Rating

Regula

This score is based on user ratings and our scenario based testing.

Overview Verification Support Stats Services provided by Regula Our Evaluation Customers Updates KYCGrid Similar Companies  Featuring is not an endorsement and to be taken for advertising purpose only.

Featuring is not an endorsement and to be taken for advertising purpose only. ![]()

Featured Solution

Socure

Verification supporting stats

Verification supporting stats

13K+

documents

247

Countries

138+

Languages

Services provided by Regula

Services provided by Regula

KYC Suite

Face Biometric Verification

Document Verification

Age Verification

eID Verification

Reusable KYC

Video KYC

Liveness Detection

Perpetual KYC

Address Verification

AML

AML for Business

PEP Screening

Watchlists Screening

Adverse Media Screening

Risk Assessment

Fitness & Probity Checks

Sanctions Screening

On-going Monitoring

Others

Know Your Business (KYB)

Know Your Transaction (KYT)

Payment Fraud Prevention

OCR for business

ID Number Checks

ESign

Hardware Scanner Devices

Flexible delivery model

2FA Verification

On-premises verification

NFC Verification

Identity Access Management

Travel Rule

Phone Risk Assessment

Email Risk Assessment

Regulatory Reports

Our Evaluation

Our Evaluation

KYCWeb

- Ease of mobile SDK integration, making development straightforward.

- Accurate results and part of a comprehensive product portfolio.

- Excellent customer service with prompt and detailed responses.

- Easy implementation and faultless operation.

- Speed of verifications and reading capability.

- Flexibility and leading-edge biometrics.

- Limited customization options for UI elements in some cases.

- Waiting for more white-labeling options for Document Web SDK.

- Some devices may not have the required performance for proper SDK functionality.

- Scanning capability is average for non-MRZ type documents.

- Price could be more scalable or offer better startup pricing options.

- Scanning speed could be improved.

1.1 This score is based the costumer journey on desktop and mobile phone.

Ease of Use

Industry average: 4.5

-- This score is based on the response time of the customer support in different scenarios .

Quality of Support

Industry average: 3.9

4.1 Based on the response time and accuracy on fraudulent /originals documents from multiple countries

Accuracy Score

Industry average: 3.5

Documents Testing

Documents Testing

1-2 secs processing time with high counterfeit documents acceptance rate. Reports are not available in PDF formats.

Accuracy - Fake Document Testing

- Accepted - ID Cards

- Declined - ID Cards

UAE

UAE Austria

Austria Turkey

Turkey USA

USA France

France

Netherland

Netherland Spain

Spain Germany

Germany Poland

Poland Italy

Italy

Accuracy - Original Document Testing

- Accepted

- Not Supported

- Declined

KYC Journey

...

Compliance Perspective

GDPR

HIPAA

P2DS

CCPA

TCPA

FFIEC

ISMS

PIPA-BC

PIPEDA

NACHA

SOC 2 Type 1

SOC 2 Type 2

ISO/IEC 27001

ISO/IEC 27018

ISO/IEC 27017

PII

COPPA

PSD2

PCI DSS

ETSI EN 319 411-2

BNM EKYC

MTL

FCA

WAS 2.0

CIP

OFAC

MAS

FINMA

FATF

FinCEN

FINTRAC PCMLTFA

IBeta Certification - Face Liveness

Privacy Shield Framework

AML Anti-Money Laundering Compliance

NIST

PAD

Security Implementation

2 Factor Authentication

VPN, IPSEC

AES-256 Encryption

AES-256 Encryption

TLS/SSL

SSO Signup

Schedule Audits

Auto Logout In Case Of Inactivity

Role/Permission Based Users

Crypto Compliance

FinCEN And FATF-Basedd Crypto Compliance

Verification Attributes

Custom Verification Flow

Behavior Data Monitoring

Browser And Geo-Location Tracking

Custom Instructions Addition

Provided List Of Documents

Age Restriction Setting

Custom Fuzzy Match Value

Ignore Middle Name Mismatch

Customize Documents Expiry Months

Custom Filed Extraction

Country-Based Settings For Front And Back Side Of Document

Custom Re-Try Option

Detailed Decline Reasons

Enhanced Document Settings

Verification Data Deletion Option

Export CSV/Excel Option

Export PDF Option

Decline Reason Stats On Dashboard

Customers

Updates

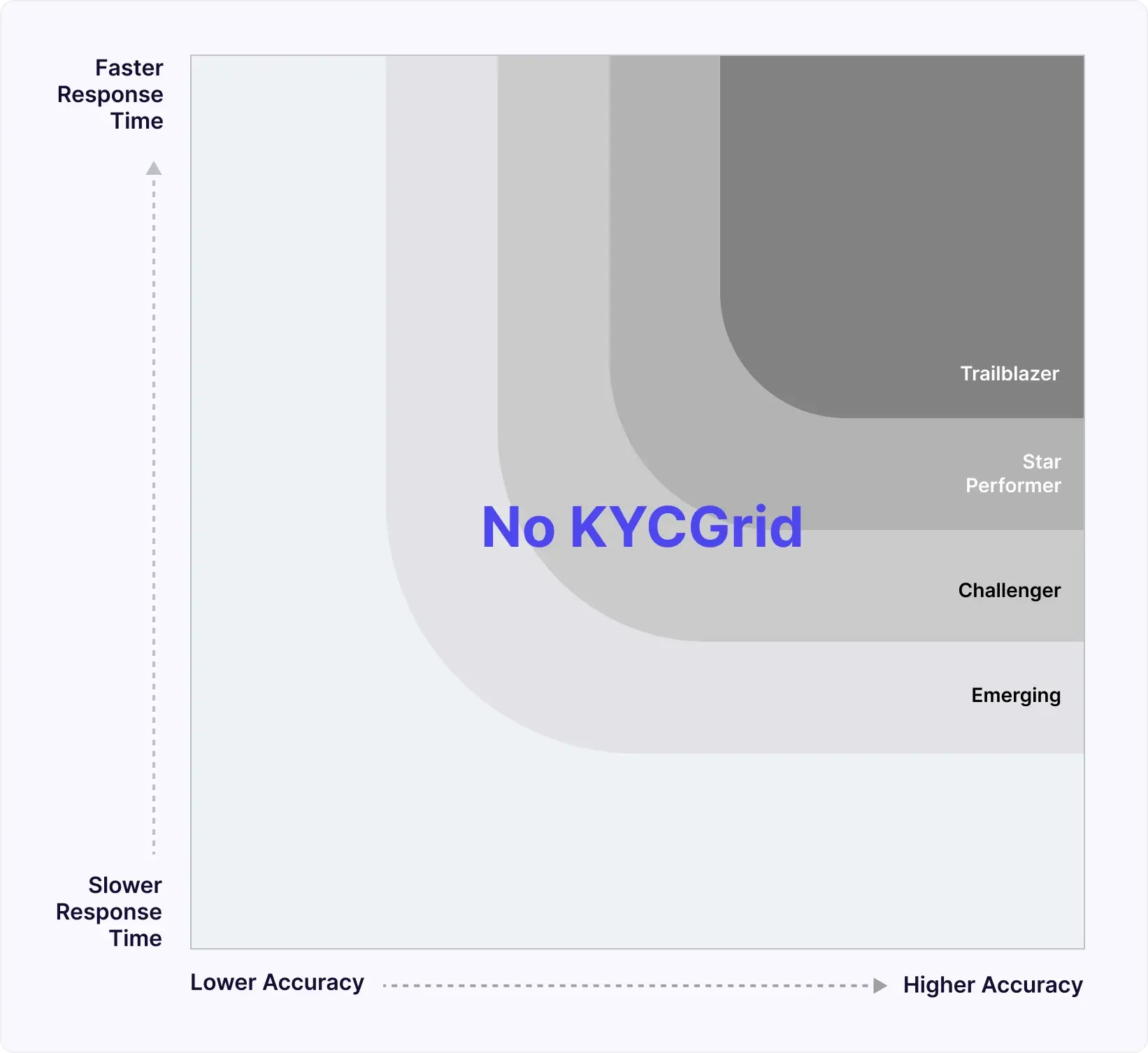

KYCGrid

Exclusive Done-For-You Product Comparison

View research based comparison of 20+ KYC vendors in one place

Acesss Reserch

UAE

UAE

Rating & Comments

Rating:4.4Comments:Comments: The user flow is smooth however despite of having clear instructions sometimes it requires patience to place the face in the said area.