Companies should prioritize KYC for two key reasons. Initially, it guarantees adherence to international laws like anti-money laundering (AML), which is required to prevent legal repercussions. Secondly, it prevents fraud, thereby reducing financial losses. Following 9/11, regulations tightened, and in 2022 alone, fines for AML offenses rose by 50%. Businesses in sectors such as banking and fintech must adhere to KYC regulations, and authorities are expanding their reach to include other industries. Significant fines or even prosecution may follow noncompliance with this regulation. Preventing fraud is also crucial. Banks lost up to $479,000 due to identity fraud. Emerging threats such as in-depth fake video fraud are a major concern and require a flexible approach to emerging threats. Investing in an efficient KYC procedure is essential as businesses deal with increasing financial concerns. Over the next three years, 91% of firms worldwide want to raise their spending in this area.

What is Automated KYC Verification?

“Automated KYC Verification” uses advanced technology to streamline the KYC process, improving its effectiveness, accuracy, and cost-effectiveness. Through services such as risk assessment, identity verification, and ongoing monitoring, businesses can reduce costs and time in compliance. This can also improve customer satisfaction and reduce human error. Businesses can use this technology to guarantee regulatory compliance, boost overall productivity, and increase satisfaction among clients.

Manual vs. Automated KYC verification

Manual KYC Verification

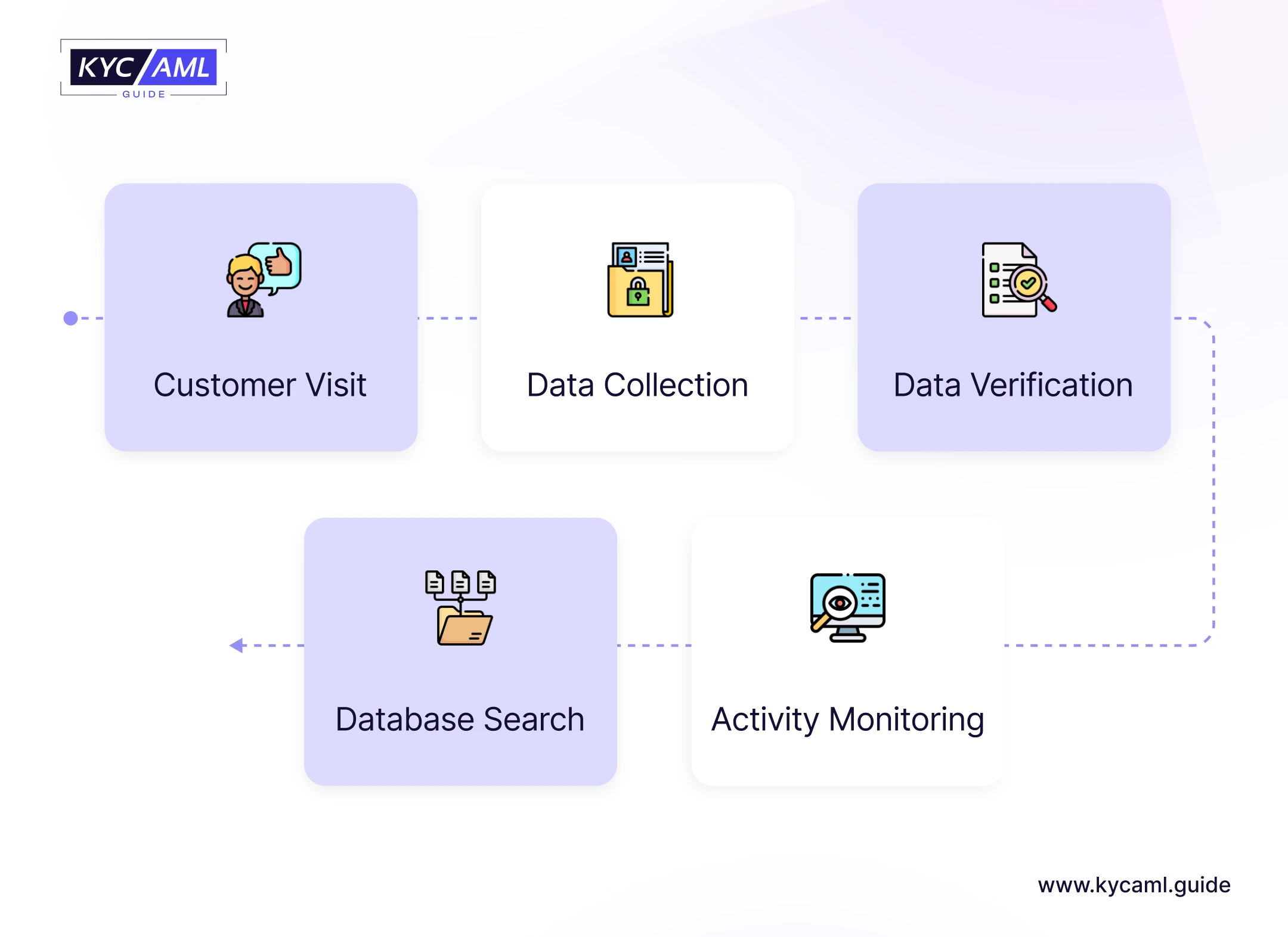

Manual KYC verification requires human assistance to verify customer identity and collect relevant information. This method still prevails, especially in smaller companies where manual KYC may be sufficient. The manual KYC process involves the following steps:

- A customer visits a company.

- The client is required to provide personal data, including name, address, and identity number, on a form. As an alternative, the user might wait patiently while the employee enters the data straight into the system.

- The employee verifies the data by checking the submitted documents and verifying their authenticity.

- Clients are checked against a checklist or database to identify potential risks and ensure they are not involved in illegal activities.

- The employee monitors customer activities to identify suspicious transactions so that intervention and reporting can be done promptly if necessary.

Manual KYC has several disadvantages as shown in the infographic below. Some companies still rely on manual KYC process. However, the usage of automated KYC verification solutions is becoming necessary as rules tighten and the demand for increased efficiency rises, particularly for large enterprises and high-risk industries.

Automated KYC Verification

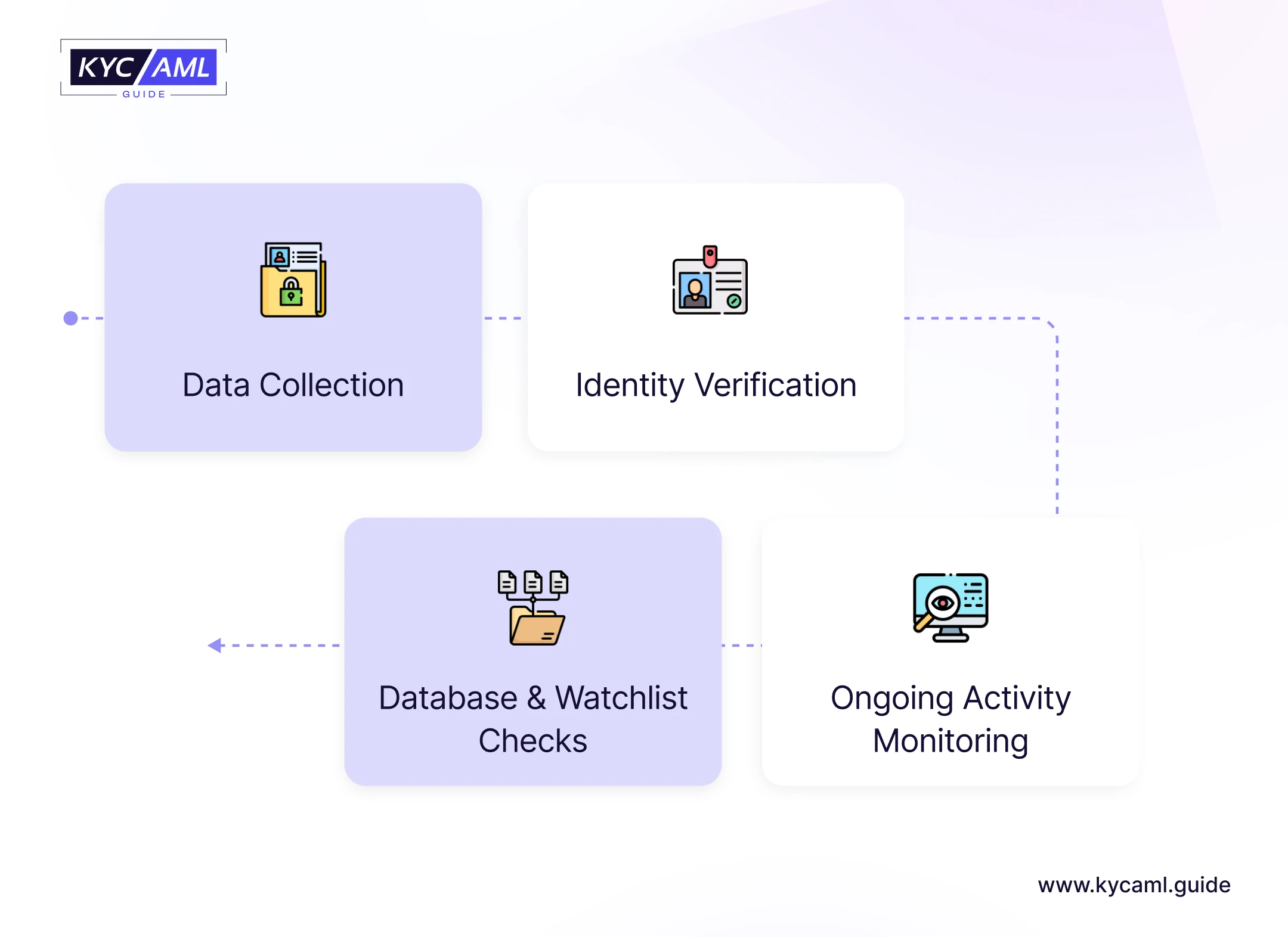

Automated KYC verification uses technology to streamline the process, ensuring compliance standards are met. The market for identity verification is anticipated to expand from $9.5 billion in 2022 to $18.6 billion in 2027. As a result, there is growing evidence that automation is happening. The following actions are part of the automated KYC verification process:

Data Collection:

The user takes a photo of the ID document (if online), or the user scans the document with a special reader (if offline ‘internet).

Document Verification

An advanced algorithm verifies documents and selfies to ensure authenticity and accuracy.

Biometric Verification:

The user submits to biometric verification and snaps a selfie to confirm their identity. Verifying that the sender of the document is a real person and not a fraud is the goal of the authentication process. Then a liveness check is performed for verification.

Checking Databases and Watchlists:

The consumer is automatically compared to databases or watchlists to find potential threats and confirm compliance with regulations.

Ongoing Monitoring:

Following the onboarding process, customer service is tracked, and machine learning and data analysis are used to spot suspect transactions and maintain compliance.

Use Cases of Automated KYC Verification

❖ Digital Customer Onboarding

The online lender uses KYC automation to simplify the application process. The system confirms the identification of applicants in a matter of minutes when they digitally upload their documents. This enhances the user experience while expediting the procedure.

❖ Financial Services

Investment firms, banks, and other financial institutions use KYC automation to assess potential risks and verify customer identity. They can better serve their clients and adhere to more stringent financial rules, such as AML/CTF regulations, with the use of automation. KYC providers save customer expenditures by up to 73% and onboarding durations from days to minutes by significantly streamlining the verification process.

❖ E-Commerce

Online marketplaces such as Amazon and eBay use automated KYC to verify seller names and prevent fraudulent activity. Vendors can submit their documents, which are then verified by operating systems, increasing security and building customer confidence.

❖ Healthcare

In healthcare, automating KYC processes is critical to complying with the Health Insurance Portability and Accountability Act (HIPAA), which will verify patient enrollment. This protects by ensuring that only authorized personnel have access to critical patient information and medical records.

❖ Crypto

Cryptocurrency systems and projects require automated processes for KYC verification. An efficient KYC verification service can penetrate 98% of users in less than 30 seconds. While cryptocurrency exchanges become the most widely used method of money laundering. Creating a good customer profile will help cryptocurrency companies avoid sanctions.

Benefits of Automated KYC Verification

Banks are reaping many benefits from the automation of the KYC process, which has been made possible by technological advances. The benefits of an automated KYC verification system include:

1. Efficient Operations

Automated KYC verification allows for faster manual onboarding and customer verification, reducing the process to just a few minutes. These improvements in customer experience allow banks to communicate with customers faster and more effectively.

2. Cost Effective

By automating KYC, financial organizations can lower the cost of customer due diligence (CDD). It also reduces paperwork and overhead costs. It makes the process more cost-effective for businesses.

3. Perpetual KYC

KYC automation enables the continuous monitoring and updating of customer information, known as pKYC. It enables continuous compliance, better risk management, and an enhanced customer profile and strengthens the KYC system.

4. Compliance Commitment

It ensures that the bank follows the rules flawlessly. This reduces the risk of non-compliance and potential liability and gives them peace of mind about compliance.

5. Enhanced Safety Measures

Automated KYC verification often has advanced security features, which reduce the risk of identity theft and money laundering. This provides additional protection for financial institutions and customers, who ultimately rely on the business relationship.

Also Read: Overcome KYC Verification Failed: A Step-by-Step Approach

How to Choose the Best KYC Automation Solution with KYC AML guide?

Choosing the right KYC automation solution requires careful analysis and understanding of business needs. Find solutions with easy integration, extensive document coverage, and detailed audit trails. Evaluate vendors based on factors such as integration options, document database coverage, and conversion-driving features, ensuring seamless onboarding without compromising security. Some of the features are given below in the infographic

For more details, delve into our comprehensive guide: “Choosing the Ideal KYC Vendor,” and discover how the KYC AML Guide aids you in buying the perfect KYC solution.

Bottom Line

To sum up, automated KYC verification is revolutionary in the fight against fraud and the enforcement of compliance. Businesses may lower expenses, boost output, strengthen security, and provide a flawless customer experience by utilizing this technology. When selecting an automated KYC solution, factors like security, scalability, and user-friendliness should be given top priority. This proactive approach not only keeps businesses one step ahead of fraudsters but also ensures regulatory compliance, which strengthens customer trust and loyalty.