What is a KYC Solution?

A KYC (Know Your Customer) Solution refers to procedures, practices, and technologies implemented in an entity, particularly in the finance sector to verify and authenticate the identity of customers. Banks, financial institutions, and investment firms most commonly employ KYC. Its digital version is called eKYC (Digital KYC).

Primary Objective of a KYC Solution

Companies choose KYC Vendors for multiple reasons. Here are the main reasons why KYC Solution is implemented as a core component of a fintech firm’s resources.

- Customer Identification, Verification, and Authentication.

- Regulatory Compliance – It is a regulatory requirement by most of the regulators across the globe that fintech firms must have a robust KYC Solution.

- Prevention of Money Laundering, Fraud, Terrorism financing, and other financial crimes.

- Customer Experience – Once customers are onboarded, they can use the services freely and securely knowing that KYC is done for their security.

Apart from these reasons, companies tend to focus on having the best Identity Verification tool for making their customer onboarding seamless and error-free.

What are the Features of an Ideal KYC Solution?

At KYC AML Guide, we define an Ideal KYC Solution as one with the following features:

- The lowest response time taken in verifying identity.

- Fake Document Testing with the lowest number of false acceptances.

- Original Document Testing with the lowest number of false rejections.

- KYC Journey with the most convenient user experience while navigating the KYC onboarding process.

- Coverage with the highest number of languages and documents tested by the KYC Verification companies.

The 3 W’s as a Premium KYC AML Guide

We are a leading KYC Solution Buying Consultancy that serves fintech firms and other industry-level clients.

What Do We Offer?

At the forefront of our services, we have:

- KYC Technology Buying Consultancy supports your decision-making and saves you from financial loss and reputational damage.

- KYC Vendor Analysis helps you compare the top KYC Solution providers and filter out the best-suited ones.

Why Do We Offer?

KYC Technology buying is different than acquiring services or purchasing products from a vendor. This is mainly because of the following 3 critical factors:

| 1 | Regulatory Compliance | Compliance with KYC AML regulations is mandatory, especially in case of financial institutions and banks. KYC Solution Buying requires prime consideration of this notion to ensure that investing a huge amount in a Solution satisfies. |

| 2 | Dangers of Wrongful Purchase | When you are opting for a KYC Solution, a misinformed decision can lead to devastating outcomes like regulatory penalties to the firm due to non-compliance, and reputational damage. |

| 3 | Inclusivity | Adherence to WCAG 3.0 guidelines for inclusivity. |

| 4 | Overall User Experience | Selecting the best KYC Solution has a core objective and that is delivering the best and most effortless customer experience. KYC Solution providers aim to deliver the best user journey that helps retain customers. |

KYC AML Guide offers distinctive consultancy that connects fintech firms and KYC vendors with the best possible match. We know the importance of informed decision-making before investing in an ideal KYC Identification Solution due to the reasons mentioned above.

We bring in the best options through our industry-level expertise in regulatory compliance and fintech we help you get real value for money.

Who can Benefit from KYC AML Guide?

KYC AML Guide is an open-for-all platform where KYC Solutions are compared and listed based on different criteria. The top-tier clients we potentially serve include fintech firms, banks, Money Service Businesses (MSBs), and crypto exchanges. On the other hand, we also guide the KYC Identity Verification Solution providers and help them establish their businesses.

Challenges in Choosing the Right KYC Vendor

As a fintech firm or another established financial service provider, opting for the right KYC Vendor is critical for compliance and seamless customer onboarding. Without the right direction, a decision can cause multiple challenges that potentially drain your resources in a quest for secure and efficient verification processes.

Below are some of the major challenges and issues that you can face if not get the right guidance/consultancy for KYC Vendor selection.

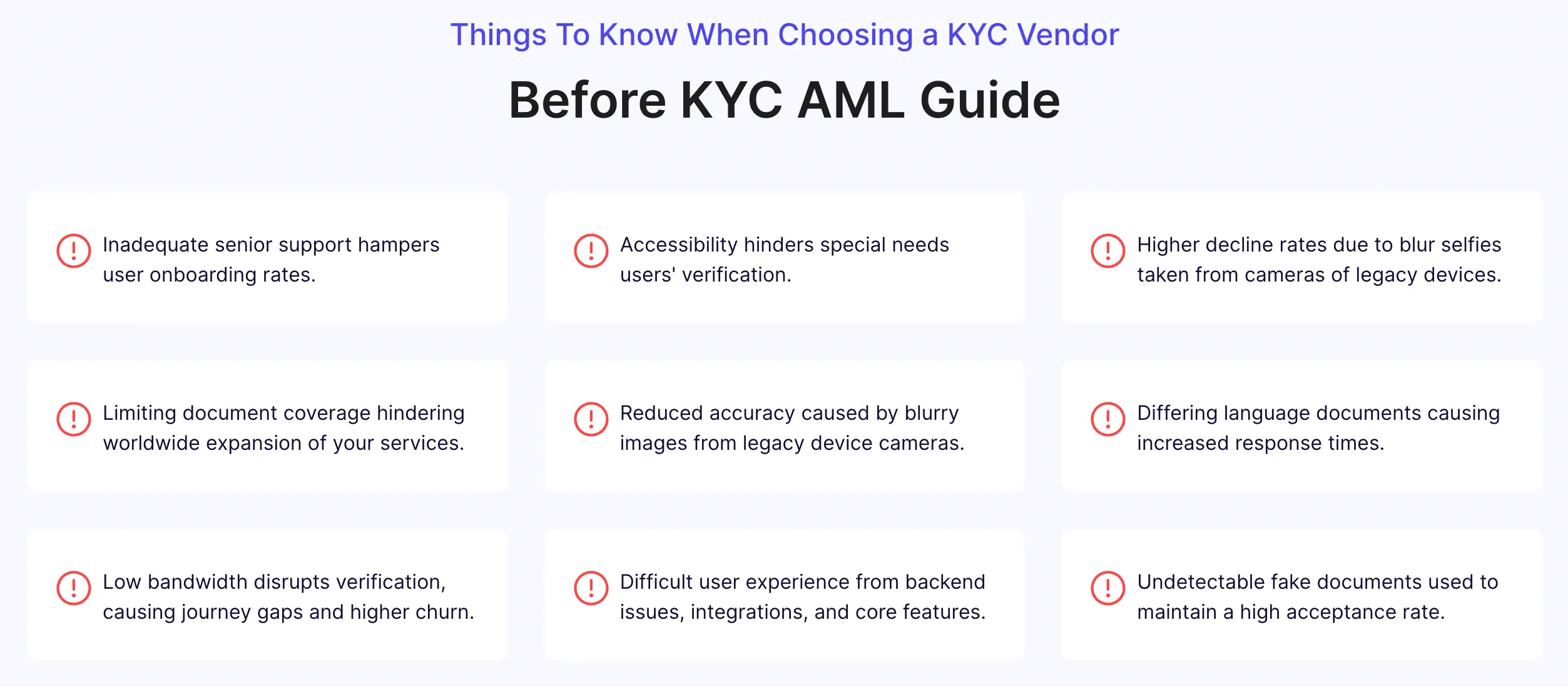

The above chart highlights the major challenges such as:

- Reduced accuracy and higher rejection rates due to blurry selfies and images of Identity documents.

- KYC Identity documents in different languages cause increased response times and limit the coverage resulting in global expansion of your business.

- Slower Internet connections cause disruption in customer identification leading to journey gaps and increased customer churn rate.

- Fake documents go undetected which causes erroneous document acceptance that decreases the authenticity and credibility of the KYC Solution.

In addition, look into the statistics on KYC and AML regulatory spending that reveal concerning numbers:

- Ondato’s report estimated the current spending of banks on compliance as $5.47m. The regulatory fines amount to an average of $14.82 million.

- Consult Hyperion’s report estimated in 2017 that KYC processes in a single bank cost $60m annually.

- The same report estimated that a single KYC check costs from £10 to £100.

- 25% of mobile applications are abandoned in the UK due to KYC friction.

- Recently, Adhaar authentication faced technical challenges including a service shortage of 54 hours till September this year. UIDAI (Unique Identification Authority of India) the responsible organization for Adhaar authentication was called incompetent for the discomfort caused to Indian people.

All these statistics show that KYC friction, hefty amounts of fines, and expenditure in AML compliance while doing KYC in banking are due to the challenges detected by the KYC AML Guide.

How KYC AML Guide help in mitigating these Challenges?

Hiring the services of a competent and result-driven consultancy can help you as a fintech or a bank in the following ways:

KYC AML Guide provides a well-researched concrete vendor analysis to boost your business in the following areas:

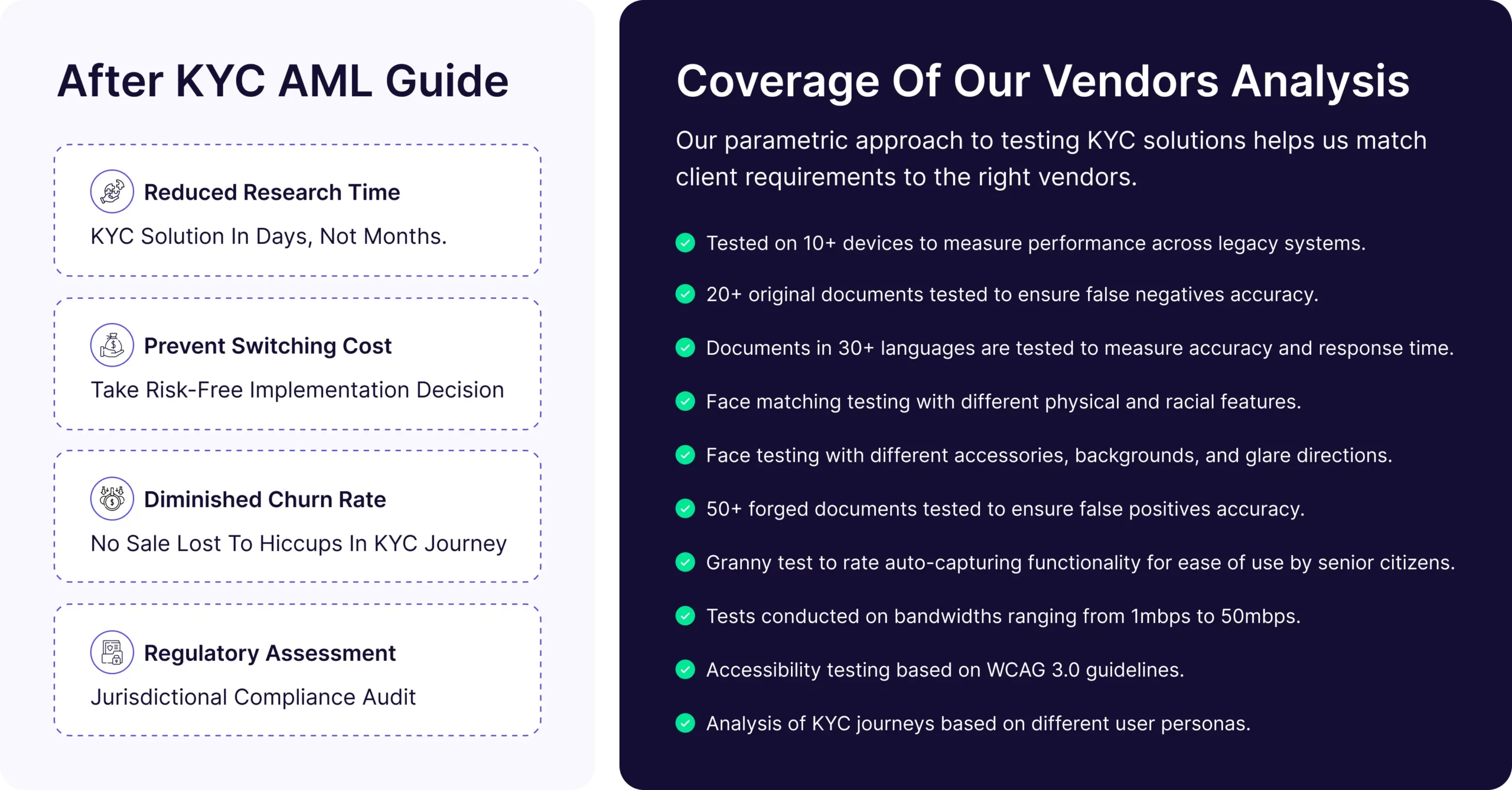

- Through our compliance guidance, you can reduce the research time on KYC solution selection to just days.

- Through us, prevent your switching cost as our research ensures a risk-free implementation strategy.

- No need to worry about the rising churn rate as our KYC Vendor analysis helps you in smoothening the KYC Journey with concrete background research and solid tests.

- Expand your market in multiple jurisdictions as we offer Jurisdictional Compliance Audit for improved regulatory assessment of your target country.

We ensure the right KYC Vendor is employed at your firm through our parametric approach containing the following deliverables:

- We ensure that the KYC Solution’s performance has been tested on 10+ different devices under different legacy standards.

- We test 20+ original documents to ensure a minimum false rejection rate.

- We test identity documents in 30+ languages to ensure high accuracy and response time.

- Face testing under different physical features and conditions like background, glare, etc.

- We test at least 50 fake documents to ensure the lowest false acceptance rate.

- Our Granny test ensures user convenience for senior citizens and a higher rate of the auto-capturing facility while KYC onboarding.

- We guarantee that the KYC Solution is WCAG 3.0 compliant.

- We distinctively analyze the KYC Journey of different KYC Solutions under different personas.

We are industry experts in steering the financial sector to achieve its compliance goals by selecting the right KYC solution. Choose the right solution for streamlining customer onboarding with KYC AML Guide.