Suppose you want to invest your hard-earned cash, so you choose to open an account with a respectable investing company. You fill out necessary forms online and enthusiastically anticipate approval to wander into the universe of banks and bonds. However, before you begin trading, the venture company ought to confirm your identity and assess the potential risks of your account. This is where KYC document verification becomes an integral factor.

You will be approached to provide some standard documents such as proof of identity or proof of address. These documents are like your financial fingerprint, assisting the organization with ensuring you are who you say you are and not engaged in any shady dealings. Once you submit your documents, the firm’s compliance team takes turns getting to work. Each document is investigated, searching for indications of altering or phony. The information you provide is used with databases and different sources for identity verification and assessing potential risks.

While this process might appear somewhat dreary, safeguarding you and the organization from financial fraud and other criminal operations is important. In addition, when you’re perfect, you can start investing with certainty, realizing that your reserve funds are safe and sound.

Importance of KYC Process in Investment Firms

Onboarding a client is the process by which an investment company acknowledges a new client and enters information into its records so the organization can transact with and for the benefit of the client. Organizations in the investment industry are legally required to verify customers’ identity through a KYC cycle before interacting with a possible client. Investment companies continually screen the activities and transactions of investors or clients with the goal that they don’t become suspicious. In such a manner they keep up with documentation and if any suspicious activity is identified, the firm must report such activity or transaction to the appropriate authorities and keep up with suitable records for reference.

Investor approval has turned into an essential move toward the investment process, particularly with the ascent of online businesses. This is particularly evident in the blockchain, payment companies, electronic money institutions, and crypto institutes, where the source of funds is not clear. Regulators are expanding and reinforcing their regulatory structures globally as they take action against organizations that fail to properly identify the sources of their wealth.

Also Read A Guide to KYC Document Verification in Money Service Business (MSB)

KYC Document Verification Process in Investment Firms

The document verifies the origin of the investor’s money and proves that the money did not come from illegal or criminal sources. The documentation presents the companies’ operations, their internal and external interactions, as well as their services. The documentation of investment sectors and companies in the investment sector is different. However, the general rules, structure, and logic of internal and external documentation apply to all types of companies. Financial Action Task Force (FATF) requires financial foundations to implement due diligence measures, including investor verification to battle terrorist financing and money laundering.

The process of KYC document verification is as follows

1 Document Collection:

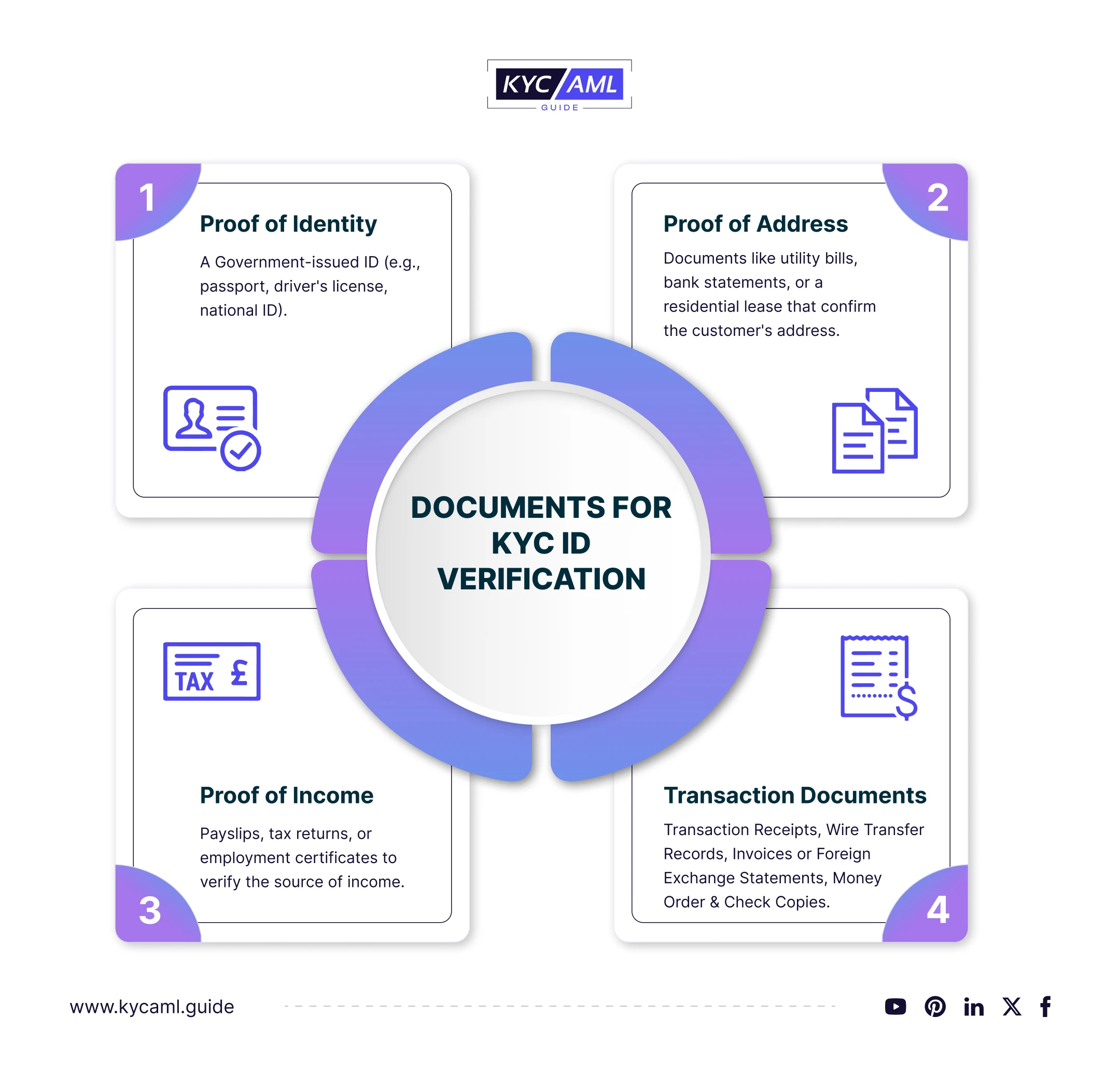

When the client opens an account or intends to invest, they must present certain documents for identity verification and risk assessment. These documents typically include

- Government-issued identification such as passports or driver’s licenses,

- Proof of address such as utility bills or bank statements, and

- Sometimes additional documents depending on the jurisdiction and nature of the investment such as income records, bank statements for assets, and credit reports for liabilities.

The most important documents required to verify the investor’s background are the following:

| Bank Statements | Bank statements are used to verify financial assets and analyze a person’s net worth during the onboarding process |

| Tax Returns | Tax returns verify income and sometimes assets during investor due diligence. In most cases, investors must submit tax returns from the last two years to prove eligibility. |

| Statements Of Investment Accounts | Investment account statements are useful for documenting ownership of assets such as bonds or other securities. |

Then, to prove ownership of the asset, the issuer or seller sends a questionnaire that includes a balance sheet and supporting documents, such as financial statements. Investors who qualify based on their annual income can submit

- W2 forms,

- Tax returns,

- Letters from CPAs (certified personal accountants), investment brokers, consultants, and tax lawyers.

2 Document Authentication:

Investment firms use a variety of methods to review documents submitted by customers. This may include manual verification by admissions staff or automated systems that can review and verify the validity of IDs and other documents.

3 Identity Verification:

After verifying the documents, the company checks the customer’s identity by comparing the information in the document with other sources. This may include government-issued databases, watchlists, or other trusted sources.

4 Risk Assessment:

Investment companies assess the risk associated with every client in addition to identity verification. This incorporates factors like the client’s financial history, source of funds, and any warning signs that may indicate money laundering or illegal activity.

5 Ongoing Monitoring:

KYC is certainly not a one-time process; it is a continuous task for the investment company. They are supposed to audit and update client data intermittently and conduct additional reviews assuming that there are massive changes to the client profile or risk profile.

Also Read: Common Mistakes to Avoid in KYC Document Verification Process

Conclusion

Investor verification is a vital stage in the investment process for organizations and investors. This shields organizations from fraudulent activities, yet in addition guarantees the security of legitimate business owners. With the rise in online investments, KYC document verification has become fundamental for accurate and effective investor verification.