Overview of Anti-Money Laundering Directives

AML Directives are necessary regulatory policies in the European Union. Primarily, these are applicable in the countries that are a part of the European Union. Mainly, mitigating the threats of Money Laundering and Terrorist Funding is necessary through these regulations. There are 6 AML Directives that define the boundaries for firms, banks & financial institutions to stay compliant with KYC/AML guidelines. Notably, these directives are based on the guidelines provided by FATF (Financial Action Task Force). So, the EU Anti Money Laundering Directives are the procedures to prevent criminals from compromising the financial system.

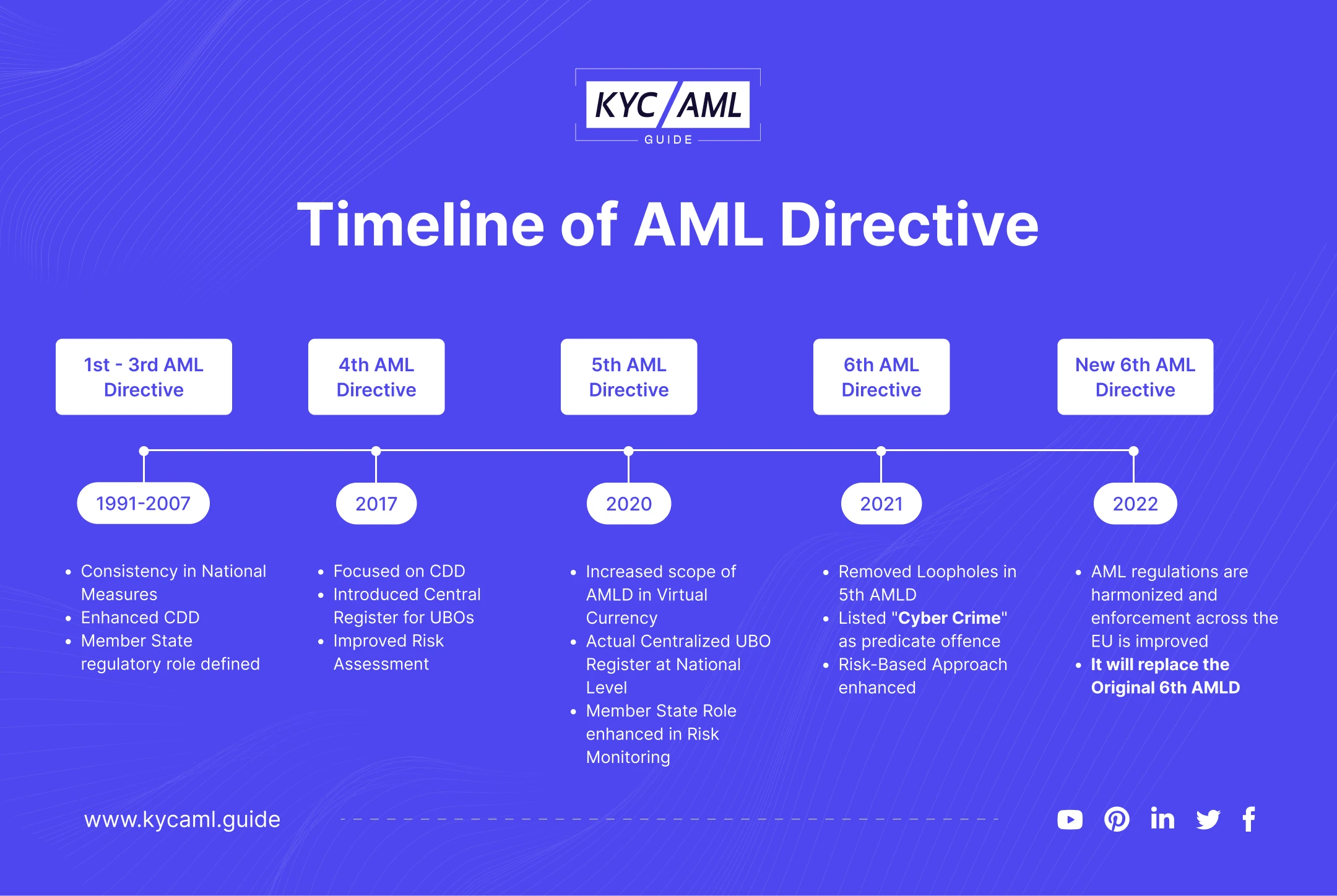

It is the EU Parliament that issued the AML guidelines in progressive form within 31 years to date. Below is the “Timeline of AML Directives” which explains the two phases in which rules against Money Laundering became stringent.

Timeline Anti-Money Laundering Directives

Firstly, the timeline shows two phases in which the 6 directives for AML are explained. The first phase is from 1991-2007 having 1st, 2nd, and 3rd directives. These three directives define the basis of Anti-Money Laundering guidelines, regulations & procedures. Moreover, they had many loopholes and progressively the need for superseding directives was direly felt. Below here is the Timeline of AML Directives.

1st Phase of Anti-Money Laundering Directives

As the timeline shows, 1st – 3rd AML Directives are aimed towards introducing a systematic approach to combat Money Laundering.

1st AML Directive – 1991

- Visibly aimed toward the prevention of Money Laundering in Financial Systems

- A requirement imposed on financial institutions to perform CDD (Customer Due Diligence)

- A requirement imposed on financial institutions to report any suspicious activity to authorities

- Generally, it covered credit unions and financial institutions

2nd AML Directive – 2001

- Improved version of 1st Anti-Money Laundering Directive covering a more comprehensive range of entities.

Mainly, it included auditors, accountants, high-end goods dealers, and real estate agents - Introduced the role of Member States in establishing the Financial Intelligence Units (FIUs).

A Requirement was imposed on businesses to have Anti-Money Laundering procedures, policies, and internal controls.

3rd AML Directive – 2005

- It enhanced customer due diligence (CDD).

- Improved the consistency in National Measures against Money Laundering

- Further improvements in the role of Member States, measures, and policies.

- Introduced the Employee Training for Risk Assessment and Strengthened the CDD.

- Improved measures for International Cooperation and Coordinated activities against Money Laundering and Terrorist Funding.

2nd Phase of Anti-Money Laundering Directives

Even after much stringency, Money Laundering was still on the rise, and criminals took advantage of loopholes in the system. Consequently, these loopholes hindered the overall financial security through KYC and AML regulations. After 2007, Money Laundering and Terrorism Funding hiked like never before. This is why the EU decided to implement an updated and enhanced version of the Anti-Money Laundering Directive. So, the second phase of AML Directives has the following details:

Fourth Anti-Money Laundering Directive

It was Issued in 2015 and implemented in 2017, the 4th AML Directive has the following outline:

- Primarily, it is aimed to combat Money Laundering and Terrorist Funding.

- Scope: Banks, Financial Institutions (FIs), and DNFBPs such as Lawyers, Accountants, and Real Estate Professionals.

- Entities are obligated to take a risk-based approach in Anti-Money Laundering initiatives.

- CDD (Customer Due Diligence) measures are to be taken for occasional transactions above a specific amount and frequency. UBOs and customers are identified and verified during the CDD.

- EDD (Enhanced Due Diligence) was introduced for high-risk customers and situations. Entities are obligated to apply EDD measures to ensure the second tier of verification.

- The UBO Register is to be set up by the Member States in which the beneficial owner’s information of companies and trusts is recorded.

5th AML Directive

In 2018 the 5th AML Directive was introduced. It was implemented in 2020 taking 2 years for further proceedings.

- Extended scope defines guidelines for Virtual Currency (Cryptocurrency, etc.).

- It also defines the guidelines for prepaid cards and updated payment methods.

- Beneficial Ownership explains the new requirements for improved transparency for making the criminal approach difficult to use for hiding assets.

- The stringent Due Diligence verification process is one of the core parts of the 5th Anti-Money Laundering Directive.

- Centralized Bank Account Registers are established by Member States allowing authorities detailed investigation.

- Criminal Sanctions are refined and more stringent in the 5th AML Directive. It harmonizes sanctions for Money Laundering all across the EU including penalties for a minimum to most serious cases.

6th AML Directive

So far, the 6th AML Directive is the latest updated version of AML regulations issued by the EU. Primarily, it removes the loopholes present in the previous Directive and focuses on the domestic legislation of the Member States.

- The Directive expanded the scope of AML regulations further and accommodated tax-related services, art dealers, and other entities.

- It enlisted 22 predicate offenses and for the first time, the EU listed ‘Cyber Crime’ as a predicate offense.

- The EDD in the 6th AML Directive introduces measures for high-risk third-world countries and enlisting them.

- Suspicious transactions are to be reported to the FIUs in three working days.

- Sanctions, penalties, and punishments became more stringent for implementing AML regulations.

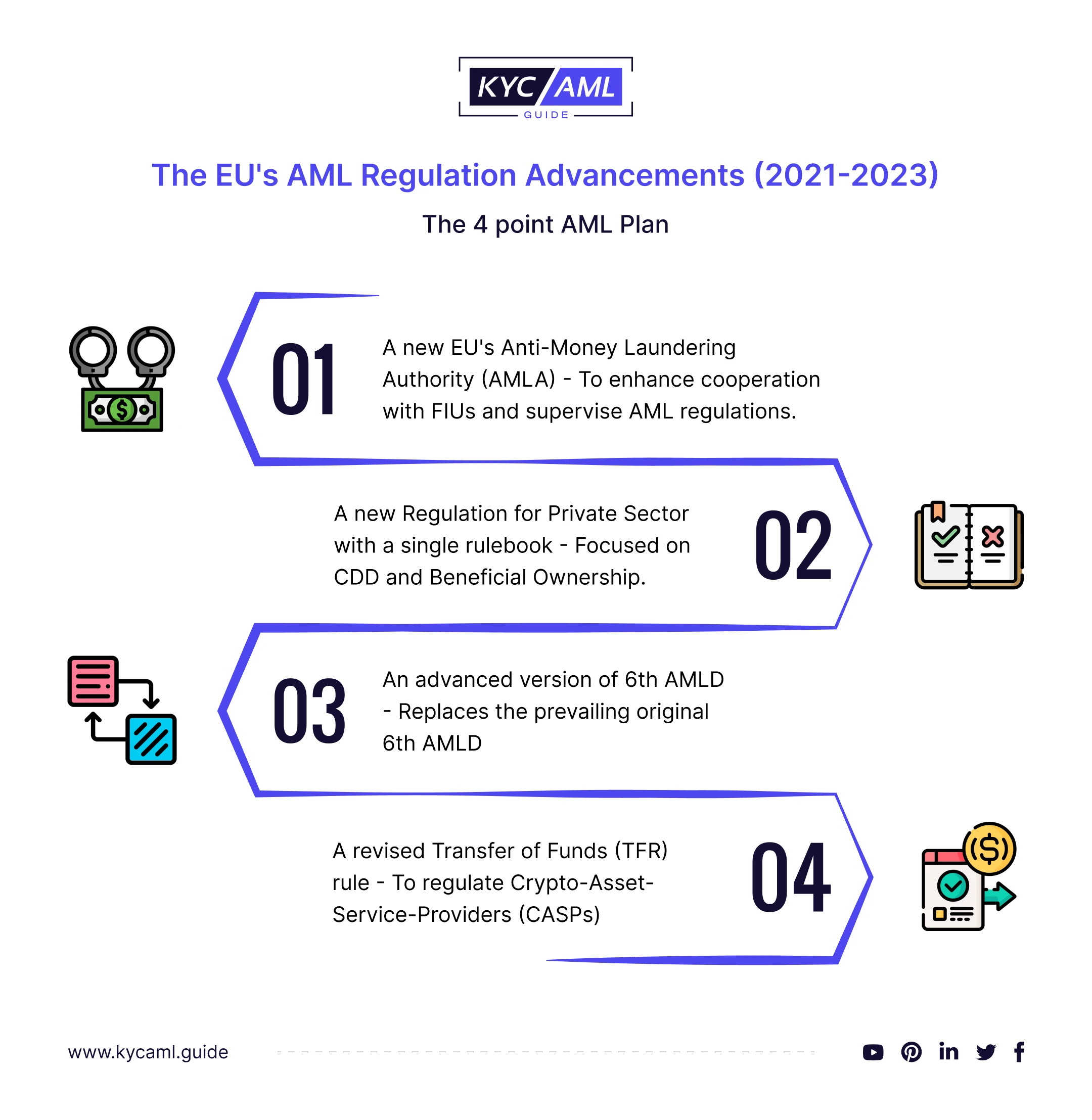

EU AML Regulations Advancements (2021 – 2023)

In 2021, the European Union proposed a package of Legislation to strengthen the implementation of AML/CFT rules. It consists of 4 proposals explained below:

- The EU proposed for creation of a new EU’s Anti-Money Laundering Authority (AMLA). The primary motive of the new body will be to enhance cooperation with Financial Intelligence Units (FIUs) and to supervise the overall implementation of AML/CFT rules.

- A new regulation on AML/CFT is also proposed to regulate the private sector with a single rulebook. It will focus on Customer Due Diligence (CDD) and Beneficial Ownership. Also, it will set a minimum limit of €10,000 for large cash payments across the EU.

- A new version of the 6th AMLD will replace the existing 6th AMLD with new rules for FIUs in the Member States.

- The revised Transfer of Funds (TFR) rule will help regulate crypto-asset-service providers (CASPs).

Also read: Crypto Travel Rule | KYC AML Guide

What Do Fintech Firms Need to Know to Stay Compliant to 6th AMLD?

6th AMLD is the most recent and significant update that harmonizes the Anti Money Laundering policies across the EU’s member states. While the UK opted out of adopting the 6th AMLD due to Brexit, businesses in both the UK and EU need to stay well-informed and updated about its requirements. This is to ensure cross-border compliance. Here is what fintech firms need to know to stay compliant with the 6th AMLD:

| 1 | Expanded list of Predicate Offenses | The 6th AML Directive extends the list of predicate offenses for money laundering. Now, the list includes 22 criminal offenses that fintech firms should avoid at all costs. |

| 2 | Dual Criminality Liability | Legal persons, companies, and partnerships can now be held accountable for money laundering offenses. Fintech firms can now be sanctioned as entities and not just individuals working for them. |

| 3 | Stricter Punishments | The minimum prison sentence for money laundering has been increased to 4 years with additional sanctions (if applicable). |

| 4 | Clarifying Aiding & Abetting | 6th AMLD is clear in explaining aiding, abetting, inciting & attempting money laundering activities. All these will be considered as money laundering offenses. |

| 5 | Extended Limitation Periods | Fintech firms should be aware that the limitation periods for money laundering offenses can be extended which may allow delayed prosecutions. |

Furthermore, the 6th AMLD with proposed action plans is yet to be agreed upon by the EU member states. However, the original 6th AMLD has already been implemented.

How can Fintech Firms Stay Compliant with the 6th AMLD?

Fintech firms in the EU are obligated to comply with the AML regulations. Under the updated rules, they are bound to have a KYC (Know Your Customer) tool implemented for the identification and verification of customers. This helps in preventing criminals from penetrating the financial circle for illicit gains. However, it is troublesome and costly to regularly monitor transactions and customer identities as well as stay up to date with the rapidly changing regulatory landscape. Therefore, Fintech firms are suggested to hire a KYC tool provider that is best suited for their business.

KYC vendors provide tailored services to accommodate various fintech needs and help them stay compliant with regulations like AML Directives. Fintech firms are always at risk of getting penalized or fined by regulators. These fines can go up to millions in amount depending upon the level and sensitivity of non-compliance. To mitigate this issue, KYC AML Guide offers consultancy services for KYC Technology Buying which enables you to save hefty costs and select the most appropriate KYC Tool while enjoying our following service benefits:

- Reduced Research Time

- Prevention of Switching Costs

- Diminished Churn Rate

- Regulatory Assistance

Conclusive Thoughts

Overall, the EU’s Anti Money Laundering Directives proved to be a concrete advancement in fighting Money Laundering. Money Laundering and Terrorist Financing are prime concerns of global financial regulatory bodies. Now, every country is striving to fight Money Laundering for which public awareness is necessary. Also, staying compliant with the regulation of KYC/AML becomes easier if proper guidance is given to everyone. Similarly, the concerned personnel must embrace the importance of prevention of Money Laundering and other fraud. The EU’s Fintech Firms should also keep a watchful eye on the updates in the new 6th AMLD and AMLA for better adherence to AML regulations.

Table of Contents

- Overview of Anti-Money Laundering Directives

- 1st Phase of Anti-Money Laundering Directives

- 2nd Phase of Anti-Money Laundering Directives

- 5th AML Directive

- 6th AML Directive

- EU AML Regulations Advancements (2021 – 2023)

- What Do Fintech Firms Need to Know to Stay Compliant to 6th AMLD?

- How can Fintech Firms Stay Compliant with the 6th AMLD?

- Conclusive Thoughts