What are Politically Exposed Persons (PEP)?

According to the Financial Action Task Force (FATF) recommendation 12, a Politically Exposed Person (PEP) is someone who is currently or has been a known service provider. This definition is expanded by the United Nations Convention Against Corruption (UNCAC) to include relatives and close associates (RCA) of persons with high public responsibilities. PEPs face a high risk of corruption, money laundering, terrorist financing, and bribery due to the nature of their influence.

Politically Exposed Person List:

- Government officials who are currently serving or have previously served

- Military officers of high rank

- Senior members of major foreign political parties

- Judges and other high-level judicial positions

- Senior executives or members of the boards of directors of foreign government-owned commercial enterprises

- Immediate family members of a PEP or publicly known personal or professional associates

What is PEP Screening in AML?

PEP screening is an important component of anti-money laundering and know-your-customer (AML/KYC) programs designed to identify and target politically exposed customers and individuals.

The PEP screening in AML allows the financial institution to determine whether the applicant has a political position and the level of risk involved when opening a new account. Even if the account is approved, it is recommended that the PEP level be monitored regularly because the political environment and influencers change frequently. Keeping the PEP list up to date is critical to the AML/KYC program’s effectiveness.

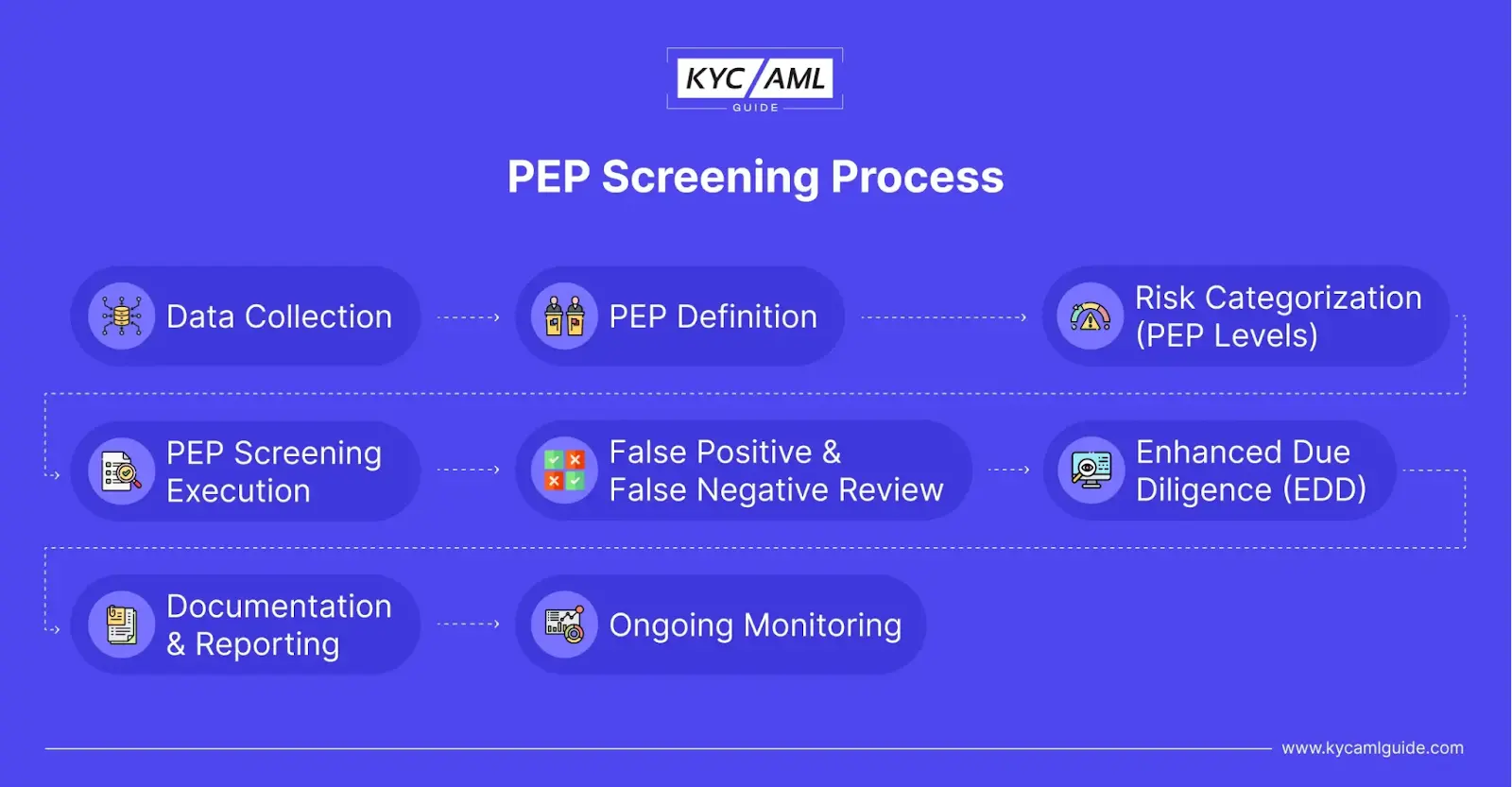

The PEP Screening Process:

Financial institutions conduct PEP screening in AML to identify and evaluate the risks associated with their clients, particularly those who may have significant public responsibilities or have close relationships with such people. For failing to fulfill her legal obligations in the position, FINRA also allegedly fined former AML officers $25,0000 and suspended them for three months.

This process usually consists of the following steps:

Data Collection:

As part of their due diligence process, financial institutions collect important customer information such as name, date of birth, occupation, and political affiliation.

Politically Exposed Persons List:

The company keeps an eye on international PEPs maintained by regulators such as the Financial Action Task Force (FATF), the World Bank, and other international organizations.

PEP Risk Categorization:

PEPs are classified into risk levels known as PEP levels, which include High-Risk, Medium-Risk, and Low-Risk.

PEP Background Check/ PEP Screening Execution:

The PEP list data are compared to identify any matches or potential politically exposed individuals.

False Positives and False Negatives Review:

The screening process is critical for identifying potential PEPs, but it is fraught with difficulties. A person’s name may match a PEP at times, but they are not the same person (false positive) or vice versa (false negative). In such cases, thorough verification is performed to ensure accuracy and data integrity.

Enhanced Due Diligence (EDD):

If a match is found, an enhanced due diligence process is initiated to gain a better understanding of the customer’s financial activities and to identify any suspicious transactions.

Documentation and Reporting:

All screening-based decisions and actions are meticulously documented, ensuring transparency and compliance with regulatory guidelines. If a PEP is identified, it is promptly reported, taking into account the specific risk level and other associated factors.

Continuous Monitoring:

AML monitoring is an ongoing process, and financial institutions should continue to monitor their customer profiles for any changes in their political status or criminal involvement.

PEP Declaration Form:

A form that buyers and sellers must fill out if they want to know if they are Politically Exposed Persons (PEPs) or if they have immediate family members who are PEPs. This PEP declaration form aids in ensuring compliance with anti-money laundering (AML) regulations while also mitigating potential risks associated with PEPs.

What is Sanction Screening in AML?

Financial institutions conduct sanction screening in addition to PEP screening as part of their AML effort. Sanctions screening in AML entails researching individuals or organizations against global law enforcement and sanctions lists to assess the risk of doing business with them. It is critical to reduce the risk of doing business with members of the restricted list.

Account screening and transaction screening are two critical areas to consider when establishing a sanction screening program.

Account screening includes matching list information to the account description entered to identify potential risks or reduce the review of accounts that do not match the restricted list. However, determining a “good match” can be difficult when variables such as alphabet, language, culture, spelling, spelling, pronunciation, and pseudonyms are taken into account. Identity verification systems must incorporate advanced matching engine technology that can consider many of these possibilities to effectively screen new customers.

Transaction screening, on the other hand, focuses on verifying customer identities and screening their transactions regularly to ensure ongoing compliance and detect any suspicious activity.

Sanction Lists:

These lists are created and maintained by governments, international organizations, and regulatory bodies around the world to limit financial transactions with sanctioned entities.

Some notable sanction lists are as follows:

- The Office of Foreign Assets Control (OFAC)

- The United Nations (UN) Sanction List

- The European Union (EU) Sanction List

- The United Kingdom (UK) Sanction List

- The Australian Sanction List

- The Swiss Sanction List

As new sanctions are imposed regularly, these lists are constantly updated. Businesses must screen their customers, partners, and transactions against these lists regularly to ensure regulatory compliance and mitigate reputational and financial risks. Using sanction screening in AML allows businesses to check multiple sanction lists from various jurisdictions around the world, ensuring full compliance with international sanctions.

The Importance of PEP Screening in AML and Sanction Screening in AML

PEP screening in AML is critical for mitigating risks associated with politically exposed individuals, adhering to regulations, and preventing illicit influence.

Sanction screening in AML is critical for avoiding legal penalties, avoiding reputational damage, and detecting and preventing financial crimes such as money laundering and terrorism financing.

Compliance Officers benefit from PEP screening in AML and sanction screening in terms of operational efficiency. Banks and other financial institutions can protect themselves from false inquiries during customer onboarding and financial transactions by using sanction screening services. The screening software aids in the detection of financial crimes, which are unfortunately common in the millions of financial transactions carried out daily by banks, payment firms, and other financial institutions. Financial institutions can effectively combat money laundering, corruption, terrorism financing, bribery, and other financial crimes by monitoring transactions and ensuring compliance with regulatory standards.

Transacting with customers on PEP and sanction lists increases the risk for organizations:

- Financial institutions that fail to comply with cheque checks may face severe legal consequences.

- Failure to detect sanctions, wrongdoers, or politically exposed persons (PEPs) involved in organized crime can harm a company’s reputation.

- “High-Risk People and Institutions” may not be specified in standard admission procedures. A follow-up audit to determine what happened to the PEP or other restricted records is required to protect the organization’s reputation.

Between 2008 and 2018, regulators around the world imposed nearly $27 billion in fines for watchlist screening. Examples of notable offenders are

- BNP Paribas (fined $9 billion in 2014),

- Barclays PLC (fined $2.8 billion in 2015)

- Societe Generale (settled for $1.3 billion in 2018),

- Standard Chartered (fined $1.1 billion in 2019)

- Danfoss, a Danish multinational corporation, was fined $4.3 million for 225 violations of various OFAC sanction programs.

Bottom line:

In today’s unpredictable financial landscape, identifying and managing risks associated with Politically Exposed Persons is critical for combating money laundering and protecting against financial crimes. PEP screening in AML, along with sanction screening in AML, is allowing financial institutions to operate with transparency, integrity, and trust.