What is Selfie Identity Verification?

Selfie Identity verification is a verification process that requires a user to take and upload a selfie to verify their identity. Sometimes multiple selfies are needed to verify a selfie, for example, a selfie looking directly into the camera and a profile selfie looking left and right to increase security against deep fakes and attempts to bypass step verification by fraudsters. Similarly, video verification another biometric verification technique, is also gaining popularity. This form of identity verification is not completely foolproof on its own. Therefore, companies use it as an additional protection against fraudsters in combination with other verification techniques such as document verification or database verification, NFC scanning, etc.

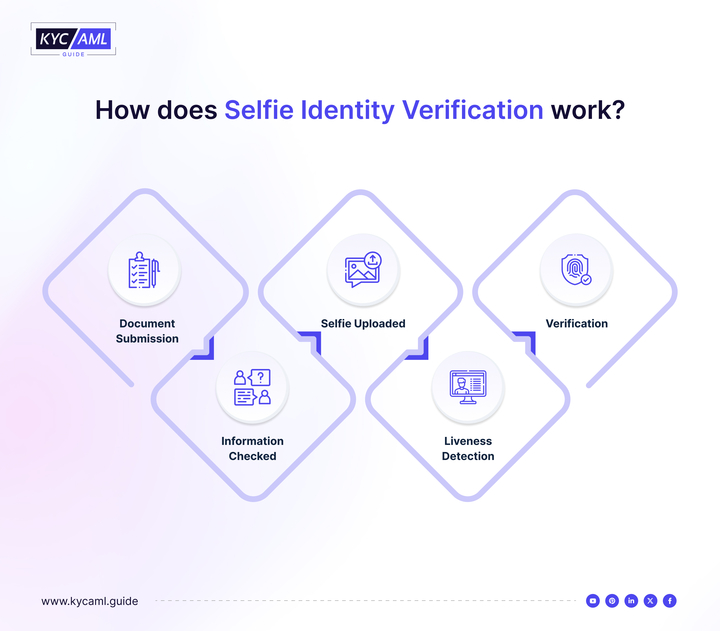

Selfie Identity Verification Process

The selfie identity verification process is often done digitally and in real-time. This means that the actual user communicates with the agency and follows the instructions given. There is no time to talk. For example, if you operate in a high-risk or highly regulated industry such as financial services or other industries subject to KYC and AML requirements, all users are required to take a photo for verification, which must be submitted during the onboarding process. The selfie identity verification process includes the following steps:

1 When you log into your account, you will be asked to provide several identification documents, including your official ID, passport, driving license, etc. You will usually be asked to take a photo and upload it to the website or app.

2 After completing the registration process, you will be asked to log in first. Some or all subsequent logins will require you to take a photo ID and upload your selfie with a smartphone, camera, or tablet to compare with scanned government documents.

3 The organization uses facial recognition software to determine if your photo matches your ID profile.

4 If your selfie passes identity verification, you can access your account.

Over time, you will be required to upload a new ID so that your photo reflects your current appearance. Financial institutions must perform identity checks during account opening as per KYC/AML regulations. Other industries may require identity verification in cases where the risk of fraud is higher. Not all customers require due diligence as this can cause unnecessary friction.

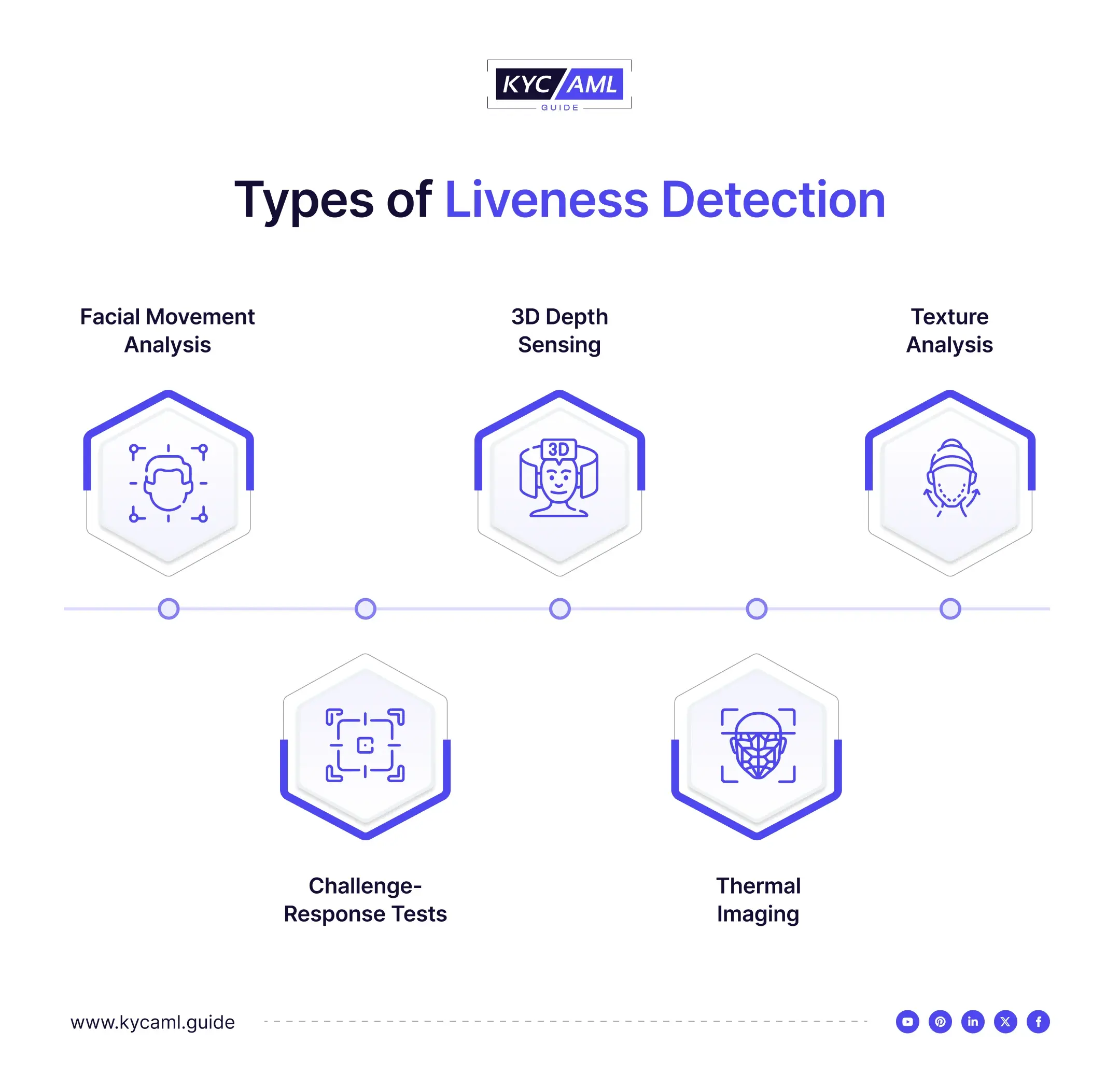

What is Liveness Detection?

Liveness detection is an important technique used in selfie identity verification to determine whether a user is a live person presenting themselves in real-time, rather than a pre-recorded video, image, or representation. Various methods such as facial motion detection and real-time interaction prompts are used to confirm user presence and prevent fraud attempts. This process usually happens automatically in the background after you upload a selfie.

Also Read: Harnessing Liveness Detection in Selfie-Based Digital KYC

Pros and Cons of Selfie Identity Verification

The pros of selfie identity verification are as follows

1 Protection Against Database Hacks

Identity verification often requires individuals to provide sensitive information such as date of birth, social security number, driver’s license number, etc. Unfortunately, all this information in the database can be hacked. As per IBM report, the average cost of a data breach in 2023 was $4.45 million, marking a 15% increase over three years.

2 Reduced False Positives

Compared to traditional verification methods that use usernames and passwords, selfie identity verification can significantly reduce false positives (rejection of legitimate users) and false negatives (acceptance of fraudulent users).

3 Efficient Re-Verification

In addition to initial account creation, selfie identity verification is useful for re-verifying login attempts, authentication failures, or high-risk transactions. Using selfie controls in this way strengthens the security of user accounts and reduces user conflict.

4 Accurate Liveness Detection.

The liveness detection in selfie identity verification is perfect for differentiating between a live picture and a static picture or video. It also detects small movements, such as blinking or smiling, that are hard to catch with still pictures.

5 Prevent Spoofing Attacks.

The combination of selfie identity verification and liveness detection effectively prevents spoofing attacks. Liveness detection techniques determine whether a person is physically present or represented by an image or video by analyzing facial movements, head movements, glare patterns, and other factors. This prevents bad guys from impersonating someone else with a pre-recorded video or image.

6 Additional Verification Layers.

Selfie identity verification can be used with other means of identity verification, such as document verification and screening against criminal investigations, increasing accuracy by providing multi-level verification.

The cons of selfie identity verification are

1 Selfie Quality

The accuracy of selfie identity verification depends on the quality of the selfies taken. Bad lighting, bad facial expressions, or obscuration can cause a false rejection or acceptance.

2 Algorithm Biases.

Unfortunately, some selfie identity verification systems and their facial algorithms can be flawed, leading to inaccuracies. This applies to people of different races or genders. Therefore, it is very important to choose a reliable solution with a reliable facial recognition algorithm.

3 Potential for False Negatives

Selfie identity verification relies on facial recognition and related technologies, which even with liveness detection aren’t quite perfect. Things like glasses or low-quality images can trick the system and make it look bad. This can falsely boost legitimate users during the verification process.

4 The Rise of Deep Fakes

Even though selfie identity verification and liveness detection can be extremely viable in detecting and preventing different fraud techniques like recording, printing, masking, digital replays, and so on, a deepfake presents a challenge. Since 2018, the number of deepfakes on the internet has multiplied, coming to 14,678 by 2021.

Wrapping Up

Ultimately, selfie identity verification is redefining what customer onboarding can look like for businesses and employees. This is important for anyone looking to transform their business and ensure that every relationship is safe and successful. So if you want to ensure the best customer experience and accessibility to your service, make sure selfie verification is part of your strategy. KYC AML guide will help you in choosing the right KYC solution for you by offering KYC Vendor Analysis.