What Is an EMI?

An EMI, or electronic money institution is a sort of financial organization that handles digital transactions (e-money) on its customers’ behalf. As the term “electronic” implies, electronic financial institutions function online. Some EMIs, like traditional banks, may have typical bank branches where they can be visited in person.

The EMI is a symbol of the evolution of financial services. Since 2009, it has become common across Europe when Directive 2009/110/EC, often known as the E-Money Directive, permitted EMI to function. These organizations are well-known for e-money payment disbursement and payment intermediation, which contributed around $6,752,388 to the total of digital payments in 2021 and are predicted to reach $10,715,390 by 2025.

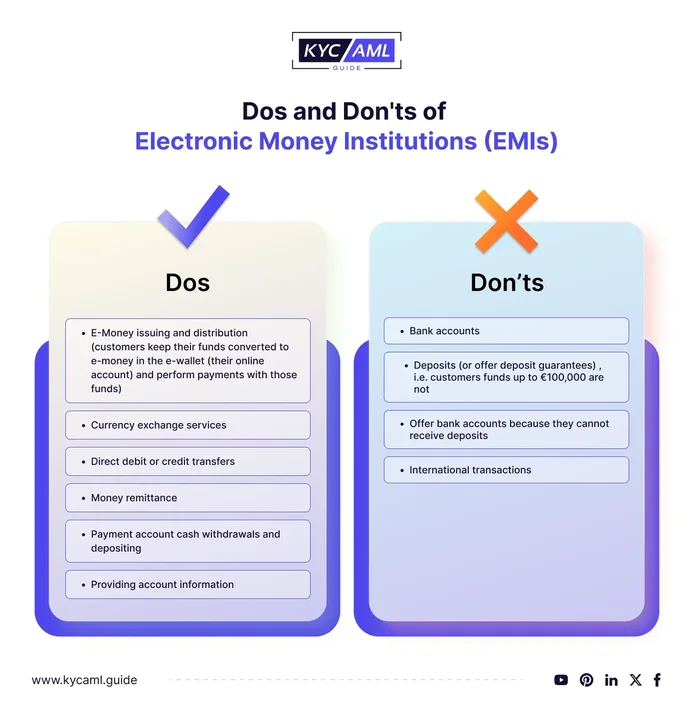

To operate as an EMI, you must first receive an electronic money license from one of Europe’s most well-known authorities, the UK’s FCA and the National Bank of Lithuania. The UK’s FCA authorizes and regulates online financial institutions. They can issue payment cards, offer bank accounts, and authorize money transfers. EMIs, unlike traditional banks, cannot provide loans or leases. They are also not covered by the insurance like Financial Services Compensation Scheme.

Malta, for example, is a country with a strong e-commerce presence. The Malta Financial Services Authority (MFSA) is the entity authorized to issue such licenses. The National Bank of Lithuania is the supervisory financial regulator in Lithuania. The following are the services supplied by EMIs.

Comprehensive Overview of EMI Services

Another example is users can now link their company cards to their digital wallets and pay swiftly at POS terminals and online payment points as EMI now allows the usage of Google and Apple Pay. You can use Apple or Google Pay wherever it shows as a payment option.

Mobile payment services like Google Pay and Apple Pay differ from e-money in that they provide digital payment options using corporate cards.

Also Read: A Guide to KYC Document Verification in Money Service Business (MSB)

How is an Electronic Money Institution Regulated?

EMI is governed by local authorities and governments throughout the world. In the United Kingdom, for example, EMIs such as Payset are regulated by the Financial Conduct Authority (FCA).To identify clients and prevent fraud and crime, all good EMIs utilize KYC and AML protocols. As a result, both banks and EMIs provide secure fund storage.

KYC document verification in investment firms is a critical process subject to regular audits to ensure compliance as well as security guidelines such as PSD2 and legislation governing client money protection.

The most current amendment to the Electronic Money Act of 2011 is Regulation No. 47 and Amendments to the Payments Act of 2017 Regulation No. 106, defining the functions of the authority, is amended to include considerations for sustainable growth and economic policies.

Regulatory distinctions between banks and EMIs are frequently the result of banks operating and managing money on a far greater scale than EMIs. Banks in Europe typically require a substantial capital base of at least €5 million, whereas EMIs are smaller firms that can function with as little as €350,000.

Similarly, the competent authorities of individual EEA member countries regulate EMIs through local rules that primarily follow European directives.

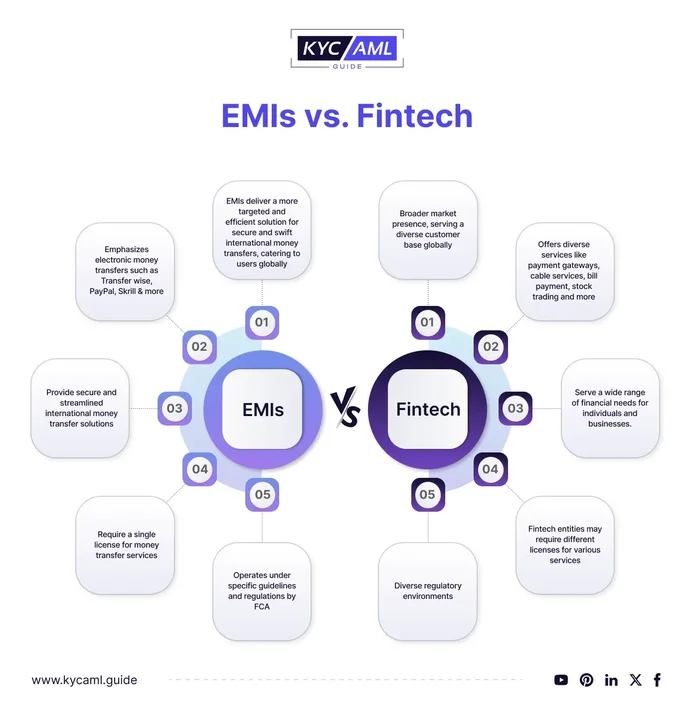

The differences between EMIs & fintech are as follows

The Comparison between EMI & Fintech

Also Read: KYC Document Verification in Banks: Requirements & Best Practices

Step-by-Step KYC Document Verification Process for EMIs:

KYC requirements must be followed by EMI firms to authenticate their customers’ identities and prevent fraud, money laundering, and terrorist financing. Identity verification processes differ by country, and financial institutions must follow KYC and anti-money laundering rules to avoid fraud. KYC compliance is the responsibility of banks, and failing to do so may result in harsh penalties.

6-Step Process Flow of KYC Identity Document Verification

Customer Onboarding:

The KYC journey typically begins with customer onboarding. Prospective users provide their details and are required to submit supporting documentation.

Document Submission:

KYC document verification, which involves the use of documents such as identity cards, employment certificates, and other credentials that confirm identity and address, is an important aspect of this process.

- Customers must present government-issued identification, such as passports, state ID cards, or driver’s licenses.

- Proof of Address, such as a passport, driver’s license, social security card, voter ID card, bank statement, and tax forms, are common KYC documents requested by EMI.

- Photo Identification

Automated Document Verification:

Many EMIs are using advanced technologies such as optical character recognition (OCR) and machine learning algorithms to automatically extract information from submitted documents this not only speeds up the verification process but also improves accuracy.

Use of Biometric Authentication:

In some cases, EMIs employ biometric verification methods, such as facial recognition or fingerprint scanning, to further enhance the security of the KYC process.

Compliance Check:

EMIs must adhere to strict regulatory requirements. The documents submitted undergo thorough compliance checks to ensure conformity with local and international regulations.

Ongoing Monitoring:

KYC is not a one-time event; it’s an ongoing process. EMIs employ continuous monitoring to detect and respond to any changes in customer behavior or risk profile.

What are the Advantages of EMI to Customers?

The EU made more than 2.1 billion e-money in 2014, which climbed to more than 4 billion in 2018. There were around 4.6 billion e-money transactions in 2019. So, what is driving the growth

Easy Accessibility

Customers of EMI will value online banking’s convenience. They can complete the transaction without having to visit a real bank because most tasks can be completed from home, which saves time.

Uninterrupted Transactions

Clients have control over when they can perform particular financial operations, such as transfers, and when they can view specific financial information.

No Credit Risk

Since EMIs, unlike banks, do not utilize their clients’ funds for lending, client monies remain secure, encrypted, and safeguarded within their accounts.

Reduced Rates

EMIs reduce transaction costs by streamlining and speeding up processes, which benefits customers.

Challenges and Innovations in KYC Document Verification

According to Transparency International UK research, more than a third of the UK’s authorized electronic money institutions have been warned of potential money laundering. In the December 2021 report the association claimed that without stricter regulation, the payments industry might become a “gateway” for illicit funds from around the world.

Security Concerns

Cyber attacks do not spare the digital environment. EMIs are constantly investing in cyber security measures to safeguard sensitive client data.

User Experience

Finding a balance between strong security and a pleasant user experience is an ongoing issue. EMIs attempt to make the KYC procedure as simple as possible while maintaining security.

Evolving Regulatory Landscape

The regulatory landscape is continuously changing. To guarantee compliance, EMIs must stay up to date on changes and alter their KYC processes accordingly.

Integration of Blockchain

Some forward-thinking EMIs are considering incorporating blockchain technology to improve the security and transparency of KYC processes.

The future of KYC in EMIs promises intriguing potential as technology advances. The landscape is positioned for continuous innovation, from incorporating artificial intelligence for increased fraud detection to investigating decentralized identity solutions.

How Does a KYC/AML Guide Assist You in EMI KYC Document Verification?

Finding the right solution for EMI KYC document verification during transactions is critical. KYC AML guide can help organizations by providing expert research-based KYC Technology buying. We can help you find a solution that meets your specific goals and operational requirements. We can also help you with in-depth KYC vendor analysis, allowing you to make an informed decision for flawless KYC compliance in EMI transactions.