01 min Read

Nov 22, 2023

How a Fintech Reduced Friction in Customer Onboarding with KYC AML Guide

In this case study, KYC AML Guide achieved a significant milestone by offering KYC Technology Buying Consultancy to a Fintech company that facing challenges in its existing KYC Customer Onboarding process. Learn how KYC AML Guide directed the fintech firm towards concrete results in customer retention through comprehensive comparative analysis.

Summary:

Old-age customers usually face challenges with customer onboarding especially when they try tech-savvy approaches like mobile applications in signing up for financial services. Our case study explores how a leading Fintech firm, specializing in services for retirees and the 60+ age group, turned to KYC AML Guide for help. Elderly clients faced challenges with blurry selfies during mobile KYC onboarding, causing frustration where outdated mobile phones compounded the issue.

This resulted in customer churn for the fintech firm due to the pertinent issues in the customer identification and authentication process through the KYC Technology they have employed. KYC AML Guide helped fintech overcome its issues with expert guidance, in-depth analysis of the KYC Technology, and recommendations.

The Challenge

The old age group being the major clients of the fintech firm faced 2 major issues that created friction in customer onboarding. The 60+ age group is known to be old school and they prefer using convenient, simple to use, and legacy devices from the 2012-2015 era. The images taken from cameras of old devices are usually blurry which results in a high false rejection rate leading to churn. Moreover, the issue was compounded that senior citizens cannot steadily hold their mobiles or documents while taking their photos.

Case

A well-known Fintech firm serving old-age/retired and 60+ age group clients that offer old-age benefits and compensation for loss and damage services operates as a Trust and approached KYC AML Guide with some concerning yet unaddressed pain points in customer onboarding through mobile camera selfies.

Here are the challenges encountered by elderly customers during the customer onboarding process, which have contributed to friction and ultimately resulted in customer churn.

- A high number of false rejections due to blurry photos during Mobile KYC. Customers of the fintech firm felt agitated due to repeated failed sign-up attempts due to systematic rejection of their photos.

- The issue also persisted in taking photos of the Identity Documents (Passports, Driving Licenses, etc.) due to the same reason.

- Mobile application of the Fintech firm lacked in showing the selfies and photos of the original document to the customer after uploading and giving the option of edit or removal to save the hassle of multiple sign-up attempts.

- Customers used outdated mobile phone models mainly from the era of 2012 to 2015.

- The existing KYC Solution could not provide runtime and simple instructions to old-age people for taking acceptable photos through mobile phones.

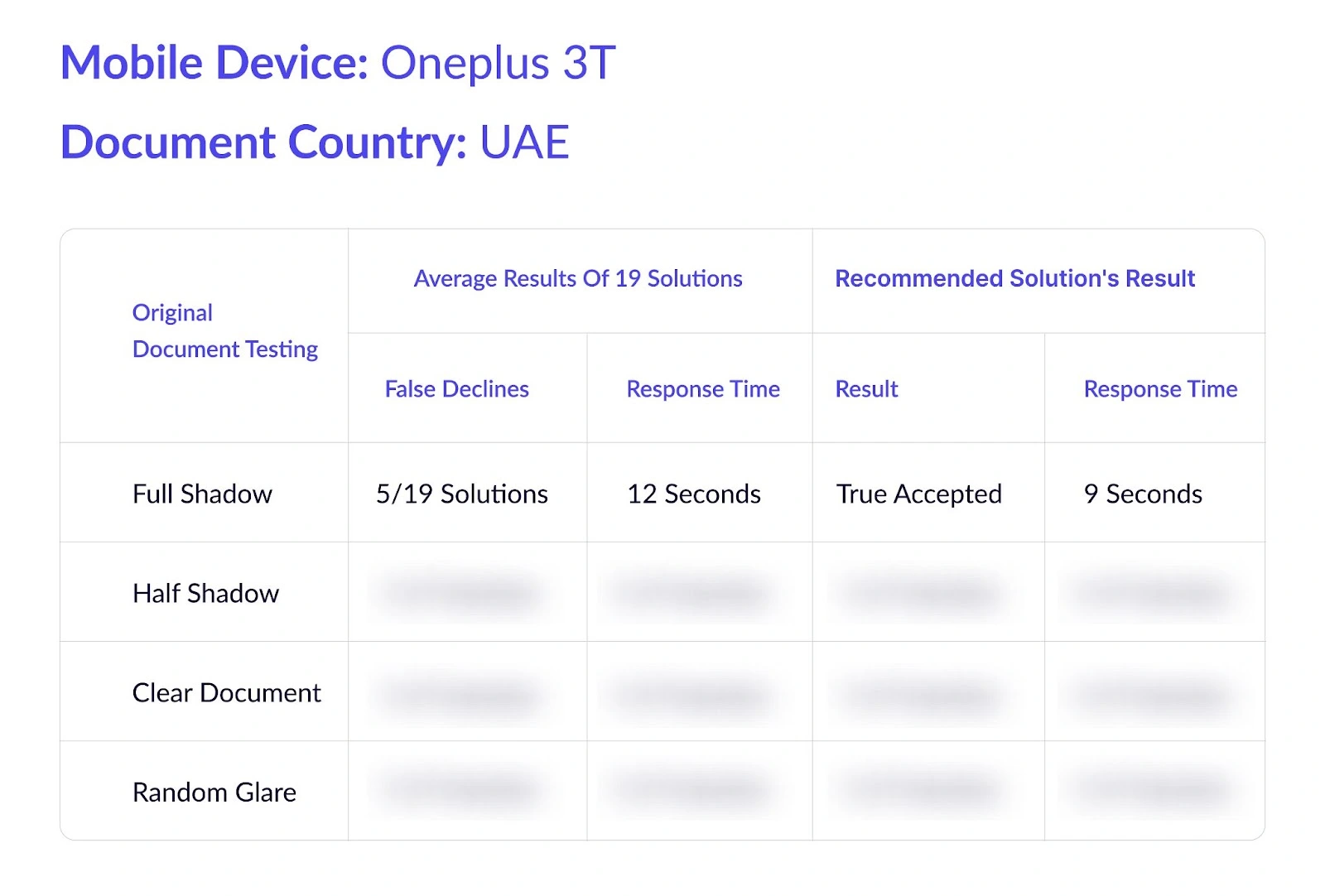

KYC AML Guide delivered research-driven consultancy services to the fintech firm, keenly resolving every critical challenge that the fintech client faced in this regard. We conducted an in-depth analysis of 15 KYC solution providers that specifically offer selfie/camera KYC services. Our analytical approach was based on three main factors including document testing for improved Identity Verification, integration & customization for enhanced user journey.

Solution and Outcomes

Document Testing

The document testing aimed to address diverse challenges, from ensuring accuracy, speed, and error handling in various conditions. By collecting user feedback, adhering to guidelines, and proposing the optimal KYC Technology, the fintech firm achieved a high success rate in streamlining customer onboarding, effectively mitigating pain points for old-age customers using smartphone selfies and taking photos of their ID documents.

- Specialized testing for the elderly population.

- Examination of various lighting conditions and backgrounds (Full Shadow, Half Shadow, Clear Document, and Random Glare).

- Consideration of aging and facial hair variations.

- Testing image correction for blurry selfies & photos of ID Documents with multiple takes.

- Addressing challenges of low-quality image uploads.

- Providing real-time feedback and combating spoofing techniques.

Integration & Customization

KYC AML Guide systematically tested the following aspects of KYC Solutions to check the issues of compatibility with legacy devices (smartphones and laptops), and error handling through alignment with the integration objectives of the fintech firm. Here, the integration and customization module of testing focused on checking the Solution’s compatibility and ability to integrate with multiple platforms.

The outdated smartphones and laptop cameras were considered as a main factor in the solution testing under the integration and customization module. Furthermore, the improvisation and adaptability were evaluated as to how much they are compatible with different supportive plugins and platforms.

User Journey

The overall user experience while signing up through Fintech’s KYC solution was tested to check the ease of customers during onboarding under the following aspects:

- Real-time customer education including visual and audio guides

- Adherence to WCAG 3.0 guidelines for inclusivity.

- Examination of how users interacted with on-screen instructions.

- Collection of valuable user feedback.

- Testing the UIs of KYC Solutions for a smooth KYC Journey.

- Appraisal of selfie-capturing interface functionality.

- Real-time Assistance for users in optimizing selfie conditions.

- Rigorous usability checks, especially for senior citizens.

- Focus on the ease of auto-selfie capture feature.

Through KYC AML Guide’s extensive Vendor Analysis based on the above-mentioned parameters, the best match KYC Solution was proposed with adjustments in a few practices of the Fintech firm. The desired success rate was achieved with the recommended KYC Solution provider. The fintech firm was able to achieve a high success rate in streamlining the Customer onboarding process.

Our requirement mapping for KYC Technology Buying consultancy proved to be successful for the Fintech firm as it mitigated the 4 major pain points for the old-age customer onboarding process via smartphone selfie.