What is a Money Service Business (MSB)?

A Money Service Business (MSB) is a financial service that converts and transfers money in any form. It is different from a bank yet its basic operations include money transfers. For example, PayPal, Western Union, and Coinbase provide money transfer services in both tangible and intangible forms.

Types of MSBs

There are 2 main types of MSBs explained below with the differences between them.

| Conversion MSBs | Transmission MSBs |

Conversion MSBs provide the following services:

|

Transmission MSBs transfer money into local and foreign jurisdictions. |

| The minimum transaction threshold to be classified as MSB is $1000 per person per day. | No minimum amount is designated for Money Transmitters to be classified as MSBs. |

According to FinCEN’s 31 CFR 1010.100(d) definition, banks are not categorized as MSBs but all MSBs are financial institutions. They include cryptocurrency exchanges, e-commerce platforms, crowdfunding, travel money, etc.

KYC (Know Your Customer) and Money Service Business (MSB)

KYC (Know Your Customer) is important for being in a Money Service Business because it helps in identifying and verifying the identities of customers. This ultimately helps in preventing unauthorized access to MSB services and protects the services from being misused for illicit activities like money laundering and fraud.

Why do MSBs need KYC Document Verification?

According to the De-Risking report published by the US Department of Treasury in April 2023, National Money Laundering Risk Assessments (NMLRA) and National Terrorist Financing Risk Assessments (NTFRA) identified that Money Services Businesses can also be exploited for illicit activities.

- In 2022, NMLRA quoted multiple examples of the elevated Money laundering risk posed by MSBs to the US’s financial ecosystem’s security. It highlighted the aspect of weak compliance with the AML (Anti-Money Laundering) and CFT (Combating Financing of Terrorism) laws by small MSBs.

- The Treasury also identified that in 2018 – 2022, MSBs have been misused by terrorist groups.

- Over 26000 MSBs are registered with FinCEN and are obligated to comply with AML/CFT rules and regulations. FinCEN has authorized the International Revenue Service’s (IRS’s) Small Business division to examine the MSBs’ compliance with BSA (Bank Secrecy Act).

- MSBs must verify their customer identification information, retain the record, and report suspicious transactions and activities.

- Money service businesses must also file two specific reports: Reports of Foreign Bank and Financial Accounts (FBARs) and Reports of International Transportation of Currency or Monetary Instruments (CMIRs).

- As of now, MSBs are required do not have a requirement to conduct customer due diligence.

- They are also not obliged to share with banks the specific identification information concerning their customers.

From the above information, it is evident that MSBs require KYC Identification and Verification procedures to remain compliant and prevent financial crimes.

KYC Document Verification in Money Service Business (MSB)

Whenever a person or an entity opts for a Money Service Business, it is a legal obligation for the MSB to have an established KYC Document Verification system that identifies and verifies associated identity with a customer’s account and authenticates service access after verification.

Also Read: KYC Document Verification in Banks

Document Verification is imperative and among the most basic requirements of a KYC process. It requires the following steps for an MSB or any other financial business.

How Does KYC Document Verification in MSBs Work?

Generally, KYC Document Verification is a three-step process:

- Identification: Customer submits documents for verification

- Verification: Identity through documents is verified by matching with existing database

- Authentication: Once verification is complete, the customer is granted access to the services.

These three steps are further broken down into the following steps in KYC Document Verification in Money Service Businesses.

| Document Collection |

|

| Document Authentication |

|

| Customer Identification |

|

| Risk Assessment |

|

| Ongoing Monitoring |

|

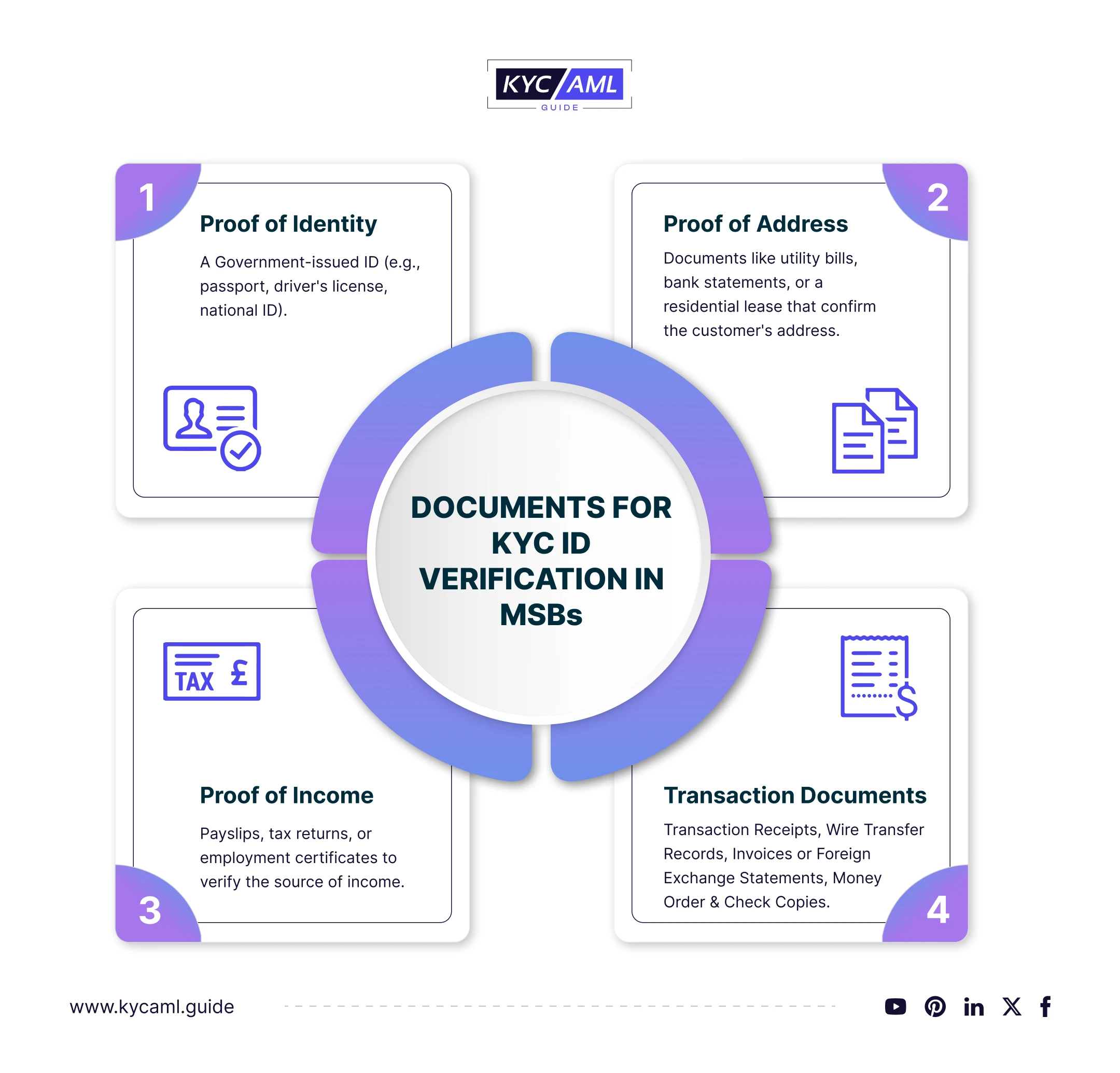

Documents Required for KYC Identity Verification in MSBs

- Proof of Identity (PoI): A government-issued ID (e.g., passport, driver’s license, national ID).

- Proof of Address (PoA): Documents like utility bills, bank statements, or a residential lease that confirm the customer’s address.

- Proof of Income/Occupation (PoIO): Payslips, tax returns, or employment certificates to verify the source of income.

- Transaction Documents: Transaction Receipts, Wire Transfer Records, Invoices or Foreign Exchange Statements, Money Orders, and Check Copies.

In case of Remote KYC Document Identity Verification through mobile phone, You need to submit high-resolution clear photos of all these documents where all necessary information is readable۔

Challenges in KYC Document Verification in MSBs

It is necessary to consider and prevent the following challenges in KYC ID Verification for Money Service Business Customer Onboarding. Especially when Document Verification is conducted online, the chances of these errors and risks are quite high.

| Document Authenticity |

|

| Biometric Authentication Accuracy |

|

| Data Security |

|

| Regulatory Compliance |

|

| User Experience |

|

KYC AML Guide: Helping MSBs towards Seamless KYC Document Verification

KYC AML Guide is the ultimate source of industry knowledge and expertise. We facilitate the financial sector as a whole where we focus on Money Service Businesses to provide KYC Technology Buying Consultancy especially to meet their compliance goals and mitigate the challenges faced in their customer onboarding process. We offer a clear understanding and navigate the MSBs in making informed choices for KYC Vendor and save resources on identity verification solution buying.