What are Deep Fakes?

Deep Fakes or Deep Fake AI is a trending way of creating fake identities including images, videos, and voice. It is an impersonation that uses Artificial Intelligence (AI) and Deep Learning to create realistic and deceptive content. Deep Fakes can manipulate and compromise original real-world people’s identities and can be used for criminal activities like fraud, scam, or defaming celebrities through ‘celeb Deep Fake’.

History of Deep Fakes

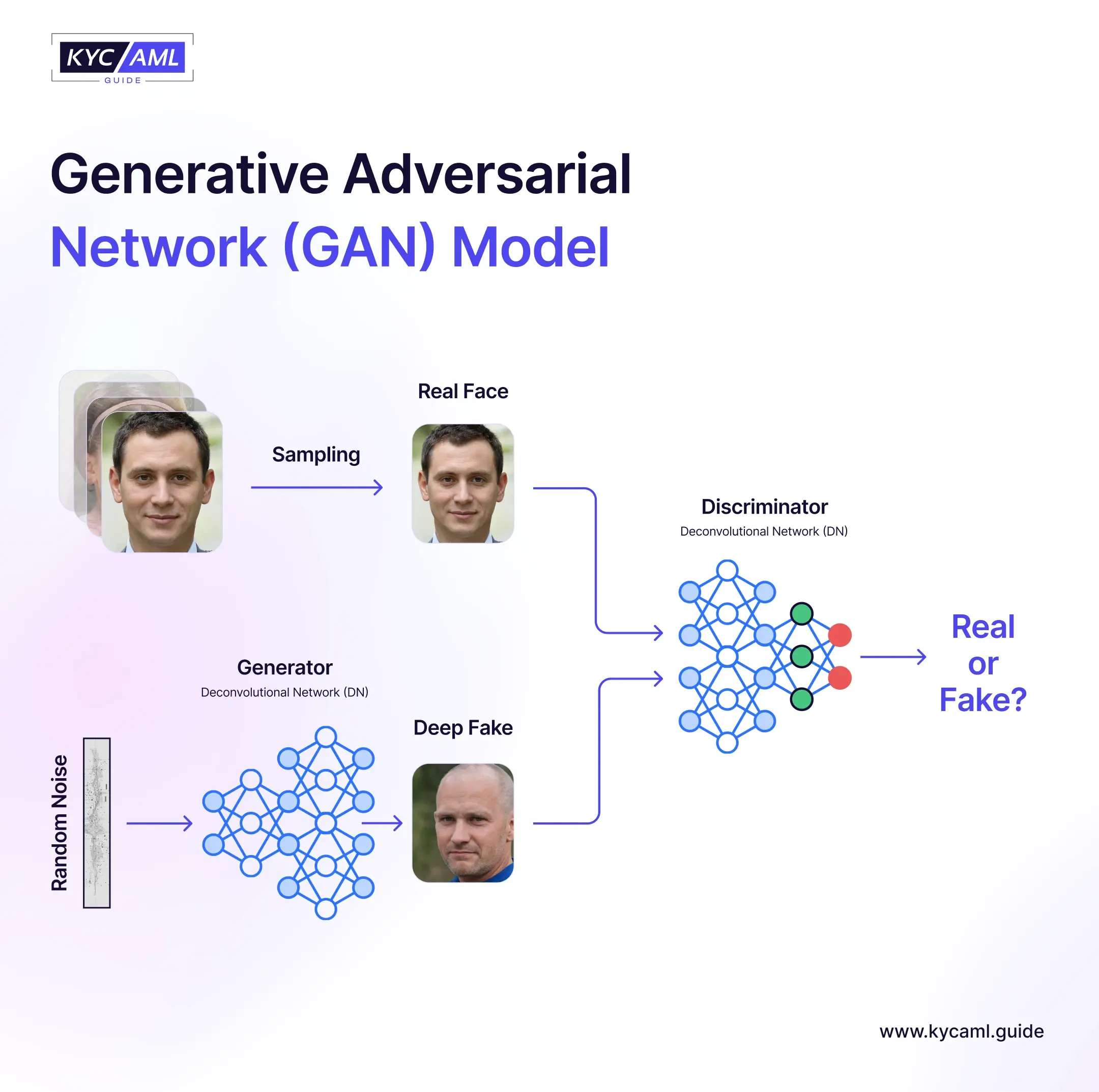

The term Deep Fake is derived from two words, Deep Learning and Fake. This technique relies heavily on Generative AI which particularly is a subset of GAN (Generative Adversarial Networks) introduced by Ian Goodfellow in 2014. It has two components; A Generator that generates a Deep Fake and a Discriminator that differentiates between real and fake data.

Here is a graphical illustration of a GAN Model:

The Role of Generative AI in Evolving Deep Fake Technology

Generative AI is a type of artificial intelligence that can produce a variety of content abundantly in less time. They generate new data instances resembling existing data sets. It is a subset of GAN technology. Through Generative AI tools, users can create Deep Fake videos, images, and voices in a matter of seconds. This has increased the risk of Deep Fake Web resulting in identity spoofing.

Gen AI has made the detection of Deep Fakes challenging for regulators and identity solutions. Last year, we witnessed 4 major Deep Fake cases listed below:

- Tom Hanks Deep Fake Video Promoting Dental Plan

- Ripple CEO Deep Fake Video Promoting Fraudulent Giveaway

- Binance Executive Targeted with Deep Fake Hologram

- Deep Fake Video of Ukraine President Zelenskyy

Read More: Deepfakes Threats

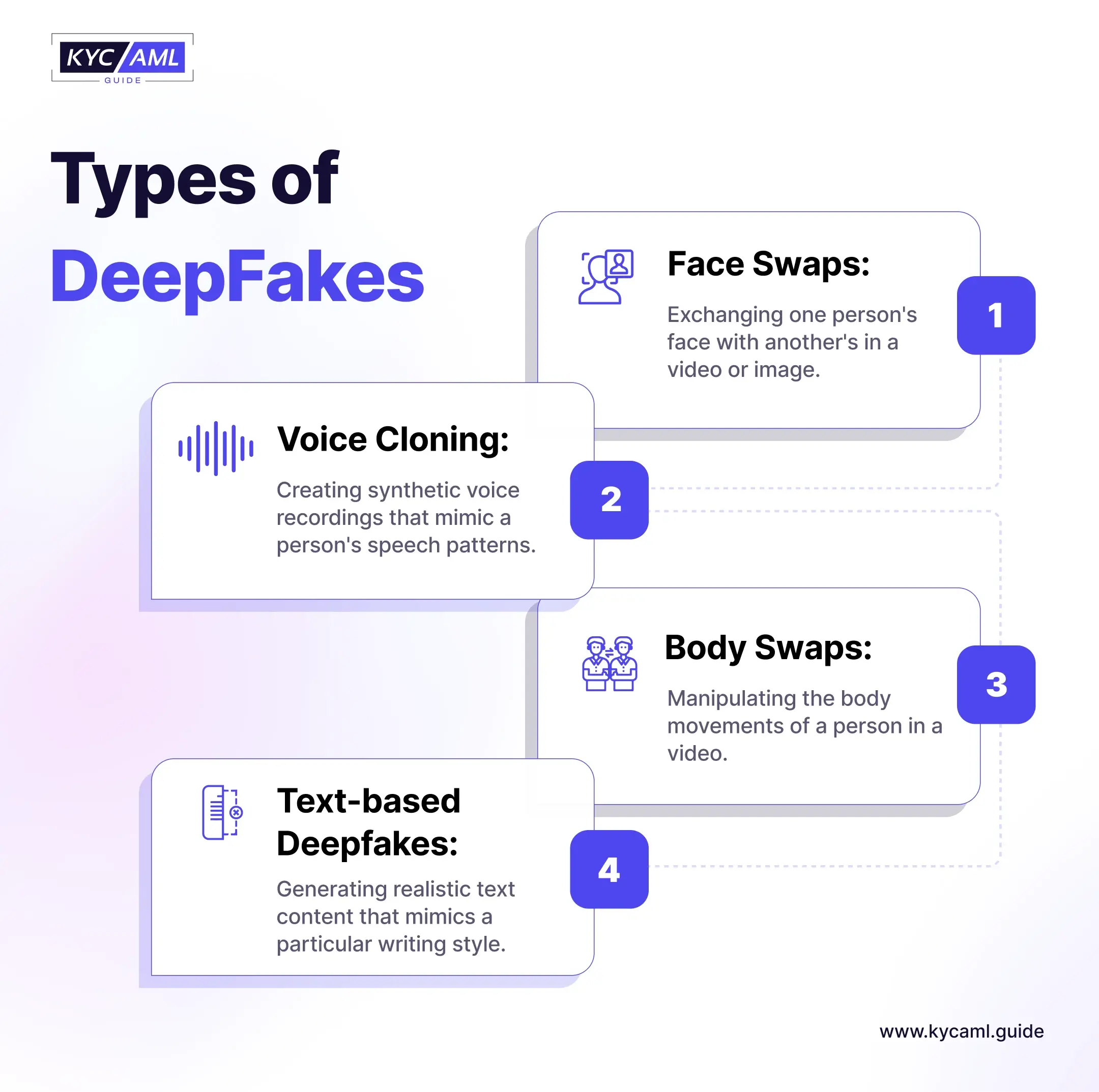

Types of Deep Fakes

Below is an explanation of these 4 types of Deepfakes:

| Face Swaps |

|

| Voice Cloning |

|

| Body Swaps |

|

| Text-based Deep Fakes |

|

Role of KYC Solutions in Eliminating Deep Fakes

KYC (Know Your Customer) Identity Verification Solution Providers play a key role in eliminating Deep Fake fraud. KYC Identity Verification Solutions implement robust document verification, biometric authentication, and other verification methodologies to deter fraudsters/imposters and protect genuine customers.

Liveness Detection and Deep Fakes

Liveness Detection is the key element in KYC Solutions used to detect deepfakes. The liveness detection mechanism involves the technical detection of images, voices, and videos and detecting fake ones.

There are 2 types of Liveness Detection in Identification:

- Active Liveness Detection: This refers to the detection of liveness from a real person sitting in front of a camera or speaking in the recording device.

- Passive Liveness Detection: This refers to the detection of liveness from a pre-recorded video, image, or voice recording played through a phone or another device in front of a biometric authentication device.

Also Read: How to Detect a Fake ID?

5 Best Practices to Detect a Deep Fake

KYC ID Verification Solutions detect the use of a deepfake in an identification attempt through the following 5 practices:

- Facial and Body Movement Analysis: It looks for unnatural movements, gestures, face and body tilts, and facial expressions that have inconsistencies and depict artificial patterns.

- Audio Analysis: It detects anomalies and inconsistencies in voices. It can also have slight differences in pitch, tone, and artificial touch that can be detected through careful hearing or an AI-based anti-spoofing tool.

- Background Analysis: It detects the artifacts, and anomalies in the background of a picture or a video. For example, in deepfake usually people use templates of backgrounds. It can also detect background artificial noise and aural anomalies in voice deepfake.

- Manual Detection: Anti-fraud experts are skilled in detecting fraud patterns and fakeness in different identification attempts. They can be employed to double-check the identities for deepfakes.

All of the above techniques alongside Liveness Detection can enhance the ability of KYC Solutions to go the extra mile while serving their fintech clients. It is the responsibility of KYC IDV Solutions and the fintech to increase the level of scrutiny in such a way that the User Journey remains seamless. For example, in the case of Transaction Monitoring, deep fake can be used extensively to transfer amounts into fraudulent accounts. KYC Solutions and Banks must play a critical and active role in identifying and stopping identity spoofing of all types at this sensitive point of their service.

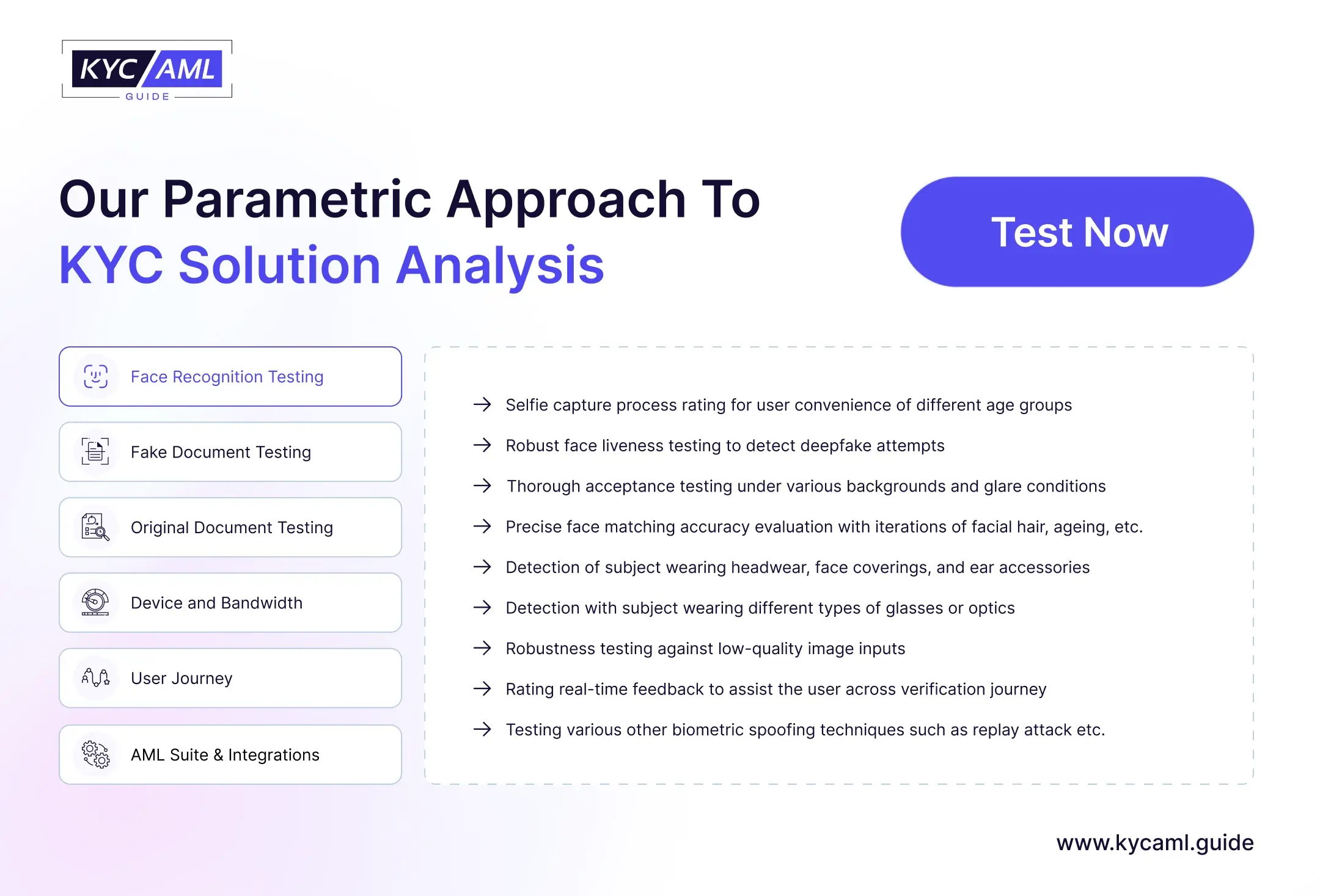

Here are the parameters on which KYC Onboarding Solutions can know their current capabilities and set clear directions for further enhancements in their tool.

KYC AML Guide’s Vendor Analysis serves as a tool to meticulously test a KYC Solution’s capabilities of detecting Deep Fakes. Our approach in analyzing a KYC Solution’s ability to detect a Deep Fake is known as “Robust Liveness Detection”. It is supported by other factors in determining different scenarios and conditions for Facial recognition in Identification.