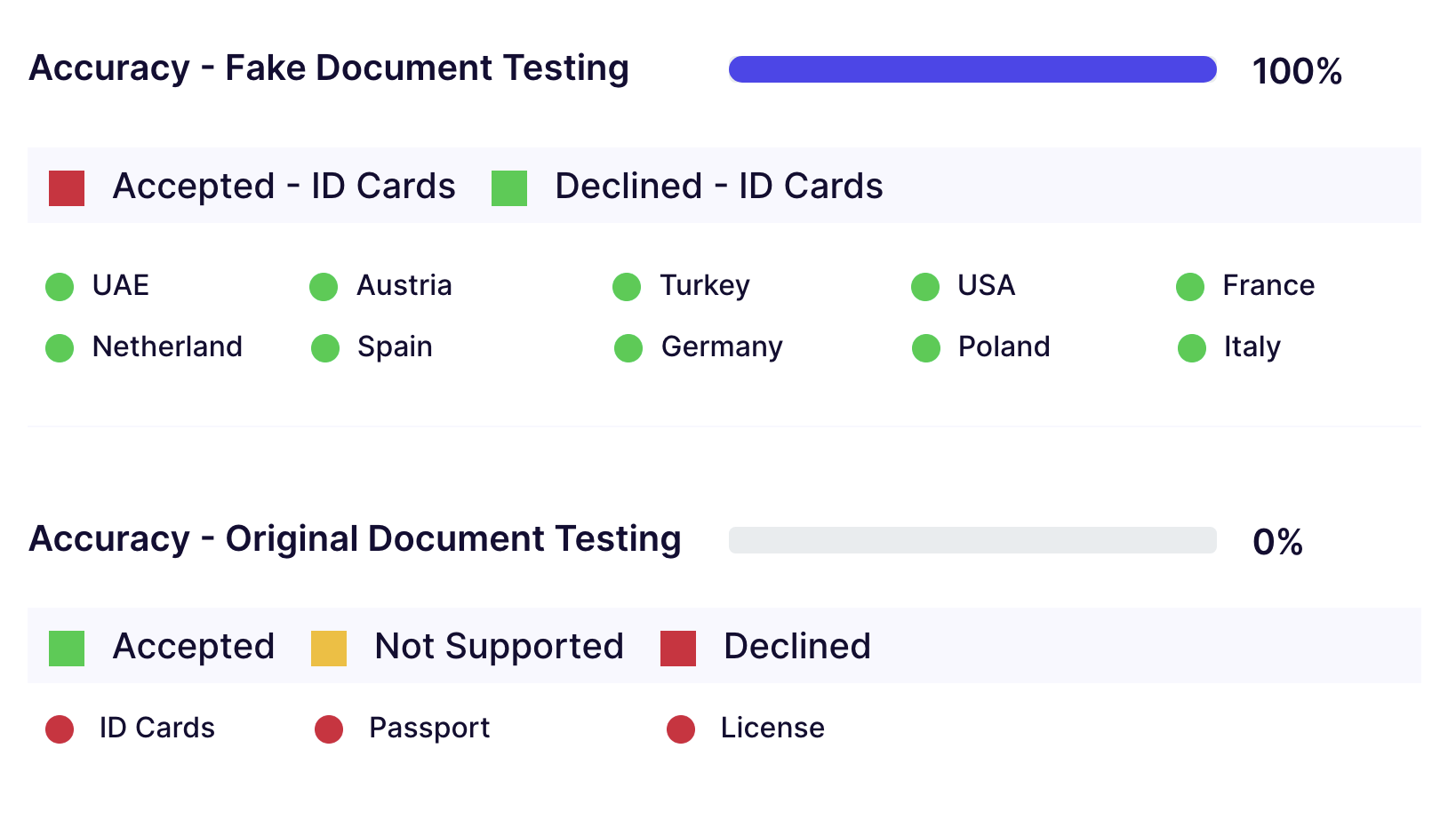

- Document processing takes about 7-8 minutes and is very good at detecting fake documents.

Services

They offer a wide range of KYC, AML, and other services.

| KYC suite | AML services | Other |

| Face Biometric Verification

Document Verification Age Verification eID Verification Video KYC Liveness Detection Address Verification |

PEP Screening

Watchlists Screening Adverse Media Screening Risk Assessment Sanctions Screening On-going Monitoring |

Payment Fraud Prevention

OCR for business ID Number Checks NFC Verification Identity Access Management |

Cons

There are some disadvantages

- It supports only a few important integrations and integration features.

- Identity verification can be sensitive to lighting conditions and can sometimes fail even in good lighting conditions, causing disruptions and potentially negatively impacting the user experience.

- Some features are not very intuitive for users.

- Considerable improvements are needed in the acceptance of original documents. The reports do not specify the reasons for rejection.

- Bugs and issues were found, including unexpected parameter changes without warning, that require further development

- Integrating Jumio into existing processes may require software development support as it is not a simple plug-and-play integration, adding complexity to the implementation process.

- The variety of features can make initial setup and customization more time-consuming.

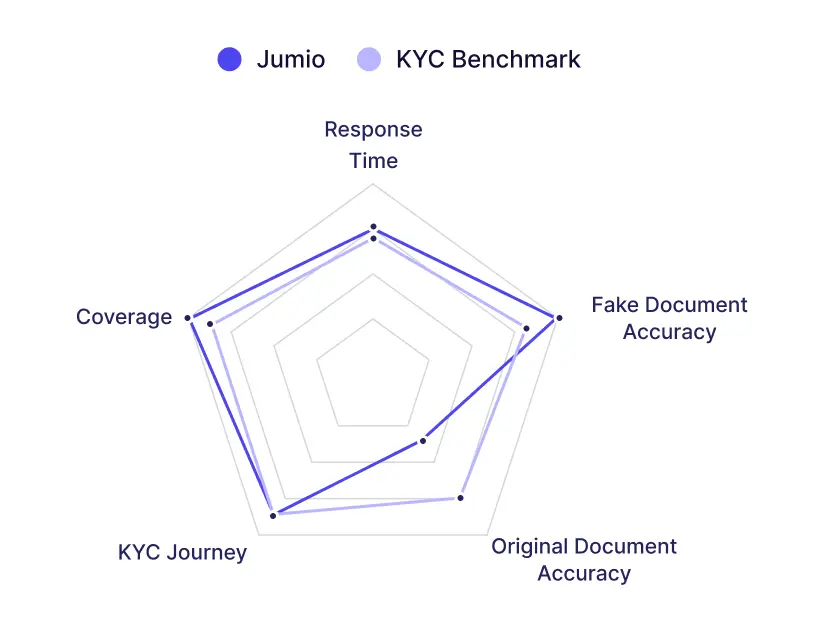

We rated Jumio based on mobile and desktop traffic, customer response time, and a quick document review

KYC Web Analysis for Jumio shows robust performance and features based on our benchmark study.

Also Read: Choosing the Ideal KYC Vendor: Finding the Right Partner for Your Compliance Requirements

Comparing Shufti Pro, Persona & Jumio

The KYC AML guide has thoroughly compared leading KYC providers based on key product criteria.

Criteria |

Shuftipro |

Persona |

Jumio |

| Trustpilot Score | 4/5 | – | 1.6/5 |

| Supported Documents | 10,000+ | Data couldn’t be found | 5000+ |

| Supported Countries | 230+ | 200+ | 235+ |

| Supported Languages | 150+ | 20+ | 5 |

| Free Trial | 7 Days | Yes | No |

| Data Retention Tenure | 2 years | – | 2 years |

| ID Number Checks | ✅ | – | ✅ |

| AML For Business | ✅ | – | – |

| Know Your Business (KYB) | ✅ | ✅ | – |

| Perpetual KYC (pKYC) | ✅ | ✅ | – |

| Reusable KYC | – | – | – |

| Know Your Transaction (KYT) | – | – | – |

| Face Biometric Verification | ✅ | ✅ | ✅ |

| NFC Verification | ✅ | – | ✅ |

| ESign | ✅ | – | – |

| Video KYC | ✅ | ✅ | ✅ |

| Travel Rule | – | – | – |

| 2 FA verification | ✅ | – | – |

How KYC AML Guide can Help you Choose the Right Identity Verification Solution Provider?

The KYC AML Guide helps banks and new online businesses find the best KYC tool to easily register customers and verify their identity. Our platform combines what you need with the perfect KYC solution. We also offer a vendor analysis service where we can check suppliers for you. The KYC AML Guide uses some factors to help you make the best choice for your needs by choosing the right KYC solution.