There are many advantages of partnership like access to new business sectors or technologies. However, when choosing a partner, poor due diligence can prompt misalignment of objectives, communication breakdowns, and conflicts of interest. Partner risk can cause reputational harm assuming one partner’s activities have a poor reflection on the other. To effectively manage partner risks, let us delve into Know Your Partner (KYP).

What is KYP?

KYP stands for “Know Your Partner”. This includes checking whether business partners comply with laws and regulations. KYP checks aim to understand better the background of agents who will launch and operate products on our platform. Agents fill out forms with information about their company, related partners, and legal representatives. They also upload the necessary documents in the same form.

KYC and KYP are compliance systems, meaning they aim to prevent fraud and ensure everyone follows rules and regulations.

The Know Your Partner (KYP) Process

The implementation of the KYP process comprises of lot of practical steps designed together. They assess and validate potential patterns to analyze the information. The steps involved in this process are;

1 Collecting Information:

Get all the necessary documents that prove the identity and legitimacy of the partner. For this purpose, it is recommended that regulated organizations receive the “Know Your Customer” form provided by the company, which contains the company’s name, legal structure, partners, their ownership, contact details, license number, nature, and purpose of the business activity, about the commercial relationship, etc.

To verify your identity, you must also obtain the necessary paperwork, such as an incorporation certificate or business license. A Memorandum of Association and Articles of Association are two documents that must be obtained concurrently to verify the organization’s structure.

Making sure that all of the data you receive from the partner’s organization is accurate and valid is essential. All of the information gathered about the company helps to determine the type and level of AML/CFT procedures that should be implemented to address the risks that the company presents.

Also Read: How do investment firms do KYC document verification?

2 Validate Information:

Verification of documents is necessary to ensure that the information and documentation provided is accurate and reliable.

3 UBO (Ultimate Beneficial Owner) Screening:

The identification and validation of partner entities’ ultimate beneficial owners provide insight into the ownership structure and associated risks.

4 Watchlist Screening:

A source of income inquiry is necessary to ensure that the ultimate beneficial owners of a corporation are not involved in any illegal financial activity, such as money laundering or financing terrorism. This reveals information on the financial integrity of a business as well as the status of its beneficiaries, partners, and financial institutions. Check a variety of databases and checklists to confirm if owners, partners, or affiliates have taken part in illicit or non-compliant operations. For example

- AML watchlist screening

- PEP screening

- Sanction Screening

- Adverse Media Screening

- Global Watchlist Screening

Also Read: Sanction Screening: A Complete Guide & What is a global watchlist?

5 Risk Assessment

Decide based on the information received whether forming or continuing a partnership poses the risk. The risk profile and due diligence of a project can also be influenced by its geographic location. A business operating in an area with a high level of financial crime or corruption may pose a danger, necessitating further investigation.

6 Ongoing Monitoring:

Review transactions and activities related to partners to identify irregularities or suspicious activity. Ensure KYP information and risk assessments are updated through regular reviews.

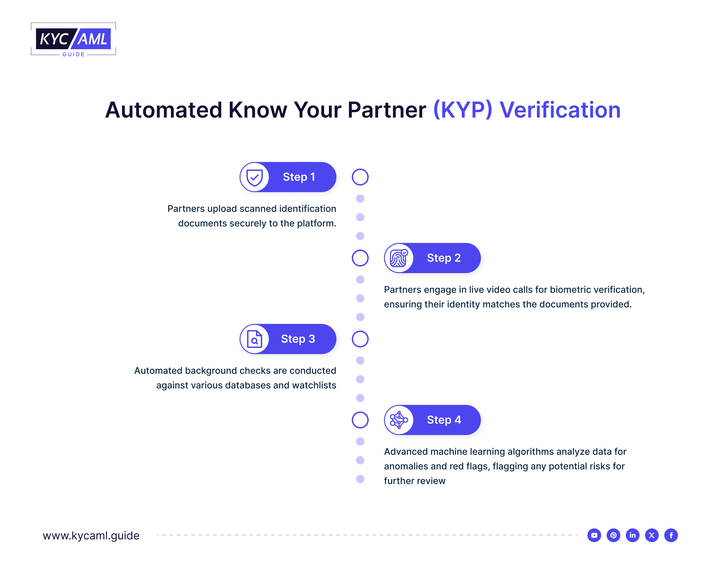

Automated Know Your Partner (KYP) Verification

Automated personnel management is essential for sharing with new, distant people and for expanding globally. Following the upload of their ID cards, partners participate in a live video call for biometric authentication. Databases and watchlists are consulted for background checks, and machine learning is employed to identify any suspicious activity. Transparency and data security are given priority, ensuring that partners are aware of and accept the policy. This permits us to grow in a morally and legally sound manner, and our alliances are dependable and secure.

Benefits of KYP

1. Building Trust

One of the essential standards of KYP is transparency. It makes trust, and in the business world, trust is the groundwork of every fruitful relationship. By transparently sharing data and accepting partner disclosures, organizations establish a climate of trust that is the basis of lasting connections.

2. Risk Mitigation

KYP serves as an effective risk management tool. By thoroughly researching potential partners, businesses can identify and mitigate potential risks before they escalate. This includes considering financial stability, legal compliance, and any warning signs that may affect the relationship. This cautious approach helps you make the right decisions and protects the interests of everyone involved.

Additionally, safeguard yourself by conducting a KYP investigation on possible investors of crowdfunding. Thoroughly investigate them by KYP to make sure they align with the legal and ethical requirements of your business. This will lower risks and boost confidence in the event of a successful campaign.

3. Effective Decision-Making

The foundation of a successful partnership is making informed decisions. KYP empowers investors to go with decisions given a complete comprehension of their partners’ capabilities, values, and monetary status.

4. Reputation Management:

Protecting the company’s reputation by ensuring that the company does not unwittingly associate itself with companies that do bad things.

Digital Identities and Footprints

The idea of digital identity and digital footprint gives the KYP procedure a new meaning in the modern digital age. The behaviors and online presence of people and organizations make up their digital identities, which can provide you with important information about their reputation, behavior, and reliability. Checking your digital footprint can help to get the following information.

- Checking the data that employees have provided

- Assessing the professionalism and online activity of the partner

- Taking into account any potential warning indicators or red flags in the participant’s conduct

- Determine any possible conflicts of interest or legal concerns of the online activities of possible partners.

- Safeguarding the business’s reputation and keeping it clear of any illegal online activities

Conclusion

With KYP, the company is prepared to protect the interests of its customers, comply with regulations, and maintain its reputation as a reliable financial services provider. With persistence and a proactive attitude, they want to stay ahead of the changing environment and ensure safety and integrity in all areas of their operations.