What is a Predicate Offense?

A predicate offense is a crime that is linked to another serious and bigger crime. For example, Money Laundering is a global crime, and shielding it with bribery & extortion is a predicate offense. In a financial context, predicate offenses are criminal activities that generate money.

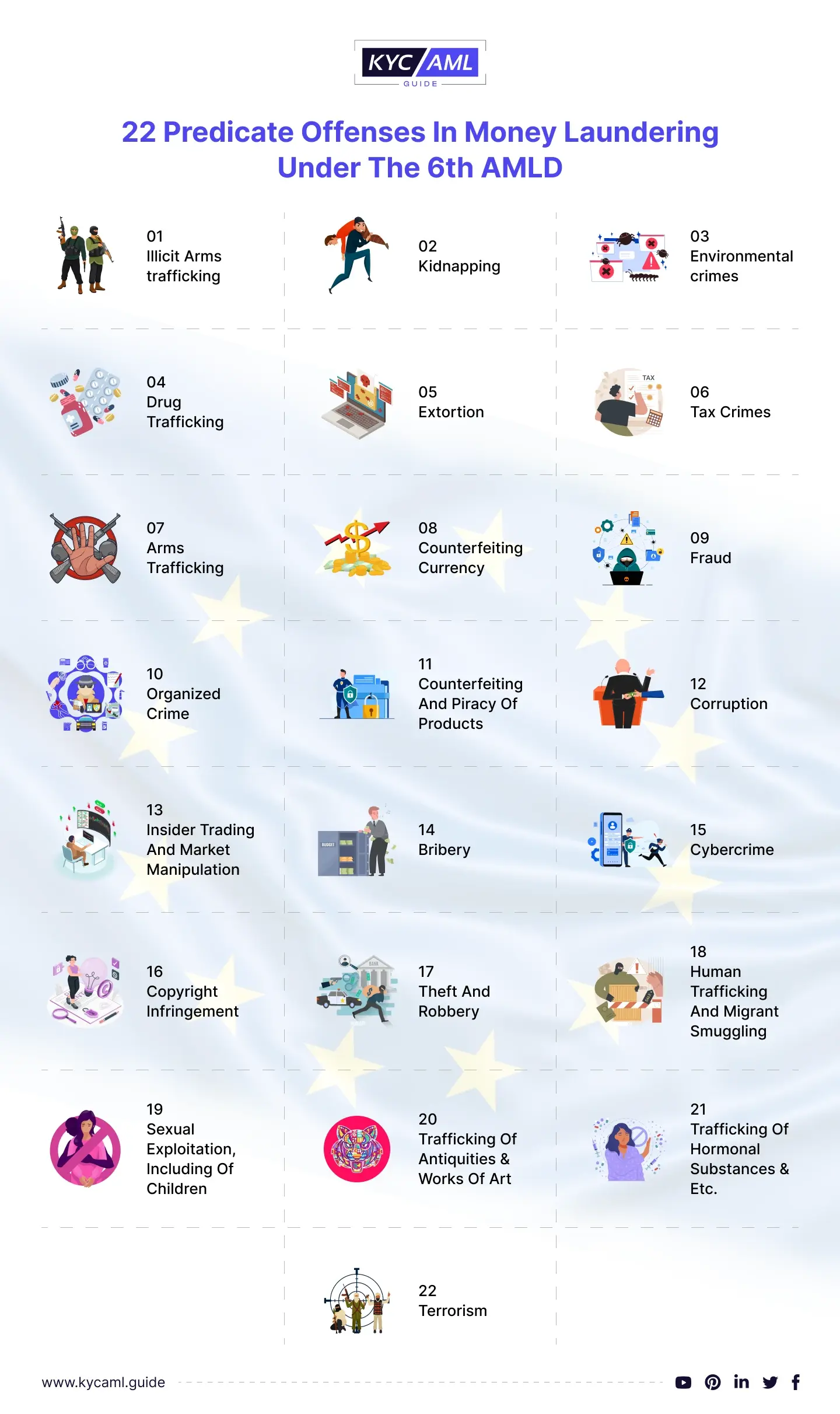

List of Predicate Offenses in Money Laundering (6th AMLD)

Predicate Offenses are closely linked to Money Laundering activities as the illicit funds generated by crimes are laundered and injected into the legitimate financial circle. There is an extensive list of 22 predicate offenses generated under the 6th Anti-Money Laundering Directive by the European Union. See the chart below:

The above list of crimes helps financial institutions & regulators to detect, link & prevent money laundering activities. Do note that this list is subject to improvements and the addition of other crimes once the EU updates it under AMLD.

Global Crime Offenses Statistics (2020-Present)

Since predicate offense is a crime, An overview of the most recent global crime statistics will help understand the trends and link with money laundering.

GOCI 2023

- Global Organized Crime Index 2023 shows that 83% of the global population is facing high criminality. Trends also reveal that response frameworks have failed to combat organized crime threats.

- 5 new crime indicators have been added to an existing list of 10 indicators listed as:

- Financial Crimes

- Cyber Crimes

- Illicit trade in Excise goods

- Counterfeit goods

- Extortion & Protection Racketeering

USSC’s Overview

- United States Sentencing Commission’s Overview of Federal Criminal Cases 2022 showed an overall decrease of 11.3% in caseload as of 2021.

- Fraud, Theft, and embezzlement decreased a decrease of 5.2% in 2020.

- On the other hand, Drug Trafficking and illegal Weapons dealing showed increases of 7.4% & 8.1% respectively in 2021.

USSC’s Money Laundering Fact Sheet 2022

| Money laundering offenses increased by 24% since 2020 and 17% as of 2021. | This sharp increase indicates that Predicate Offenses support money laundering in the US. |

| 17% of median losses amounted to greater than $1.5 million. | This indicates that money laundering is costing the government of the US a significant amount of money. |

| 67% of Money Laundering offenders had no prior criminal history. | This indicates that adherence to AML (Anti-Money Laundering) compliance is decreasing among individuals. |

The above-explained statistics indicate that the predicate offenses are backing up Money Laundering activities. This is because Money Laundering can’t have a sharp increase in numbers until and unless these predicate crimes are generating illicit cash for criminals. Once the cash is earned, it is laundered through the stages of money laundering.

How Do Banks and Financial Institutions Prevent Predicate Offenses In Money Laundering?

Banks & financial institutions play a crucial role in the prevention of predicate offenses in money laundering. Here are some common steps that they take to prevent financial crimes:

- Banks and Financial Institutions are obligated to implement rigorous and updated KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to ensure safe customer onboarding and prior detection of suspicious activities.

- Banks focus on Customer Due Diligence (CDD) programs as an extension of their KYC programs to ensure that customer’s accounts and transactions are regularly monitored. The process enters enhanced due diligence (EDD) in case a suspicious transaction or behavior is detected.

- Banks and Financial Institutions are required to share information with the regulatory bodies and authorities for further investigation. This helps in identifying the criminal activities which ultimately speeds up the legal actions against the criminals.

- Banks and FIs are employing the latest technologies like Artificial Intelligence (AI), and Machine Learning (ML) to enhance the data collection and reporting procedures.

Despite the stringent regulatory compliance framework and procedures, Predicate Offenses are a rising concern and a risk to the financial integrity of the banking & finance sector. Banks and FIs face this risk due to the following reasons:

- Loopholes in existing KYC/AML system

- Outdated or poor regulatory compliance knowledge

- Sophisticated Money Laundering techniques

- Cross-border Transactions

Improvements in KYC/AML Systems

Continuous improvement in existing KYC and AML systems is crucial in which the key objective is to prevent money laundering at all levels. Outrightly, the banking sector needs robust KYC and AML solutions to mitigate the risk of falling prey to predicate offenses. For this purpose, the KYC solution should offer the following features:

- Higher Cost efficiency while making informed decisions about regulatory compliance.

- Spontaneous in aligning services to the specific needs of the banking and finance sector

- Should be updated with the latest regulations as per jurisdictional & global KYC and AML standards.

- It should equip the banks and FIs with all necessary aspects of customer onboarding and ongoing monitoring to prevent money laundering.

Hiring a KYC vendor requires professional and calibrated guidance to fortify your services against predicate offenses. KYC AML Guide serves as a prime source of information and consultancy, offering a range of solutions that can make a significant difference for banks and FIs.

Final Word

Predicate Offenses in Money Laundering are not just the responsibility of the banking and finance industry rather they are a concern of the society as a whole. Predicate offenses must be considered as keystones in detecting and preventing money laundering.

Also Read: Money Laundering White Collar Crime