Who is an Ultimate Beneficial Owner?

As the name suggests, the Ultimate Beneficial Owner is a real-life person or entity who ultimately owns a legal entity. Notably, this entity can be a company, trust, or business. A UBO’s compliance with KYC regulations helps to ensure that these institutions are not facilitating financial crimes. Especially, money laundering or terrorist financing, are the prime concerns while identifying a UBO.

Basically, a UBO in KYC relates to the transparency, accountability & legal compliance of the firm’s ownership in the course of AML regulations. Likewise, an Ultimate Beneficial Owner is the Ultimate beneficiary of the firm when it makes a transaction.

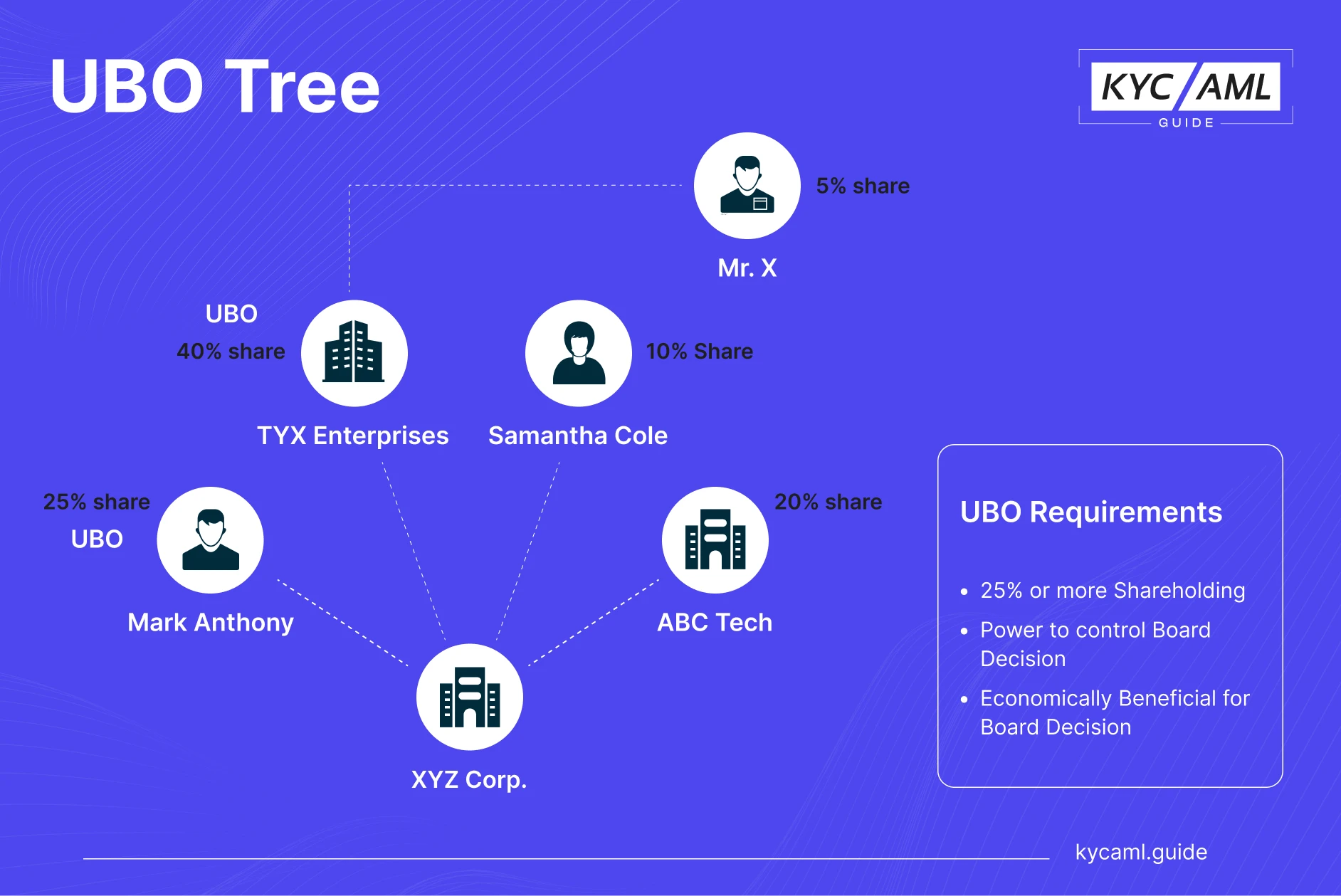

Requirements of UBO in KYC

To fall into the category of a UBO the minimum requirements are listed below:

- At least, 25% ownership of the company

- Power to influence and control the Board’s Decision

- Benefits the Board’s decision economically

Bank’s UBO identification steps

Mostly, banks have SOPs to identify the UBOs through the KYC and AML guidelines. Following are the basic steps to place a UBO in banks:

- Acquiring the firm’s credentials

- Researching and verifying the chain of ownership

- Shortlisting and filtering out the Ultimate Beneficial Owner in the KYC process

- Perform the Anti-Money Laundering and Know Your Customer (KYC) check

Importance of UBO in KYC

Outrightly, the KYC regulates UBOs for the identification & verification of real persons owning a firm or entity. So, the Fintechs and other regulated entities must identify the natural person who ultimately owns or controls a legal entity or structure. Also, it can include document reviews, such as articles of incorporation or trust deeds.

Therefore, to determine the ownership and control structure of the entity a UBO is identified and verified. Once the UBO has been identified, the institution must verify his identity too. This is done using reliable and independent sources such as proof of ID documents.

UBO in KYC for Improved Regulatory Compliance

UBO Regulations play a vital part in KYC processes. In fact, they help FIs (Financial Institutions) and regulated entities to understand the true identity and ownership structure of their clients. So, it enables them to assess the risk of financial crime, such as money laundering or terrorist financing. Therefore, it requires appropriate measures to ensure that the UBOs are KYC/AML compliant.

Ultimately, it helps to ensure that these institutions are complying with laws and regulations designed to prevent financial crime. In this way, the integrity and trust of the financial system is maintained. Moreover, the UBOs cannot falsely benefit from the system if kept under watch by a fair KYC AML system.

The Negative Impact of UBO Regulations on KYC

1 Increased Compliance Costs:

Even though the UBOs are of core importance, Financial institutions and other regulated entities may incur additional costs to comply with UBO regulations. For instance, the cost of obtaining and reviewing documentation, training staff, and implementing new processes. Ultimately, a firm may need to transfer the cost to the customers in the form of hidden charges or other. This will reduce customer satisfaction and may cause unrest.

2 Reduced Financial Services:

Since the identification of UBO in KYC can be time-consuming and complex and may hinder streamlined services to entities. So, businesses and individuals might not be able to render financial services or open bank accounts. Particularly, this can be problematic for small and medium-sized enterprises (SMEs). So, it may have limited resources and may be more sensitive to compliance costs.

3 Identity Theft and Fraud:

Similarly, UBO regulations require financial institutions and regulated entities to collect and store large amounts of data. This can be personal and financial data about UBOs and their beneficial owners. So, the data may be vulnerable to identity theft and fraud especially if it is not properly protected.

4 Privacy Concerns of UBO in KYC:

Particularly, it is objectionable to disclose personal and financial information in the UBO identification and verification process. Especially, if another party is asked to share the UBO’s information. Surely, this can have negative impacts on financial privacy. Also, it can endanger the security of the third party if the UBO is of criminal background.

Switzerland and UBO Regulations

Certainly, Switzerland has not adopted the UBO regulations to increase the cash inflow. Also, the country is not concerned with the sources of income of any individual having a Swiss account. Incidents have shown that Switzerland’s decision not to adopt UBO (Ultimate Beneficial Owner) regulations will make it easier for criminals to misuse the system. Mostly, they use shell companies to open Swiss bank accounts.

Significantly, it has increased money laundering and other financial crimes. As a result, it is expected that the prevalence of these crimes will be higher in Switzerland compared to other nations. Despite this, other countries that have implemented regulations for Ultimate Beneficial owners in KYC are much more trustworthy.

Following are some updates in Switzerland’s KYC and AML regulations to combat the fin crime for UBOs:

AMLA & Switzerland

The Swiss Anti-Money Laundering Act (AMLA) requires all regulated entities in Switzerland to identify and verify the Ultimate Beneficial Owners. Additionally, if the client is a legal entity or structure, such as a company or trust, the requirement of UBO increases. This process is regulated by the AMLA and is intended to help prevent financial crimes such as money laundering.

Furthermore, it ensures that these institutions are aware of the true identity and ownership structure of their clients. So, UBOs in KYC are identified through AMLA guidelines for maintaining the public’s trust in the financial system.

FINMA & Switzerland

Actually, FINMA is a regulatory authority that supports the cause of AMLA. Generally, financial institutions in Switzerland are responsible for the Ultimate Beneficial Owners (UBOs) of their clients.

However, the Swiss Financial Market Supervisory Authority (FINMA) has the authority to request information about the UBO of a legal entity or structure. Also, it determines the need to meet the requirements of the Swiss Anti-Money Laundering Act (AMLA).

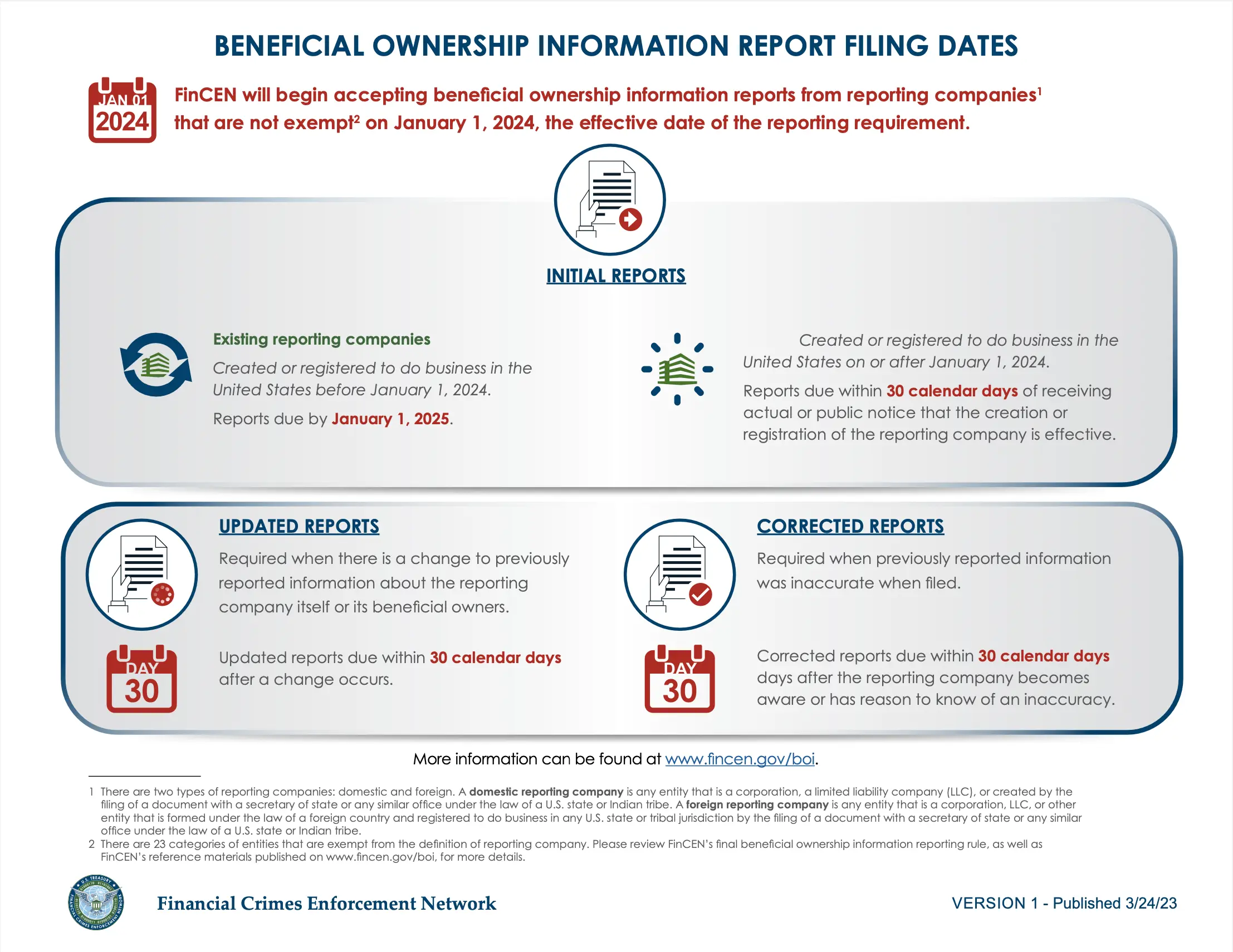

The USA’s Regulatory Environment & UBOs

In September 2022, FinCEN issued the final rule of beneficial ownership information reporting under the Corporate Transparency Act (CTA). The final regulations will go into effect on 1st January 2024. Businesses need to keep track of the following important dates to stay compliant with the FinCEN beneficial ownership regulations.

UBOs in the UK

In the UK, the Economic Crime & Corporate Transparency Bill is now considered a solution for the mitigation of financial crime. It was passed by the UK’s parliament in September 2022 and intended reforms in the identification of UBOs.

Following is the updated information regarding this bill:

Bill Overview

The UK Economic Crime and Corporate Transparency Bill is designed to address gaps in financial crime legislation and controls.

| Key Focus Areas |

|

| Timeline |

|

| Impact on Information Sharing |

|

| Company Registration Reform |

|

| Limited Partnership Reform |

|

| Impact on Organizations |

|

| Impact and Technology |

|

| Global Implications |

|

Difference between Beneficial Ownership and UBO

| Beneficial Owner | Ultimate Beneficial Owner (UBO) | |

| 1 | A Beneficial Owner is a broader term that refers to any individual or entity that enjoys the benefits of ownership or has the authority to control or influence a legal entity, such as a corporation, trust, or partnership. | The Ultimate Beneficial Owner specifically refers to the individual who ultimately owns or controls a legal entity. This is the person at the very top of the ownership or control chain. |

| 2 | For many regulatory purposes, including FinCEN’s Customer Due Diligence (CDD) Rule, a Beneficial Owner directly or indirectly owns a certain percentage of equity or voting interests in a legal entity. | UBO regulations often require identifying not only those with direct ownership or control but also tracing the ownership structure to determine the UBO, which may involve multiple layers of ownership. |

Final Thoughts

Overall, Criminals including money launderers and cybercriminals, often find new ways to exploit the financial sector for illicit purposes. One of the biggest challenges in preventing fincrime is detecting them in a timely manner. So, it is essential to implement a robust AML regulatory framework for the Ultimate Beneficial Owners in KYC. This AML compliance framework must be able to trace, detect, and mitigate the risk of money laundering and terrorist financing.

Lastly, Switzerland has become notorious for sheltering criminals and corrupt politicians. It has opened up ways for illicit money to be laundered and injected back into the system. So, to mitigate it the identification of the UBO in KYC will facilitate tracing back illicit money and link it to actual organized crime syndicates. Despite this, the US and the UK are taking significant steps to lead in regulating UBO identification.

Table of Contents

- Who is an Ultimate Beneficial Owner?

- Importance of UBO in KYC

- UBO in KYC for Improved Regulatory Compliance

- The Negative Impact of UBO Regulations on KYC

- Switzerland and UBO Regulations

- The USA’s Regulatory Environment & UBOs

- UBOs in the UK

- Difference between Beneficial Ownership and UBO

- Final Thoughts