What is Identity Theft?

It is a fraudulent practice of using someone else’s identity documents including his personally identifiable information to obtain illicit gains like credit card loans, bonuses, etc.

Identity theft is a punishable offense and according to Federal Law 18 U.S.C. § 1028 (a)(7) Identity Theft and Fraud carries a maximum sentence of 15 years in imprisonment, fine, and confiscation of the criminally earned property.

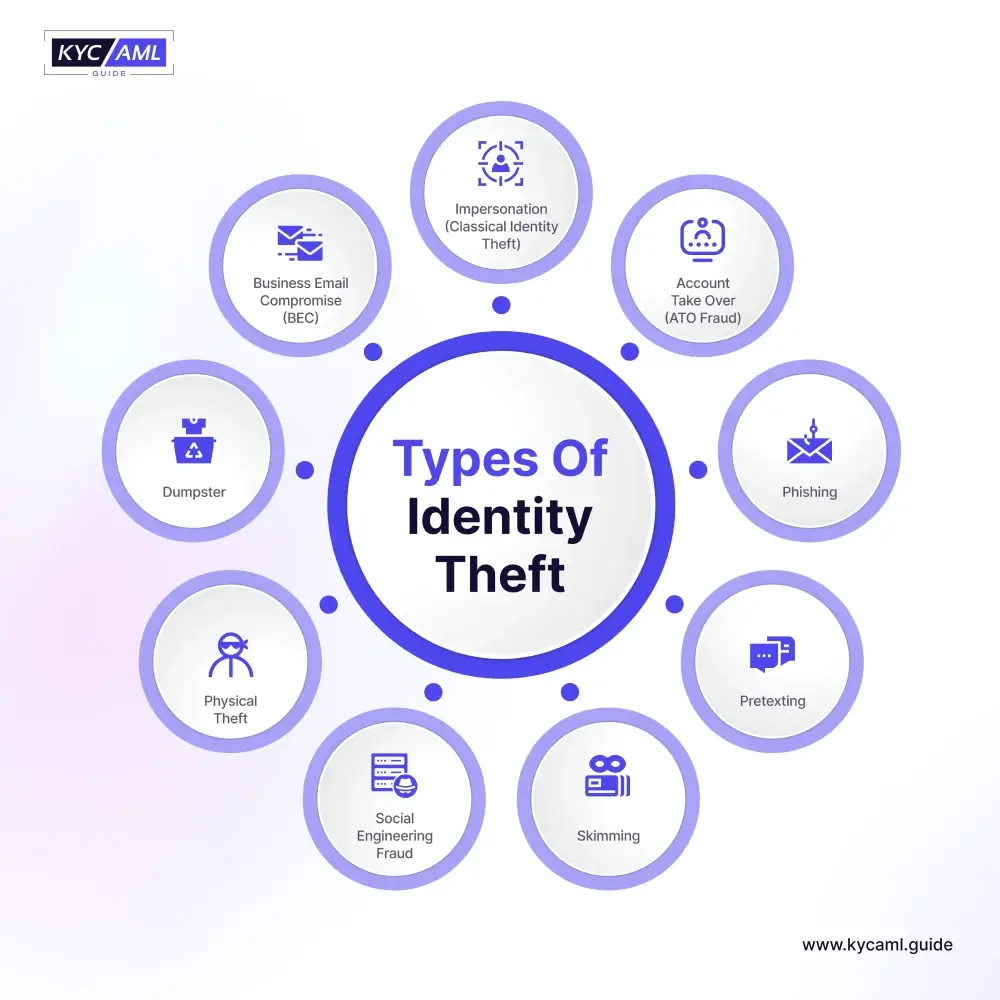

Types of Identity Theft

| Impersonation (Classical Identity Theft) |

|

| Account Take Over (ATO Fraud) |

|

| Phishing |

|

| Pretexting |

|

| Skimming |

|

| Social Engineering Fraud |

|

| Business Email Compromise (BEC) |

|

| Dumpster Diving |

|

| Physical Theft |

|

How Customers Can Prevent Identity Theft Attacks?

Keeping in mind different types of Identity Theft Attacks, Customers themselves can take simple and easy steps to safeguard their personal information and secure their finances. Here are a few practical tips that have been proven to prevent most Identity Theft Attacks.

- Using Strong Passwords is the key to protecting personal information at all times. Instead of using your birthday or wedding anniversary date, use a combination of Capital and Small letters with numbers and special characters. This will make it nearly impossible for a hacker or an attacker to hack your password. Also, you need to be sure that whenever you are typing in your password, your screen, keypad, and your position must not be visible to anyone.

- Enabling Multi-factor authentication (MFA) can also add an extra layer of security to your credentials and protect your personal information. Use a combination of biometric authentication factors like fingerprint, facial recognition, and a voice note to strengthen your guard against identity theft.

- Do not use public Wifi, especially in a jurisdiction where cyber regulatory laws are weak. People can steal the information through your login information.

- Refrain from falling prey to a seemingly attractive offer sent to you via email, brochure, or a website that sounds amazing in offering rewards, prizes, and other forms of incentives. These are 99% scams and are only there to steal your money.

- Regularly monitor your financial transactions to check for any unusual and suspicious transactions and immediately report to your bank in this case. Also, change your mobile banking application passwords, pin code ATM, and other credentials on an immediate basis.

Tips to Identity Fraud Prevention for KYC Identity Verification Solutions

Generally, KYC Solutions are strong enough to filter out any suspicious identity or anomaly through different features like Liveness Detection or Morphing Detection. However, few benchmark practices can help a KYC Solution to better scale its Identity Verification tool and equip it against the evolving types of Identity Fraud Attacks.

KYC Best Practices against Identity Theft

|

|

|

|

|

What is the Responsibility of Banks and FIs in Identity Theft Prevention?

Firstly, banks should implement a KYC (Know Your Customer) Solution and implement Customer Due Diligence (CDD). They should select the KYC Solution that distinctively offers an Anti-Fraud feature that is focused on detecting identity fraud attempts. For this purpose, they require comprehensive industry-level testing metrics that can illustrate the performance capabilities of KYC Solutions through a comparative analysis.

Final Word

KYC Identity Verification Solutions need to understand the evolving identity fraud tactics and improve their IDV Tools accordingly. Only then we can hope for a strong foot against cyber criminals. Lastly, KYC AML Guide stands as a knowledgeable partner for banks, FIs, and other fintech to help them choose the best KYC Solutions.