What is Sanction Screening?

Assume you are the manager of a large business and you need to check the license. A business like a grand ball has partnerships with various guests (customers, suppliers, partners). Consider these guests to be people with secrets or a bad past. The most famous guests are excluded from this great ball, but there is a list at the door known as the “sanction screening list,” which is used by vigilant gatekeepers to check everyone. If someone’s name appears on this list, it’s like they have a forbidden secret; they can’t enter the ball.

Sanction screening meaning is to verify individuals, entities, and transactions to ensure that they are not subject to government-issued sanctions or trade restrictions. Sanction screening takes place in the financial industry, where it serves as an anti-money laundering (AML) measure. Sanction screening serves as a powerful tool for detecting and preventing financial errors. Sanction lists are maintained by private and government institutions and regulatory bodies. This research process aids in narrowing down business transactions involving specific people, companies, groups, and even departments. It is important to note that failing to inspect restrictions can result in serious consequences such as heavy fines and possible legal action, making compliance critical.

In a recent case, Microsoft faced serious consequences in April 2023 when it was allegedly fined $2,980,265.86. This penalty was imposed as a result of Microsoft’s violation of exporting services and software from the United States to sanctioned countries and Specially Designated Nationals (SDNs), thereby violating OFAC sanctions programs related to Cuba, Iran, Syria, and Ukraine/Russia. The violation was primarily based on Microsoft’s failure to properly identify the ultimate users of their products, which resulted in sanctioned entities using their software and services.

Sanction screening is a required practice in almost every company; however, it has traditionally drawn attention and popularity in certain areas.

Financial Institutions:

They must follow anti-money laundering (AML) laws, which include legal due diligence as an important part of detecting, preventing, and suppressing money laundering and financial law violations. Financial institutions must monitor both transactions and clients to ensure regulatory compliance and avoid penalty procedures.

Some examples are

- The US Federal Reserve and Treasury allegedly fined Wells Fargo bank $97.8 million in March 2023 for violating US sanctions regulations.

- Two months later, cryptocurrency exchange Poloniex agreed to pay $7.6 million to settle with OFAC for violating 66K sanctions.

- As per ECJU, a UK enterprise was allegedly fined £1 million in August 2023 for unauthorized trade of goods in violation of The Russian Sanctions (EU Exit) Regulations 2019.

Health Sector:

Companies in the health sector are required to conduct AML sanctions screening that includes employees, service providers, suppliers, doctors, new employees, and volunteer work. Individuals on the federal exclusion list are not eligible to participate in federal health programs as part of this approval process. Prohibited individuals frequently engage in illegal or unethical behavior, demonstrating responsibility for the organization.

What is Sanction Compliance?

Sanctions compliance is an important aspect of regulatory adherence that entails verifying individuals, entities, and transactions to avoid engaging with sanctioned parties, with the importance of up-to-date data and effective screening technology emphasized to avoid penalties and resource waste.

A Step-by-Step Guide to Sanctions Screening

Sanctions screening is an essential component of any robust compliance program but how exactly does it work? Let’s take it one step at a time:

1. Data Collection:

The process begins with the collection of massive datasets containing names, transactions, and other relevant information. Customer lists, transaction records, and external sanctions lists from government agencies and international bodies may be included in these datasets.

2. Data Screening:

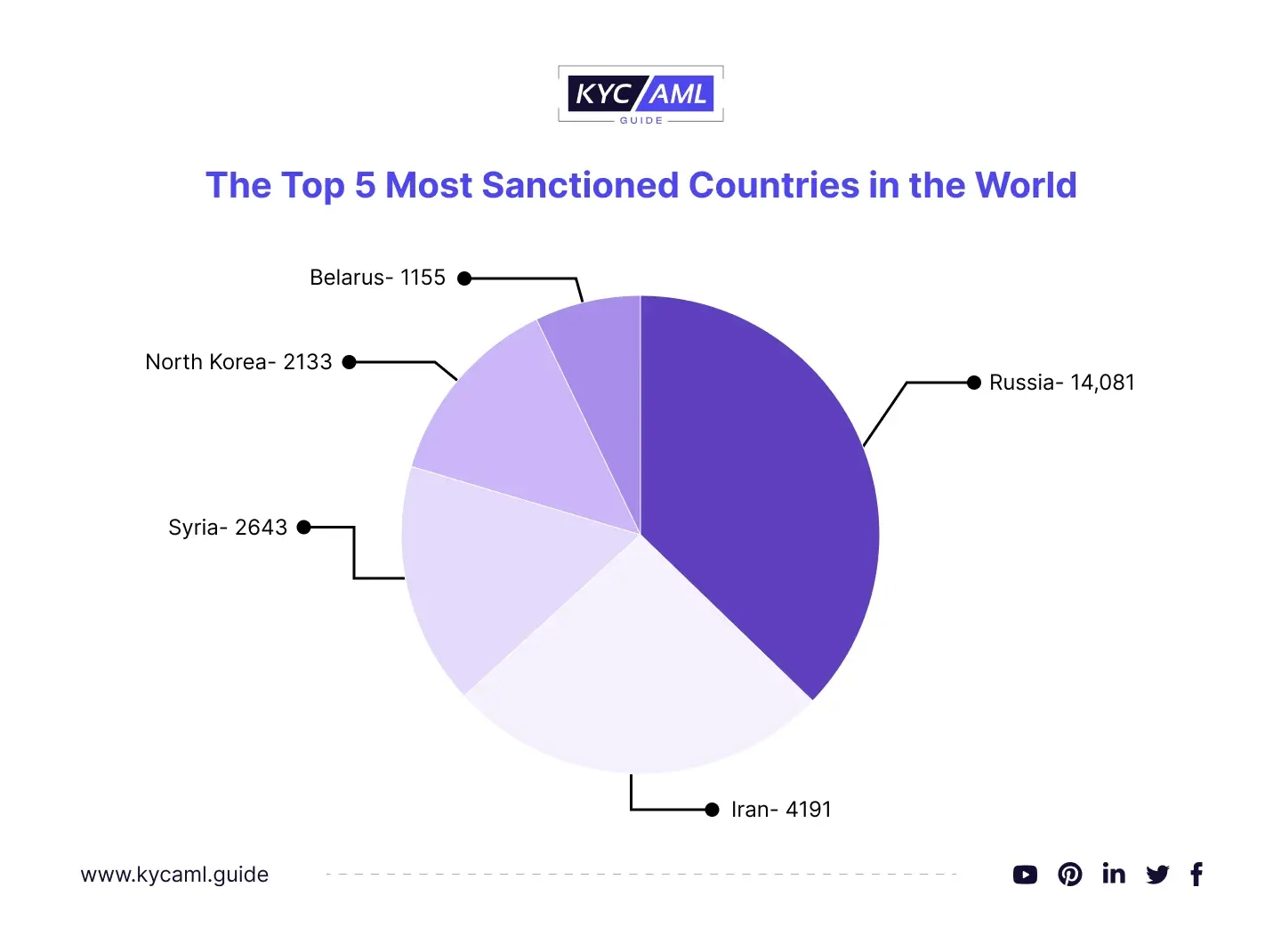

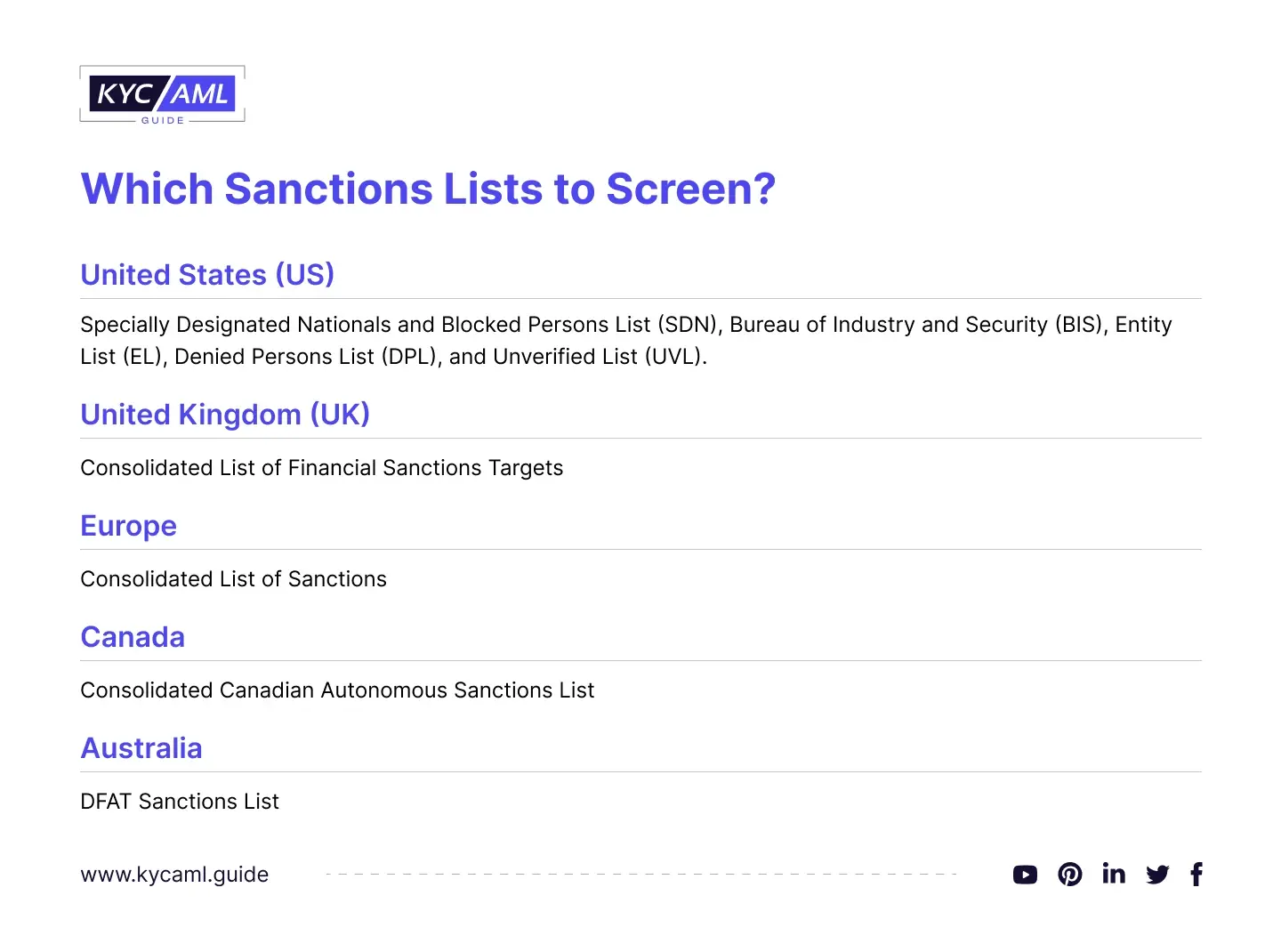

The data is then checked against a sanction screening list. This entails comparing the collected data to entries on various sanctions lists, which may include individuals, entities, vessels, or even entire countries sanctioned. Companies must conduct sanctions screenings against global sanctions and watch lists in all jurisdictions where they operate to comply with sanctions screening requirements. Data on sanctions lists can be found on government websites as well as through data providers such as Dow Jones and World-Check.

3. Matching Algorithms:

To identify potential matches between collected data and sanctions screening list entries, sophisticated matching algorithms are used. These algorithms account for spelling variations, aliases, and other factors that can complicate the matching process.

4. Risk Scoring:

Many screening systems assign risk scores to potential matches based on variables such as name similarity and the level of risk associated with a specific sanctions list entry.

5. Review and Reporting:

Compliance professionals investigate the validity of a potential match and report on it. When a match is confirmed, a detailed report is generated for further action, such as blocking transactions, freezing assets, or reporting to authorities.

6. Ongoing Monitoring:

AML sanction screening is not a one-time event. As sanction screening lists are frequently updated, it is an ongoing effort. Businesses must screen their data regularly to ensure compliance with the most recent sanctions regulations.

Also Read: Why AML Ongoing Monitoring is Crucial for Your Business?

7. Documentation:

Detailed records of screening activities, including reports, investigations, and actions taken, must be kept throughout the screening process. This documentation serves as proof of compliance in the event of an audit or regulatory inquiry.

Role of Sanction Screening in KYC/AML

Sanctions screening is an important part of the Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. It entails cross-referencing customer information with global sanctions lists to identify any matches. If a match is found, it indicates a higher level of risk, necessitating greater caution and ongoing monitoring. Sanctions screening compliance is critical to meeting regulatory requirements and preventing financial crimes, and failure to comply results in severe penalties.

Here’s how sanction screening fits into KYC/AML:

- Customer Identification

- Risk Assessment

- Transaction Monitoring

- Compliance

Challenges in Sanction Screening

Many businesses face serious constraints as a result of the following key issues:

Data Overload:

The sanction screening process entails the analysis and processing of a large amount of data, including customer names, transaction details, transaction types, and so on. A large amount of data can make correct game identification more difficult, resulting in the occurrence of falsehoods that can be difficult to resolve.

Linguistic Confusion:

The list of restrictions reflects linguistic confusion, with numerous alternative spellings, nicknames, alphabets, abbreviations, and other ambiguities. These complexities can obscure legal entities’ and individuals’ identities, increasing the risk of fraud. Such monitoring can identify businesses that may be breaking the law.

Limited Resources:

Many businesses face resource constraints that limit their ability to perform routine sanction screening, especially when done manually. These constraints can undermine your compliance efforts and expose you to regulatory scrutiny.

Regulatory Updates:

The list of restrictions is frequently, if not daily, updated. The regulatory authorities are actively monitoring the company’s compliance with the sanction regime raising expectations for the company’s strict measures and operational procedures to be implemented quickly.

Companies involved in sanction screening will navigate the complex area in light of these challenges, emphasizing the importance of strong solutions and good compliance practices.

Best Practices for Sanction Screening

Compliance with sanctions laws is critical for avoiding major sanctions that can catch businesses off guard. Consider the following best practices to ensure compliance and avoid fines or criminal charges:

Maintain Complete Data:

Ensure that your data collection is up-to-date and complete. Implementing data processing software can improve data quality, reduce the occurrence of false and negative data, and streamline the research process.

Reliable Scanning Technology:

Use reliable and efficient scanning technology. It must be able to handle large amounts of data, show proven performance, and have user-friendly features.

Advanced-Data Sources:

For analysis, use comprehensive data sources. Instead of relying solely on search engines, create a global network of multilingual experts who collect data continuously and 24/7. Integrating the watch list into a centralized database can be extremely beneficial.

Stay Up-to-Date:

Keep up with the ever-changing list of restrictions. Update your screening process regularly to ensure compliance with the most recent laws and restrictions.

Review:

Implement a review process for both potential users and customers against a restricted list. This proactive approach protects the integrity of your business environment by preventing transactions with approved companies.

Bottom line

Sanction screening is more than just a legal requirement; it is a critical tool for companies looking to operate responsibly and ethically on a global scale.