What is Face Recognition?

KYC Face recognition is a process that multiple KYC solutions use to identify a user’s unique features and authenticate that they are who they claim to be. Any device with digital photography technology can produce and capture the images and data required to create and record a biometric face pattern of the individual to be identified for the facial recognition process. It works on the 1: Many principles. We don’t have to seek far for examples of this technology’s application; it’s also found in Apple devices.

Explore the KYC AML guide and KYC solution directory to discover a diverse range of providers.

Face identity verification is an important aspect of face recognition technology since it focuses exclusively on establishing an individual’s identity by comparing their facial features to reference data, assuring secure and reliable authentication. This technique is required for applications such as secure device access and KYC procedures.

Unlike other forms of identity verification, such as passwords, email verification, selfies or images, or fingerprint identification, biometric facial recognition employs unique mathematical and dynamic patterns that operate as face scanners, making it one of the most secure systems available. The most common application of facial recognition is to prevent fraud efforts by combating ID theft. face recognition compares two photos online for identity theft prevention and AML compliance.

Where is Facial Recognition Used?

Depending on when it is performed, the KYC face recognition online can be carried out in two ways:

The one in which, for the first time, a facial recognition system addresses a face to register it and associate it with an identity, in such a way that it is recorded in the system. This process is also known as digital onboarding with facial recognition.

One in which the facial recognition system initially deals with the face to register and correlate it with the identification so that it is documented in the system. This method is also known as digital onboarding with facial recognition.

Before registration, the user was authenticated. In this process, the data incoming from the camera is crossed with the data in the database to verify the identity is this the same person face. If the user’s face matches their registered identification, they are permitted system access using their credentials

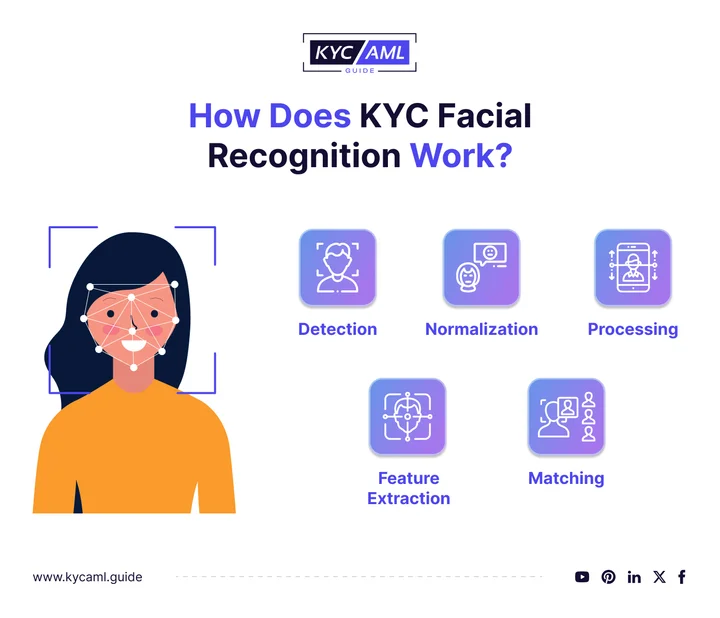

How Does it Work?

Biometric facial recognition can match the visual patterns of a two-dimensional image with a three-dimensional person for a Customer Identification Program (CIP). To accomplish this goal, KYC face recognition technology typically employs five steps

Also Read: Video KYC: A Game Changer in Remote Identity Verification

Detection

The face image detector identifies human faces forms an image and distinguishes them from simple or complicated backgrounds. This method separates ‘face’ and ‘non-face’ photos to segment the face, its location, and shape.

Normalization

The face normalization tool then uses canonical coordinates to geometrically align the face. The normalization method recognizes and locates facial features using facial landmarks such as eyes, ears, nose, mouth, and facial outline.

Processing

Traditional face recognition systems do not usually include a face processing stage. This technology, however, can help process lighting and face position to convert a two-dimensional image into a three-dimensional representation using deep learning technologies.

Feature Extraction

The extraction process extracts facial traits to distinguish if is this the same person face. This method employs around 32 geometric and photometric points to convert the pixels of image characteristics into vector representations or vice versa.

Matching

The last stage is the comparison stage. Face matching software compares samples from photos and databases to determine the greatest match and face recognition compare two photos online. The software utilized for identification is commonly referred to as Automated Face Recognition (AFR).

KYC Face recognition systems can perform closed-set or open-set identification. Closed-set verification verifies known individuals, as in KYC verification, whereas open-set searches for unknown individuals, as in crime databases. Facial recognition is primarily used to identify, authenticate, or classify individuals based on a specific task.

Why is Facial Recognition Important?

KYC face recognition is used in banks, financial and security organizations, healthcare facilities, and other businesses that require identification verification. Facial recognition is an important tool for Know Your Customer (KYC) procedures, helping to reduce identity fraud and ensure the authenticity of individuals in financial transactions and other key contexts.

However, many businesses need consumers to snap a picture and, optionally, a photo of the document. Due to its great accuracy without the intrusive character of other physiological identification systems, biometric facial recognition has become a widely applied technology. KYC face recognition online does not need to be there or touch anything, unlike fingerprints and DNA testing. Biometric facial recognition, unlike iris scanners, can be employed relatively remotely as in the case of security cameras. In this regard, facial recognition technology outperforms alternative options in terms of accuracy while putting less burden on the human body.

In London and Chinese cities, facial recognition technology is utilized for street monitoring. Street facial recognition systems are intended to assist police in identifying criminals, but many citizens are strongly opposed to them. However, these systems are being developed in China without the implementation of data protection standards that would restrict government surveillance in this area of life. The open usage of these devices in Moscow to monitor protests and identify protesters may be cause for alarm. Several communities in the United States have outlawed the deployment of so-called Big Brother equipment on the streets, claiming that the system is ineffective and can lead to crime.

Benefits of Facial Recognition

The advantages of facial recognition technology encompass the following practical applications:

- KYC face recognition is used in banks and fintech when providing identification documents as identity check and in conjunction with other biometric technologies such as fingerprints to avoid ID fraud and identity theft.

- Facial comparison is used at border control to compare the holder’s face with the image on the digitized biometric passport to verify the identity.

- Drones and aerial cameras offer an interesting mix of facial recognition for a wide range of activities. According to the June 2018 issue of the Keesing Journal of Documents and Identity, certain drone systems can carry a 10-kilo camera lens capable of detecting a suspect from 800 meters to 100 meters in height.

- Facial recognition CCTV systems can help public safety workers perform better. To locate missing children and disoriented adults, locate and identify exploited youngsters, and detect and apprehend criminals. It also helps to speed up the investigations.

Challenges of Biometric Facial Recognition

The challenges of biometric facial recognition technology are numerous, originating mostly from ethical and practical concerns.

- As demonstrated by the 2019 UK police breach, bulk gathering of personal biometric data raises privacy and security concerns that could be abused and forces the EU to impose stringent controls on data usage.

- Misidentification can arise owing to differences in technology and implementation, with the potential for false allegations, as shown in law enforcement situations.

- Furthermore, bias is still a concern in both traditional and deep-learning systems, as face recognition can be influenced by people who build the algorithms or by the diversity of the original training data.

These difficulties highlight the importance of careful evaluation and regulation in the use of facial recognition technology.

Bottom Line

KYC Facial recognition is important in KYC identification testing since it provides a safe and convenient approach to verify the identity. It streamlines the identity check, and verification process, eliminates identity fraud, and assures perfect security in financial transactions and a variety of other businesses. As technology advances, KYC facial recognition online is an important step toward more efficient and reliable identification verification. KYC AML guide can provide expert guidance in this matter by providing the service of KYC technology buying.