KYC is an important process for many companies and plays a vital role during customer onboarding. Although often mentioned in the financial industry, it is legally required in gambling, banking, and even travel and tourism. These companies require a robust KYC solution to verify and record their customers’ identities without causing unnecessary delays or risking compliance errors. Customers don’t look forward to KYC procedures and often see them as an obstacle, and the wrong solution can impact customer satisfaction and a company’s retention rate.

In this article, we will thoroughly review the services offered by Veriff, Onfido, and Sumsub. Also, compare what each has to offer from a business perspective.

What is a KYC Provider?

The regulation requires many organizations to know the beneficiaries of their products or services. Companies should also verify that their customers are who they say they are. These regulations are intended to prevent money laundering and ensure that extremist organizations do not use these products or services. They typically target financial institutions, but others may also fall under these laws. KYC providers work with these companies to verify their customer IDs. This provider offers identity verification services using a database of verified identity documents. When customers share their ID, KYC providers compare it against their database to verify its authenticity.

The following steps should be followed when choosing a KYC provider.

In this comparison article, we have selected three KYC solution providers – Veriff, Onfido, and Sumsub, based on our industry’s KYC AML guide analysis. We work closely with each of these platforms and have gained a deep understanding of their functionality and capabilities. Now let’s look at each, analyze what differentiates them, and find the one that suits your business needs.

1 Veriff

For many digital companies, Veriff is an identity verification partner such as gaming, fintech, crypto, travel, banking, etc. It was founded in 2015. Veriff automatically verifies customer identity and uses AI to analyze various technical and behavioral indicators, including facial recognition. The company provides services to businesses to reduce fraud attempts and assist with regulatory compliance.

According to our research & analysis, these are Veriff’s verification metrics for documents, countries, and languages

Key Features:

- It provides AI-based identity verification solutions for many industries, including finance, banking, crypto, etc.

- Veriff offers many KYC suite services including Face biometric verification, Document verification, Age verification, eID verification, Video KYC, Liveness detection, and Perpetual KYC & Address verification.

- AML services such as PEP screening, Watchlists screening, and Adverse media screening

- Other services such as Payment fraud prevention, NFC verification, E-sign, ID number check, & Identity access management.

- The average response time is 2 to 3 days.

- Supports major integration methods like iOS, PHP, Android, NodeJS, Flutter, etc.

- Easy to use and provides excellent Identity Verification.

- Supports more than 11,300 documents from more than 230 countries.

- The processing time of document testing is 12 hours with good counterfeit document testing.

- A single-camera session can capture all documents seamlessly with a link-on-SMS feature on mobile devices.

- Meet major compliance and security standards.

- Veriff’s back office looks good but is difficult to use.

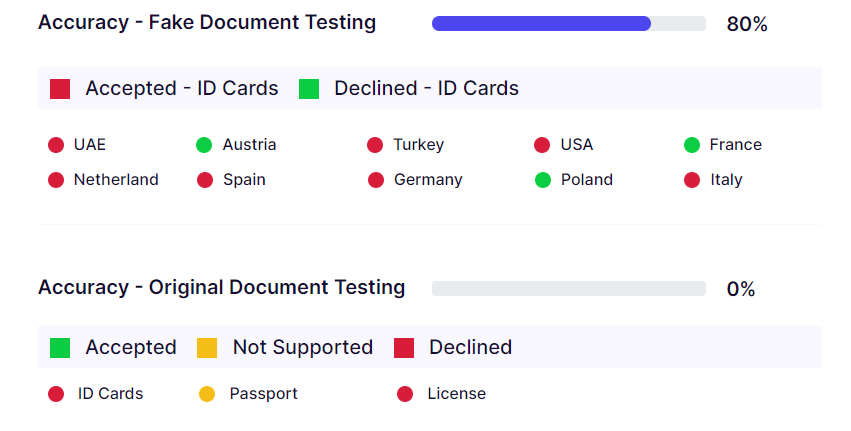

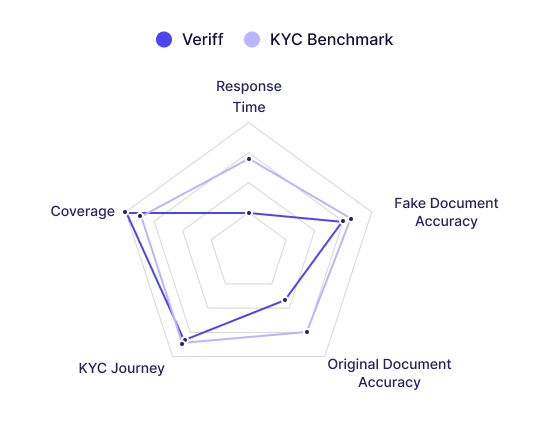

We rated Veriif based on mobile and desktop traffic, customer response time, and a quick document review

KYC web analysis for Veriff as per KYC benchmark

2 Onfido

Onfido is globally recognized as a technology leader providing digital identity and automated verification solutions. Onfido has over a decade of experience in identity verification, AI development, and fraud detection. It was founded in 2012. The Real Identity Platform is a complete identity verification solution to automate onboarding and navigation globally.

Based on our research, here are Onfido’s verification stats for documents, countries, and languages

Key Features:

- It supports more than 2,500 documents in more than 195 countries.

- Onfido offers many KYC suite services including Face biometric verification, document verification, Age verification, Address verification, and Perpetual KYC.

- AML services as AML for business, PEP screening, Watchlist screening, Adverse media screening, Risk assessment, and ongoing monitoring.

- Other services such as Payment fraud prevention, NFC verification, ID number check, & Identity access management.

- Support gives a 2-3 hour response time.

- High precision on fake testing documents with 7-10 mins processing time.

- It meets many compliance and security standards

- All major integration methods are supported such as SDK, PHP, Javascript, and Rest APIs with good documentation

- Onfido’s back office is easy to use but lacks the features that the industry needs.

We evaluated Onfido based on mobile and desktop traffic, customer response times, and document accuracy tests.

KYC web analysis is not available for Onfido.

3 Sumsub

Sumsub started in 2015 as a graphic editor-detecting technology. It is the foundation of a powerful KYC/AML solution and is known for its anti-fraud capabilities. Today, Sumsub is a verification platform that helps companies detect fraud globally and at every stage of the customer journey. Based on our research, the verification supporting statistics of Sumsub for documents, countries, and languages can be found here.

Key Features

- For accurate identity verification and making compliance easier AI algorithms and machine learning are used.

- More than 220 countries and 30+ languages are supported.

- KYC suite services such as Face biometric verification, Document verification, Age verification, eID verification, Reusable KYC, Video KYC, Liveness detection & Address verification.

- AML services such as PEP screening, watchlist screening, Adverse media screening, Risk assessment, sanction screening, and Ongoing Monitoring.

- Other services such as KYB, KYT, Payment fraud prevention, ID number checks, NFC verification, Identity access management, Travel rules, Phone and Email risk assessment, and Regulatory reports.

- It supports multiple SDK integration methods, PHP, Node, Javascript, etc.

- 15-20 minutes EST business hours with a friendly representative.

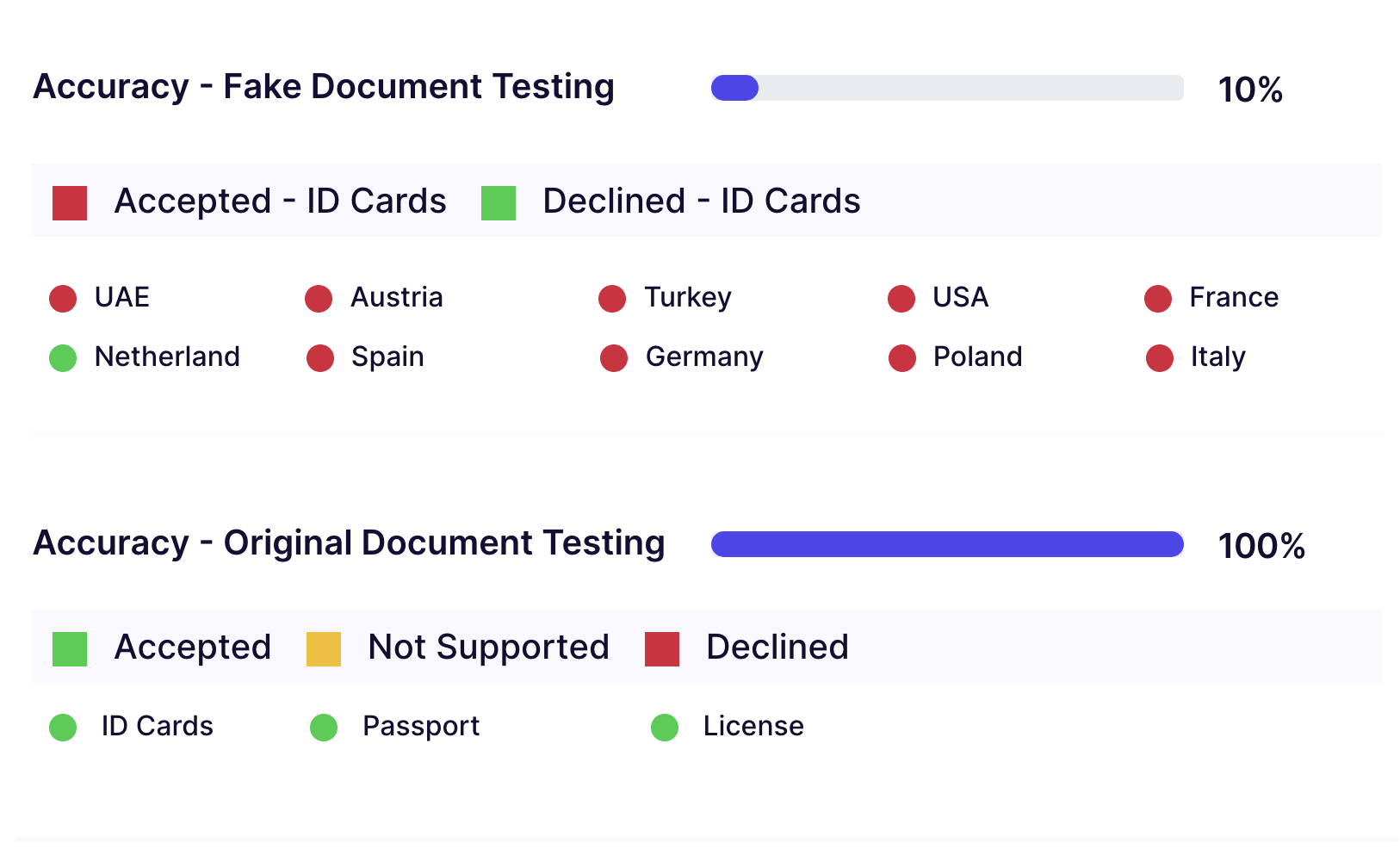

- For original document verification, the processing time is 7-10 mins processing time however for capturing counterfeit documents improvements could be made

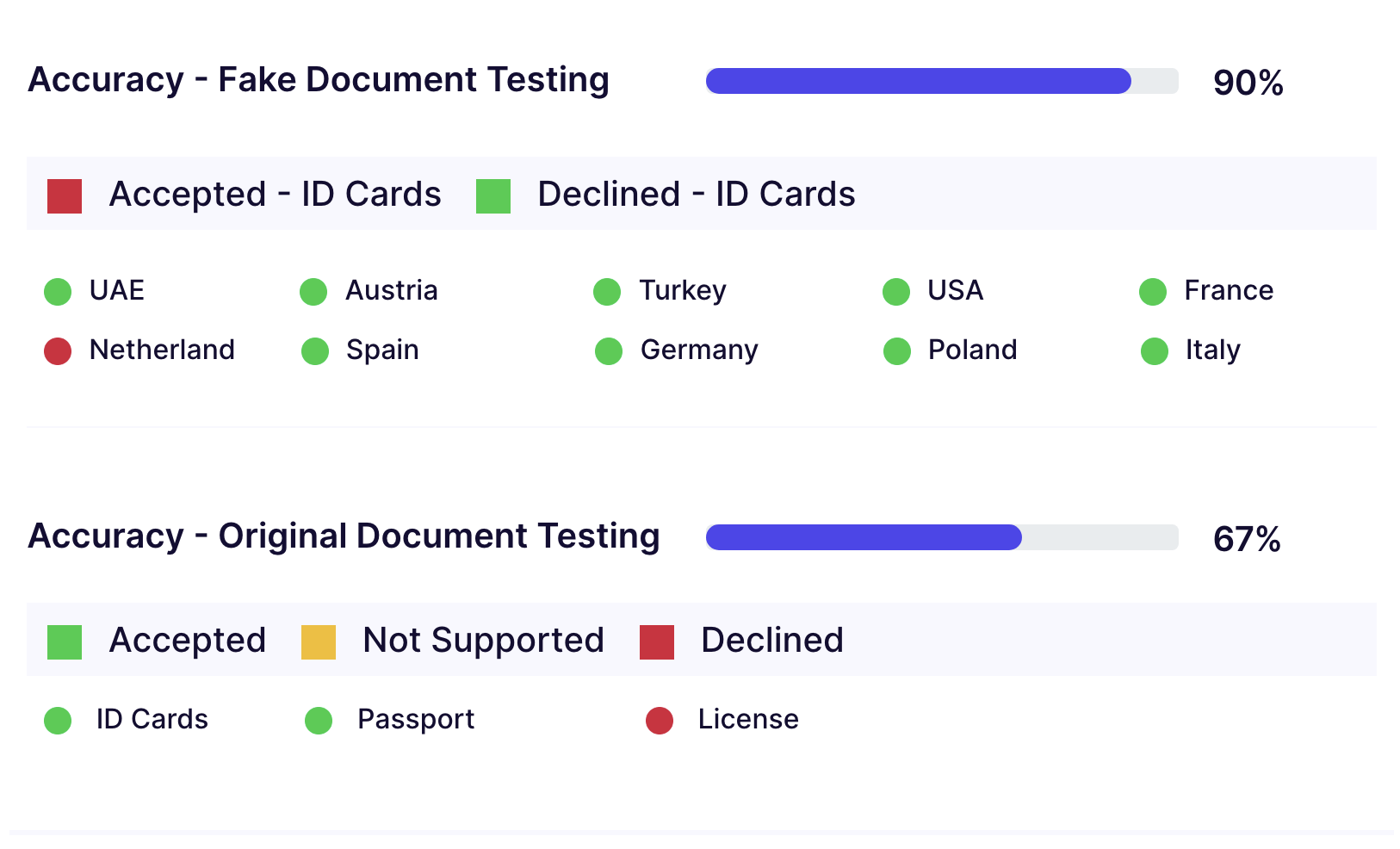

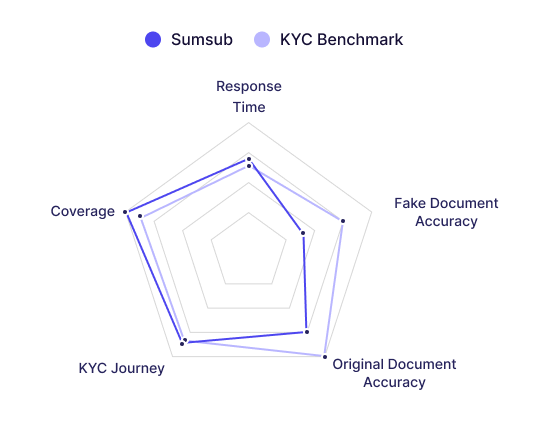

We evaluated Sumsub based on mobile and desktop traffic, customer response times, and document accuracy tests.

KYC web analysis for Sumsub as per KYC benchmark

Comparative Analysis of Veriff, Onfido, and Sumsub

KYC AML guide has done an extensive comparison of top KYC providers on different criteria that are essential for the product.

| Criteria | Veriff | Onfido | Sumsub |

| Trustpilot Score | 3.0/5 | 1.4/5 | 2.9/5 |

| Supported Documents | 11.3K+ | 2.5k+ | 6.5k+ |

| Supported Countries | 230+ | 195+ | 220+ |

| Supported Languages | 47+ | Multi Scripts | 37+ |

| Free Trial | 30 days | No | 14 days with 50 free checks |

| Data Retention Tenure | 3 years | 1 year | 5 years |

| ID Number Checks | |||

| AML Screening | |||

| AML For Business | Χ | Χ | |

| Know Your Business (KYB) | Χ | Χ | |

| Perpetual KYC (pKYC) | Χ | ||

| Reusable KYC | Χ | Χ | |

| Know Your Transaction (KYT) | Χ | Χ | |

| Face Biometric Verification | |||

| NFC Verification | |||

| ESign | Χ | Χ | |

| Video KYC | |||

| Travel Rule | Χ | Χ | |

| 2 FA verification |

In KYC identity verification, Veriff, Onfido, and Sumsub are the main players each with unique features. Veriff is a specialist in the fields of fintech, crypto, gaming, and mobility and offers a wide range of services such as biometric facial verification and AML screening. Onfido stands out for its extensive experience in identity verification and fraud detection, offering services such as address verification and risk analysis. Sumsub, which was founded by Graphic Technology in 2015, focuses on anti-fraud features and provides comprehensive KYC services. Veriff has the largest document database as compared to Onfido and Sumsub. Veriff and Sumsub both offer extensive language support. Veriff avoids double the number of clicks in the onboarding process found in the Sumsub process. Onfido excels in AI technology and customization. Sumsub excels in fast response time and providing artificial intelligence or accurate identity verification. Understanding these differences is critical for companies looking for a KYC solution tailored to their specific needs.