Several cases have been reported where the PEPs have misused the Banking services for Money Laundering and Reverse Money Laundering.

What is a Politically Exposed Person (PEP)?

A person with a prominent position and who is influential in society is known as the Politically Exposed Person or PEP. As they have a sensitive role, they are highly exposed to illicit activities such as Money-Laundering and Terrorism Financing.

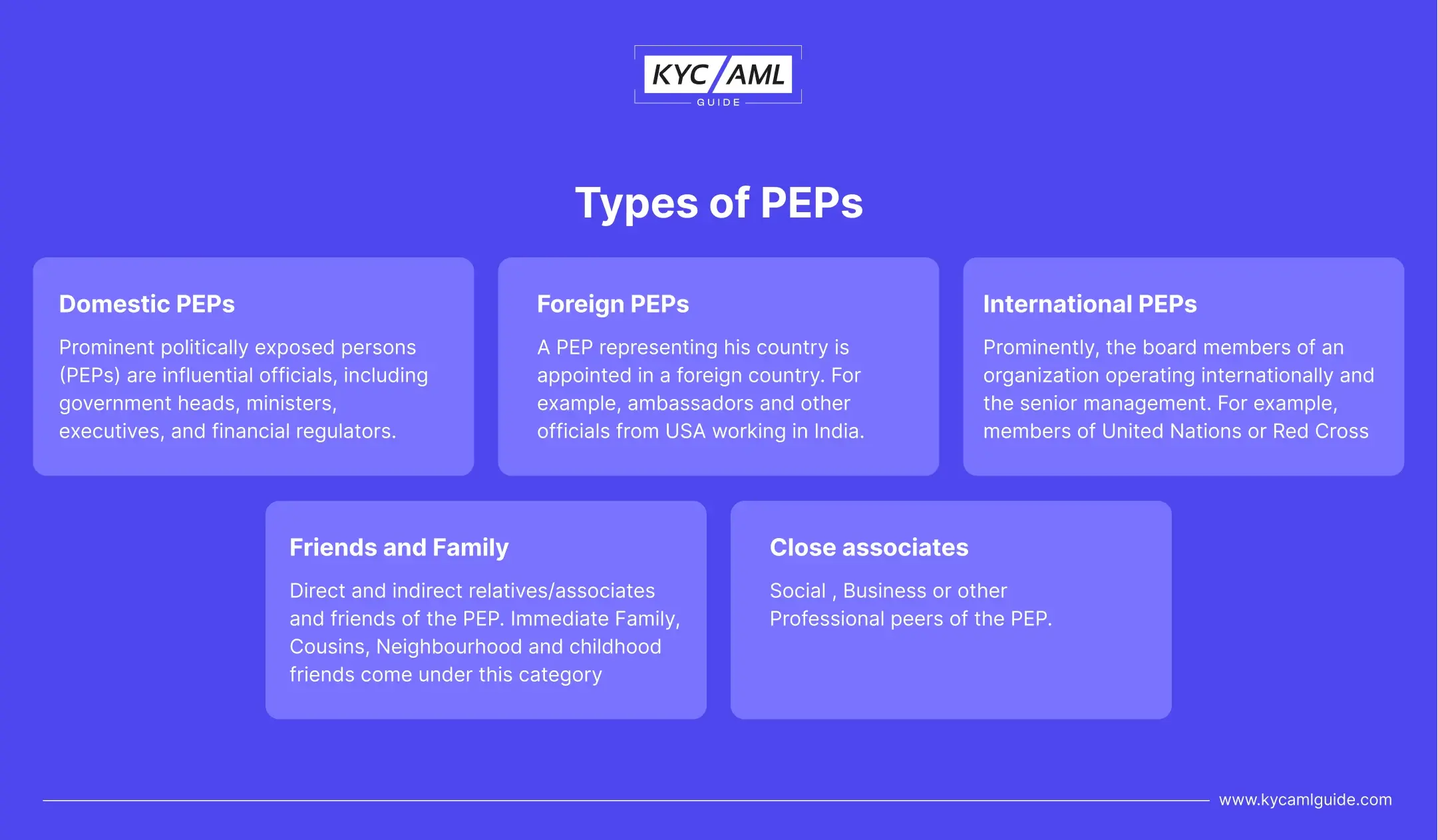

Types of PEPs

PEPs and the Banks

Banks identify PEPs as customers who can pose a threat of Terrorism Funding or Money Laundering at different levels. By the status of PEPs, the banks assign the risk levels to the PEPs and then deal accordingly. Subject to various regulations of AML, PEPs are considered sensitive and monitored closely. Banks closely check their transactions, funds, and sources of finance. Similarly, they are asked to submit the reports of their details and update their KYC regularly.

The PEP, The Bank, and the Money Laundering

Money laundering is a hideout for the criminally involved Politically Exposed Person. Especially in banks, the PEPs use banking services for all three stages of Money Laundering to conceal their illicit money. Since the banking itself is legal and highly regulated, the PEPs need strong influence or other way-outs for Money laundering through banks. Mostly, PEPs use banking services under the shell companies of an acquainted person’s name. The following are some points that need to be understood in this course:

- PEPs can use foreign banks for the placement and layering

- They can use the banks for the integration stage of money laundering

- They can use the banks to deposit illicit money through influence, bribery, and other illegal practices.

- They can pose risk to others through corruption, fraud, and other serious political crimes.

How Do Banks Prevent PEPs from ML and TF?

Firstly, the Bank Secrecy Act (BSA) and the AML both regulate the Banks to act in this course. But these regulations do not define the PEP. Mostly, the PEP is confused with an SFPF, which is a type of PEP. Secondly, the Risk mitigation for banks is done through the customer’s risk profile where eKYC is needed. The basic BSA/AML requirements entail customer identification, verification, and customer due diligence for banks. Moreover, the PEPs are also liable to comply with these requirements. The risk management approach defines the guidelines on how to prevent Fincrime in banks. However, there is no specific section that forbids the PEPs from using banking services. Also, they are not sanctioned by the banks in case the Money Laundering is not proven on them.

Politically Exposed Person: Latest News Case

Last week, Nigel Farage, an influential figure in British politics got de-banked by Coutts a well-known wealth management company. He posted on social media that his account was closed due to his status as a PEP. A controversy was hyped when media reports stated that the account of Nigel Farage was closed due to commercial reasons whereas, BBS reporter Simon Jacks is of the view that this only happened to Farage and not other customers.

This controversy indicates that banks are striving to improve their efforts in mitigating financial crimes. However, dealing with PEPs requires further steps. Involvement of such a person in Money Laundering poses a high risk to the financial integrity of the bank itself. That’s why banks are too cautious about them.

How can a Politically Exposed Person avoid Money Laundering?

Firstly, a Politically Exposed Person (PEP) must stay compliant at all costs. BSA/AML regulations, even after not directly being applied to a PEP but still, the KYC requires them to update their information. Hence, by being ethical, they can prevent Money Laundering. Secondly, they can keep the regulatory authorities updated in case someone tries to exploit their power. This exploitation can be in terms of bribes, threats, and other offers. Here a PEP’s moral training counts a lot. Also, being a dutiful citizen is necessary, which comes with character building.

Another way of preventing Money Laundering in the case of a PEP is to conduct Ongoing Monitoring of Transactions. By keeping a continual and close check on the transaction patterns of PEPs as a part of KYC, the risk of Money Laundering activity can be greatly reduced.

Conclusion

A Politically Exposed Person might not be a criminal in every case. But the position and power entrusted to him can be misused. Therefore, the authorities and regulatory bodies of KYC, BSA, and AML always keep a close watch on them. PEPs should always stay compliant and honest about their earnings and financial status to the authorities. They must contribute their part in combating Money Laundering on every forum.