What is Fintech KYC?

Particularly, the Fintech in KYC (Know Your Customer) is the process of transformation of financial compliance for making customer identification and onboarding more convenient and safe. To make it more transparent, efficient, and intuitive, digital platforms are introduced. Especially, in banking and other Financial Institutions, FinTech helps in the innovation of systems for improved security against Fincrime. Now, customers expect seamless solutions where a secure and fast onboarding experience is easy. Therefore, Fintech enables a seamless and robust KYC by leveraging digital identity verification. Most importantly, the use of biometrics has revolutionized the Fintech KYC process.

Examples of Fintech Firms

Following are the renowned and internationally recognized Fintech KYC Solution Providers.

- Onfido – it uses AI and machine learning to verify the identity of customers in real-time.

- Jumio – provides identity verification services through real-time ID and facial recognition technology.

- Circle – a peer-to-peer payment platform, uses blockchain technology to securely store and verify customer information.

- IdentityMind – provides a real-time, global identity verification platform that uses big data, machine learning, and other technologies to minimize fraud and risk.

Also, one must know that every Fintech is now competing to revolutionize further to stay compliant and evolve.

Regulations of Fintech KYC for firms

Mainly, five regulations are legally involved in regulating the KYC for Fintech firms.

- Anti-Money Laundering (AML) regulations require the FIs (financial institutions) to implement measures against money laundering.

- Customer Due Diligence (CDD) regulations require financial institutions to verify the identity of customers and assess financial risk.

- The USA PATRIOT Act requires financial institutions to implement KYC procedures and maintain records of customer identification.

- The Fifth Anti-Money Laundering Directive (5AMLD) in the European Union requires Fintech companies to implement robust KYC procedures. Also, it includes ongoing monitoring of customer transactions to detect and report suspicious activities.

- Financial Action Task Force (FATF) Recommendations provide international standards for anti-money laundering and countering the financing of terrorism (AML/CFT).

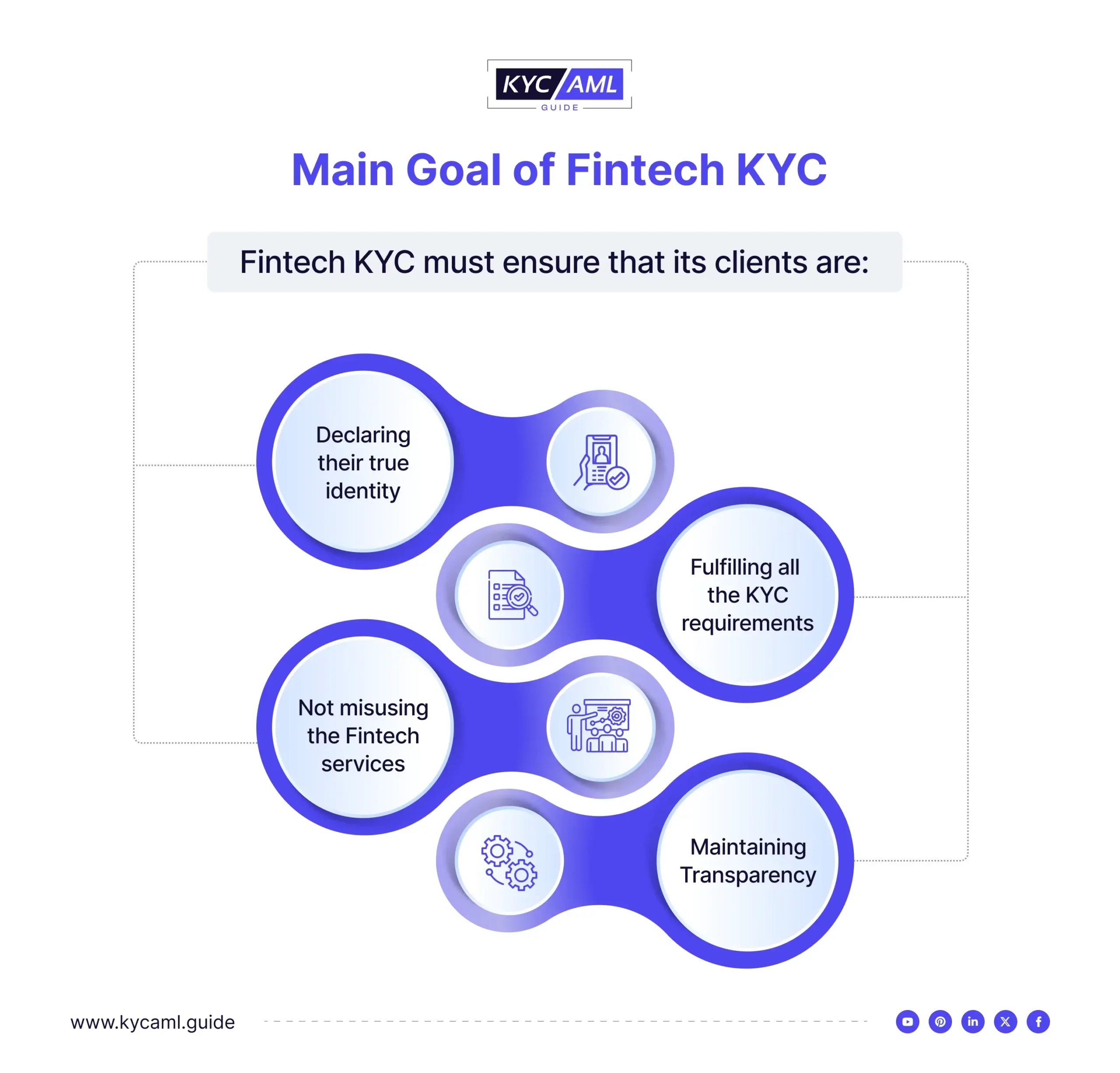

Main Goal of Fintech KYC

Firstly the goal is to stay compliant. It means that every firm exercising Fintech KYC wants to stay compliant with AML regulations. After the adherence to AML, the standards of credibility of the firm increase. But, KYC is not just a regulatory term. There are more uses of KYC in gaining a competitive advantage over the competition. Data from customers can lead to better insights into customer preferences and demand. Hence, decision-making in businesses is enhanced through KYC in Fintech.

KYC ensures that Fintech companies’ clients are:

- Declaring their true identity to the financial system during sign-up and sign-in.

- Fulfilling all the KYC requirements for using corporate or individual services.

- Not misusing the services to commit a crime like money laundering or fraud.

- Maintaining a transparent, trustworthy, and low-risk relationship with the FIs.

Streamlining the Customer Onboarding for Fintech Firms

Despite facilitating secure compliance, there are other goals associated with Fintech KYC Solutions. Customer Onboarding is more transparent as well as more seamless with the Fintech approach.

Ongoing Monitoring through Fintech KYC Solution

Fintech helps in ongoing monitoring through various tech-based solutions such as:

- Real-time data processing and analysis – Fintech companies use advanced algorithms and artificial intelligence to monitor financial transactions in real time. Moreover, they detect any anomalies and flag them for further investigation.

- Automated reporting – They provide automated reporting and analytics tools to help FIs monitor their operations and make concrete decisions.

- Digital wallets and mobile banking – Digital wallets and mobile banking applications allow users to monitor their finances on the go.

- Risk management – Fintech companies use predictive analytics and machine learning algorithms to identify and mitigate financial risks. So, it helps to ensure that financial institutions are better prepared to manage their risks.

Therefore, Fintech KYC helps in ongoing monitoring by providing financial institutions with real-time data and insights. Also, AI (Artificial Intelligence), and cutting-edge technology help them to make informed decisions and manage their risks.

Final Word

Fintech KYC is an approach where digital technologies like blockchain and AI are revolutionizing the financial industry. Mostly, Banks and other FIs are widely embracing the concept and moving towards digitalization. Similarly, companies that are liable to do their KYC are also focusing on the KYC Fintech Solution for improved compliance. However, it is important to note that compliance is always a cost. To mitigate the risks of money laundering, a firm needs to implement eKYC and improve its identification and verification methods.

Finally, the robustness of KYC in Fintech depends upon many factors and regulations. While choosing a KYC partner a customer needs to be sure to select the best FinTech KYC Solution provider as per compliance and requirements. Here KYC Technology Buying helps you in choosing the right FinTech KYC Partner through expert consultancy and KYC Vendor Analysis.