The Financial Conduct Authority, the UK financial sector regulator, stated in early September 2023 that it will begin a review of obligatory checks on politically exposed persons (PEPs) performed by banks. The revelation came after a well-publicized tale about Nigel Farage, the former leader of the Brexit Party, whose bank account was purportedly canceled due to his political views.

What are Politically Exposed Persons (PEP)?

According to the Financial Action Task Force’s (FATF) 12th recommendations, a politically exposed person (PEP) is someone who is presently or has been a known as service provider. This category was expanded by the United Nations Convention Against Corruption (UNCAC) to include relatives and close associates (RCA) of public officials. PEPs face a high risk of corruption, money laundering, terrorist financing, and bribery due to the nature of their power.

The Anti-Money Laundering and Counter-Terrorism Act of 2006 (AML/CTF Act) categorizes PEPs into three types:

- Domestic PEPs are those who have been entrusted with a prominent public role in a national government.

- A foreign PEP is a high-ranking political politician from another country.

- International cooperation PEPs are prominent public members of international organizations such as the United Nations (UN), World Trade Organisation (WTO), and NATO.

PEPs include, for example, heads of state, Government ministers or similar officials, top government officials, senior military and judicial officers, governors of central banks, and board members or executives of international organizations.

Why PEP is High-Risk?

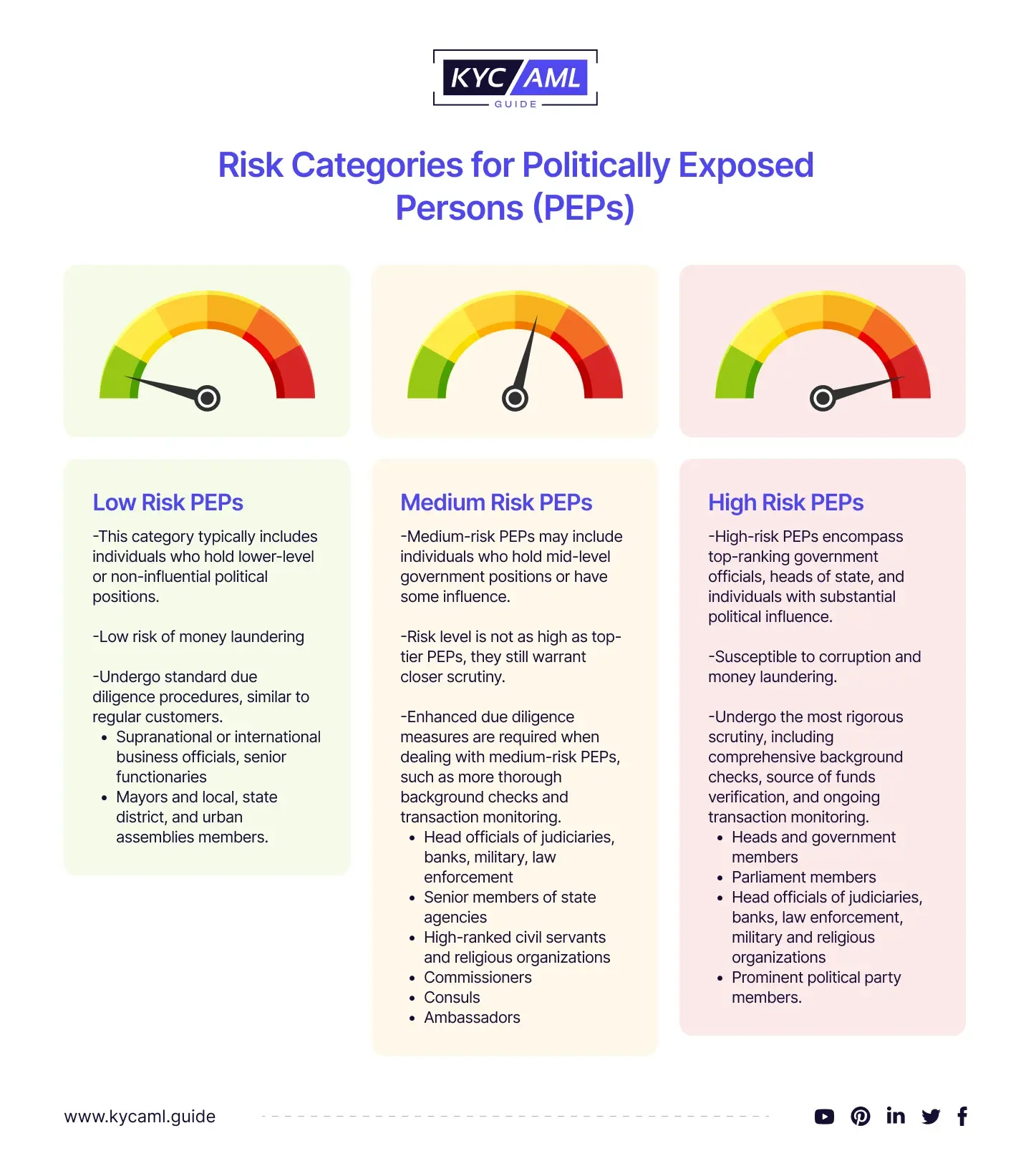

Politically exposed persons (PEPs) are high-risk clients who have more potential to obtain wealth illegally than ordinary citizens, such as accepting bribes or money laundering. They are high-risk persons due to the possibility of using their titles for illicit purposes. PEPs are classified as having varying degrees of risk. Foreign PEPs, for example, are more risky than domestic PEPs. PEPs are classified into three risk categories: low, medium, and high. The first stage in developing the entity’s risk assessment criteria is to determine which category they fall into:

What is PEP Screening?

PEP checks or PEP screening look into global application databases and global watchlists for connections to money laundering, fraud, and terrorism. You ensure that your organization complies with anti-money laundering (AML) requirements by requesting a PEP check or PEP background check for a candidate. It enables organizations to identify candidates who pose possible financial or reputational hazards. By reducing these risks, the organization is protected from corruption, financial losses, and costly scandals.

According to SmartSearch, only one-quarter (24%) of businesses are always verifying new customers. However, more than half (54%) freely confess that such checks are only performed occasionally.

The UK’s Financial Conduct Authority (FCA) has recently initiated an investigation into the treatment of ‘politically exposed persons’ (PEPs) in the financial services sector. The Financial Conduct Authority (FCA) UK has launched a review of its guidance on PEP risk management. The move is part of a broader investigation into “unbanking” practices, a matter that has attracted political attention due to the closure of high-profile persons’ accounts.

PEP Screening Process

It is important to conduct a PEP check, PEP screening, and PEP background check before onboarding a client. While performing a PEP check, the following actions should be taken.

Step 1: Collect the Necessary Information

A complete PEP check begins with the careful collection of detailed and accurate information on the individual in question. This is a critical stage that determines the efficiency and accuracy of following checks.

- Full Name

- Date of Birth

- Place of Birth

- Nationality

- Occupation and Position

- Photographs or Visual Identifiers

- Associated Entities

- Family and Close Associates

It is critical to ensure that this information is correct. Any error or omission can result in false positives if an innocent person is flagged mistakenly or in false negatives if the true PEP is not discovered. Both of these scenarios have major ramifications. As a result, businesses should invest time and resources in this initial step to lay a solid foundation for future research.

Step 2: Use Reliable Databases

The accuracy of the PEP check is determined by the database used. Various KYC Solution Directory providers by KYC AML guide offer a comprehensive database that is constantly updated to capture the most recent information on PEPs from across the world. Using these reliable databases ensures that businesses receive accurate, up-to-date, and consistent results. Using outdated or incomplete databases can jeopardize the overall effectiveness of the PEP screening process.

Step 3: Conduct the Politically Exposed Person Checks

Once you have the appropriate data in a reliable database, conducting a PEP check requires a methodical strategy to assure accuracy and robustness. Here’s a closer look at the essential procedure:

| Initial Database Analysis | Begin by entering the individual’s obtained data into the chosen database. This preliminary PEP screening should yield a preliminary list of potential matches or hits. |

| Analyzing Matches | Not every match has a genuine PEP. Examine each match carefully and compare the details to what you’ve learned. Find exact matches between names, dates of birth, and other distinguishing characteristics. Be wary of common names, which can yield a plethora of unrelated results. |

| Contextual Understanding | You can learn why someone qualifies as a PEP by looking at the depth of each possible match profile. The next step in risk assessment depends on their position, family connection, or affiliation as shown in the infographic. |

| Geographical Considerations | Some regions may be prone to political corruption or instability. PEP interactions in these areas can aid in understanding potential dangers. |

| Cross-referencing with Other Databases | To improve the accuracy of the results, it is best to compare them to other credible databases. Multiple sources can validate the match and lessen the possibility of false results |

| Verifying Negative Result | Negative results, while first showing that the individual is not PEP, should be interpreted with caution. Consider double-checking your information. |

| Documenting Findings | Record each step, match, and any further actions as you progress through the PEP check. This not only fosters transparency but also assures that any subsequent check may link back to this initial check. |

Step 4: Regularly Monitor & Review

A PEP check is not a one-time event. Because of the dynamic nature of global politics and industry, an individual’s PEP status can shift over time. As a result, there is an urgent requirement for AML ongoing monitoring and evaluation of existing consumers and partners.

Ongoing due diligence is a regular review and update of documents to ensure that businesses stay compliant and aware of evolving risks associated with their operations. Regular review is an example of a proactive approach to risk-based approach KYC/AML.

Why are Politically Exposed Persons Checks Necessary?

Doing business with PEP entails specific problems and hazards. Money laundering is one of the most serious issues. PEPs might directly or indirectly participate in money laundering activities due to their important functions. Corruption is another important risk. Dealing with such PEPs poses legal and ethical challenges.

Even if a PEP has not been involved in unlawful activity, simply being associated with someone under inquiry or scrutiny can harm a company’s brand. As a result, AML PEP check is critical not only to compliance standards but also to guarantee the business’s ethical and transparent functioning.

Some regulated businesses, particularly financial services, are required to do customer due diligence (CDD) on PEPs and sanctions as part of their onboarding processes. They must perform additional due diligence based on the findings of these PEP checks or PEP screening before deciding whether to hire the client. These CDD procedures are a minor component of the KYC procedure.

Conclusion

A PEP check is essential to risk management in AML and risk management in KYC. This lessens the risks related to PEPs and shields organizations from negative financial and reputational effects. PEP databases are essential for efficient AML PEP checks since they offer integrated sanctions list integration, extensive PEP lists, and combination screening capabilities. Financial institutions can detect high-risk persons, conduct PEP background checks put in place the necessary due diligence procedures, and lower the risk of financial crimes.