What is CKYC?

CKYC is abbreviated as Central Know Your Customer. CKYC integrates customer data to create a secure repository for KYC processes on one platform. It is a central repository that holds or stores information about each customer. Earlier, each financial institution had its own KYC process. CKYC was established by the central government. This will help standardize all KYC processes on one platform.

Therefore, once an investor’s Central KYC is approved, his or her identity does not need to be verified if the person decides to invest their money in another financial institution. After it is uploaded to a central server, it is then stored in digital form for an unlimited period. All authorized banking institutions have access to this data. The Bank may use such information whenever they think appropriate.

The CKYC register is maintained by the Central Registry of Securitization and Asstet Reconstruction and Securities Interests of India (CERSAI). CKYC was introduced in the Union Budget 2012-13.

Features of CKYC

CKYC number is a useful solution developed by the government and has the following features:

- You will get a unique 14-digit KYC number linked to your ID for secure access to all your KYC documents.

- This eliminates the need for physical KYC documents as all documents are stored online.

- CKYC documents must be thoroughly reviewed and approved before being accepted.

- When you change your KYC details, it will be done automatically across all relevant companies. This keeps the database up to date and eliminates the need to visit your financial service provider to update your KYC details.

- CKYC processes KYC information. This makes it easier to detect and prevent fraudulent activity, especially identity theft.

- CKYC improves customer experience when using financial services. CKYC helps banks and financial institutions access and manage customer data, thereby improving overall efficiency.

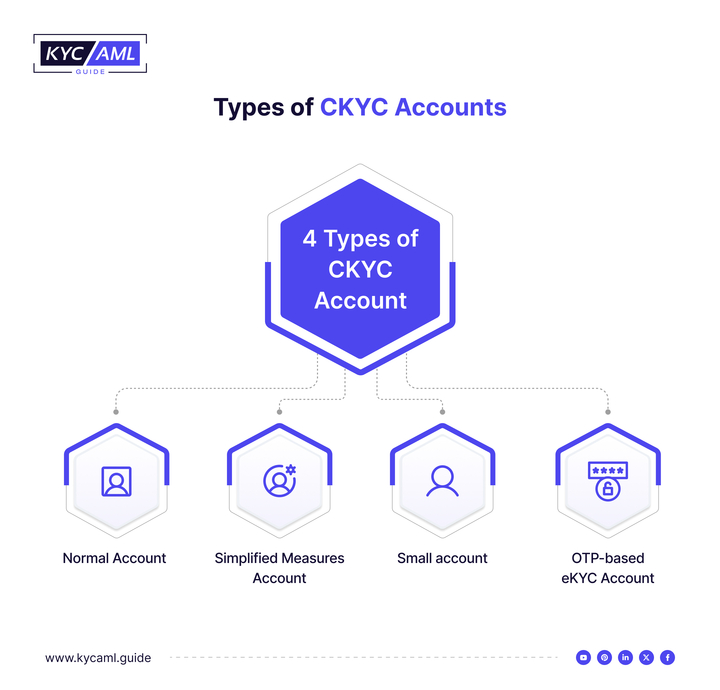

CKYC Account Types

CKYC accounts also differ depending on the documents submitted for CKYC verification. There are four account types of CKYC

| Normal Account | The documents submitted by the customer determine the type of account that will be created. A normal account is opened when the customer presents one of the following identification documents such as

|

| Simplified Measures Account | This account is created when the customer presents an official valid document (OVD) to prove his identity. This CKYC document has been prepared as per RBI Circular RBI/2015-16/42. Simplified measures accounts have a CKYC identifier that starts with the letter “L”. |

| Small Account | This account is opened when the customer submits a photograph and proof of identity. The account’s CKYC Identifier starts with the letter ‘S’. |

| OTP-based eKYC account | A one-time password is used for digital KYC. The Unique Identification Authority of India (UIDAI) website allows you to join by uploading a PDF version of your Aadhaar card photo. When a consumer is identified by OTP-based eKYC, such accounts are opened for them. In this case, the CKYC identifier starts with ‘O’. |

Documents Required for CKYC:

The CKYC process requires the following documents:

1 Identity proof- This includes government-issued photo IDs like an Aadhaar card, passport, driving license, voter ID, etc.

2 Proof of address– This includes any government-issued identity documents that contain your address, such as an Aadhaar card, passport, driving license, voter ID, etc.

3 PAN card details

4 A recent passport photo

5 Bank details.

The Process of CKYC

There are a few steps you must take, but CKYC registration is a rather straightforward procedure. It will be reviewed by the CRA in 15 days. After successful verification, your CKYC application number will be generated and sent via SMS or email. This unique identification number will be shared when you make a deposit or open an account with a different group. The process of CKYC is as follows

1 Customer Onboarding:

Any person or legal entity that is allowed to open an account or obtain financial services from a bank, mutual fund, insurance company, or other financial institution subject to Indian regulation must complete a KYC procedure.

2 Data Collection:

Customers must provide relevant identification, address, and other information proof to comply with KYC regulations. Aadhaar, passports, ID cards, driver’s licenses, PAN cards, wage slips, and other papers are typically accepted.

3 Verification:

The financial institution checks the submitted documents and information. This could include legitimate entities such as UIDAI performing electronic or physical verifications of original papers for Aadhar verification.

4 Creation of CKYC Record:

The financial institution uploads the client’s KYC data into the Central KYC Registry (CKYCR) following the completion of the verification process and KYC detail verification. The CERSAI is in charge of maintaining CKYCR, a central repository.

5 CYKYC Number Generation

A unique 14-digit CKYC number is generated after successfully submitting customer data to CKYCR. The KYC data for the customer in the central database is referenced by this number. Customers can use their CKYC number to access their accounts at any participating financial institution after the verification process is finished. Just by doing the following:

- First, visit the online portal of any financial institution that offers CKYC checks.

- Second, you need to enter the customer’s PAN number.

- Third, customers must enter the verification code displayed on the screen.

- Finally, the number appears at the bottom of the screen. Here you will find the contact details of CKYC.

Customers can copy the CKYC number for easy access later. With this information, you can easily pass it on when investing in a financial institution.

6 Interoperability:

CKYC numbers are shared with customers and can be used by financial institutions and partners in India. This allows customers to open accounts or use services from different companies without repeated KYC procedures.

7 Access and Updates:

To verify a customer’s KYC status, authorized users of financial institutions can directly access CKYCR over secure online platform channels. The financial institution is responsible for updating the information in the CKYCR when the customer’s KYC data changes or is updated.

8 Regulatory Compliance:

CKYC helps financial firms comply with the KYC compliance set by the RBI and other regulatory authorities This reduces the chance of fraud and theft by ensuring that the KYC process is correct, uniform, and consistent.

9 Data Privacy and Security:

To secure its clients’ sensitive information, CKYC follows strict data security and protection rules. Only authorized users may access CKYCR, and customers’ permission is needed before sharing their information with other financial institutions.

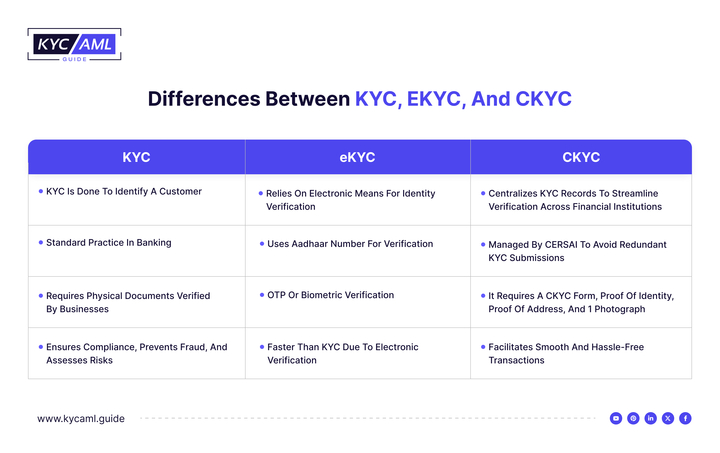

What Distinguishes KYC, CKYC, and eKYC?

There are some significant differences between KYC, eKYC, and CKYC despite their seeming similarities. KYC is the identity verification procedure used to thwart financial fraud, especially money laundering. Traditionally, this is done by supporting documents physically or digitally via video format. The digital identity verification process is known as eKYC or the electronic Know Your Customer process, where the Aadhar verification is based on OTP.

CKYC, on the other hand, refers to the Centralized Know Your Customer, which allows you to complete the KYC process just once and use that information to complete the KYC process for multiple companies instantly.

ALT Text: This table shows the difference between KYC, eKYC, and CKYC.

Advantages of the CKYC

There are many advantages to having a centralized KYC database instead of completing KYC multiple times for different groups.

- CKYC saves time and effort for everyone involved in the KYC process. Once the investors are registered with CKYC, no more documents are required. The onboarding process is faster if you invest in other financial institutions.

- It’s a straightforward process that anyone can complete.

- Money laundering and other illicit practices in the banking industry are eliminated

- Customers can update their information in CKYC records at any time without much hassle.

- This reduces the workload of the staff. The process of obtaining financial data is now much easier. The government can also determine how much a customer has invested, thanks to CKYC. Individuals can invest in various financial schemes like stock markets, mutual funds, and insurance policies using their CKYC number.

- CKYCR centralized KYC data reduces the possibility of data inconsistencies and errors. This makes customer information more up-to-date and accurate, enabling better decision-making processes for fintech companies and financial institutions.

- By recording customer information, Central KYC facilitates monitoring and compliance with regulatory requirements. As a result, the financial system is made safer and anti-money laundering (AML) and counter-terrorist financing (CTF) are more effective.

Potential Drawbacks of CKYC

Although CKYC in India has many advantages, its implementation also has disadvantages. This is one of its weaknesses

Privacy and Security Issues:

Sharing and storing customer data increases privacy and security issues. Personal data may be accessed or used without authorization in the case of a security breach. According to CERSAI, 700 million KYC documents acquired by more than 5,000 organizations are included in the KYC data.

Relying on One Database:

Relying on one central database, any technical, system failure or cyber-attack can compromise the entire KYC verification process across multiple financial institutions simultaneously.

Limited Scope:

CKYC focuses on the financial sector and does not cover other sectors.

Potential for Outdated Information:

While customer data is collected and stored in the CKYC database, the information may change over time. Changes to personal information or documents may not be immediately reflected in the database.

Conclusion

CKYC is an important and convenient way to process financial transactions. This simplifies customer identity verification and maintains and updates their data, reducing fraud and money laundering. Therefore, implementing and following CKYC principles can help companies improve customer understanding, compliance, and experience.

KYC AML guide can help businesses find the perfect solution for Central Know Your Customer (CKYC) processes, providing fast and accurate identity verification through KYC technology buying consultancy.