What is the Best KYC Solution?

A best-in-class KYC solution is more than just a tool for verifying customer identities; it’s a strategic asset that enables businesses to operate securely in a digital world. Here are the factors of the best KYC solution:

| No | Factor | A KYC solution that |

| 1 | Advanced Technology Integration |

|

| 2 | Regulatory Compliance |

|

| 3 | Scalability |

|

| 4 | Enhanced Security |

|

What Parameters Define a Best KYC Solution?

To identify the best KYC solution for your business, it’s essential to evaluate several key parameters that distinguish top-performing solutions from the rest:

1 Data Accuracy and Verification

- The ability to verify customer information accurately through multiple reliable data sources.

- Integration with government databases, watchlists, and biometric data for enhanced accuracy.

2 User-Friendly Interface

- An intuitive, easy-to-navigate user interface for both customers and internal users.

- Minimal friction in the onboarding process to improve customer satisfaction.

3 Cost-Efficiency

- Transparent pricing models with no hidden costs.

- Options for flexible pricing structures that align with your business’s size and needs.

4 Customization and Integration

- The flexibility to customize the solution to meet specific industry requirements.

- Seamless integration with existing systems and workflows, reducing disruptions during implementation.

5 Speed and Efficiency

- Fast KYC processing times to prevent delays in customer onboarding.

- Automated workflows and decision-making to streamline the KYC process.

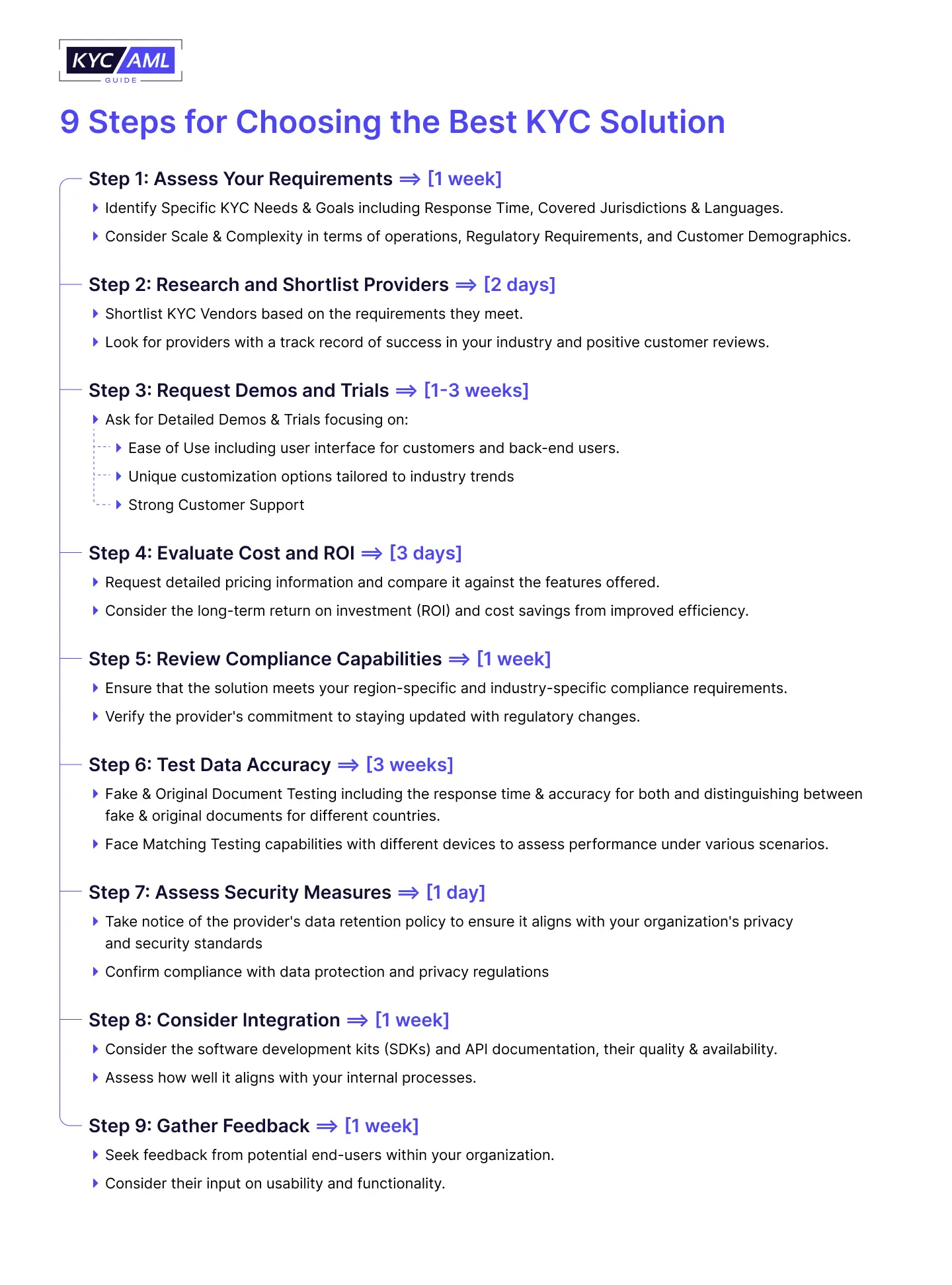

9 Easy Steps for Choosing the Best KYC Solution

Choosing the best KYC solution involves a stepwise process that aligns with your organization’s unique needs.

What Clients Need to Know Before Selecting a KYC Service Provider?

When selecting a KYC service provider, clients should be aware of a few critical factors:

Data Ownership and Privacy

- Understand who owns the customer data collected during KYC processes.

- Ensure that data privacy and security standards align with your business operations.

SLAs and Support

- Clarify & discuss service level agreements (SLAs) and support arrangements with KYC Vendors.

- Ensure that the provider offers responsive 24/7 customer support for troubleshooting and inquiries.

Future Proofing

- Consider the scalability and adaptability of the KYC solution to accommodate future growth and regulatory changes.

Why To Choose Consultancy For KYC Technology Buying?

KYC technology buying consultancy is the key solution to your problems. KYC Technology Buying involves a thorough comparison among different KYC service providers based on various industry parameters. It is a challenging and resource-intensive task where firms may exhaust their potential and miss out on growth opportunities. A KYC Technology Buying consultancy will assist you every step of the way to streamline your KYC technology selection, minimizing costs and effort in this complex procedure. Your business can utilize its analysis to assess as it is a done-for-you template to help you choose a KYC solution.

Selecting the ideal KYC (Know Your Customer) solution is a multifaceted process that demands expertise, resources and a comprehensive understanding of your organization’s unique needs. As the intricacies of KYC compliance grow, many businesses are recognizing the wisdom of outsourcing KYC vendor selection to specialized analysts.

So, hiring a credible resource who has already done this part will ease your choice of KYC vendor. Here’s why this approach is becoming increasingly prudent.

| 1 | Expertise and Specialization | Outsourcing KYC technology buying ensures specialized handling of the entire selection process, aligning solutions precisely with your organization’s needs, including regulatory compliance and technological intricacies. |

| 2 | Comprehensive Vendor Evaluation | Selecting the right KYC Solution involves an exhaustive evaluation of potential vendors. Consultants not only identify suitable options but also scrutinize them based on your specific criteria. This diligent assessment can seamlessly integrate with your existing systems and workflows, minimizing potential disruptions. |

| 3 | Customized Solutions | Prudent KYC Vendor selection tailors the chosen solution to specific business needs, in a diverse corporate environment ensuring a precise alignment with demands. |

| 4 | Risk Mitigation | Choosing the inadequate KYC Technology may lead to dire consequences including non-compliance penalties, security threats, and money laundering & terrorism financing. Hiring a Consultancy for KYC Technology Buying will not only prevent these risks but ensure the security standards, privacy protocols & due diligence. |

| 5 | Time and Resource Efficiency | In-house vendor selection can be a resource-intensive process, requiring significant time, cost, and effort from your internal teams. Acquiring proper consultancy for this frees up your resources to focus on core business activities. |

| 6 | Cost Savings and ROI | Hiring experts for KYC vendor selection can lead to long-term cost savings. Analysts assess the total cost of ownership (TCO) and evaluate the potential return on investment (ROI) accurately, considering both short-term expenses and long-term benefits. |

| 7 | Continuous Monitoring and Adaptation | KYC compliance is an ever-evolving concept. KYC Technology Procurement Experts not only assist in vendor selection but also provide ongoing monitoring and adaptation to regulatory changes. |

Acquiring the services of KYC Technology procurement experts is highly beneficial for businesses seeking efficiency, cost-effectiveness, and industry expertise. By leveraging the expertise of KYC analysts, organizations can navigate the complexities of vendor selection, optimize“` their KYC processes, and maintain regulatory compliance.

How KYC/AML Guide Helps You in KYC Technology Buying?

KYC/AML Guide is your ultimate source of compliance decision making. We pave the way for your success throughout the compliance journey where we offer the following standout benefits:

- Within 14 business days, we reduce the time taken for KYC Vendor Selection

- We enable you to channelize your resources more on strategic goal achievement

- Speeding up your Customer Onboarding & ensuring faster ROI

Conclusion

Selecting the best KYC solution for your business is a strategic decision that requires careful consideration. The right solution will not only ensure regulatory compliance but also enhance security, streamline operations, and improve customer satisfaction. By assessing your specific needs, evaluating key parameters, and considering client-focused factors, you can make an informed choice that aligns with your business goals. Remember that the best KYC solution is one that evolves with your business, ensuring long-term success and compliance in an ever-changing landscape.

Table of Contents

- What is the Best KYC Solution?

- What Parameters Define a Best KYC Solution?

- 9 Easy Steps for Choosing the Best KYC Solution

- What Clients Need to Know Before Selecting a KYC Service Provider?

- Why To Choose Consultancy For KYC Technology Buying?

- How KYC/AML Guide Helps You in KYC Technology Buying?

- Conclusion