“Money Muling is Essentially Money Laundering.” (Europol)

Money Muling is one of the most commonly used methods of money laundering, which is currently affecting the overall economic business model of digital crime. Due to the drastic emergence of online banking services, the risks of money laundering and illegal money transfers through mule accounts have increased. Nonetheless, it allows criminals to conduct money mule scams to launder illegitimate money and remain unsuspected.

Let us find out what Money Mule Scam is and how it is connected to Money Laundering.

What is Money Muling?

Money Muling or a money mule scam is a type of financial fraud used by criminals to use an unsuspected or innocent person’s bank account to launder money acquired through illicit means. Usually, the scammers trap and convince the individual to receive and transfer money via their bank account.

Financial regulatory authorities are in a constant struggle to combat frauds and scams on a global scale.

Most recently, the FBI has warned against Money Mule scams through Job Advertisements.

The person who is targeted to be used for money laundering is known as a mule. However, the mule, while receiving or transferring money, might think that they are participating in a job, making an investment, or helping an online friend. Yet, for this purpose, they are offered a commission for receiving and transferring money.

Types of Money Mules

Federal Bureau of Investigation (FBI) categorizes Money Mules into three different types as per the level of awareness of the Money Muling Activity of the Mule.

| Unwitting | The targeted individual is unaware of the Money Mule Scam.

|

| Witting | The individuals show willful blindness and ignore the red flags.

|

| Complicit | The mules are fully aware of the money laundering activity and willfully take part in it.

|

Money mule fraud is considered illegal and if a person, conducting this crime, gets caught, he may encounter some serious consequences such as penalties, sentences, huge fines, and a decrease in their credit score. Therefore, it is crucial to remain alert if an individual gets an offer that doesn’t sound to be true. Moreover, it is also advised not to share your bank account details with any third person.

How Does the Money Mule Scam Work?

The process of money muling is pretty straightforward and includes several steps:

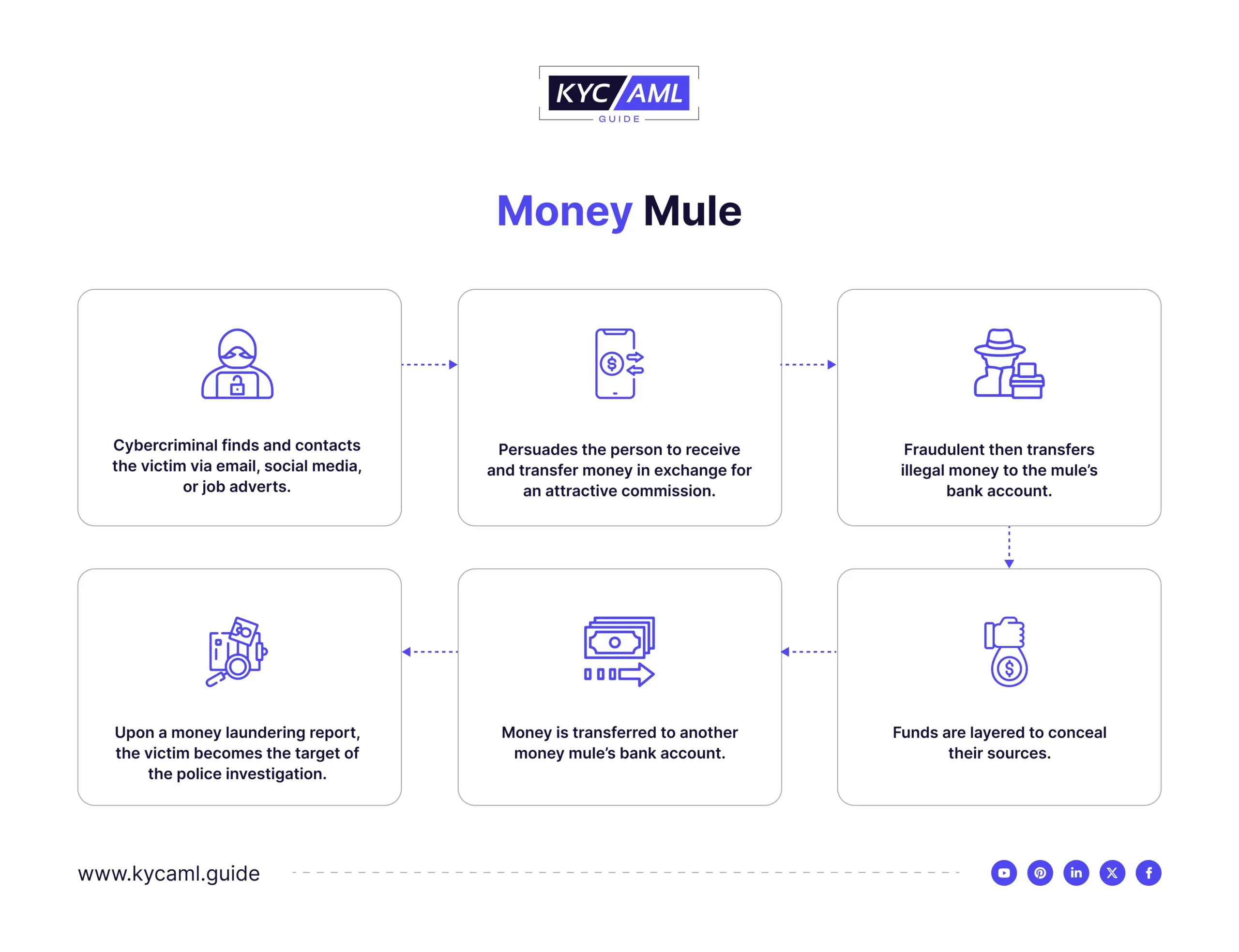

- The fraudulent acquire money through illegitimate means such as corruption, drug or arms trafficking, e-commerce fraud, phishing, etc.

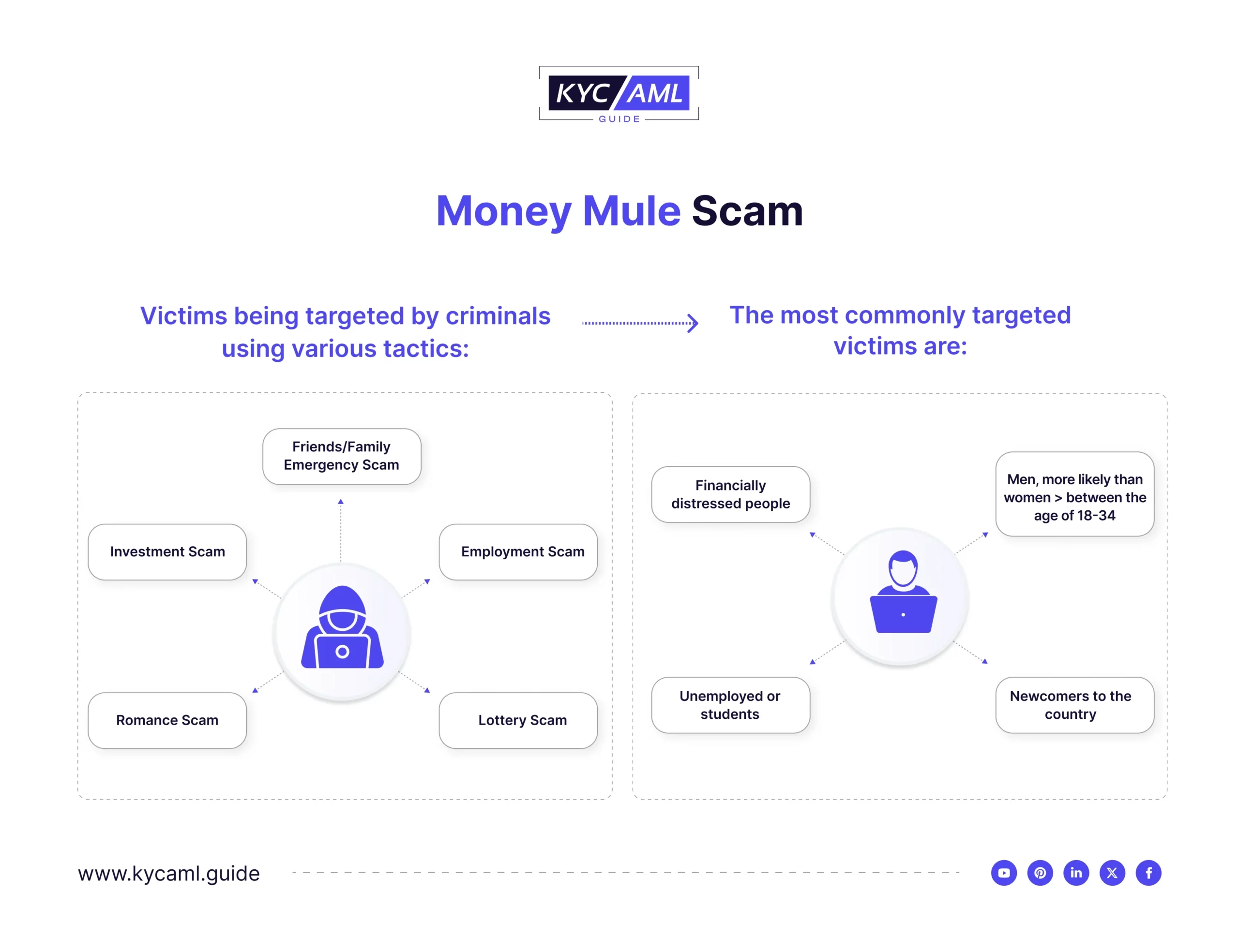

- Then the criminal searches an individual to make him the target of a money mule.

- The criminal contacts the mule in a fraudulent manner whether by offering a fake job, lottery, or government support system to convince and trap the victim.

- Once the person gets persuaded, they receive money in their bank account and transfer it to a third-party account.

- However, the mule has to follow the instructions for transferring the money, such as exchanging the funds into cryptocurrency.

- Once the money is transferred, it reaches the criminal successfully, leaving the victim at the center of an investigation of money laundering.

As per Europol, Money-Muling transactions are mainly connected to illegal arms smuggling, terrorism funding, and drug trafficking. Above all, more than 90% of these transactions are linked to cybercrime.

Warning Signs of Money Muling

If you want to know whether you are becoming the target of money mule money laundering, you should keep an eye on some red flags of money laundering and recognize money mule activity:

For Victims

- You are surprisingly contacted and get a job offer with easy and huge money that sounds too good to be true.

- Your job requires receiving and transferring funds through your personal bank account.

- The job offer is only through online or social media platforms and no company is involved in it.

- The names of the sender and the company don’t match with each other.

For Businesses

- Customers become unwilling to perform the Know Your Customer process.

- Users log in from different geolocations every time.

- Large transactions spontaneously.

- Funds are deposited and withdrawn quickly.

Protect Yourself from Money Mule Scam

To prevent money mules in banking and becoming their victim, you should take some prevention measures, such as:

- Do not provide your bank account details or other financial information to anyone, especially someone you don’t know.

- Remain alert of sudden and surprising employment offers, specifically those that involve funds transfer.

- Beware of unexpected messages, emails, calls, and social media requests that may steal your personal or financial information.

- If you have doubt that you’ve become a money muling victim, report it right away to the bank authorities and law enforcement.

- Be cautious of accepting anyone’s friend request on social media platforms.

- Use unique and powerful passwords for all your accounts including social media and bank accounts. Also, try to enable two-factor authentication.

- Lastly, educate yourself about how to deal with and report money mule scams to avoid becoming the main target of money laundering investigations.

By taking these measures, you can diminish the risks of becoming a victim of a money mule scam and protect your finances.

The Role of KYC Identity Verification Solution in Identifying Money Muling

KYC (Know Your Customer) Solutions have a core objective of customer identification and authentication. Considering this, KYC solutions are at the forefront of identifying money mules in banks and other financial institutions where their identities are used for illicit transactions. Mules can be identified through the warning signs as discussed above. Also, the KYC Solutions are integrated with lists of risky identities around the world. Any anomaly or suspicious profile can be detected and reported to the authorities for further investigation.

KYC AML Guide knows the best way to link your business with the best-suited KYC Solution. Our KYC Technology Buying Consultancy is the tool to help you prevent Money Muling at the early customer onboarding stages.