What is a Due Diligence Background Check?

A background check is a procedure for investigating an individual’s or company’s past. These financial assessments serve a variety of functions, including assisting organizations in making decisions about developing business relationships, hiring employees, and licensing people. It is important to note that there are various types of background checks, one of which is the distinction between a pre-employment background check and due diligence background checks.

Due diligence background checks are performed as part of important business transactions involving business entities and their executives. As a company grows, whether it is onboarding new clients or considering forming a partnership, its reputation is determined by how third-party risks are managed.

Lawsuit due diligence background checks typically include seven years of criminal and judicial records, but this can be extended depending on compliance laws and searches. An example of a due diligence background check is thoroughly looking into potential business partners to determine their financial stability, legal history, and company reputation. These checks are performed for a variety of reasons, including mergers and acquisitions, additional investment, international business partner evaluation, “Know Your Customer” and business loans.

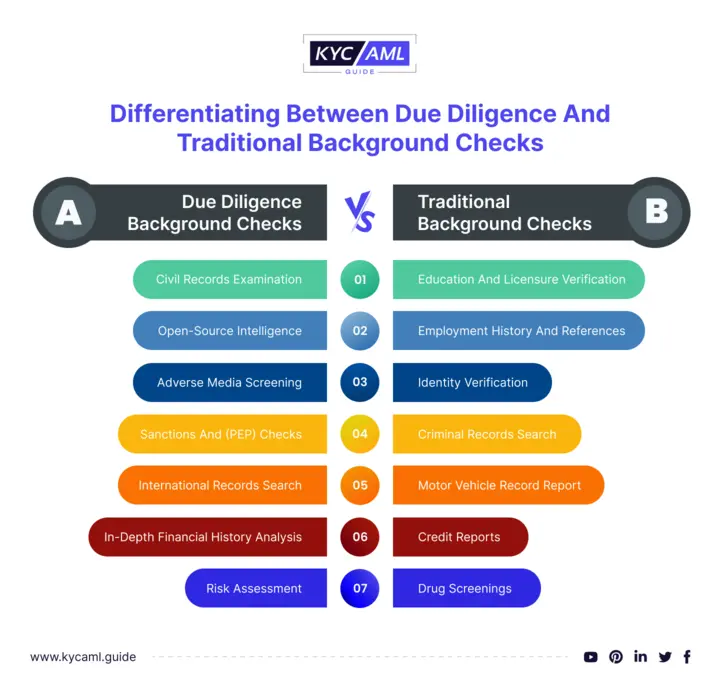

Distinguishing Between Due Diligence and Traditional Background Checks

Traditional background checks provide a basic evaluation while due diligence background check services provide a more thorough and meticulous examination. They are especially useful when making critical decisions that involve significant risks and potential ramifications for your organization.

How to Conduct a Due Diligence Background Check?

Due diligence background check services are extremely important in a wide range of situations, serving as a valuable tool for obtaining complete, unbiased, and accurate information. When conducting due diligence, it is imperative to follow a comprehensive background checklist that covers critical aspects, including:

- Identifying key stakeholders entails identifying key company members, shareholders, ultimate beneficial owners, and any other corporate connections.

- Address verification entails verifying and confirming all registered addresses to ensure their legitimacy and accuracy.

- Employee Qualification entails verifying key employees’ academic backgrounds, career histories, and professional licenses and certifications. 87% of the discrepancies discovered through background checks were within employment and academic verifications. Incorrect dates account for 11.2% of employment discrepancies and 8.6% of education discrepancies.

- Obtain information from credible sources such as official government records, financial institutions, and reputable background check providers.

- Sanction Screening to find people, organizations, or nations that are the target of financial restrictions imposed by government or international organizations.

- Examine lists of politically exposed persons (PEPs) for potential risks associated with these institutions.

- Monitor adverse media reports, such as allegations published in popular media outlets and other publications that implicate individuals or businesses. and illegal activities such as fraud, money laundering, corruption, terrorism, and drug trafficking

- Examine financial results, balance sheets, assets, and liabilities to determine the subject’s health and financial stability.

- Expand the search to international records if necessary to ensure a thorough background check, especially for global business transactions.

- Ensure that your background checks adhere to all applicable laws and regulations, especially when it comes to KYC/AML requirements.

- Consider implementing ongoing monitoring to keep track of any changes in the person’s or entity’s background depending on the nature of the relationship.

The Importance of Due Diligence Background Checks

Background checks and Due diligence are critical tools in KYC and AML processes. They assist in verifying customer identities, risk assessment, monitoring transactions, and ensuring regulatory compliance to prevent money laundering and protect the financial system’s integrity.

Risk Mitigation:

Thorough background checks are critical to reducing the risk associated with potential criminal history, bankruptcy, and other red flags that can harm your company’s reputation and financial stability.

Criminal Background Check:

It reveals important information such as arrests, convictions, and pending charges. Ignoring this step can result in legal problems, reputational harm, and financial loss.

Identifying Hidden Risks:

Background checks and due diligence assist in identifying hidden risks by providing valuable information about employment history, education, and criminal records. This data informs hiring and partnership decisions, thereby protecting your company.

Credit Record:

It is critical to examine a person’s financial history, including delinquency, bankruptcy, and employment, especially in high-risk situations. Ignoring this consideration could lead to fraud and bankruptcy for your company.

Choosing the Right Partners:

A Case Study of a High-Profile Company Theranos is a stark reminder of the importance of conducting thorough due diligence when conducting business. Ignoring this process can result in massive financial losses.

Reputational Damage:

Neglecting due diligence can result in reputation damage, affecting your profitability and revenue.

Bottom Line

If a business fails to conduct a thorough background check on the supplier with a history of fraud. The contract will result in negative media attention, damage to the company’s reputation, and potentially costly litigation. This situation emphasizes the critical importance of conducting due diligence background checks on key business partners to avoid such risks and protect the company’s reputation. Explore the power of due diligence background checks with our comprehensive guide, which provides insights and expertise to assist businesses in improving their KYC/AML practices.