What is Global Watchlist?

The database is used to regularly conduct identity checks against suspected terrorists, money launderers, fraudsters, politically exposed persons (PEPs), adverse media, and a sanctioned list kept by the government, regulatory agencies, and private businesses. Companies must modify their due diligence procedures to make sure they have enough information to make judgments about a customer’s status because the sanction lists vary by system and data. Targets on the global watch list are

- Cybercrime,

- Human rights abuses,

- Trafficking in weapons and drugs,

- Treaty violations

- Terrorism and

- Terrorist financing

People without a criminal record who are suspected of engaging in such activities may likewise be included on the government’s watch list. These databases frequently include data for global watchlist search like:

- Names

- Aliases

- Dates of birth

- Addresses

- Fingerprints

- Criminal history

What are the Types of Global Watchlists?

In compliance with their sanctions policies and international obligations, many governments maintain global watch lists. For instance, the United States has implemented dozens of different sanctions programs, including those directed at Iran, Cuba, Russia, and Syria as well as those imposed by the UN Security Council (UNSC).

Governments and international bodies have levied the following important sanctions lists:

- The US Office of Foreign Assets Control (OFAC) Blocked Persons and Specially Designated Nationals (SDN) List

- The EU Consolidated List

- The UK’s Office of Financial Sanctions Implementation (OFSI) UK Sanctions List

- Canada’s Consolidated Canadian Autonomous Sanctions List

- Australia’s Department of Foreign Affairs and Trade (DFTA) Consolidated List

- The UNSC Consolidated List

- Dow Jones Watchlist

- U.S. Bureau of Industry and Security Denied Persons and Entities

- United Nations Security Council consolidated sanctions list

Individuals who have committed dangerous crimes such as terrorism, mass murder, or significant fraud are brought under the jurisdiction of national or international law enforcement authorities such as:

- Interpol red notice list

- Immigration and Customs Enforcement (ICE) most wanted list

- Federal Bureau of Investigation (FBI) most wanted terrorists and seeking information lists

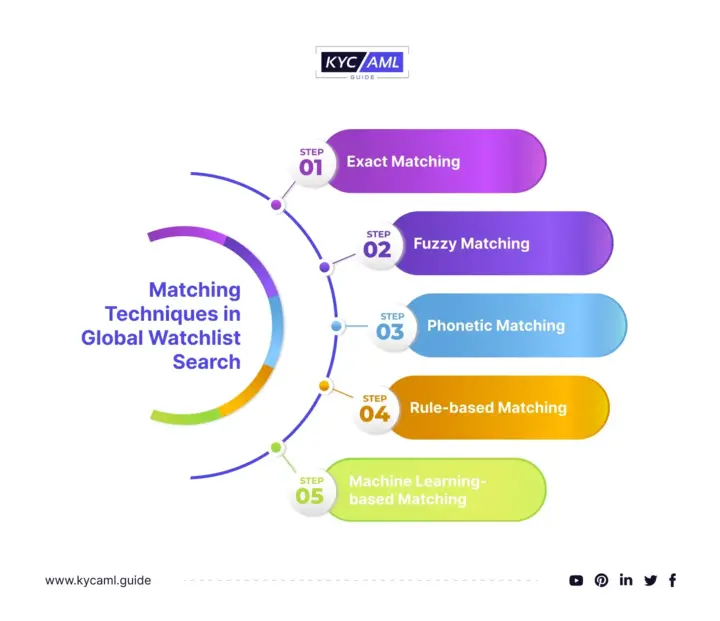

Techniques for Global Watchlist Search

This comprises algorithms and methods for comparing names or units in a watchlist in real time with a database of names or units for the global watchlist background check. To identify prospective matches, various matching algorithms can be utilized, each with its own set of advantages and disadvantages.

| Exact Match |

|

| Fuzzy matching |

|

| Phonetic matching |

|

| Rule-based matching |

|

| Machine learning-based matching |

|

How is the Global Watchlist Search Conducted?

A global watchlist search entails comparing an individual’s or entity’s information to the entries in a global watchlist database. The search can be done manually or with the help of specialist tools and APIs. When conducting a global watchlist search, the following are some frequent elements to consider:

- The first step is to ensure that the person in question and their identification documents are correct and appropriate. Various data sources are thoroughly examined.

- Once the identity is established, the research institute compares the profile to a global watchlist. comparable matches, such as comparable names or images, are also presented in the global search results.

- The most effective method to benefit from global benchmarking is to adopt an automated solution that provides ongoing access to accurate statistics as well as powerful rankings.

- Other verification parameters, in addition to the global watchlist screening, should be provided by the solution during the global watchlist search, such as Transaction monitoring, PEP screening, and Adverse media screening

- Frequent alterations are required to guarantee that the information is up-to-date and accurate.

KYC AML Guide, a consultancy firm specializing in KYC and AML compliance provides a comprehensive approach to global watchlist services to clients.

Important Laws for Global Watchlists Background Checks

U.S. Patriot Act

The law’s goal is to combat the financing of terrorism and money laundering. Employers in certain businesses are required to undertake both global watchlist screenings and domestic watchlist checks. Under the Patriot Act, each US member is responsible for ensuring that it does not do business with individuals or entities whose names appear on the Treasury Department’s OFAC-SDN list. Some industries have more stringent standards, such as transportation, import/export, and financial services.

Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) governs employment background checks undertaken by consumer reporting agencies (CRAs), which are third-party screening providers. For those aged seven and up, the law limits the reporting of the following data to seven years:

Detention does not end after the trial Civil suit community practice to pay taxes Chapter 13 bankruptcy (10 years for Chapter 7 bankruptcy). The reporting limit does not apply to positions earning $75,000 or more per year.

Title VII of the 1964 Civil Rights Act

VII of the law makes employment discrimination against workers and candidates from protected groups. When an employer becomes aware of a candidate’s criminal record, this statute applies to background checks.

Importance of Global Watchlist Screening for Financial Institutions

Global watchlists are essential in Know Your Customer (KYC) processes due to their importance in mitigating financial crime risks and ensuring regulatory compliance. It is important for companies in high-risk industries such as financial services, sports, and real estate. This is also important for companies using international products, as they need to know the watchlist in each country where they operate. Watchlist screening is essential for several reasons, including:

Compliance:

Global watchlist screening helps companies comply with anti-money laundering and counter-terrorist financing (CTF) laws. Many countries require companies to screen their customers against checklists and lists of high-risk individuals and companies.

Risk management:

Watchlist screening helps companies identify and mitigate risks to their customers.

Reputation:

Watchlist screening helps businesses protect their reputation. If a company is found to be doing business with sanctioned individuals or legal entities, it can damage its reputation and harm its business.

Conclusion

Placing a person’s name on a global watch list is one of the best methods to avoid the headache of selling to or buying from somebody you can’t lawfully do business with. Numerous individuals on these lists are forbidden from trading by the law. Global watchlist search is crucial in defending organizations, countries, and people from risks and dangers. They are important for global watchlist background checks, compliance, or security purposes. Organizations can better defend themselves and uphold the highest standards of integrity and security by remaining aware of international checklists and their activities.