What is KYC and Risk Management?

Know Your Customer, or KYC is an essential process used by businesses and financial institutions to confirm the identity of their customers. Its main objective is to stop illegal activities like fraud and money laundering. To comply with laws like those against money laundering (AML) and countering terrorist financing (CTF), this process helps organizations make sure they are doing business with legitimate people or entities.

Understanding and controlling an organization’s risk exposure is part of risk management. It is one of the “4 pillars of KYC”. A poor governance and compliance culture can increase the likelihood of fraud and money laundering, which could result in lower profits, inefficiencies, and reputational harm for the business. The introduction of the Bank Secrecy Act in the United States in the late 1990s laid the foundation for risk management in AML compliance.

KYC risk management is the term for a centralized system that unifies policies and practices for information sharing between organizations. Its goal is to follow laws and regulations while recognizing and reducing various risks. Coordinating efforts across the entire organization, including branches and subsidiaries, is necessary to manage integrated KYC risks effectively and protect banks from fraud.

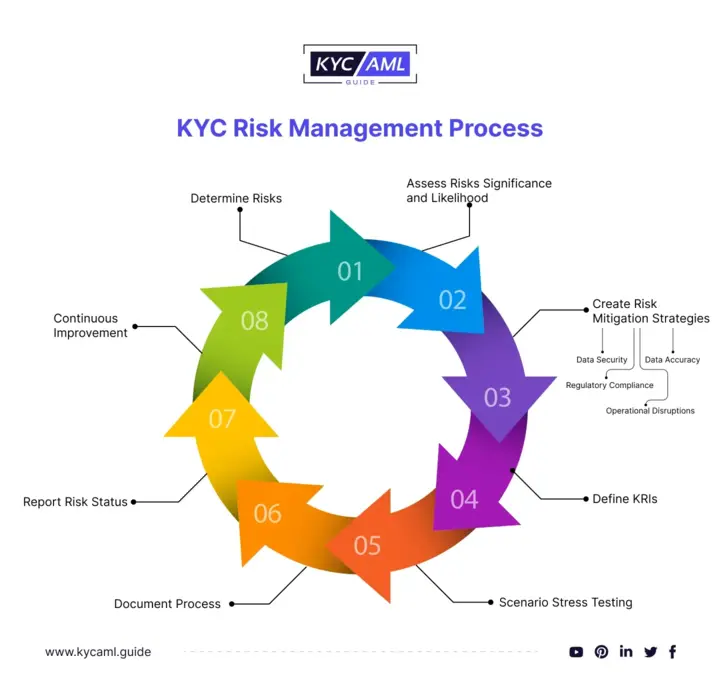

Steps for Risk Management in KYC:

Here is an illustration of how to do risk management using the KYC policy

Assume you work for a financial institution, and the scenario calls for you to implement a new KYC process to onboard customers using a digital identity verification platform.

- Determine any risks associated with the new digital KYC process. Data security and privacy breaches, regulatory noncompliance, customer data accuracy issues, and operational disruptions are examples.

- Assess the significance and likelihood of each identified risk. Consider using a risk matrix to classify them according to severity and probability.

- Create strategies for dealing with each identified risk:Implement strong encryption, access controls, and regular security audits to prevent data breaches. To reduce compliance risks, ensure that the KYC process adheres to relevant regulations. To improve data accuracy, implement data validation checks and customer authentication procedures. Create redundancy and backup plans to reduce operational disruptions.

- Define Key Risk Indicators (KRIs) to continuously monitor the KYC process.

- To test the effectiveness of your risk mitigation measures, simulate potential risk events such as a data breach or regulatory audit. Examine how well your KYC process handles these stress scenarios.

- Document the entire process, report risk status to stakeholders, and constantly improve strategies based on real-world feedback and evolving threats and regulations

Types of Risk Management in KYC

Risk management in KYC focuses on evaluating and reducing the financial and compliance risks connected to customers entering into ongoing relationships. KYC and Risk management include various forms like:

Compliance Risk Management:

Financial institutions regularly audit and inspect their KYC procedures to make sure they adhere to the most recent regulations, including those on customer due diligence (CDD) and anti-money laundering (AML).

Identity Verification:

When setting up an account and logging in, online banking systems use multi-factor authentication (MFA) to verify customer identity, which includes one-time passwords and biometric authentication.

Customer Due Diligence (CDD):

Financial services companies thoroughly investigate new clients, looking into their sources of wealth, connections to politically exposed persons (PEPs), and financial history.

Also Read: Customer Due Diligence (CDD):

Enhanced Due Diligence (EDD):

The cryptocurrency exchange has an impact on the EDD process for clients who want to conduct significant cryptocurrency transactions, necessitating additional research and documentation.

Transaction Monitoring:

The payment processor monitors all transactions using automated software to look for patterns that might point to suspicious activity, like slow and large transfers and transfers to high-risk jurisdictions.

Also Read: Transaction Monitoring

Sanctions Screening:

The company should use analysis software to check potential business partners against the global sanctions list including OFAC, UN, EU, and many others, which can assist in locating high-risk clients with ties to terrorism or financial crime.

Also Read: Sanctions Screening:

Risk-Based Approach:

Banks divide their customers as low, medium, or high risk. High-risk customers get a more thorough effort, while low-risk customers get a great onboarding process.

Third-Party Risk Management:

A financial institution evaluates the threat posed by third-party KYC service providers and performs due diligence to confirm their adherence to legal requirements.

Advanced-Data Analytics:

Artificial intelligence and machine learning technologies are being used more and more to improve KYC risk management. These tools can analyze enormous amounts of data to spot fraud and potential risks.

Documentation and Record-Keeping:

To prove compliance during regulatory audits, insurance companies keep thorough records of customer relationships, KYC checks, and transaction reports.

Importance of Risk Management in KYC

Risk management in KYC is critical due to its multiple implications. The integrity of the financial system is first protected by ensuring that financial institutions adhere to pertinent international standards and regulations. This all-encompassing system aids in guarding against illicit activities like money laundering, fraud, and terrorism financing on financial networks.

Effective risk management in KYC entails identifying and reducing fraud risks through actions like customer due diligence, transaction monitoring, employee training, and cutting-edge fraud detection tools, with the goal of protecting banks from fraud. This protects the institution’s reputation in addition to its financial resources.

Risk management is crucial in determining customer identity and evaluating their risks when it comes to KYC. It aids financial institutions in verifying the validity of their clients and keeping an eye on their transactions. This process affects more than just legal compliance; it also has a big impact on investor interest, customer satisfaction, and company reputation.

Internal communications also require a strong AML and KYC risk management system. Financial institutions can make sure that their operations comply with current standards and regulations by establishing efficient internal controls and procedures. In turn, this enables them to produce accurate reports and carry out research that proves their compliance, decreasing the likelihood that fraud will have an impact on their work.

Final Thoughts

Finally, an effective risk management KYC policy is the foundation of a safe and successful financial institution. Visit our KYC/AML Company Comparison page for an in-depth look at how various companies provide a variety of services tailored to managing risk, ensuring compliance, and ensuring security in the financial sector.