What is Watchlist Screening in AML?

Watchlist Screening is a process designed to screen or filter individuals or business entities by matching them against a list of suspected individuals or entities. This list contains the individuals or businesses that pose a risk to financial security and are prohibited or sanctioned by law enforcement.

In most cases, the list has Politically Exposed Persons (PEPs) or sanctioned person lists who are somehow connected to terrorism, money laundering, and criminal activities.

Basically, Watchlist Screening in AML compares the names and identifies all necessary information of individuals or businesses against the compiled list. It is to detect the potential matches and once a match is found, the screening process triggers due diligence and investigation.

Importance of AML Watchlist Screening

Watchlist Screening in AML is an important tool for banks, financial institutions, and even law enforcement authorities. It is useful in the identification and mitigation of risks of money laundering and terrorism financing. Also, it helps firms and financial institutions to stay compliant. Most commonly, banks, financial institutions, and money service businesses use Watchlist Screening.

Categories of AML Watchlist Screening

As compared to the KYC list of customers, the AML database consists of different categories. These categories serve the purpose of Watchlist Screening in AML. Do note that these categories are set upon the risk-based approach in AML compliance. They might be tagged differently as per the filters and parameters that a firm uses. But in most cases, the generic terms are the same.

- Politically Exposed Person (PEP)

- Sanction (SAN)

- Regulatory Enforcement List (REL)

- Reputation Risk Exposure (RRE)

- Profile Of Interest (POI)

- Insolvency (INS)

- Disqualified Director (DD)

Risk-Levels in Categories

- Red-Flag – High

- Red-Flag Medium

- Red-Flag Low

- Not Screened

Also Read: AML Ongoing Monitoring | KYC AML Guide

AML Watchlist Screening Process Explained

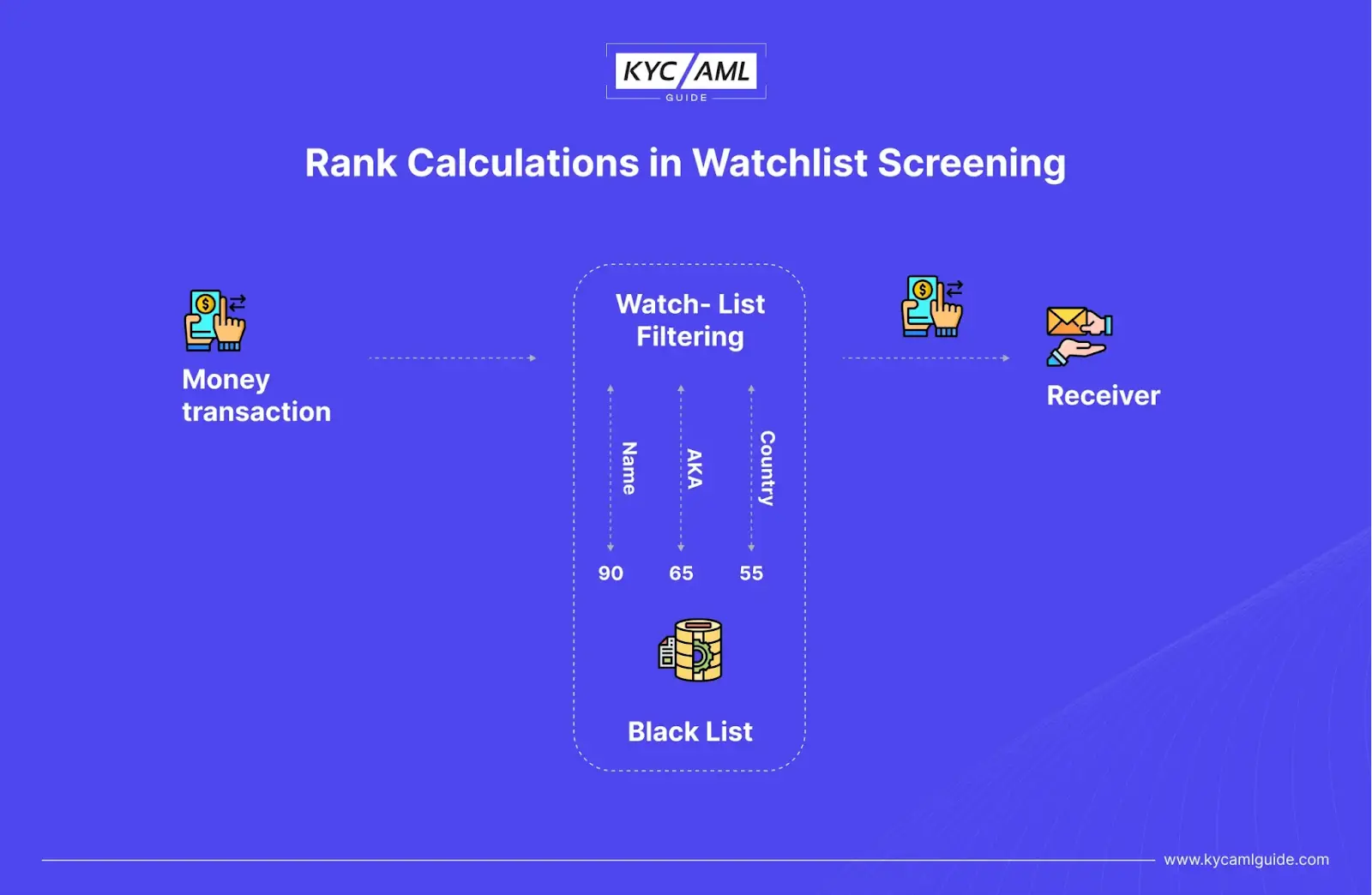

Financial Institutions mostly implement a watchlist-screening process in the above-mentioned manner. For example, research in IEEE Journals & Magazine about “Investigation of Applying Machine Learning for Watch-List Filtering in Anti-Money Laundering”,

explains the watchlist screening process from Money transactions to the rejection of transactions based on the lists of identities. In this process, watchlist screening is called watchlist filtering. It is implemented for both the sender and receiver of the transaction. Both parties are responsible for validating the transaction information and matching it with the list. The AML software implements strings matching algorithms to verify the transaction information and matches it against a provided [preloaded] list.

How is an AML Watchlist made?

Generally, for making a watchlist, there are no hard and fast rules. However since the regulatory authorities provide some specific guidelines to the AML service providers, they have to keep an eye on updated guidelines for making watchlists. Also, AML watchlist screening requires a robust, updated, and error-free database for properly executing the matching triggers of identities.

Based on the Data Sources:

AML Watchlists may include a variety of data sources like government sanction lists, law enforcement agencies databases, and third-party database service providers.

Based on Legal Requirements

Typically, the watchlists for screening are based on regulatory requirements by regulatory authorities in countries. Furthermore, prominent international organizations like the United Nations and FATF. publish lists, and guidelines on who can be politically exposed persons, sanctioned persons and organizations, banned outfits, or other such entities. Each region and country can also have its specific list of sanctioned entities and criminals that can pose a compliance risk for financial institutions if they facilitate them in any capacity.

Risk-Based Approach

With reference to the risk levels associated with an individual or an entity, it is included in the AML watchlist. The risk level itself is determined by different factors like geographic location, industry, behavior, trends of transactions etc.

Also Read: Risk-Based Approach In KYC/AML

Overall, the AML Watchlist Screening entails different datasets including a diverse set of information about persons or entities. Data is collected through different authentic sources and recorded in a database that is connected to the AML software. This data is used to screen new and existing customers and carry out ongoing monitoring of transactions and other patterns. If the person is matched to any suspicious identity, the AML watchlist screening will further investigate and carry out the set procedure in this regard.

Latest Developments in AML Watchlist Screening

AML Watchlist Screening process has been continuously improved and digitized. Most Prominently, the use of Artificial Intelligence (AI) and Machine Learning (ML) has boosted the performance of AML screening solutions. Similarly, the implementation of Natural Language Processing (NLP), Blockchain, Biometrics and Robotic Process Automation (RPA), and AML Screening has made the process more advanced and sophisticated.

However, AML Watchlist Screening still faces a few recurring challenges:

| False Positives |

|

| Data Quality |

|

| Dynamic Regulatory Approaches |

|

| Cultural Differences & Linguistic Variations |

|

How Do Rank Calculations Facilitate AML Watchlist Screening?

Evidently, the success of a watchlist screening system in AML compliance depends upon the matching algorithms. These algorithms consider many possible matches and measure the matching rank such as:

| Variation | Example |

| – Spelling variations | Emily, Emilie, Emilee, Emma Lee and etc. |

| – Phonetic variations | Smith, Smit, Smyth | Jon, John, etc. |

| – Double names | Mary Ann, Maryann, etc. |

| – First names | Bobby Smith, Bob Smith, Robert Smith, etc. |

| – Alternative names | Alexander Johnson, Alex Johnson, Xander J., Alex J., Alex John, etc. |

In the figure below the AML watchlist filtering refers to the screening system where it utilizes matching algorithms to calculate the matching rank.

Conclusion

AML Watchlist Screening is an important tool in identifying and preventing Money Laundering and Terrorism funding. It is an essential part of AML Compliance where financial institutions and banks must look towards utilizing emerging technologies and become more sophisticated in their AML Screening approach. The new AML compliance systems should be more focused on removing false positives, identifying new fraud and money laundering tactics, and stopping it at its source. Lastly, the challenges faced during AML watchlist screening should be mitigated through best practices, training, and ongoing monitoring.

Readers are encouraged to stay updated with the KYC AML Guide for the latest insights and updated knowledge of AML compliance.

Table of Contents

- What is Watchlist Screening in AML?

- Importance of AML Watchlist Screening

- Categories of AML Watchlist Screening

- Risk-Levels in Categories

- AML Watchlist Screening Process Explained

- How is an AML Watchlist made?

- Latest Developments in AML Watchlist Screening

- How Do Rank Calculations Facilitate AML Watchlist Screening?

- Conclusion