Which KYC Documents are Accepted and What Information is Analyzed?

A KYC document is one that customers need to submit to a company to confirm their identity and address. KYC document verification aims to guarantee that clients are what they say they are and don’t represent any fake or stolen identity. Documents related to KYC fall into two categories: identity documents and address documents. The ID contains the customer’s name, date of birth, photo, nationality, and so on. The address document is usually a bank statement or utility bill (no longer than 3 months old)to confirm the current residential address.

The three common types of KYC document verification are Manual, Active, and Passive Document verification.

The documents required for KYC document verification vary by country’s laws, but some standard documents are accepted in almost all countries. KYC document verification is required in every sector such as Fintech, EMIs, payment companies, Crypto, and MSB, The most common documents are described in the infographic below

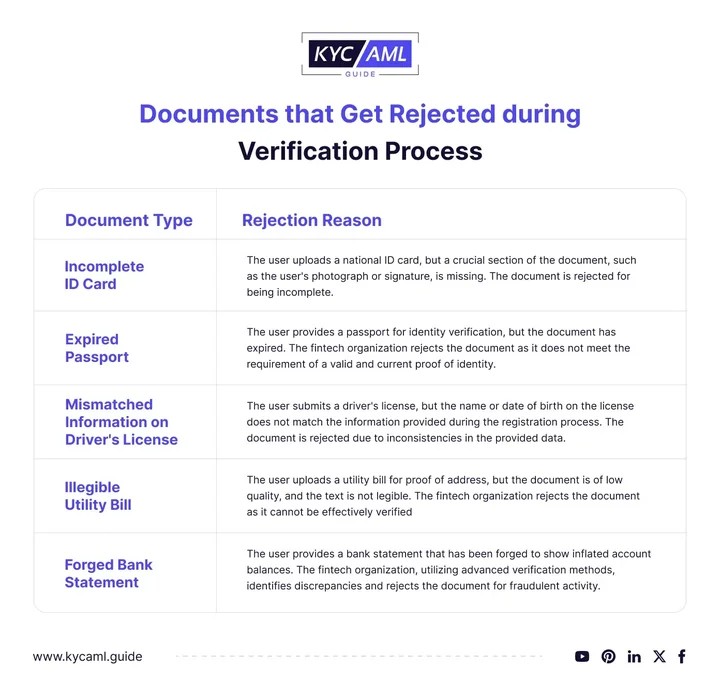

The following are some examples of documents that can be rejected during the verification process.

Process of KYC Document Verification

Most companies verify the customer’s documents by doing the following step

Document Submission by Customers:

Customers submit their KYC documents to companies for example ID, driver’s license, bank details, passport, proof of address, or other business-related documents.

Document Validation:

The subsequent stage after document collection is manual or digital verification. This incorporates approving the structure, format, and content of the documents as well as the syntax, logic, and understanding of information and data. This incorporates evaluating submitted documents for, fabrications, alterations, or inconsistencies. Organizations of all sizes use OCR technology to upgrade the reliability of KYC document verification, protect their information, and recognize signs of tampering or fraud right away. The OCR market was assessed to be valued at $15 billion in 2019, and it is expected to ascend to $70 billion by 2030.

Biometric Verification:

The next stage is biometric verification after the initial document verification. This consolidates the usage of biometrics, for instance, fingerprints and facial recognition to check the customer’s identity. Biometric verification adds extra security to the KYC process.

Compliance Requirements:

KYC compliance is a prerequisite for organizations while doing KYC document verification. This requires enhanced due diligence for high-risk customers, ongoing monitoring, and customer due diligence.

Also Read: What are some major KYC Document Verification requirements in the UK

Why is KYC Document Verification Significant?

KYC document verification is significant due to the following reasons

Reduction of anonymous transactions

Financial institutions can use KYC documents to verify customers’ identities and addresses to prevent customers from opening bank accounts or conducting transactions using fake or stolen identities. This reduces the risk of money laundering, terrorist financing, or other anonymity-based crimes.

Fast Onboarding

By submitting KYC documents in person or online, customers can easily and quickly complete the verification process. They can get the financial products and services they require without having to worry about delays.

Detection of suspicious activities

Financial institutions can continuously monitor their transactions and activities by collecting and verifying KYC documents from customers regularly. Any changes or anomalies that indicate fraud or money laundering are identified by doing this.

Compliance with AML laws

Financial institutions can comply with AML regulations and guidelines by acquiring and holding client KYC documents. According to AML lays organization is expected to know its customers and report suspicious activities. AML regulations require due diligence on customers and the inability to comply with the regulations might bring about fines, punishments, or sanctions.

Better Customer Service and Support:

Clients can fabricate a trusting relationship with the financial institution to receive better customer care and support. For instance, if they have an inquiry or issue, they can contact customer support and get a speedy and individual response. Additionally, they can take advantage of additional benefits and features, such as lower fees, increased transaction limits, or exclusive offers.

Also Read: KYC Document Verification Requirements in UAE

Common Mistakes to Avoid in the KYC Document Verification Process

Common errors in the KYC document verification process include incomplete data, inconsistent ID document vs. selfie photos, uploading blurry or scanned ID photos, using photoshopped images, providing expired or wrong ID documents, and ID documents and proof of address having different addresses. Other mistakes include reliance on manual processes, inadequate risk assessment, a lack of security that can lead to potential data breaches, and inadequate employee training.

Conclusion

KYC document verification is huge for financial organizations to assess the gamble of their customers. KYC documents have a huge impact on the KYC cycle, which contains three phases: Each stage has its objectives and prerequisites, including the customer identification program, customer due diligence, and enhanced due diligence. KYC documentation supervises risk and forestalls money laundering and fraud by following AML guidelines and building trust and notoriety.