What is NFC Verification?

Near Field Communication (NFC) is a wireless communication technology that allows data to be exchanged between two devices that are within a few centimeters of each other. The same technology powers contactless payment methods like tapping your phone to pay for food or public transport. Although it is like Bluetooth, NFC distinguishes itself through functionality and focuses on specific data exchange. NFC technology is most commonly used for mobile identity verification and provides access to a large number of users. The NFC is divided into two parts: the NFC chip and the NFC compatibility. The global near-field communication (NFC) market was nearly $21.1 billion in 2022 and is expected to grow to approximately $33.1 billion by 2030.

The NFC chip, a small wonder with an antenna and the chip itself, is at the heart of NFC technology. A remote NFC chip that looks like a small plastic disc, also known as an NFC tag or card, may be found. These particular pages are frequently embedded in other documents such as biometric identification documents such as passports or ID cards. The insertion of the antenna allows the NFC chip to connect to the NFC reader, resulting in the formation of an electromagnetic field. This field serves as the foundation for wireless data transmission, which is required for NFC-based applications like identity verification.

Any device that can use NFC technology has NFC compatibility. Consider a smartphone with NFC capabilities; it is capable of reading cards with built-in NFC, such as credit cards and ID cards.

What is NFC Identity Verification?

NFC identity verification takes advantage of the remarkable capabilities of smartphones equipped with Near-Field Communication (NFC) technology to simplify the verification process. It enables users to easily access their biometric identification data, kicking off a secure journey towards confirming their identity. This new system eliminates the issues associated with manual data entry while providing reliable, consistent, and error-free results.

Consider the following scenario: a user must verify their identity to complete a secure transaction or gain access to a restricted area. This process is made more accessible by NFC technology. This is how it works:

Smartphone with NFC:

A smartphone with NFC capabilities turns the user into a chave for perfect identity confirmation.

Biometric Authentication:

NFC-enabled phones use biometric authentication data from the user, which may include facial recognition or digital print information.

Also Read:

Authentication:

The phone initiates authentication by comparing the captured selfie to the stored biometric data.

Verification:

The user’s identity will be correctly verified if the in vivo image matches the stored biometric data within predefined parameters.

Advantages of NFC-based Identity Verification

This next-generation identity verification system provides numerous benefits, making it the preferred choice for a wide range of applications. Here are some of the main benefits:

Improved Security:

NFC technology provides impenetrable protection and resistance to intrusions. The risk of forgery or counterfeiting of documents is eliminated, increasing the overall safety of the authentication process.

Efficient Data Transfer:

NFC chips allow for error-free data transmission, which is especially important when dealing with sensitive information such as biometrics. Data transfer reliability is unparalleled, lowering the risk of inaccuracies.

Speed:

The streamlined one-tap procedure speeds up the customer verification process, resulting in significantly lower customer drop-off rates.

Enhanced User Experience:

Since NFC technology is contactless, the user experience is vastly improved. With NFC-enabled smartphones becoming more common, the entry barrier is low. Users can easily engage in the verification process by using familiar devices, which adds to the convenience.

Versatility:

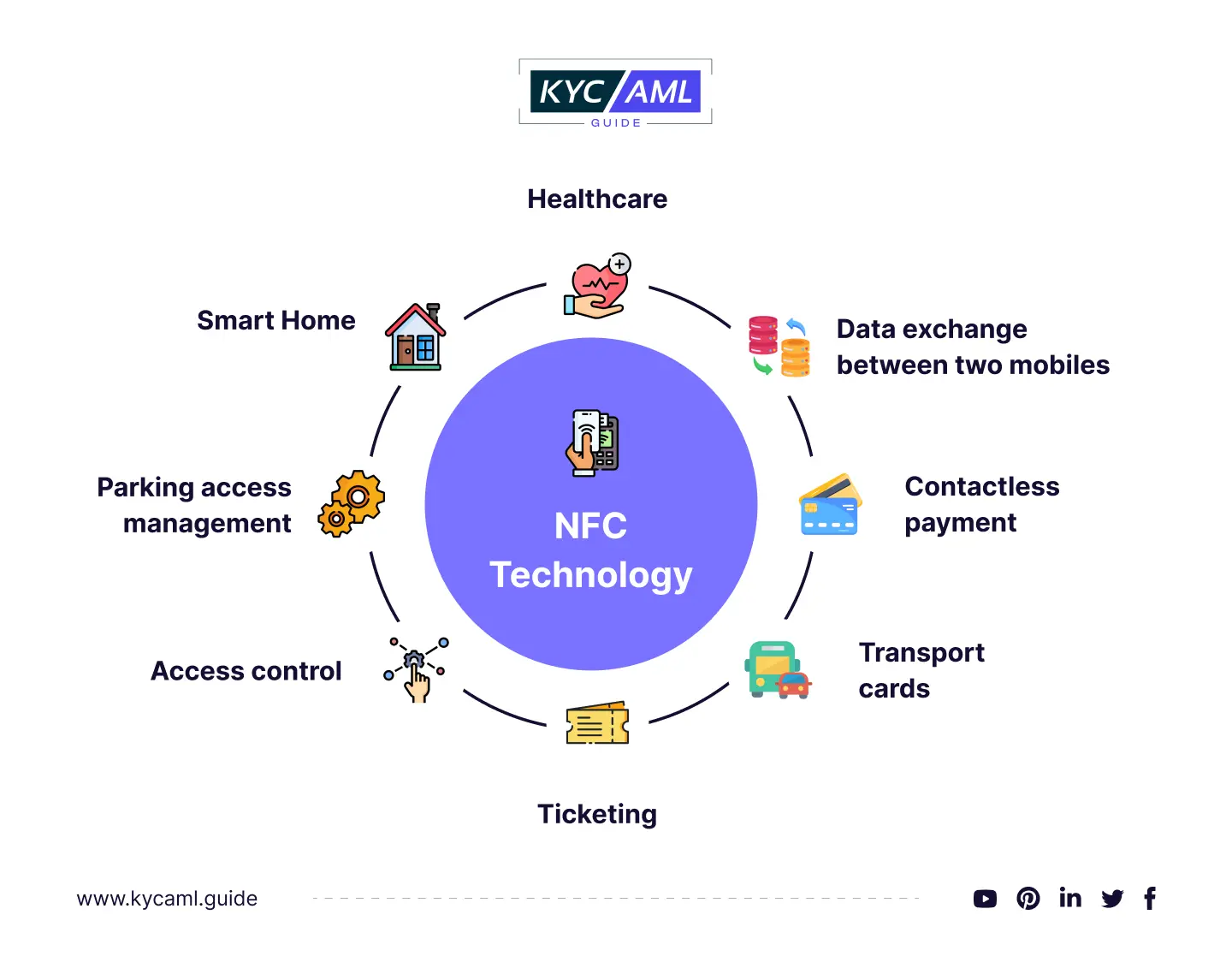

NFC verification can be used in a variety of applications, including access control, mobile payments, e-passports, and others. Because of its adaptability, it is a versatile solution for identity authentication.

Applications of NFC

1. Smart card

Smart cards with NFC are available from major financial institutions such as Visa and MasterCard for instant transactions. With a single tap, these smart cards make grocery shopping, parking payments, loyalty points, and coupon redemption simple. Smart cards with NFC chips are available from major banks worldwide.

2. Electronic wallet

Mobile cashless payments have grown in popularity, with apps like Apple Pay, Google Wallet (Android Pay), and Samsung Pay leading the way. With a quick tap or wave, NFC technology built into smartphones makes payments simple. Furthermore, NFC enables data transfer via applications such as Android Beam, allowing users to share documents, photos, business cards, and other items with a simple swipe.

3. Smart ticket

For various modes of transportation such as airplanes, trains, and buses, NFC technology replaces traditional ticketing systems with smart tickets. NFC tags are embedded in colorful posters, movie tickets, concert tickets, advertisements, brochures, and information links, allowing customers to access other information with a simple tap or scan.

4. Healthcare

NFC-enabled patient records improve accuracy and quality in healthcare by automating activities such as prescriptions, patient check-ins, payments, and records. Healthcare companies are investigating the use of NFC in diagnostic tags that monitor conditions such as temperature changes and blood glucose levels.

5. Transportation and Logistics

NFC and RFID tags are being used in the logistics industry to improve tracking and inventory control and reduce errors.

6. Go Keyless

A keyless entry system that is NFC-compatible offers convenience and security. NFC and RFID tags can be used instead of traditional access keys and ID badges to gain access to restricted areas, vehicles, and other devices.

7. Anti-theft Measures

RFID tags are extremely useful in preventing theft and protecting valuables. When you enter the RFID proximity zone, the smart tag sounds an alarm.

8. NFC Information Tags

Low-cost NFC smart tags, such as QR codes, provide quick access to information. Users can retrieve information about products or services by touching their phones to NFC smart tags. These clever stickers adhere to a variety of surfaces, including metal siding and walls.

NFC and KYC

Near-field communication (NFC) technology is becoming increasingly useful in KYC/AML. The KYC process is being streamlined by NFC-based identity documents and smartphones, which provide secure and efficient identity verification, document authentication, and biometric verification. This technology improves data accuracy, customer experience, and real-time verification, as well as compliance automation and secure data storage. Furthermore, NFC verification has the potential to play a role in AML transaction monitoring, ensuring that financial institutions can identify and address suspicious activities as soon as possible. As the financial industry prioritizes security and compliance, NFC is emerging as an important tool in modernizing KYC and AML procedures.

Conclusion:

As the world becomes more digital, the demand for secure and efficient identity verification methods grows. To meet these demands, NFC verification has emerged as a dependable and user-friendly solution. Its ability to combine security and convenience makes it a game changer in a variety of industries, including banking and healthcare. With the advancement of NFC technology, we can anticipate even more innovative applications and enhanced security measures in the realm of identity verification.