KYC is an important process for many industries and plays an immense role in customer onboarding. Companies need robust KYC solutions to verify and onboard their customers without causing unnecessary delays or risking compliance errors. Juniper’s recent study shows that digital identity checks will reach over 70 billion in 2024, a 16% increase from the previous year’s 61 billion. This number is expected to keep rising through 2028. Customers rarely look forward to KYC processes and often see them as a hindrance, and the wrong solution can substantially impact customer satisfaction and business retention rates.

The Importance of Choosing the Right KYC Identity Verification Solution

There is a big role of the KYC process in modern business transactions. Most industries are required by law to collect and verify identification documents from their customers. These companies need robust KYC solutions to meet requirements without inconveniencing customers or disrupting their processes. The good news is that modern KYC identity verification solutions use advanced artificial intelligence and machine learning algorithms to detect fraud and fake identities, detect identity theft, and secure transactions on their platforms. Companies just need to ensure that the chosen solution meets all requirements. The ID verification market is expected to grow by USD 10.81 billion, with a projected CAGR of 16.18% from 2022 to 2027.

In this article, we will discuss three key players in the KYC identity verification landscape: Trulioo, IDnow, and Au10tix. The KYC AML guide has gained valuable insight into their solutions by working with these leading vendors. Join us as we dive into each platform’s specifics, strengths, and nuances to help you make an informed decision based on your organization’s identity verification requirements.

1. Trulioo

Trulioo is a global identity verification company based in Canada. Trulioo can verify 5 billion people and 300 million businesses in 195 countries. It provides access to 400+ trusted data sources worldwide to verify individuals and businesses. The KYC service offers identity document verification, AML compliance, and watchlist checks.

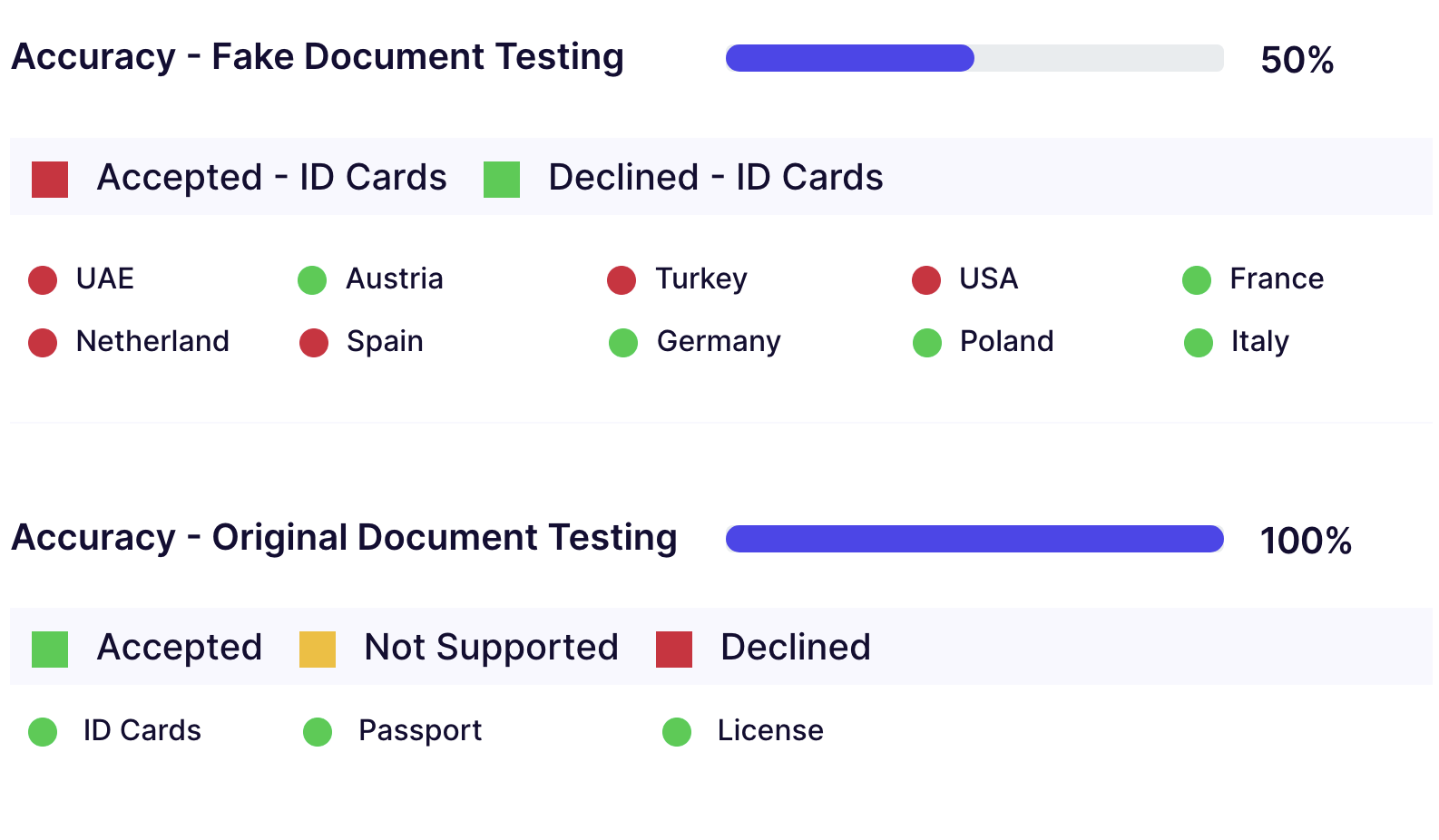

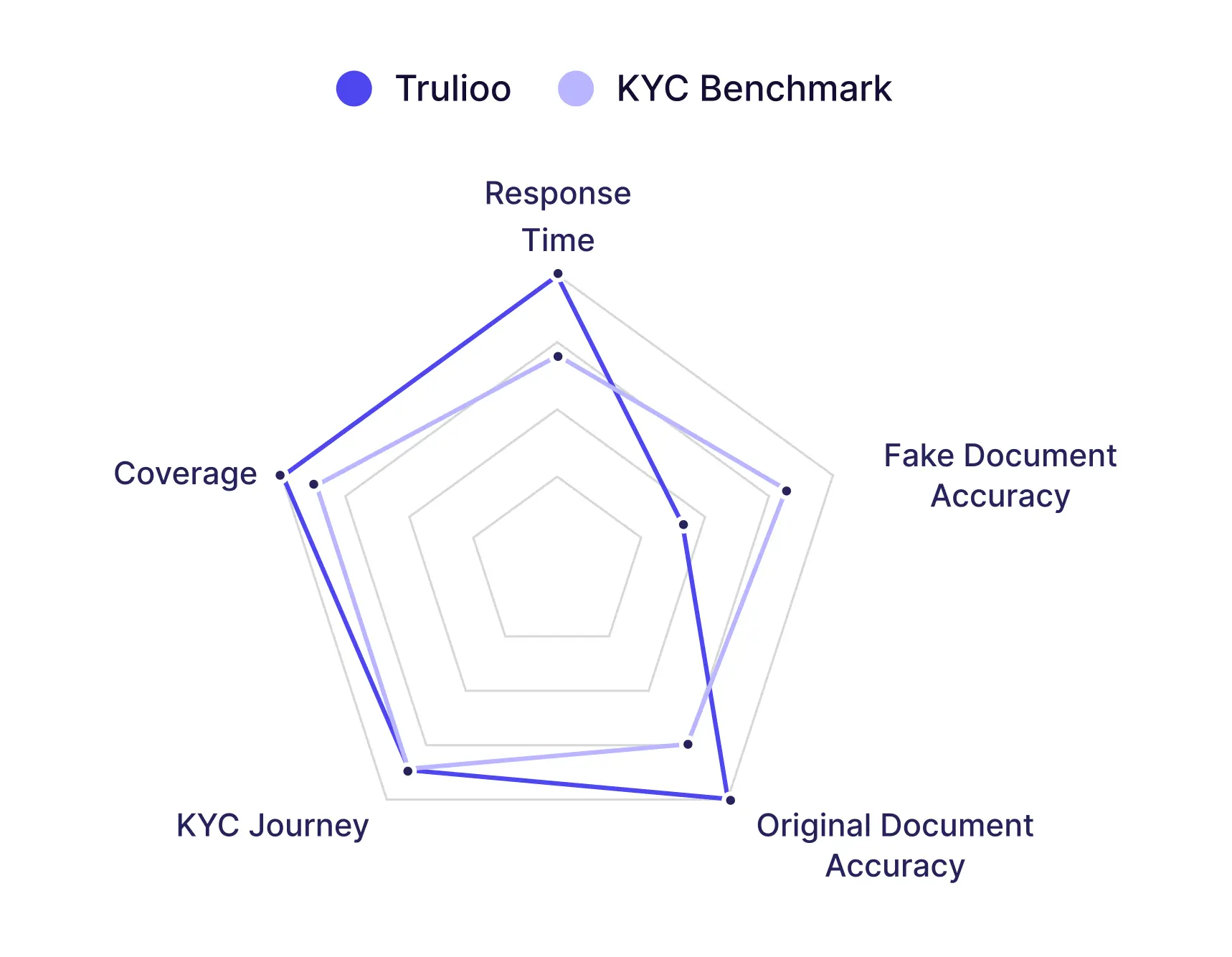

Our findings indicate that Trulioo offers robust verification metrics for a wide range of documents, countries, and languages.

Key Features

- Trulioo offers a comprehensive security system, including KYC solutions with a secure digital identity network that enables elements of identity verification by verifying a user’s address, documents, and accounts

- It supports major integration methods like iOS, Android, PHP, Flutter, NodeJS, etc. with very good documentation and several integration options.

- The ticket system is efficient and resolves issues quickly, within 2-3 hours.

- The customer service team is knowledgeable about the product and answers our questions quickly.

- The service offers multiple pricing plans as well as low setup fees.

- The platform has a modern design with clear and useful instructions.

- The system quickly verifies identity, streamlines compliance processes, and minimizes customer interactions.

- The service uses multiple data sources, enabling customization and accurate risk assessment.

- The platform offers companies a customized workflow that can be tailored to their specific needs and risk appetite.

- Trulioo complies with many international financial crime regulations, including AML and CTF regulations.

- A dedicated and helpful support team is on hand to assist with implementation and provide ongoing support when needed

- The system processes the document in 2 to 3 seconds.

Services

Their service lineup includes a diverse range of offerings, including KYC, AML, and additional services.

| KYC | AML | Other |

| Face Biometric Verification, Document Verification,

Age Verification, eID Verification, Video KYC, Liveness Detection, and Address Verification |

AML for Business,

PEP Screening, Watchlists Screening, Adverse Media Screening, & Sanctions Screening |

Know Your Business (KYB),

Identity Access Management |

Cons

- The service supports major integrations but lacks integration capabilities in certain areas.

- The platform lacks some important verification features.

- The system requires users to upload multiple documents on a single screen, which can be mentally challenging.

- The platform lacks basic features like advanced search capabilities and an extensive dashboard overview that users are asking for.

- The complexity of global data can sometimes delay the verification process.

- Fake documents are rarely accepted and the resulting reports are unattractive.

- Many users find Trulioo’s API responses to be cluttered and difficult to parse, making it challenging to extract data in an easy-to-read format.

- The user experience is somewhat compromised and some key features that could increase efficiency and usability are missing.

- Data protection consent is not required from users.

We rate Trulioo based on criteria such as mobile and desktop traffic, and speedy document review.

Trulioo’s performance in our KYC web analysis aligns impressively with industry KYC benchmark standards.

2. IDnow

IDnow is a trusted KYC software solution that provides remote identity verification services for a wide range of industries. It offers flexible pricing plans based on your business needs. It verifies the real-time identity of more than 7 billion people in 193 countries. IDnow also offers a demo version that allows businesses to explore the service before signing up. In 2021, IDnow acquired ARIADNEXT and Trust Management AG and expanded its authentication offering to provide its customers with a comprehensive solution through a unified platform.

IDnow has unveiled the new VideoIdent Flex, which combines artificial intelligence and human interaction to increase trust amid rising fraud and bank branch closures. The updated service offers live video verification, real-time fraud prevention, and customization features, although it has been criticized for low detection of fake documents and visually unappealing reports.

Through our in-depth analysis, stands out with its comprehensive verification capabilities for countries, and multiple languages.

Key Features

- The platform is powered by advanced artificial intelligence and machine learning technologies.

- It offers intelligent video authentication through VideoIdent, which supports both document and biometric authentication.

- It offers seamless integration with both web and mobile platforms.

- The staff respond quickly within 2-4 hours and are knowledgeable and help you with facts and figures.

- The app or website they offer is easy to use, making identity verification simple.

- Users love how helpful the reviewers are; they will guide you through the process with knowledge and care.

- They offer a wide variety of data sources for identity verification, giving users plenty of options and in-depth coverage.

Services

They provide an extensive suite of services including KYC, AML, and various other offerings.

| KYC | AML | Other |

| Face Biometric Verification

Document Verification Age Verification eID Verification Video KYC Liveness Detection and Address Verification |

PEP Screening

Watchlists Screening Adverse Media Screening Sanctions Screening |

ID Number Checks

ESign Flexible Delivery Model NFC Verification Identity Access Management |

Cons

- We were unable to test the user experience because back-office access was not available.

- Users have been facing technical issues like network issues, unreliable SMS code delivery, and authentication errors.

- Some users struggle with customer service and find them unfriendly, unhelpful, or even rude.

- People had to wait a long time to get help or finish verification which caused delays and inconvenience.

- The service was not very responsive or helpful, which shows that better customer support is needed.

We review and evaluate IDnow using metrics such as customer response time.

3. AU10TIX

AU10TIX is a company focused on preventing fraud and making the online world safer. Big brands like Google, Uber, and PayPal use their technology to verify and protect their customers’ identities. AU10TIX is located in Israel and owned by ICTS International N.V. They offer several tools, such as checking lD documents, using biometrics, and detecting fake identities. With their smart technology, they help businesses register customers faster, fight fraud, and comply with regulations. Their technology works faster and provides results in seconds, which is great in today’s fast-paced online world. They recently received an investment of USD 80 million for further growth and innovation.

Based on our research and analysis, Au10tix stands out for its excellent performance in many countries and languages.

Key Features

- AU10TIX excels in instant verification and uses advanced artificial intelligence for identity verification and deep learning fraud detection.

- The customized pricing is tailored to the needs of your business.

- The customer login process with AU10TIX is seamless and secure.

- AU10TIX quickly verifies the legitimacy of customer identities to prevent fraud.

- Integrating AU10tix with users’ systems is easy and provides easy access and control of identity information.

- The AU10tix support team is helpful, especially during product integrations and updates, and provides a positive customer service experience.

Services

They offer a wide range of services including KYC, AML, and many other essential services.

| KYC | AML | Other |

| Face Biometric Verification

Document Verification Age Verification Reusable KYC Video KYC Liveness Detection Perpetual KYC |

PEP Screening

Watchlists Screening Adverse Media Screening Sanctions Screening |

Know Your Business (KYB)

Payment Fraud Prevention Identity Access Management |

Cons

- The platform offers great integrations, but there is room for improvement in the integration options.

- Although it meets security and authentication needs, it does not meet many compliance standards.

- There are concerns about the accuracy of identity checks as they accept known forgeries and process false information.

- OCR capabilities need to be developed and product documentation is lacking in some areas.

- API documentation can be more detailed and clear to better guide the development team.

- Price information requires direct consultation.

AU10TIX’s performance was analyzed and rated based on customer response efficiency

Also Read: Choosing the Ideal KYC Vendor: Finding the Right Partner for Your Compliance Requirements

Trulioo, IDnow & AU10TIX: A Comparative Review

The KYC AML Guide provides an in-depth comparison of the KYC providers, focusing on key product features. It provides insights for businesses to choose the best solution for their needs. This comprehensive overview will help you understand the strengths and differences of the leading KYC providers.

Criteria |

Trulioo |

IDnow |

Au10tix |

| Trustpilot Score | 0/5 | 2.8/5 | – |

| Supported Documents | 12000+ | Data couldn’t be found | Data couldn’t be found |

| Supported Countries | 195+ | 195+ | 190+ |

| Supported Languages | 1+ | 5+ | 190+ |

| Free Trial | Limited verifications | No | No |

| Data Retention Tenure | 72 hours | 90 days | – |

| ID Number Checks | ✅ | ||

| AML For Business | ✅ | ||

| Know Your Business (KYB) | ✅ | ✅ | |

| Perpetual KYC (pKYC) | ✅ | ||

| Reusable KYC | ✅ | ||

| Know Your Transaction (KYT) | – | – | – |

| Face Biometric Verification | ✅ | ✅ | ✅ |

| NFC Verification | ✅ | ||

| ESign | ✅ | ||

| Video KYC | ✅ | ✅ | ✅ |

| Travel Rule | – | – | – |

| 2 FA verification | – | – | – |

Use The KYC AML Guide to Navigate Identity Verification Solutions

A good KYC solution accelerates and automates processes, reduces costs, improves data accuracy, and improves the customer experience. The ultimate goal is to create two-way trust, facilitate customer acceptance, and thereby minimize the churn rate. Given the importance of the aforementioned benefits, not just for financial institutions, but for all businesses, choosing the best KYC software solution for your business should be carefully considered. When choosing the best KYC identity verification solution, businesses should consider a range of factors, from feature sets and compliance processes to accessibility and integration capabilities.

The KYC AML Guide helps businesses choose the perfect KYC tool for identity verification. We offer a Vendor analysis service to evaluate suppliers. Using key factors, we help you choose the right KYC solutions.