Essentially, the objective of KYC is to prevent businesses and their relationships with customers from being connected with entities that are involved in illicit activities.

However, whenever a company onboards a new client, it needs to verify customer identity by implementing KYC regulatory steps. The KYC documentation verification process involves a few steps that help identify the firm that the client, they’re working with, is free of any risks and threats.

In this blog, you will learn about what are the vital steps of KYC document verification, advanced technologies for KYC document verification, and future trends.

What is KYC Verification?

KYC verification refers to the procedure of verifying the identity of a customer that a company goes through to identify the legitimacy and reliability of a customer. This process is conducted to investigate the threats and risks associated with the user’s financial and transactional activities. KYC verification is one of the vital parts of customer due diligence.

Fundamentally, financial organizations and businesses that deal with finances such as banks and insurance industries adopt this procedure. However, it has become a mandatory practice for such sectors to remain threat-free.

Know Your Customer verification requires the user’s personal information including:

- Name

- Date of birth

- Residential address

- National ID card number

Other than these documents, several companies may also require some additional documents such as a passport, driving license, or utility bills to verify the address. Once the company collects this information, it is compared with the data stored in a public database, sanction watchlists, global watchlists, and customer reporting agencies.

3 Vital Steps of KYC Document Verification

The KYC document verification process is done just like banks and financial institutions conduct KYC traditionally to verify their customers. However, this procedure involves numerous steps:

i. Collecting User Information

The first step to verifying customer identity is to gather user information. According to the CIP final rule, financial services providers must obtain specific information from consumers before opening an account, such as their full name, date of birth, address, and identity number — such as a passport ID number, a taxpayer ID number, or an Alien Registration Number. This data includes the client’s personal information with the user’s consent. This information is acquired from an online user where the customer is supposed to provide the required details while registering for an account opening application.

ii. Uploading of Supporting Evidence

Once the user has uploaded the information, he is further asked to provide adequate evidence that supports his identity. KYC proof of identity helps the company verify that the client has provided authentic information.

iii. Investigation of Information

Now that all the information and pieces of proof have been uploaded by the customer, the company begins the verification process. First of all, the document template is examined against various checks. The firm verifies that the uploaded documents are not stolen or modified. Once it is successfully verified, the institution extracts the data in two ways:

a. Via OCR

The first procedure of extracting user data is through Optical Character Recognition, in which the system automatically mines out the data for the documents that the user uploaded. Further, it also checks the authenticity of the information.

b. Without OCR

However, if the company wants to run authentication checks manually, it enters the acquired information and verifies the data by comparing it with the one present in the database.

Usually, depending on the organization, customer verification is done in numerous ways such as:

- KYC passport verification

- KYC biometric identity verification

- KYC photo ID verification

- KYC ID verification

- KYC address verification

- Face recognition

Nonetheless, the process of KYC document verification entirely depends on the industry and the level of risk associated with the customer. Besides, these documents should also carry an individual’s picture that indicates the person’s nationality and facial features to authenticate whether the user is genuine. The company has the right to request more than one of these or some additional documents to mitigate any possible risk.

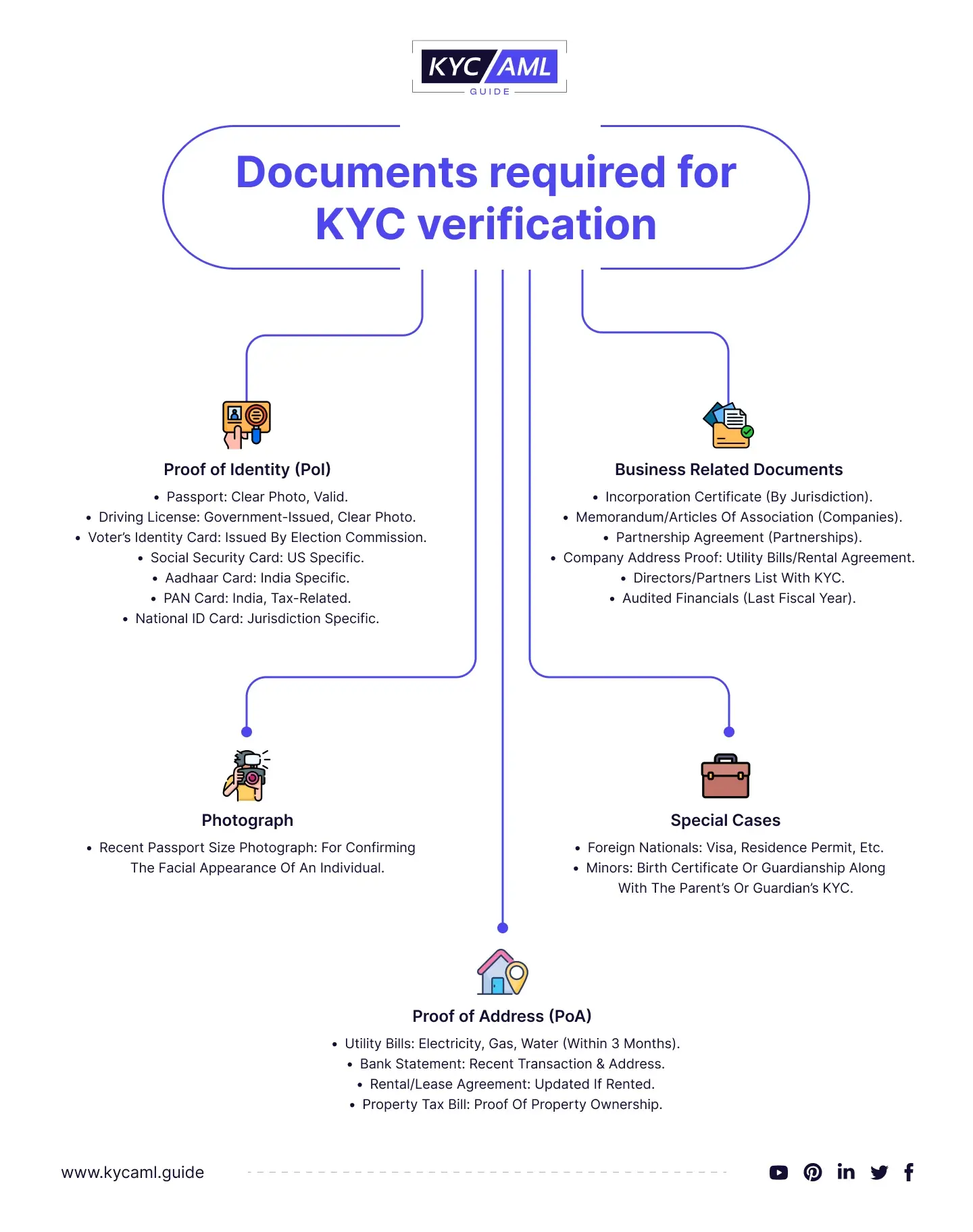

Documents Required for KYC Verification

The KYC Verification Process varies based on the jurisdiction and institution that requires identity verification. Here is a detailed list of primary documents required for KYC verification.

Advanced KYC Document Verification Technologies

Advanced KYC document verification approaches work together to speed the process, decrease errors, and increase KYC security. They include:

| Optical Character Recognition (OCR) | As described above OCR is a technique for extracting data from documents. OCR is a set of techniques necessary to recognize printed or handwritten text in a scanned identity document. |

| Near Field Communication (NFC) | NFC is used for wireless data transfer. NFC can be used in KYC to read and send data from smart cards, electronic passports, and other NFC-enabled papers. This can increase the efficiency of KYC document verification, particularly in instances where manual data entry is time-consuming. |

| Machine Readable Zone (MRZ) | MRZ code is a method of extracting identifiable information from an identity document digitally through a printed machine-readable code. It uses Optical Character Recognition (OCR) to read the codes from passports, ID Cards, and Driving Licenses. |

| Biometric Verification | Biometric Verification such as fingerprint scanning, facial recognition, and Iris Scan act as an extra layer of protection to the KYC process. This not only makes criminal conduct more difficult but also gives a smoother user journey for KYC document verification. |

| eKYC | eKYC also known as Digital KYC enables a faster, more accurate, and seamless way of customer onboarding that enables every step of KYC process to be carried out digitally. From customer document submission to online verification, every step has involved the latest technologies. |

Benefits of KYC Document Verification

KYC document verification is critical for financial security and risk management in firms. Probably, it is the best way of identifying customers and mitigating potential risks. It helps in retaining clients and maintaining the company’s reputation. It has several advantages, including:

Identifies Money Laundering

With a rigorous customer authentication procedure through KYC, financial crimes like Money Laundering become nearly impossible. KYC Ongoing Monitoring keeps track of accounts and observes transaction activities. If a suspicious activity or transaction is observed, an immediate alert is sent to the relevant department.

Cost-Effective

KYC Document Verification also helps in retaining customers with the seamless onboarding process. This helps reduce client acquisition costs, reducing customer churn and increasing savings rather than investing in customer retention.

Available, Anywhere, Anytime

Remote KYC document verification can now be conducted from anywhere and anytime through digital KYC solutions. Through the Mobile KYC verification process, customer onboarding is more accessible, convenient, and user-friendly.

Regulatory Compliance

KYC verification procedures ensure that firms are compliant with all AML (Anti-Money Laundering) regulations in that specific jurisdiction. It also aims to carry out Enhanced Due Diligence (EDD) for higher-risk customers.

Also Read: 5 Issues in KYC Document Verification and Their Solution

Future Trends in KYC Document Verification

Identity Verification is becoming more advanced every day. For example, Decentralized identity solutions, zero-knowledge proof, and self-sovereign identification are becoming a benchmark for KYC Solution providers. These technologies empower individuals over their data while passing stringent KYC standards.

KYC ID document reader technology is revolutionizing the KYC process by allowing businesses to scan and validate identity papers swiftly and efficiently through improved verification devices and software. This evolution is likely to continue and newer technologies may take place with even higher accuracy and efficiency.

Furthermore, the integration of blockchain technology has transformed KYC databases by offering a secure and fool-proof digital ledger to retain the identities of customers. It increases data security and streamlines cross-border identification verification.

In coming years, KYC document verification is highly likely to shift towards predictive document verification, which goes beyond simple binary KYC checks. AI is in practice for identity verification in many firms which has shown promising results.

KYC AML Consultancy For Best KYC Solution

To achieve excellence and remain compliant, Banks and Financial Institutions are recommended to hire KYC Vendors to provide a suite of KYC services, including KYC Document Verification. However, it is difficult to say which solution is best suited to a specific fintech company. Therefore, KYC Tech-Buying Consultancy helps these firms in choosing the KYC partner that specifically suits their Identity Verification needs. Moreover, it guides companies and users in comparing different solutions over segments of KYC document verification like Fake Document Testing and original Document Testing.

Wrap Up

Almost every business sector requires an effective KYC to comply with specific regulations to prevent fraud and financial crimes. However, to comply with the evolutionary KYC and AML regulations, these institutions need users’ documents for KYC verification and follow all the required vital steps of KYC document verification. This process can be done in three simple steps and delivers numerous benefits. It is not only useful for financial organizations but for customers associated with them as well as it helps them prevent any possible financial loss and reputational damage.