Rating

ComplyCube

This score is based on user ratings and our scenario based testing.

Overview Verification Support Stats Services provided by ComplyCube Our Evaluation Customers Updates KYCGrid Similar Companies  Featuring is not an endorsement and to be taken for advertising purpose only.

Featuring is not an endorsement and to be taken for advertising purpose only. ![]()

Featured Solution

Socure

Verification supporting stats

Verification supporting stats

10K+

documents

220+

Countries

7+

Languages

Services provided by ComplyCube

Services provided by ComplyCube

KYC Suite

Face Biometric Verification

Document Verification

Age Verification

eID Verification

Reusable KYC

Video KYC

Liveness Detection

Perpetual KYC

Address Verification

AML

AML for Business

PEP Screening

Watchlists Screening

Adverse Media Screening

Risk Assessment

Fitness & Probity Checks

Sanctions Screening

On-going Monitoring

Others

Know Your Business (KYB)

Know Your Transaction (KYT)

Payment Fraud Prevention

OCR for business

ID Number Checks

ESign

Hardware Scanner Devices

Flexible delivery model

2FA Verification

On-premises verification

NFC Verification

Identity Access Management

Travel Rule

Phone Risk Assessment

Email Risk Assessment

Regulatory Reports

Our Evaluation

Our Evaluation

KYCWeb

- The platform is user-friendly and offers a wide range of features, including AML screening, biometric verification, and device intelligence.

- Comprehensive audit logs, access controls, security measures, and robust reporting functionalities are provided.

- Seamless onboarding process, enhancing efficiency, and saving time and costs.

- Offers a comprehensive range of compliance tools, addressing KYC, AML, and identity verification requirements within a single platform.

- User-friendly interface and enables seamless integration for efficient compliance processes.

- Responsive customer support team providing assistance in ensuring a secure and compliant environment.

- Allows only major integrations with room for improvement in documentation and support for integration facilities.

- Satisfies compliance and verification attributes but lacks in some security standards.

- Lacks integration with external information management tools.

- Features can be enhanced such as custom journey maps and capturing additional personal details, as well as more granular control over customer outreach.

- Limited customization options for reports through the dashboard, potentially restricting ability to tailor reports to specific needs.

---- This score is based the costumer journey on desktop and mobile phone.

Ease of Use

Industry average: 4.5

---- This score is based on the response time of the customer support in different scenarios .

Quality of Support

Industry average: 3.9

---- Based on the response time and accuracy on fraudulent /originals documents from multiple countries

Accuracy Score

Industry average: 3.5

Documents Testing

Documents Testing

Accuracy - Fake Document Testing

- Accepted - ID Cards

- Declined - ID Cards

UAE

UAE Austria

Austria Turkey

Turkey USA

USA France

France

Netherland

Netherland Spain

Spain Germany

Germany Poland

Poland Italy

Italy

Accuracy - Original Document Testing

- Accepted

- Not Supported

- Declined

...

Compliance Perspective

GDPR

HIPAA

P2DS

CCPA

TCPA

FFIEC

ISMS

PIPA-BC

PIPEDA

NACHA

SOC 2 Type 1

SOC 2 Type 2

ISO/IEC 27001

ISO/IEC 27018

ISO/IEC 27017

PII

COPPA

PSD2

PCI DSS

ETSI EN 319 411-2

BNM EKYC

MTL

FCA

WAS 2.0

CIP

OFAC

MAS

FINMA

FATF

FinCEN

FINTRAC PCMLTFA

IBeta Certification - Face Liveness

Privacy Shield Framework

AML Anti-Money Laundering Compliance

NIST

PAD

Security Implementation

2 Factor Authentication

VPN, IPSEC

AES-256 Encryption

AES-256 Encryption

TLS/SSL

SSO Signup

Schedule Audits

Auto Logout In Case Of Inactivity

Role/Permission Based Users

Crypto Compliance

FinCEN And FATF-Basedd Crypto Compliance

Verification Attributes

Custom Verification Flow

Behavior Data Monitoring

Browser And Geo-Location Tracking

Custom Instructions Addition

Provided List Of Documents

Age Restriction Setting

Custom Fuzzy Match Value

Ignore Middle Name Mismatch

Customize Documents Expiry Months

Custom Filed Extraction

Country-Based Settings For Front And Back Side Of Document

Custom Re-Try Option

Detailed Decline Reasons

Enhanced Document Settings

Verification Data Deletion Option

Export CSV/Excel Option

Export PDF Option

Decline Reason Stats On Dashboard

Customers

Updates

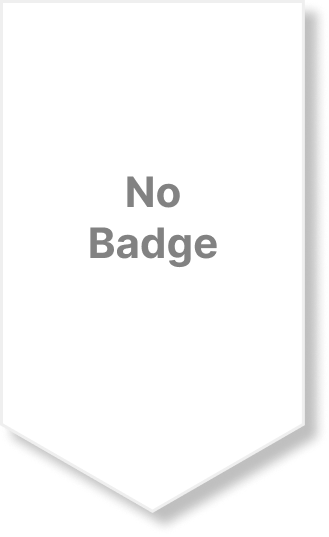

KYCGrid

Exclusive Done-For-You Product Comparison

View research based comparison of 20+ KYC vendors in one place

Acesss ReserchPricing

Enterprise

Essentials

$0.10

per credit

Standard

$159

per month

Premium /Starting

$449

per month

UAE

UAE