What is Customer Risk Rating?

Financial institutions screen new customers using customer risk ratings to see if they are politically exposed persons(PEPs) or linked to any criminal activity, which can be a problem. They collect information such as identity and job and process it through their system known as ‘Know Your Customer’ (KYC) to ensure everything is correct. Customers are given a risk score i.e. low, medium, or high based on the level of risk that can identify potential fraudsters or money laundering. Banks monitor transactions to detect suspicious activity and make sure they are not helping criminals. Understanding the customer’s risk level is very important for banks before doing business.

The Customer Risk Score

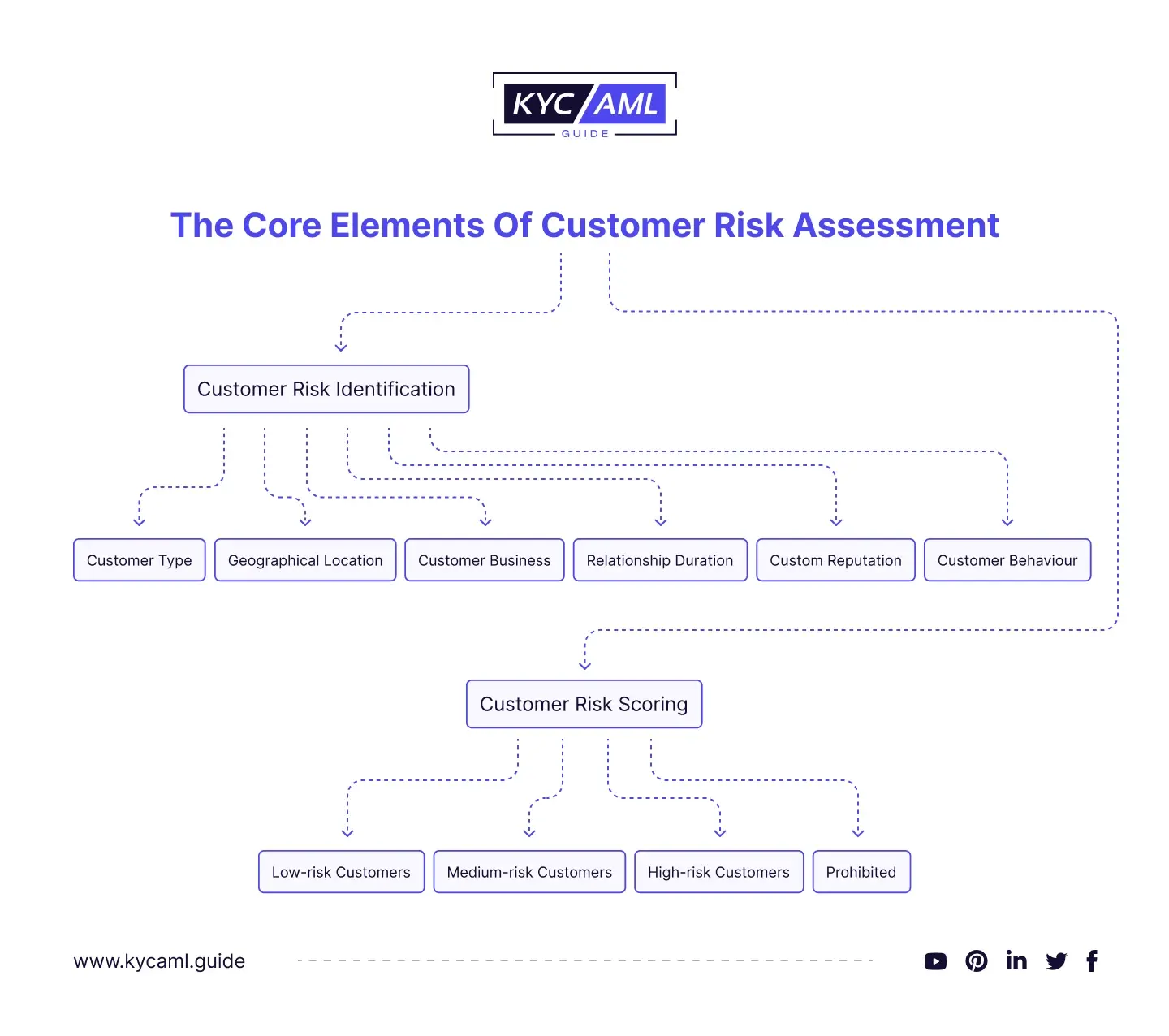

Financial organizations can identify consumers who pose a high risk of committing financial crimes or engaging in unlawful activities by using customer risk ratings, often known as risk scores. Financial institutions are required by FinCEN’s Customer Due Diligence (CDD) rule to use customer risk rating to assess the risk of money laundering and terrorism financing. For many financial institutions, this takes the form of a customer risk rating. The risk scores enable targeted assessment of high-risk customers.

This risk score is used to identify customers who should be carefully screened for potential financial fraud. As it is impossible to analyze every customer in detail, risk assessment allows you to target high-risk customers.

The types of customer risk ratings for KYC are as follows.

| Low-Risk Customers | Low-risk customers are those whose identities and income sources are easily verified, and transactions are conducted within legal limits. These customers typically maintain transactions within set thresholds and comply with regulatory requirements. Examples include

Organizations apply Simplified due diligence (SDD) to them. |

| Medium-Risk Customers | Medium-risk customers are those who have commercial transactions but do not have sufficient documentation for a low-risk rating. Examples include

Organizations apply Customer due diligence (CDD) to them |

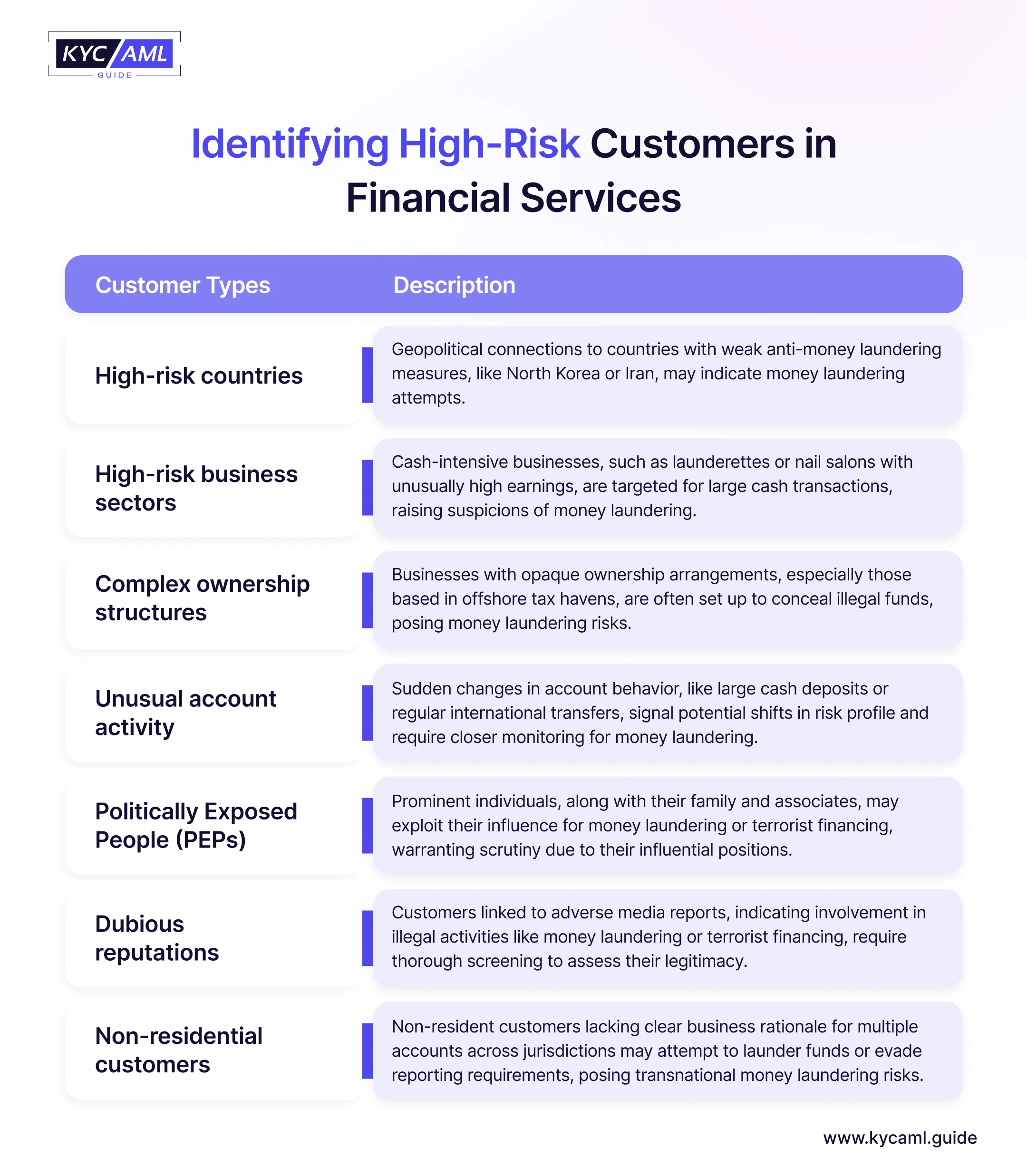

| High-Risk Customers | Clients that could endanger your organization, whether through fraud, compliance, or cyber security concerns, are considered high-risk clients. Within the banking and financial industry, these encompass businesses that operate in high-risk or international sectors, possess intricate ownership structures, or engage in dubious or unusual operations.

Significant monitoring, such as Enhanced Due Diligence (EDD), is necessary for high-risk consumers, and they could also be impacted by legal standards. |

| Prohibited or Very High-risk Customers | These are customers who have a history of fraud, money laundering, illegal or corrupt practices, or who pose a significant threat to the company’s operations or strategic goals.

Business organizations must have processes and procedures in place to monitor and manage customer risk levels. This may include background checks, continuous monitoring of customer behavior through KYC, setting credit limits, and implementing other risk mitigation strategies. |

- Some of the high-risk customers are given below in the infographic

The Process of Risk Rating

During the customer risk rating KYC process, banks decide how likely a customer is to be involved in money laundering. According to FATF recommendation 40, the risk assessment methodology should consider four factors: customer type, location, channel, and product. It goes like this:

1. Data Collection:

Banks collect information about customers, such as name, address, and ID. They also analyze clients’ financial history and trading activities.

2. Risk Assessment:

They analyze this data to find out how risky the customer is. They look at things like customer transactions and who they do business with. Some risk classification factors are

- Transaction patterns: Analyze customer transactions for unusual or suspicious activity, such as frequent transactions or large transfers.

- Geographic location: Assess whether a customer’s location is linked to money laundering or terrorist financing.

- Type of business: The type of the client’s business determines the risk level, with the financial industry typically carrying larger risks.

- Source of Funds: Verify the legitimacy of the source of the funds and whether there should be any concerns regarding deposits or cash transfers from countries with high risk.

- Customer reputation: To assess reliability, take into account the customer’s standing in the sector and the institution’s previous performance.

- Politically Exposed Person (PEP) Status: Verifying if a client is employed by the government at a high level could be a sign of financial crime risk.

3. Assigning a Rating:

Based on the analysis, customers are classified from low to high risk. High-risk customers are more suspicious than low-risk customers, who often don’t become involved in questionable activities. These ratings support banks in adhering to laws against fraud and money laundering. This enables them to see potential troublemakers among their consumers and take appropriate action.

4. Using Technology:

Banks use advanced software to make this process faster and more accurate. This allows them to more easily identify high-risk customers and transactions.

5. Ongoing Monitoring:

Customer risk ratings for KYC are not static and can change over time depending on circumstances. Therefore, ongoing monitoring of customer activity is essential to ensure that risk ratings remain current and accurate.

Overall, this system helps banks keep an eye on criminals and ensure they follow the rules to keep everyone’s money safe.

Methods for Customer Risk Rating

A survey conducted by PwC shows that 62% of organizations believe that improving customer risk rating methods is a priority in their AML programs.

a. Rule-Based Approach:

A rules-based approach uses pre-defined rules and thresholds to assess customer risk. These rules are usually based on certain criteria, such as many transactions, frequency, or country of origin. For example: A bank may enforce a rule that any transaction greater than $10,000 has a higher risk rating. Therefore, if a customer regularly transacts above this threshold, we mark them as high risk.

A rules-based approach is easy to implement and ensures consistent risk assessment. However, capturing complex risk scenarios can be difficult. For example, a large transaction may not necessarily involve high risk if it involves events that are unusual occurrences for the customer.

b. Advanced Analytics and Machine Learning:

Large volumes of data are analyzed using advanced analytics and machine learning techniques to spot trends and forecast risk. This method uses algorithms to adapt and learn from new data over time. Financial institutions, for instance, can examine different consumer attributes, transaction histories, and behavioral patterns using machine learning algorithms. The technology can identify potentially dangerous consumers by identifying anomalies or departures from normal behavior.

Advanced analytics can recognize minute patterns and adjust to novel threats. For instance, even if they fall below a set threshold, it can spot anomalous transaction patterns that deviate from typical client behavior. However, putting this strategy into practice calls for certain knowledge and tools, such as data scientists and cutting-edge technological infrastructure.

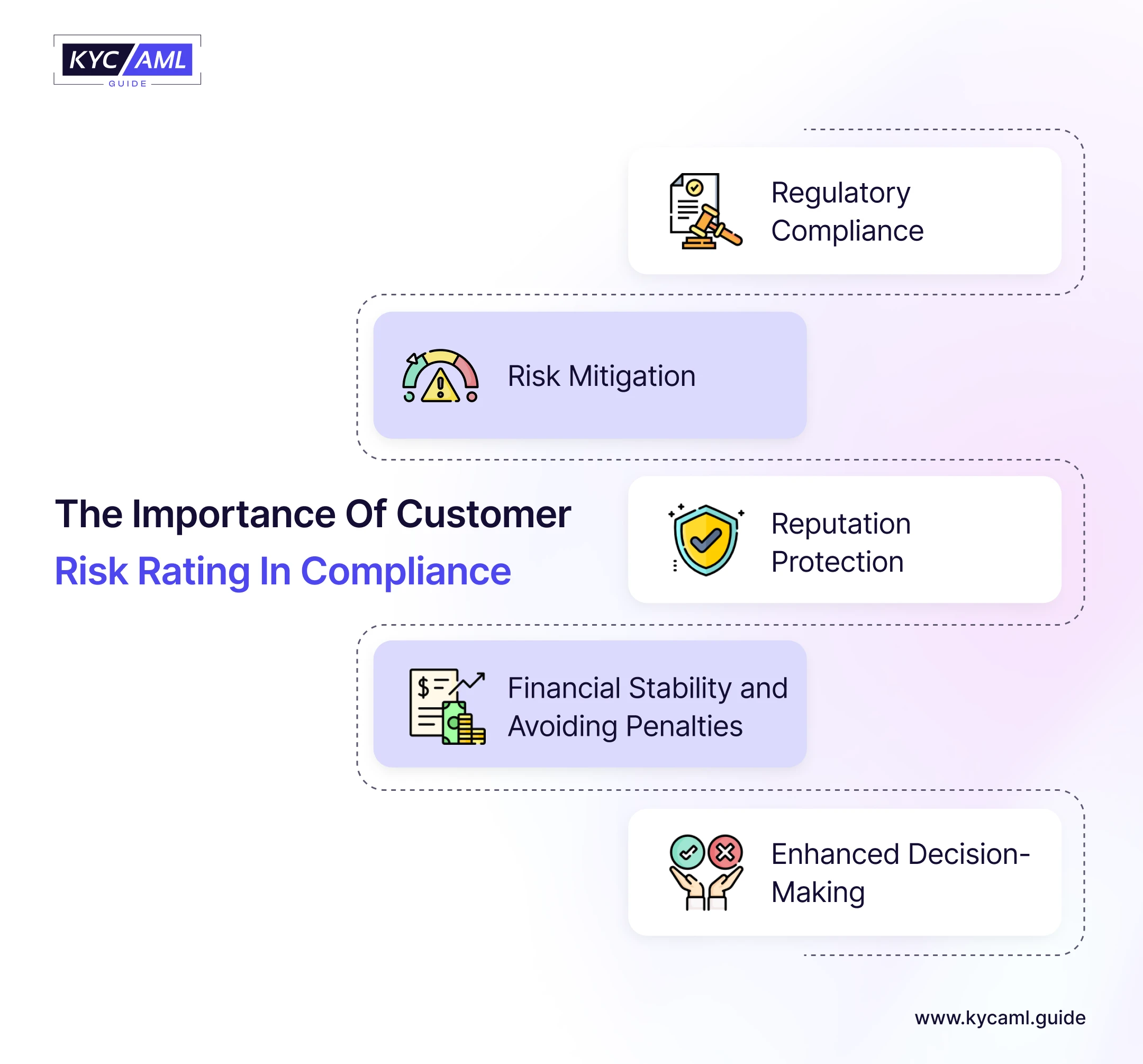

The Importance Of Customer Risk Rating In Compliance

KYC risk scores can be challenging, but they are crucial for preserving compliance. According to ACAMS, 35% of businesses struggle because they either lack sufficient data or have poor-quality data. Banks can target customers who could be more vulnerable by evaluating their risk. Research from McKinsey shows that good risk rating systems can reduce the number of false alarms in transaction monitoring by up to 40%.

In short, customer risk rating for KYC is critical to compliance and anti-money laundering efforts. It helps organizations manage KYC risks, detect money laundering, and allocate resources efficiently.