What is In-Person Verification?

In-person verification, or IPV, refers to the physical KYC process. IPV is a process in which the participant evaluates documents and other information personally. The intermediary is responsible for collecting and maintaining a record of all relevant and important customer details in the KYC Form, such as company, name, designation, and signature. Customers must submit relevant KYC documents such as identity proof, proof of address, and so on. To ensure accuracy, a KYC specialist will cross-check the data across multiple records.

How to conduct IPV?

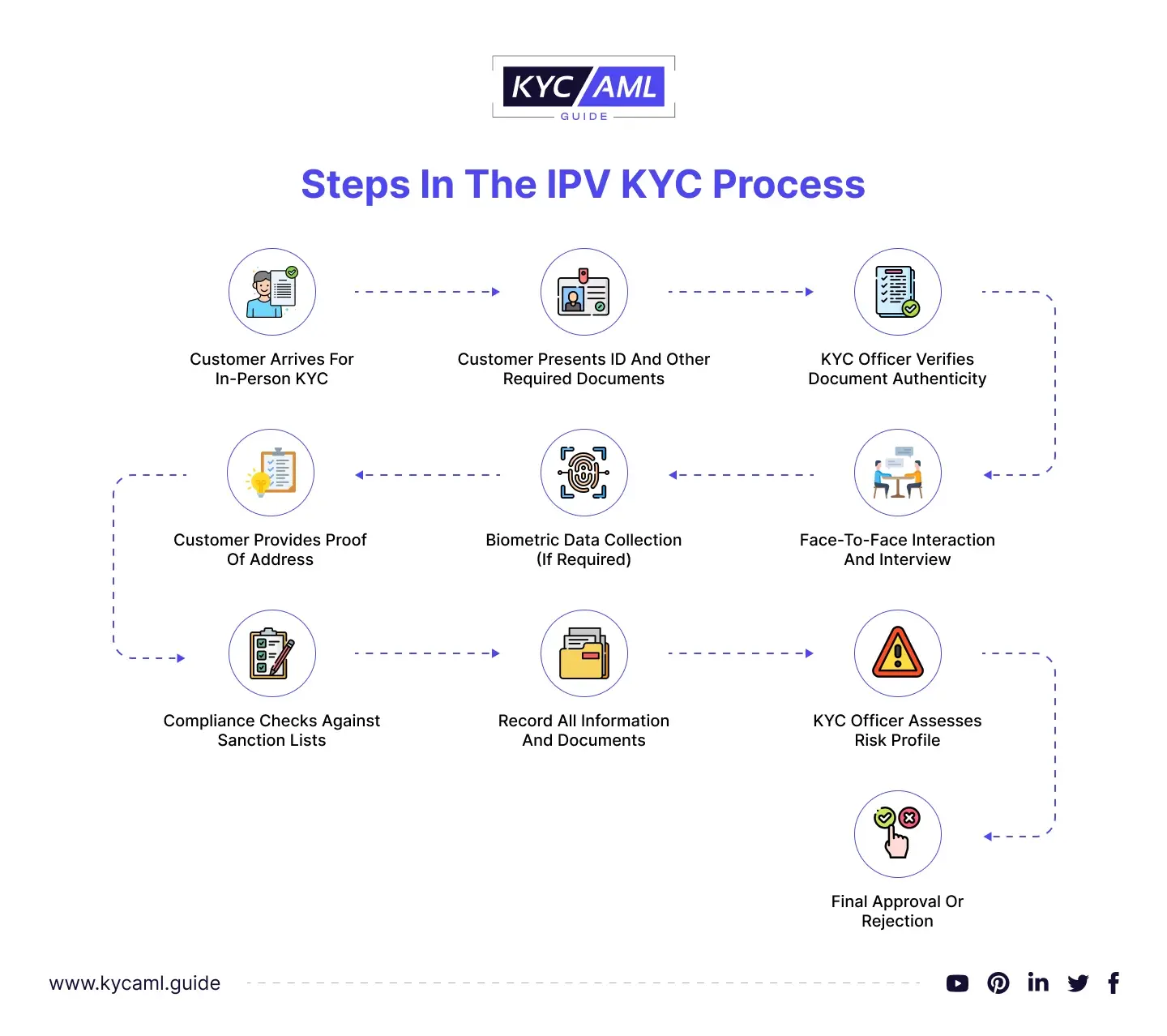

The in-person verification KYC process is very simple. The individual must submit original documents such as proof of identity and proof of address to KYC officials for verification. Face-to-face interviews, biometrics, risk assessment, and compliance checks are all part of the process. Depending on the regulatory variations, all information is recorded, and the process concludes with the customer’s approval or rejection of the required financial service.

Individuals had to go to the office to do IPV previously. However, with the advancement of technology and employee scheduling, the process has shifted to video KYC, which is completed via video chat. Furthermore, there are numerous ways to use the IPV process to determine the client’s identity. IPV KYC online can be completed by submitting a verified printout of personal identity and address proof, as well as a passport-sized photograph to the KYC Registration Agency (KRA). Nowadays, the procedure of in-person KYC is carried out online via video communication tools such as Skype. The person conducting the inspection may also question you about the documents you have presented. If there is a discrepancy between your answers and the documents you have submitted, they may reject your application.

The US Financial Crimes Enforcement Network (FinCEN) added new requirements in May 2018 for banks to verify the identity of legal entities that own, control, or benefit from entities when those entities open an account. The following documents are required for an in-person KYC verification process:

- Government-issued ID card

- Passport

- Driving Licence

- Registered Lease or Sale Agreement of Residence/Flat

- Maintenance bill

- Life Insurance Policy

- Landline bill

- Utility bills (not older than three months)

- Bank Account statement (not older than three months)

- PAN card

The following are the steps to conduct IPV KYC

Importance of In-person KYC

In-person verification is critical in the KYC process because it ensures the customer’s physical presence. This is a one-time approval requirement, and once completed, investors can safely invest in multiple mutual funds without the need for additional IPVs. This verification process reduces identity fraud and strengthens the integrity of customer identities, making it an important step in ensuring compliance and security across a variety of industries, particularly banking.

Technology advancements and the need for quick and seamless customer onboarding have led many nations to adopt digital and remote KYC methods. However, in certain circumstances or for specific types of business, In-person verification may be required, particularly for high-risk regions and regions with limited digital resources. According to statistics, South Asian countries have over 705 million people without internet access, with India and China ranking first and second.

According to SEBI regulations, it is now necessary for all investors, including NRIs, Indian citizens, and expatriates, to obtain an IPV before making investments in mutual funds and cash as of January 1, 2011.

Limitations of In-Person KYC

However, there are a few limitations of in-person KYC

- The in-person verification KYC process necessitates significantly more resources, including manpower, office space, technology, training, and so on. A team of well-trained KYC experts will cost more than any software. We estimate that large banks in Germany, the Netherlands, France, and Switzerland spend an average of €5.7 million per year on KYC processes. Also, labor accounts for 74% of the total cost.

- Customer satisfaction is highly dependent on onboarding time. IPV means that businesses can only onboard customers during working hours and on a per-employee basis. To avoid losing customers, it is critical to make the process as quick as possible. Traditional banks with many paper-based processes can take up to 18 minutes to complete a KYC check for a customer.

- Another important factor to consider is how many checks can be completed in a given amount of time. In a traditional bank, a specialist performs three checks per hour on average.

- In manual processes, human error is common. Verification errors can occur due to a lack of properly trained specialists, fatigue, and a lack of focus. As a result, entrusting the entire process to humans is inefficient. To achieve the best results in customer due diligence, it is critical to combine human input with technology.

- In many cases, people’s physical identification documents have been stolen, making it difficult for them to access basic services like government aid and medicines. It also leads to repeated misdiagnoses when they visit hospitals because providers do not have their medical histories and must often start from scratch each time they visit.

All of these limitations are overcome by digital KYC, which eliminates the resource-intensive, time-consuming, and error-prone aspects of in-person KYC, increasing efficiency and accuracy while preventing identity theft-related challenges.

IPV vs. eKYC

e-KYC is a value-added service provided by many financial institutions today to streamline the application process. Investors can log in and upload required documents from the comfort of their own home or office. Many of these businesses have created tools for real-time authentication, such as biometrics or one-time passwords (OTP). The maximum limit for OTP verification is Rs.50,000 per investor per fund. India, for example, uses eKYC for Adhar authentication.

One of the primary differences between eKYC and in-person KYC is the level of availability and convenience. eKYC is ideal for those who live far away from financial institutions or have a busy schedule because it can be completed anywhere with an internet connection and is convenient. In-person KYC, on the other hand, provides a higher level of authentication and security. There is less chance of fraud or errors in the transaction because an experienced bank representative physically checks the customer’s ID card and other documents.

Conclusion

In-person verification KYC refers to the verification of the consumer’s information. This procedure is critical for mutual fund clients before they are onboarded. This type of KYC verification necessitates the user physically interacting with a company representative and submitting documents and other information to be verified. If the user is unavailable, the firm agent schedules an online appointment where the user’s identity is verified. The goal of IPV KYC online is to protect banks and their customers from financial crimes like duplicate PANs and identity theft. The customer is successfully hired once the KYC verification process is completed.

However, people are evolving towards digital KYC as we progress into the digital age. Accepting this technological shift is not a choice; it is the future of KYC.