Defining KYC Remediation

KYC (Know Your Customer) Remediation is the key to smart customer onboarding in every FinTech organization. The customer’s data and information must be regularly reviewed to achieve a flawless state of customer experience during onboarding and maintain it during the rest of the services.

In KYC Remediation, the customer’s collected information is regularly checked for accuracy and it should be up-to-date, and sufficient for risk profiling. It involves the cleaning, updation, and deletion of the information from the customer database.

Why does KYC Remediation require optimization?

Firstly, the regulatory landscape of KYC AML and CTF is ever-evolving. Every month we hear the news of some regulatory updates or changes being introduced. Due to these changes, the KYC Remediation process needs to check customer data for irregularities according to the new guidelines. Apart from this, here are the main reasons for which KYC Remediation should be optimized:

- It enhances Risk Management in the overall KYC Process.

- It helps in maintaining data accuracy and integrity of the KYC Solution and the fintech firm.

- It helps in increased surveillance over customer profiles and protecting the genuine ones from fraud, and money laundering.

- It improves the User Journey by removing friction in a KYC Onboarding process through regular monitoring.

5 Steps to Optimize KYC Remediation

1 Implementing Robust KYC Technology

Using Advanced KYC Tools can streamline the KYC Remediation process. This includes the use of AI (Artificial Intelligence), Biometric Identity Verification, and NPL (Natural Language Processing) to automate the KYC. For this purpose, fintech needs to consider technology buying consultancy before taking this crucial decision of choosing a KYC Partner.

2 Maintaining Data Quality

KYC Solution providers and fintech firms must ensure the completeness of your data and they must ensure that this data is aligned with the government database and is accurate. For instance, there should be no discrepancies between your digital identity and your personally identifiable information in the records of the bank. Moreover, regular cleansing of this data is very important to ensure data authenticity.

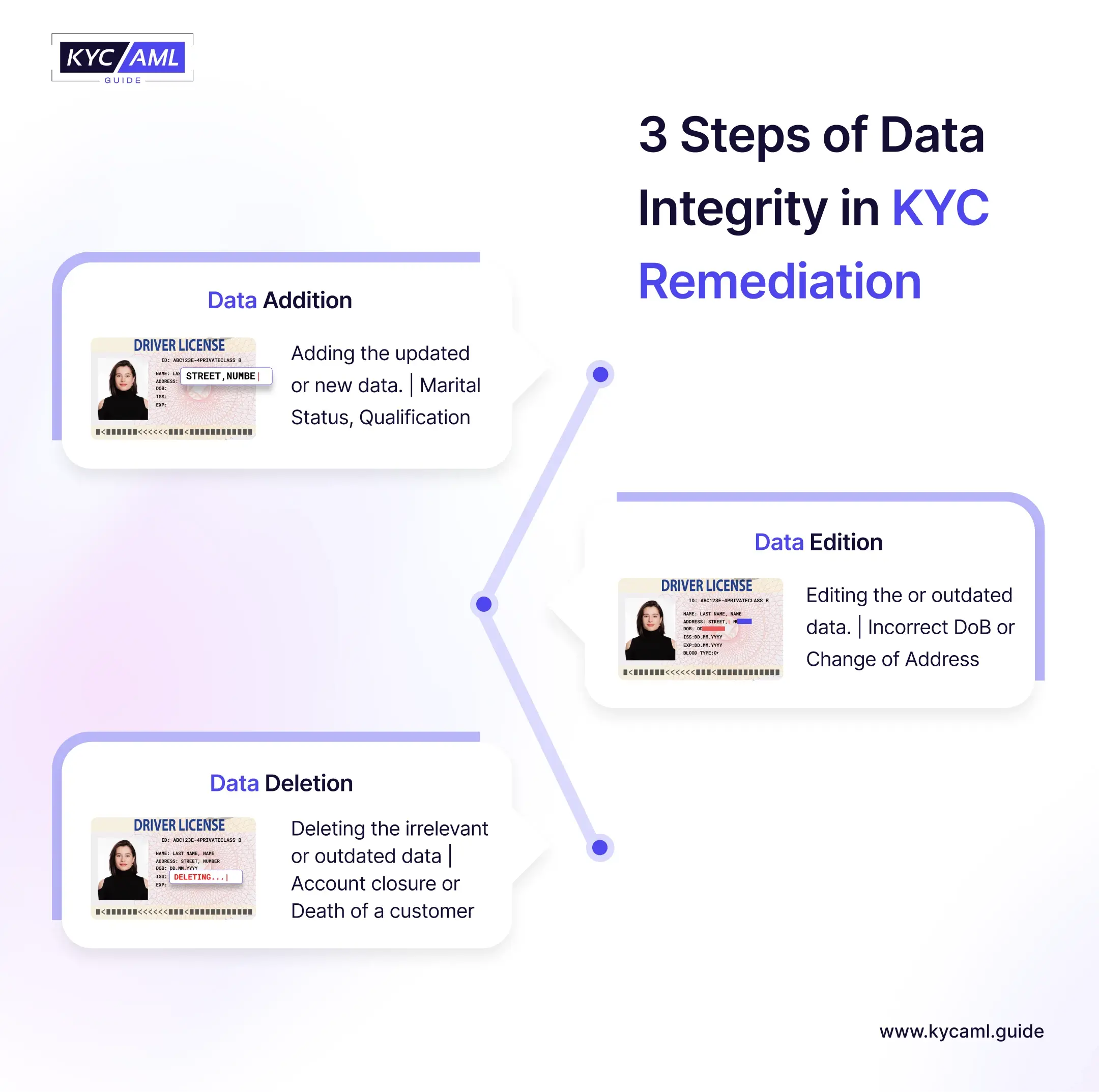

Here KYC Vendor can take three steps to ensure data integrity such as:

- Data Addition:

- Adding the updated or new data that was previously missing in the customer profile.

- For example, Updated Marital Status, Qualification status of Employment Status are updated regularly and must be added accordingly.

- Data Edition:

- Editing the data in the customer profile that was previously incorrect or outdated.

- For example, incorrect information on any of the data sets like date of birth, name, or any other information that requires editing due to being incorrect.

- Data Deletion:

- Deleting the data in the customer profile that is no longer relevant or needed.

- For example, if a person dies, his records need to be deleted from a specific database, or a customer requests closer to his bank account.

3 Prioritizing Risk-Based Approach

Adopting a risk-based approach and prioritizing the high-risk customers for in-depth KYC Remediation checks. This will help in efficient resource allocation in customer risk profiling. Your KYC Tool Provider and Bank should have risk-scoring models to assess the risk associated with each customer and tailor the remediation process accordingly.

4 Enhanced Reporting and Analytics

KYC Solution Providers should implement advanced anomaly detection mechanisms such as AI-based data analytics. This will help in detecting patterns of suspicious activity and behavior of customers. Furthermore, the KYC Remediation should have fast and accurate reporting to identify the bottlenecks and ensure compliance with the Remediation.

5 Foster a Strong Communication Environment

Communication is the key to efficient business operations. KYC Remediation also requires the compliance teams, KYC personnel, and other business leaders to effectively communicate and collaborate through fast and seamless means. Also, maintaining a transparent communication line with regulatory bodies will support the KYC Remediation activity.

Conclusion

These 5 ways can help KYC Solutions and Fintech achieve an optimal state in the KYC Remediation process. It is important to ensure that only up-to-date and accurate information is stored in the customer database. 4 pillars of KYC require remediation as a support beam in building a secure and compliant financial ecosystem. You as a customer should have a sound knowledge of KYC and its Remediation process to protect your identity and associated financial information.