What is the Transaction Monitoring Process in KYC and AML?

KYC and AML transaction monitoring involve ongoing monitoring of financial transactions to recognize any fishy activity such as money laundering, or fraud. Generally, this procedure uses automated systems to investigate transaction data in real-time and identify any red flags during the process.

The purpose of AML Transaction Monitoring is to prevent financial crimes such as Money Laundering, combat terrorism, and maintain the reputation of the financial institution. This monitoring is meant to detect the irregularities and patterns that might be signs of money laundering or other crimes.

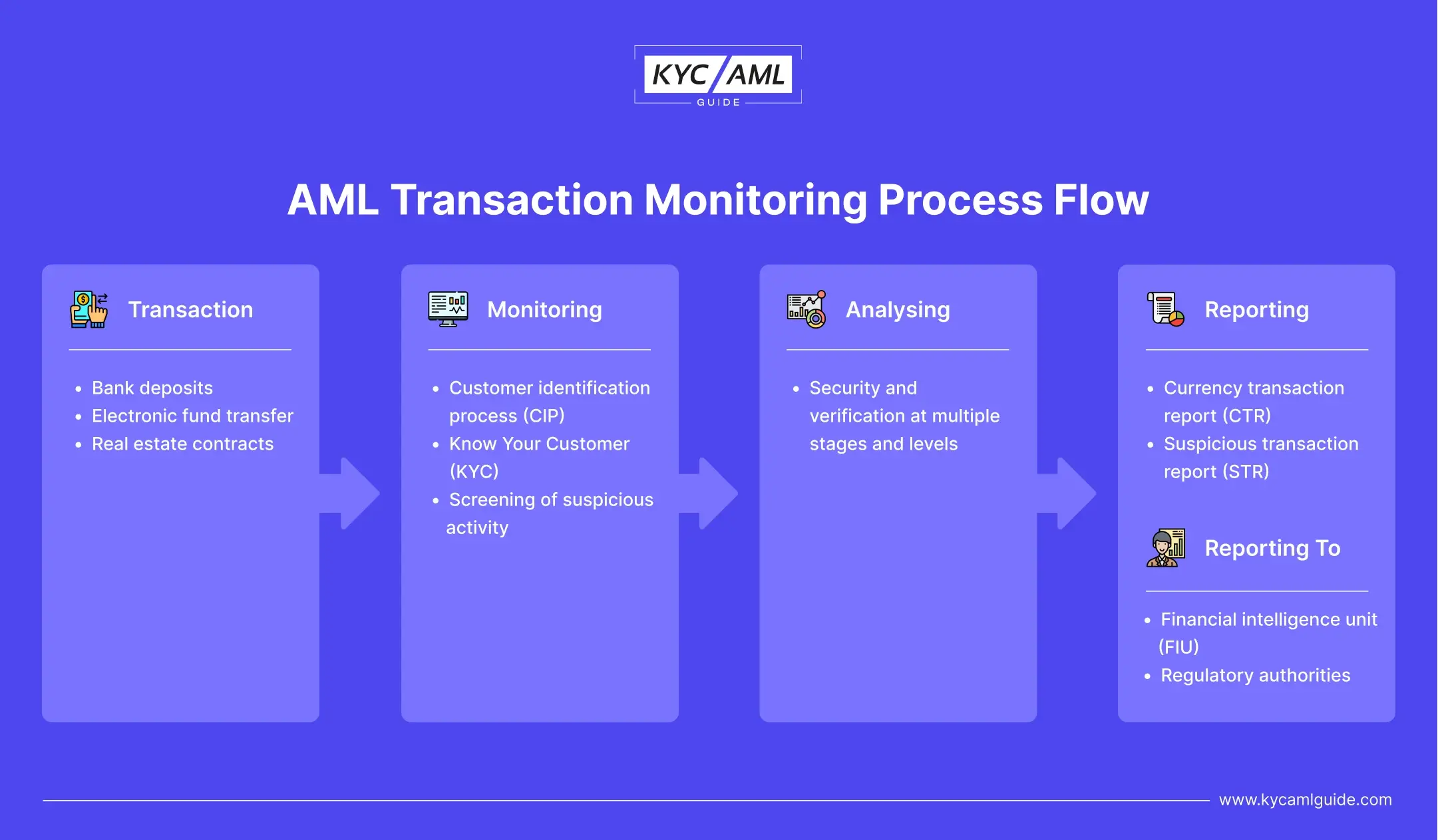

Transaction Monitoring Process Flow

The above-shown process shows how an Anti-Money Laundering Process monitors transactions in a simplified manner. Though the procedures and activities are complex and well-defined in reality. But for general understanding, this flow diagram can be a handy tool to conceptualize the process and identify key steps and decision points.

Significance of AML Transaction Monitoring

As discussed above, Monitoring Transactions in KYC AML helps financial organizations in the fight against financial threats and money laundering challenges. Yet, any corporation encountering such threats must meet some legal regulations to secure its networks.

In addition, when it comes to the gateways through which transactions are monitored, they are also set by several regulations. Nonetheless, transaction monitoring in AML is important in numerous ways:

- It determines any suspicious activity during the process of the transaction.

- It saves transaction records and submits them to SARs.

- It connects these transactions with the user identity.

AML Transaction Monitoring Rules Examples

AML Transaction Monitoring Rules help financial institutions in detecting suspicious financial activities in different scenarios. Here are a few examples of rules that are fine-tuned by financial institutions under the guidelines of different regulatory bodies.

1. Structuring Rule

Normally, transactions below $ 10,000 in multiple deposits or withdrawals are reported as suspicious if they appear to be structured or layered to hide illicit cash.

2. Large Cash Transactions Rule

Under this rule, large amounts of deposits or withdrawals in multiple transactions are detected. Money Laundering activities are identified that involve large amounts of cash.

3. High-Risk Country Rule

This rule helps in identifying transactions to and from the individuals stationed in sanctioned countries. These countries are flagged as high-risk countries due to being involved in Money Laundering, Terrorism, or other criminal activities. Countries in watchlists, grey lists, etc. are also identified under this rule.

4. Abnormal Transaction Pattern Rule

This rule sets the boundaries of a customer’s normal transaction behavior or pattern. Any sudden large transaction, frequent and unusual international transactions, or unidentified source of deposits or withdrawals come under this category.

5. Rapid Fund Movement Rule

This AML Transaction Monitoring rule monitors unusual movements of funds and transfers at a fast pace. This rule helps in identifying the structuring or layering stages of Money Laundering.

6. The Round Robin Rule

Accounts or transactions that indicate attempts to hide the sources of funds through circulation or round-robin transfers are detected in this rule of Monitoring of Transactions in KYC.

Apart from the above-mentioned explanatory list of Transaction Monitoring Rules, there are various other rules and regulations that help in identifying and detecting money laundering activities. Some of these rules include:

- Negative News Rule that highlights the individuals or entities linked to any negative news related to criminal activity or a corruption scandal. It also includes news on terrorism and drug trafficking.

- The Virtual Currency Rule prevents the negative use of anonymity in cryptocurrencies like Bitcoin and Ethereum. As crypto assets exist virtually identifying the exact ownership or source of funds is difficult. Virtual currency rules and regulations like the Crypto Travel Rule help to mitigate Money Laundering threats in this zone.

- Third-party Payment Rules can help in monitoring transactions and detecting those involving third parties for the purpose of layering funds to obstruct the Anti-Money Laundering audits.

How Does Transaction Monitoring Work?

Essentially, Monitoring of transactions in KYC AML is used by financial institutions to detect all activities associated with customers’ bank accounts. This process involves keeping track of all purchasing patterns and transaction flow in and out of the accounts. A highly accurate and efficient AML Transaction Monitoring process will identify suspicious transactions with a high level of true hits and a low number of false positives and false negatives. The True hits are reported as Suspicious Transactions Reports (STR) to law enforcement for further actions against the Money Launderers.

Ongoing Monitoring of transactions is a regulatory requirement for all businesses that fall under the money laundering regulations.

Which Industries Need AML Transaction Monitoring?

Usually, institutions that are involved in transferring money tend to conduct transaction monitoring in AML. This practice keeps these firms protected against any kind of crime. Monitoring transaction practice is required by:

- Banks and other financial services

- Broker-dealers

- Cryptocurrency exchanges

- Gaming and gambling

- Insurance companies

- Legal Professionals

- Money service businesses

Typically, any industry that tackles a significant amount of money and is obliged to remain compliant with AML regulations needs transaction monitoring.

AML Transaction Monitoring Tools

Here are a few AML Transaction Monitoring Tools provided by KYC AML Vendors that are widely used by financial institutions.

- Actimize by NICE

- SAS AML

- Norkom AML

- Alessa by Caseware RCM

- Mantas by Oracle

- Feedzai

- Actico

- Token of Trust

Apart from the above-mentioned list, there are several other AML Transaction Monitoring Tools available in the market.

Conclusion

Monitoring of Transactions in KYC and AML is a crucial aspect of financial regulation aimed at preventing money laundering and other financial crimes. It involves ongoing monitoring of financial transactions to detect any suspicious activity, such as money laundering.

Additionally, the AML Transaction Monitoring process uses automated systems to investigate transaction data in real-time to identify red flags, which helps financial institutions maintain their reputation and prevent any legal issues. Industries that handle a large amount of money need to remain compliant with AML regulations.

Generally, monitoring transactions is essential for financial institutions to stay protected against financial threats and keep their customer’s assets secure.

Also Read: Best Practices in AML Ongoing Monitoring