What is a Risk-based Approach?

A risk-based approach as per the FATF guide calls for states, competent authorities, and financial institutions to recognize, measure, and understand the dangers posed by money laundering and terrorist funding to take appropriate measures for risk management, one of the 4 pillars of KYC. To do this, you must first Know your customer (KYC). This means that you must educate yourself about the prospective and actual clients’ business operations, industries, and characteristics. You can better determine whether your consumers are likely to be involved in money laundering or any criminal activity.

FATF’s revised International Standards on Combating Money Laundering and the Financing of Terrorism and the Proliferation of Terrorism is based on a risk-based approach (RBA) and was adopted in 2012. The FATF has revised its 2007 RBA guidance for the financial sector, to comply with the new FATF requirements and take into account the experience gained by public authorities over the years in implementing the RBA.

Recommendation 40’s introduction states that the RBA “allows countries within the framework of the FATF requirement, to adopt flexible approaches so that they can better target their resources and implement preventive measures that can commensurate with the risks, to focus their efforts in a very effective manner.”

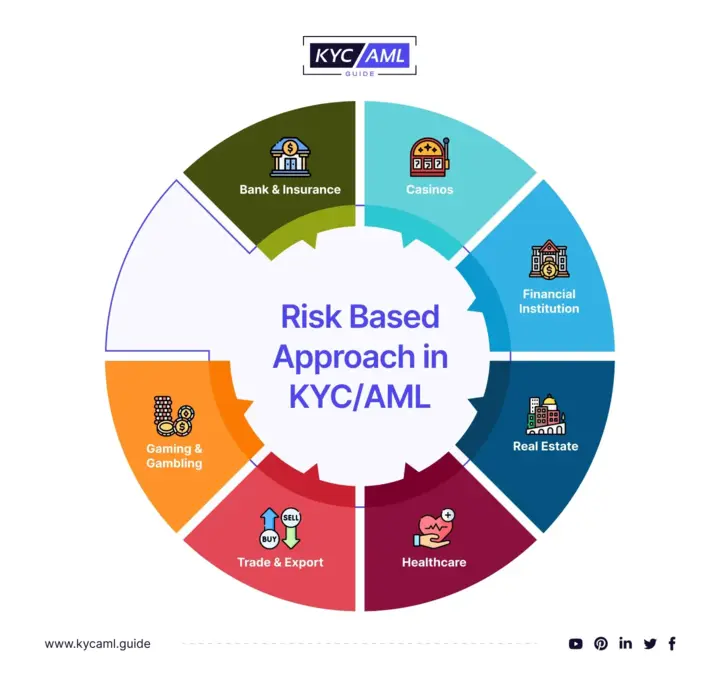

The risk-based approach in KYC/AML has diverse applications across various industries

How to Implement a Risk-Based Approach in AML?

Let’s consider a problem, a multinational bank named XYZ Bank is quickly growing both its customer base and business. The bank is now at a high risk of money laundering and financing terrorism. Monitoring the growth of its customer base and ensuring compliance with AML/CFT regulations are among the management’s main concerns.

Bank XYZ is putting into place a thorough AML/CTF program based on a risk-based approach (RBA) to handle this problem. Here is how they handle the situation.

i. Risk Assessment

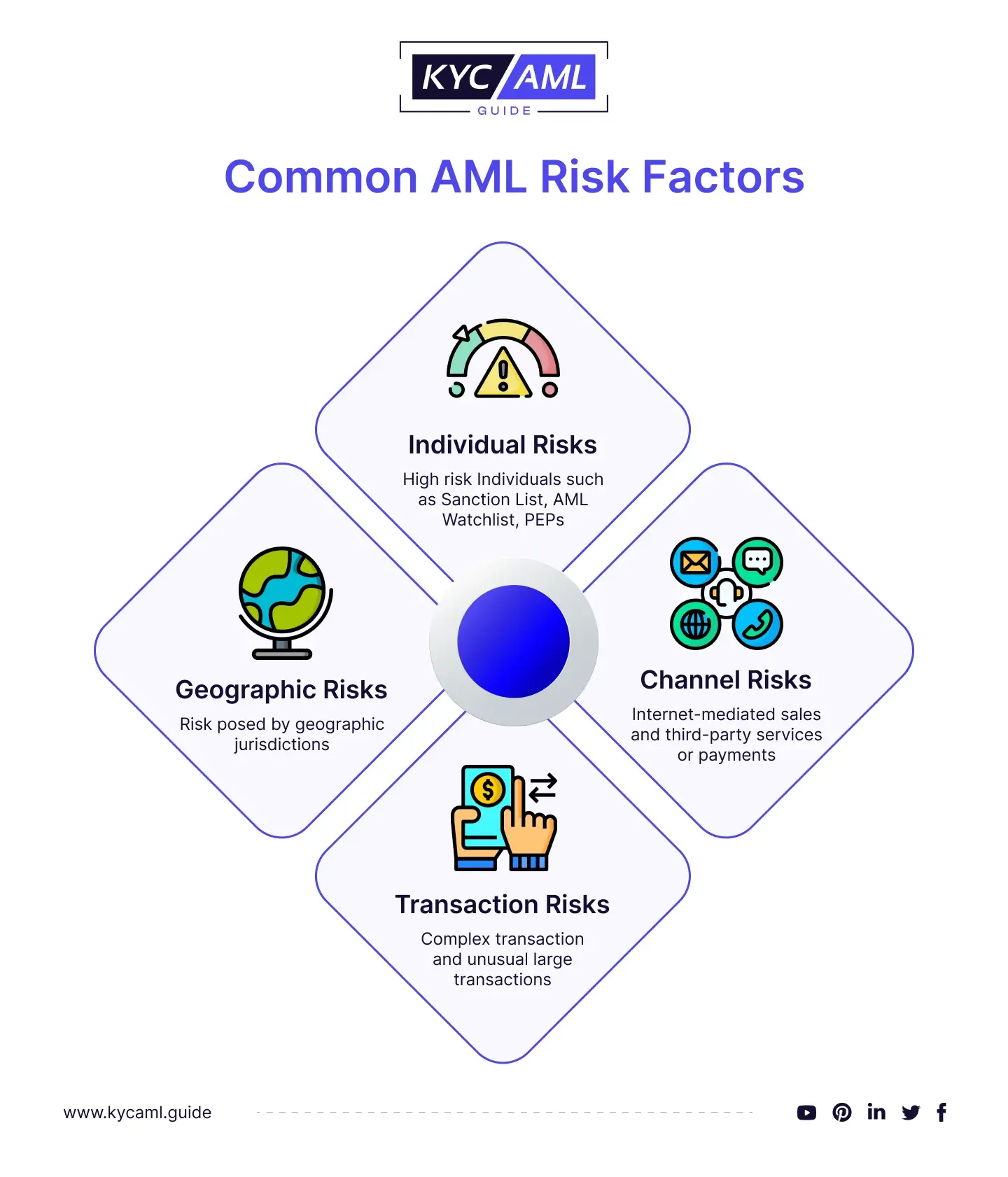

-Banks will carry out risk assessments to identify AML risk in financial fraud and terrorism financing.

-The risk assessment will consider elements such as the bank’s business model, target markets, customer risk assessment, exposure to high-risk jurisdictions, distribution channels, and number of transactions.

-Some of the most popular methods to assess a customer’s risk level include sanction screening, PEP screening, Global watchlist, AML watchlist, AML name screening, and adverse media screening.

-Classify the customers into high, medium, and low risk, exempted, or prohibited categories.

-The risk assessment of banks has to be reviewed and updated regularly.

-Utilizing a simple matrix, the FATF Guidelines for National Money Laundering and Terrorist Financing Analysis describe how to classify risk.

ii. Risk Mitigation

-To reduce ML/TF risks discovered by their risk assessment, banks should create policies and procedures.

-Following AML technologies are used to mitigate risk

-Know Your Customer (KYC) refers to Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) procedures carried out by regulated businesses to confirm that their customers are real and do not pose any business hazards both before they enter the market and as part of ongoing monitoring of all business interactions.

-Banks should use a customer due diligence (CDD) procedure to better understand their customers, their objectives, and the risks involved in doing business with them.

-In high-risk situations, banks should use enhanced due diligence (EDD), and in low-risk situations, simplified due diligence (SDD).

-Banks should do transaction monitoring regularly to ensure that they meet customer profiles and objectives to reduce AML risk. The monitoring can be performed manually or automatically.

-It’s crucial to comply with local, national, and international laws and regulations.

Also read: Risk Management in KYC & Risk Management in AML

iii. Reporting

-The AML compliance officer must immediately notify the Financial Intelligence Unit (FIU) of any suspicious activities, embezzlement, money laundering, or terrorism financing.

-Banks must create mechanisms to report suspicious transactions and thoroughly investigate them.

iv. Internal Controls, Governance, and Monitoring

-Adequate internal controls are required for the efficient implementation of AML/CFT procedures.

-AML/CFT responsibility should be allocated under governance arrangements.

-The AML/CFT program should be led and overseen by senior management.

-Staff vetting, recruiting, and remuneration should take ML/TF risks into account.

-Conduct effective employee training programs.

-Banks must use compliance and audit services to ensure the adequacy and compliance of their AML/CFT procedures.

Challenges in Implementing Risk-Based Approach AML

1 Allocation of duties under the RBA:

-An effective risk-based anti-money laundering framework is based on national risk assessment and regulatory control.

-Banks, even if not regulated, should adapt their anti-money laundering measures based on current ML/TF dangers.

2 Flexibility in Risk Mitigation:

-There should be flexibility in handling risks, but they must be consistent with national laws and regulations.

-In a threat-based system, not all banks use the same AML/CFT measures.

-The ability of a bank to successfully identify and manage risk should be used to assess resilience.

3 Supervisory Resource Allocation:

-Even if a company is fully compliant, it should not be exempt from AML/CFT supervision.

-A risk-based approach empowers authorities to assign various monitoring measures to high-risk businesses.

4 ML/TF Risk Identification:

-Accurate information on ML/TF risk is required for an effective risk-based approach.

-It might be difficult to identify and assess AML risk when there is a lack of information

-The Risk-based approach allows banks and countries to select the most appropriate ML/TF risk-reduction solutions. Strategies should be commensurate to the level of AML risk and governments should consider the risk’s severity.

5 A General Understanding of RBA:

Effective enforcement is dependent on competent authorities and banks agreeing on a consistent interpretation of the RBA. For banks to implement their AML/CFT duties in a risky manner, guidance from relevant authorities is required.

6 Financial Inclusion:

Financial exclusion does no longer always equate to low ML/TF danger. A risk-based approach AML may aid in financial inclusion, particularly for low-income individuals who have difficulty accessing the regulated financial system. Countries using an RBA may thus establish particular situations for exemptions from FATF Recommendations (based on proven low risks), or allow financial institutions to be more flexible

These challenges underscore the intricacies and nuances of applying a risk-based approach to AML compliance, emphasizing the importance of personalized, risk-sensitive techniques as well as effective communication between banks and relevant authorities.

What is the Significance of a Risk-Based Approach in KYC/AML?

Risk-based approach AML are significant because they take a more proactive approach to illegal activity. The RBA allows the reduction of loopholes rather than waiting until illicit transactions and transfers have already occurred. These strategies either prevent problems from occurring or reduce the severity of existing AML risks.

A risk-based KYC approach, for example, can assist you in implementing a better client onboarding compliance program by altering verification levels depending on risk indicators. Low-risk consumers are accepted more quickly, whereas high-risk customers may require more verification steps.

Bottom line

To combat money laundering, financial institutions must follow government regulations. Furthermore, risk-based approaches enable people to better safeguard themselves. You must know your consumer well enough to adopt effective risk-based measures to safeguard yourself and your financial institution. KYC AML guide can assist organizations in effectively managing risks and protecting against financial crimes while preserving operational efficiency.