What is KYC?

KYC is a process that an organization uses to verify the customer’s identity This incorporates gathering customer’s information such as proof of identity like name, date of birth, proof of address, and other significant data. The data gathered is compared with official documents, for example, identity cards, passports, or driving licenses. KYC is significant for sectors that have a high risk of fraud and money laundering like healthcare, banks, telecommunications, etc.

The fundamental objective of KYC is to guarantee that an organization doesn’t unknowingly support criminal operations. A company can use KYC to verify the identity of its customers and identify risks associated with the services they provide. KYC assists organizations with reducing financial risks and meeting regulatory requirements.

What is Digital KYC?

Digital KYC uses optical character recognition (OCR) to cover various forms of online and remote identity verification. It involves reading, scanning, and verifying data using biometric information. eKYC is a part of Digital KYC. There are various ways to do digital KYC such as

- Video-based EKYC means the agent verifies the customer via video call and asks the customer to show their identity and address, such as ID card, passport, driver’s license, etc.

- OCR-based eKYC involves the customer document scanning using a web browser or mobile app to automatically extract relevant information.

- Biometric-based eKYC is based on facial biometrics, which involves taking a photo of a customer’s face with a camera and matching it with the photo on their national identity card or identity document.

What is eKYC?

e-KYC stands for Electronic KYC. it is the online paperless process for verifying a customer’s identity using a National Identification Number. This number is a unique identification number issued by the government to all citizens of a country. With eKYC, customers can permit the government to share their name, gender, age, and photo with financial institutions using biometric authentication or OTP. Biometric identity verification involves scanning a customer’s fingerprint or iris, whereas, with OTP authentication, a one-time password is sent to the customer’s registered phone number. eKYC is fast, easy, and safe because it does not require document submission and physical verification.

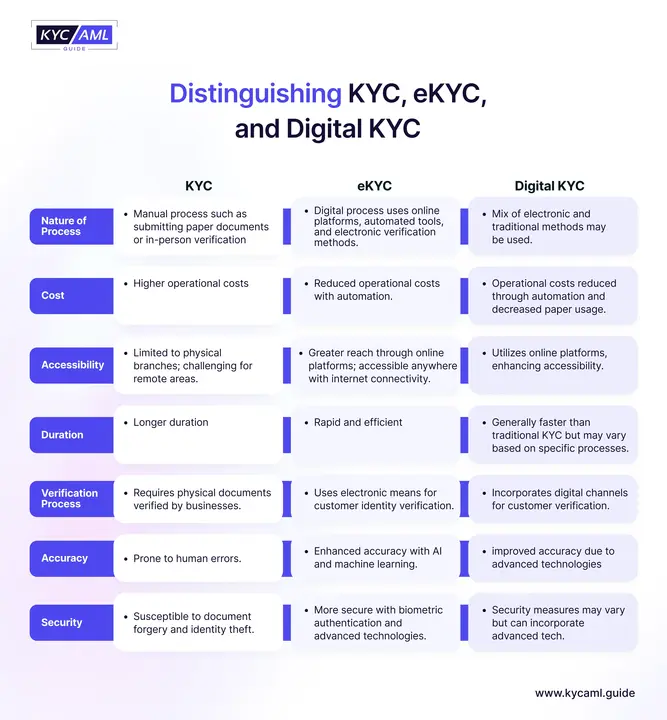

The main difference between KYC, digital KYC, and eKYC.

There are two types of KYC, traditional KYC, and digital KYC, so we can say that digital KYC is the main type of real KYC. The scope of Digital KYC is wide and widespread while the scope of eKYC is narrower than Digital KYC. Currently, eKYC is a part of digital KYC, as it is used to verify the identity of customers.

The main differences between KYC, digital KYC, and eKYC are given below

Compliance Requirements for KYC, digital KYC, and eKYC

KYC, digital KYC, and eKYC are subject to compliance rules set by governing bodies. These requirements vary by country and company but generally require companies to collect and verify customer information.

- For KYC, compliance requirements may include verification of the customer’s identity, address, and source of funds. Per local regulations and laws, this information must be collected and analyzed

- Digital KYC solutions are designed to implement compliance and oversight requirements. This reduces the risk of non-compliance and associated fines.

- Compliance requirements for eKYC include electronic signatures, biometric verification, and secure storage of customer data. These requirements vary from country to country and company to company, but companies must ensure that they meet all applicable standards.

Integration with Other Systems

Another aspect of choosing between KYC, digital KYC, and eKYC is how they integrate with other systems. For example, you can choose eKYC for seamless integration if your company uses a digital onboarding system. On the other hand, traditional KYC may be a better choice if your business relies heavily on physical documents. Digital KYC systems can be seamlessly integrated with banks or other business systems enabling comprehensive analysis of customer data and risk assessment such as customer relationship management (CRM) and risk management systems.

Which is Best for Your Company?

So which is better for your business: KYC, eKYC, or digital KYC? The answer relies upon certain factors, including your organization, customer base, and compliance requirements. Eventually, the decision between KYC, digital KYC, and eKYC relies upon the necessities and requirements of your business. It is vital to painstakingly consider all elements, including accessibility, security issues, and integration with other systems before settling on a choice.

At, KYC AML guide we grasp that KYC, digital KYC, and eKYC processes can be challenging for organizations. That is the reason to address the issues we are giving research-based KYC technology buying and KYC vendor analysis services. We will assist you in selecting the most effective and based KYC solution based on cutting-edge technology. With the best KYC solution, you can have confidence that your compliance is secure, your client’s information is safe, and your transactions are streamlined

So if you’re searching for a reliable and proficient KYC solution look no further than the KYC AML guide. Reach us today to dive deeper into our services and how we can help your business.