What is KYC? Why is it so Important?

Know Your Customer (KYC) is a procedure for verifying a customer’s identity. Many financial services have gone online, diminishing face-to-face encounters between customers and service providers and increasing the importance of customer verification in preventing fraud and other financial breaches.

The implementation of this legislation is not only limited to detecting fraud and money laundering but also terrorist financing. As a result, in addition to identity verification and document verification, analyzing the purposes for which consumers utilize the service has become critical.

The requirement of identity verification of customers is required from many industrial segments however it is of the most concern to some regulated businesses such as:

- Banks and fintech KYC

- Money service businesses

- Insurance companies

- Online gaming and live streaming

- Gambling services

- Alcohol industry

- Travel sector

- New economy companies

- Crypto industry

Many other industries, particularly new and emerging areas also face regulatory requirements to conduct ongoing KYC checks.

The Key Components of KYC Solutions for Businesses

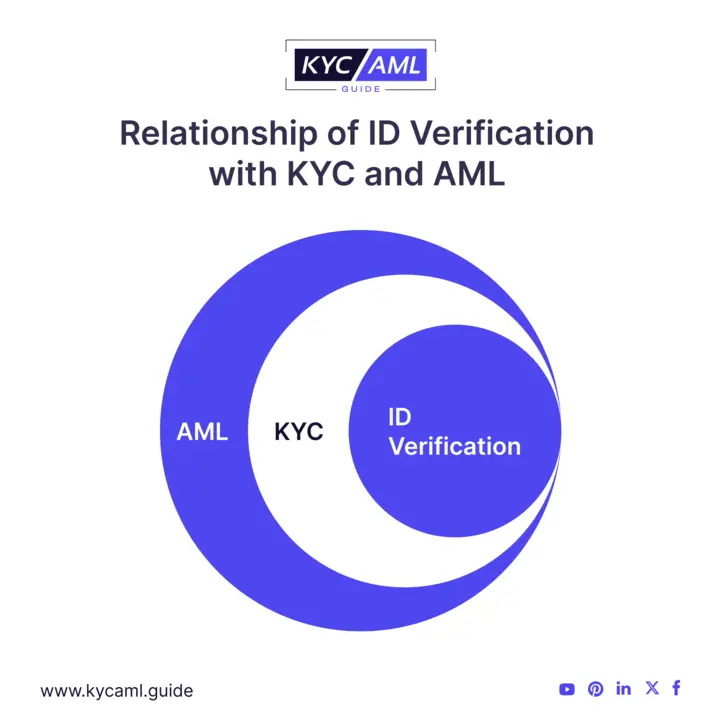

KYC and AML practices are foundational in the financial and regulatory landscape. Identity verification is an important part of a broader KYC process, which ensures that businesses have a comprehensive understanding of their customers. Essentially, identity verification is a key building block in KYC and AML processes. It helps companies identify their customers, assess risk, monitor their operations to prevent fraud and financial crime, and ultimately ensure compliance and financial system integrity.

Identity verification is a part of KYC and AML and is a component of following KYC processes.

- Customer Identification Programme (CIP)

- Customer Due Diligence (CDD)

- Ongoing Monitoring

- Electronic Know Your Customer (e-KYC)

- Corporate KYC, or Know Your Business

Why is it Important to do KYC Vendor Analysis?

As per Fenergo report, In the first half of 2023, global financial regulators imposed 97 fines totaling $189,098,690 for noncompliance with Anti-Money Laundering (AML) requirements, including Know Your Customer (KYC) and customer due diligence (CDD), as well as sanctions violations.

KYC vendors should strike the ideal mix between a good customer experience with regulatory compliance. It should be simple for your customers and workers to use while also providing sufficient risk assessment skills to allow your team to execute acceptable CDD policies. Some KYC solution analysis may make the KYC verification process easier for customers with a higher acceptance rate, but it exposes the financial institution to penalties for KYC failure. Other solutions may allow your institution to maintain exceptionally high levels of compliance, but they will churn off potential customers due to increased friction through stringent requirements.

That is why it is vital to do KYC vendor analysis that allows for smooth customer onboarding while still giving a justifiable level of control to ensure compliance.

Various KYC solution analysis provides a variety of solutions that enable your team to:

- Improve the onboarding process

- Report Suspicious Activities

- Streamline Due diligence

- Facilitating Enhanced Due Diligence (EDD)

- Reduce the amount of time spent on KYC compliance.

While doing a digital KYC solutions comparison any or all of the above may be required.

For example, banks in the United States must follow FinCEN’s customer due diligence (CDD) protocols to detect and report suspicious transactions and adapt client information maintenance to risk. FinCEN emphasizes bank-specific criteria based on the Bank Secrecy Act (BSA)/Anti-Money Laundering (AML) risk profile, which is determined by factors such as product offerings, client base, and the institution’s characteristics.

It is critical to have all the features required to meet performance goals and regulatory obligations. However, KYC software can be an expensive investment, so only pay for necessary services.

The KYC AML guide provides Vendor Analysis services that assist you in making informed decisions to prevent unnecessary expenditures on unsuitable solutions. Also, the KYC solution directory offers a comprehensive analysis of different KYC solutions.

How to do KYC Vendor Analysis?

Here’s how to do KYC solution analysis for your company:

Stakeholder Alignment

Ensure that all stakeholders, including executive management, technical teams, the compliance department, and line and operational managers, are in agreement. Create a complete list of requirements from the perspectives of these involved stakeholders to establish clear goals of the collective needs, expectations, and areas of responsibility.

Make a List of Requirements

Understanding your business requirements is the first step in selecting the right KYC Solution. Specific criteria differ depending on the applicable rules, compliance requirements, type of organization, and overall risk management plan. Some of the questions that come to mind are

- How many countries does the business plan to onboard customers from?

- What types of ID documents can the business accept?

- What is the demographic profile of the users who will undergo the KYC process?

- Which pricing plans would best suit the current financial situation of the business? Is there a preference for a pay-as-you-go model or a cumulative one-time fee offering a specific number of checks?

- What integration options would the technical team feel most comfortable with, such as SDKs or APIs, among others?

- What level of customer service is provided by the KYC vendor, and how responsive are they to issues and concerns?

- What are the ratings and reviews of KYC solutions from different companies?

Some organizations, for example, may require an on-site ID verification, but others may require online verification. Some businesses need liveness detection and biometric authentication. Compiling a list of needs can assist you in digital KYC solutions comparison.

Research and Compile a List of KYC vendors

There are numerous KYC providers and solutions available. Check the KYC AML solution directory and have a long list of KYC and AML compliance tool providers. Compiling a list of service providers who suit your specific business demands can assist you in KYC vendor analysis that best fulfills your goals and requirements.

Compare Various Vendors

Conduct a KYC solution analysis to assess whether vendors meet your specific needs. Most suppliers are delighted to provide free demonstrations and trials, so take the time to investigate them. These providers may have various capabilities to prevent fraud or streamline the customer onboarding process, which can minimize risk and time to market in addition to AML.

Consider Future Requirements and Scalability.

Considering long-term company needs is a smart idea because switching providers can be costly. As your company expands, you may require stronger authentication solutions that scale with it. However, you must determine by doing a KYC vendor analysis whether the vendor can stay up with business growth.

Key Features to Look for in KYC Solution

KYC solutions include a variety of features that assist organizations in easily identifying and verifying the identification of their clients. The yearly global volume of KYC procedures done will approach 6 billion by 2027, up from 1.25 billion in 2021. When deciding which KYC Solution to purchase, your business needs to keep the following points in consideration:

Geographical Coverage:

Identify which countries your customers will be based in to draft a policy on types of documents your business can accept as proof of identity. As your business must scale over time, it’s essential to select a solution that can handle your current and future requirements.

Face Verification

A key requirement in any KYC solution is a robust face identity verification algorithm to match the person holding the document with their picture on a government-issued ID. Furthermore, it should have extra layers of security such as liveness check, depth analysis, video KYC, etc.

Document Verification

Another key aspect of a KYC solution is its document verification system. The IDV solution must be capable of determining the legitimacy of IDs and be able to match the PII data with the information the user submitted to your business.

False Acceptance Rate

It measures the percentage of fraudulent/spoofed attempts by users who are mistakenly accepted by the solution. Lower rates imply greater precision and safety. Either you can test a solution with multiple fake documents or you can head out to a free research preview of KYC AML Guide’s testing with fake documents on 13 leading KYC solutions. You should be looking for the least possible FAR.

As per our internal testing, the current ID verification market has a 15% False Acceptance Rate.

False Rejection Rate

It measures the percentage of legitimate users who are mistakenly rejected by the solution. Lower rates indicate a higher accuracy and smoother user experience. You should be looking for the least possible FRR.

As per our internal testing, the current ID verification market has a 10% False Rejection Rate.

Response Time

Estimate how long it will take the KYC solution to verify the identity of a customer and return a response to your business’ servers or its own back office. You should also take note that response time varies by country, document languages, and types of images taken.

As per our internal testing, the current average response time for ID verification vendors has a high variance with an average of ~60 seconds.

Anti-Money Laundering (AML) Databases:

Most identity verification solutions are also integrated with an AML Database that helps conduct a background screening check (PEP Screening, Sanctions Screening, Watchlist Screening, etc.) against each verification request. You must verify which AML Database they are using and how well it is aligned with your operational workflow such as case management system, managing false positives, ongoing monitoring, etc.

Find a KYC solution with the help of KYC Technology Buying consultancy and guidance to carry out such audits efficiently.

Document Languages:

It is critical to remember that your customer documents may be available in other languages, especially if you provide services globally. Your identity verification solution should be able to validate data in different languages with utmost accuracy and without compromising response time.

Integration:

Your KYC solution should be compatible with all customer-facing solutions, including your website and mobile apps. Look for a partner who provides API integration or other seamless integration possibilities. This can be accomplished by checking –

- Mechanisms to integrate such as via an API or SDK.

- Time is taken to integrate before beginning to verify customers.

- Supported platforms such as Web SDK, Android, and iOS.

KYC AML Guide’s free research preview has listed the integration documentation of 13 leading KYC solutions here.

Deployment Options

Choose a KYC solution with a variety of deployment choices. Consider whether it can be installed on-premises, in the cloud, or a hybrid configuration. Determine which deployment technique best fits your organization’s infrastructure and security needs. Most banks require on-premise deployments so that PII data does not leave their firewalls while fintechs are mostly utilizing cloud-based deployment. However, cloud deployment comes with its benefits such as cost-effectiveness, scalability, real-time updates, etc.

Technical Documentation

Comprehensive technical documentation is required for a successful integration. Make certain that your KYC solution contains extensive documentation of APIs, SDKs, and integration methods. Technical documentation assists development and IT teams in efficiently integrating a KYC solution.

KYC AML Guide’s free research preview has listed the integration documentation of 13 leading KYC solutions here.

Data Retention Policy

Understand the data retention policy of your KYC vendor. Examine how long customer data is kept and for what purpose. Check for compliance with data protection standards and, if necessary, investigate data deletion or anonymization solutions.

KYC AML Guide’s free research preview has listed the data retention policy of 13 leading KYC solutions here.

Data Security Compliance

The protection of client data is critical, hence it is critical to choose a KYC vendor who takes data security seriously. Look for a partner who has strict security procedures and compliance with high-end encryption and data storage standards such as GDPR, ISO 27001, AES, SOC Type 2, etc.

KYC AML Guide’s free research preview has listed the compliance standards of 13 leading KYC solutions here.

Jurisdictional Compliance

Check that your KYC software can assist your company in meeting KYC regulations in your jurisdiction and industry.

Cost

When evaluating which KYC vendor to choose, pricing is always a crucial consideration, but it is also important to balance price with the value the partner delivers to your organization. Look for a vendor who not only has a competitive price but also provides the service and assistance your business requires. Your KYC solution should scale your business and allow your business to seamlessly switch to cost-effective options as it grows. To compare the cost of different vendors visit KYC Solutions Pricing.

User Experience

The identity verification process must be very swift and smooth for a user to go through. Research has shown that there is a 40% churn rate of old-age customers as they are unable to go through the complete verification process. Your business should analyze the KYC journey experience from the persona of different users such as old-age customers, young and tech-savvy customers, tech-illiterate customers, etc.

You must analyze if detailed instructions are provided before a customer has to go through the verification process, consent to the solution’s privacy policy is taken or not, availability of auto-capture functionality, time taken to auto-capture, preview shown to the customer before submission, etc.

KYC AML Guide has provided a free research preview of some of the aforementioned metrics here.

Support:

If your team is unable to resolve some integration issues or needs support once the solution is in production, the KYC vendor must answer your queries promptly. Thus, you need to see if they provide 24/7 support availability and by what means.

Final Thoughts

Assume you’re a member of a fintech business aiming to revolutionize internet financing. To comply with banking regulations, you must have a strong KYC procedure in place to verify your customers’ identities. You need a KYC solution that can integrate with your platform effortlessly, guaranteeing a smooth and quick onboarding process for your users.

You will need to do an extensive vendor analysis to find a KYC solution with robust integration capabilities and cost-effective solutions, perfect for a fintech organization looking for adaptability and efficiency. KYC AML Guide’s vendor analysis cuts this research time from weeks to mere days and aids in KYC Technology Buying decisions for businesses.