The example set by Singapore police in one of the world’s largest operations related to money laundering in which police seized 62 vehicles, 3 billion Singaporean dollars in cash, and 152 properties. This incident shook Singapore and spoke out strongly against terrorist financing and money laundering, in Singapore Anti-money laundering (AML) and Know Your Customer (KYC) laws are strictly enforced. The main money laundering law in Singapore is the Corruption, Drug Trafficking, and Other Serious Crimes (Confiscation of Benefits) Act (CDSA). The laws and precautionary measures are taken to prevent laundered money from entering the country and efforts were made to verify the consumer’s identity.

Singapore has been a member of the FATF since 1992. 37 out of 40 recommendations are rated “compliant” or “largely compliant” for combating financial crimes and fraud. In turn, financial institutions are adopting new practices due to support from 39 member states representing some of the world’s largest financial hubs.

KYC Requirement in Singapore

In Singapore, the Monetary Authority of Singapore (MAS) regulated KYC and issued its Anti-Terrorism Fund and Financing of Terrorism in 2007. This directive requires financial institutions to assess the level of risk associated with them. They investigate customers, each client, and transactions of suspicious activity. Financial institutions should also keep a record of their KYC due diligence and report any suspicious transactions to authorities.

The Act requires financial institutions to verify the following for each customer.

- The full name

- Surname

- Identification numbers from an ID card certified by an attorney or notary

- Residential Address

- Date of Birth

- Nationality

- Independently verified telephone number

- Telephone confirmation of work status (approval).

- Evidence of salary statement (recent bank statement).

- Initial deposit by using a check with a bank in Singapore

Verification can be completed using electronic or physical documents and other independent data sources such as relevant databases.

KYC Requirements for Company Incorporation in Singapore

For a company based in Singapore, there is a specific KYC first rule developed & implemented by the Monetary Authority of Singapore (MAS) to ensure that your identity is legitimate, authentic, and transparent. The following documents are required.

- Proof of identity with relevant documents, nationality, date of birth, and residence of shareholders and board members);

- Copy of company memorandum & articles of association

- A copy of the decision of the Governing Body

- A copy of the Business Statement

- Initial deposit using a Singapore bank cheque

- Bank details verification to check user income

- Confirmation of job status with user approval

- Certificate of identity issued by a notary or attorney

Corporate Service providers develop a comprehensive screening process to find and identify clients, focusing on background checks, contacts with existing clients, politically exposed person (PEP) status, corporate structure complexity, unusual communication tolerance, avoidance of collisions, and control of capital expenditure. Regular monitoring and record keeping are required to ensure compliance with the regulatory requirements and to asses business history, risk profiles, and customer transactions.

Beneficial Ownership

On 21 June 2023, it emerged that DBS, OCBC, Citibank, and Swiss Life (Singapore) had all breached specific requirements highlighting the critical need to scrutinize and identify clients’ beneficial ownership structures for AML purposes. The fine was revealed in the MAS investigation following the Wirecard scandal and allegations of involvement by Singapore-based companies.

There are also other requirements for verifying businesses and beneficiaries. Any director, partner, or person with senior authority must verify the identity information. To comply with UBO regulations, companies must collect and verify UBO credentials, including proof of residency and proof of share ownership.

Digital identity can also help with this process through Myinfo Business, as forms can be automatically populated with proprietary information from government sources. If the company discovers a change in ownership or the person(s) authorized to represent the client, further due diligence is required.

National Digital Identity (NDI) Program

The National Digital Identity Program in Singapore is a major initiative led by the Government’s Ministry of Technology (GovTech) and the Ministry of Communications and Information (MCI) to provide individuals and businesses with a secure and easy way to verify their identity online and access digital services. NDI aims to create a trusted digital identity ecosystem that ensures safety, security, and efficiency across industries such as government services, healthcare, banking, and e-commerce

Launched in 2003, SingPass, is the cornerstone of Singapore’s Smart Nation journey, allowing access to more than 130 government digital services, and allowing business owners to license and manage businesses. SingPass is a digital identity for individuals, while CorpPass is for businesses and third-party organizations. SingPass is a digital identity application that enables a passwordless experience, driven by biometric verification such as facial verification or mobile Touch ID or 6-digit passcode. The Singpass app also offers two-factor authentication (2FA) features such as Singpass Face Verification and Multi-User SMS 2FA over SMS one-time password (OTP). protect it properly and allow people to communicate anywhere, anytime. In addition, from 2019 onwards, KYC methods now approved by MAS include video verification, the use of third parties, and other technologies.

MyInfo has ensured that personal and corporate data related to digital communications between public institutions and private ecosystems, such as banks and insurance companies, citizens can register with government and private companies using the Singpass app. Singpass, which is linked to the Myinfo, also allows remote signing of documents

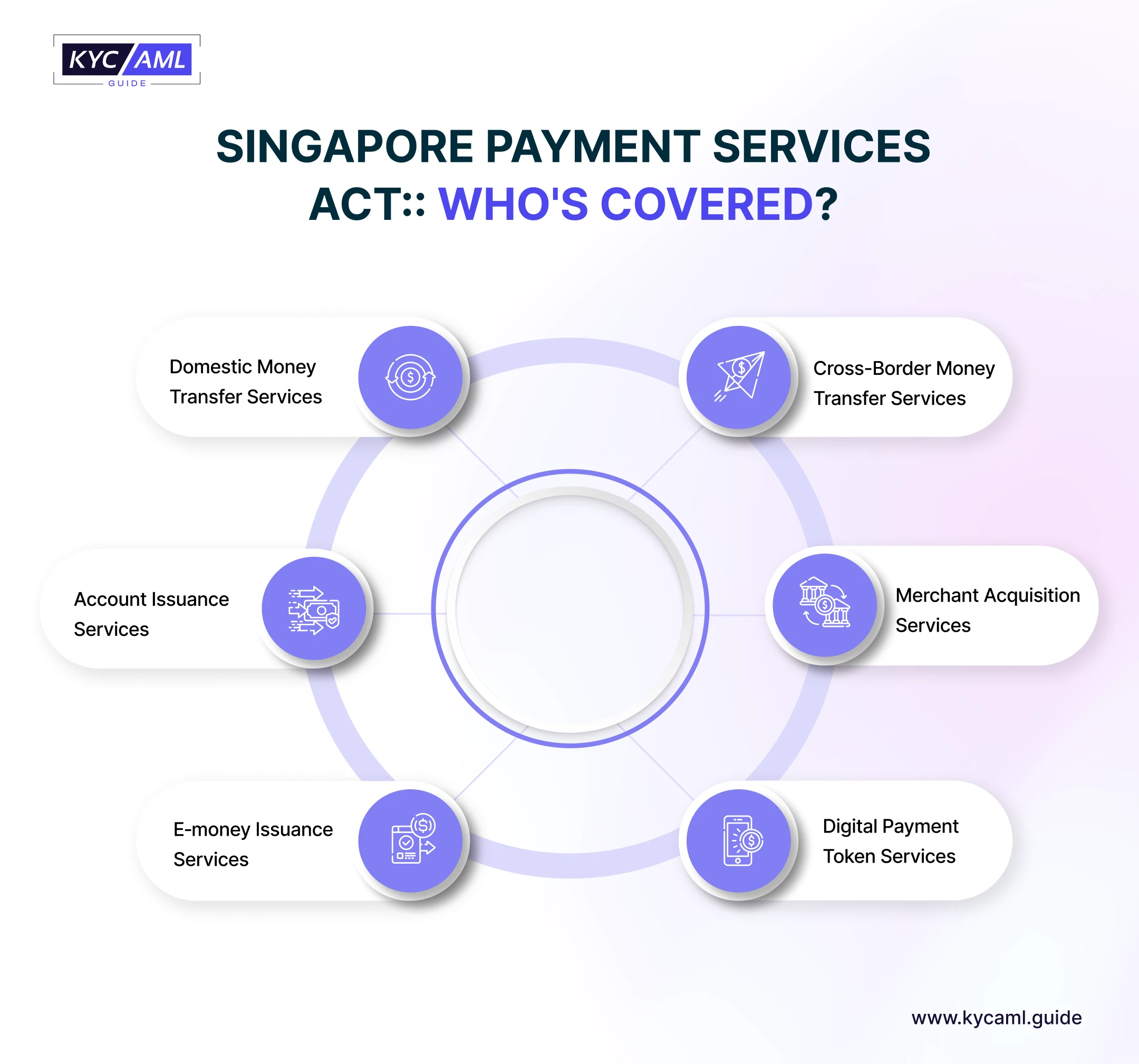

Implementation of the Payment Services Act (PSA)

The Singapore government passed the Payment Services Act (PSA) in 2019, which came into effect in January 2020. The law defines the legal liability of payment service providers. The Payment Services Act (PSA) is a regulatory framework established by the MAS to govern payment services in Singapore. The regulations apply to all payment service providers operating in Singapore, including new and existing players. Given the growing importance of payment services in the digital economy, the introduction of this regulatory framework is timely. The PSA has three main objectives:

- To make payment systems more flexible and efficient,

- Ensure payment processing providers protect customer funds and data, and.

- To promote the acceptance of electronic payments in Singapore.

Under the PSA, payment service providers must obtain a license from the MAS to operate in Singapore. The licensing criteria are determined by the hazards connected with payment services. For example, providers of high-risk payment services such as e-wallets are subject to stricter restrictions than providers of low-risk payment services such as money transfers.

On April 5, 2022, the Parliament of Singapore passed the Financial Services Management Regulations (FSM Regulations) for Payment companies. The FSM sets out specific requirements and guidelines for payment service providers, including:

- Licensing requirements for various payment services, such as accounts receivable, intra- and cross-border transfers, and digital payment token processing

- Operational and governance standards to ensure the integrity, security, and reliability of payment services.

- The consumer is protected by taking measures, such as transparency of cost and management rules are required.

- The law enforcement agencies formed regulations aimed at combating illicit financial activities including anti-money laundering (AML) and counter-financing of terrorism (CFT).

On April 2, 2024, MAS introduced amendments to Singapore’s Payment Services Act 2019 (PSA) and its associated rules. Frequently these changes want

(1) Expansion of payment services controlled by MAS beginning April 4, 2024.

(2) Impose user security standards on digital payment token (DPT) service providers beginning October 4, 2024.

Sanctions for Non-Compliance

The strict policy introduced by the Singapore government is zero tolerance for money laundering. According to their criminal law, one who is found guilty can be imprisoned for up to 7 years or fined up to $365,930, or both. Financial institutions that fail to comply with MAS’s AML processes can be fined up to 1 million Singaporean dollars (i.e.; $73,296) per violation or, for persistent violations, an additional 100,000 Singaporean dollars (i.e.; $732,958) per day.

Violation of ACRA KYC rules carries severe penalties including suspension:

- Cancellation of ACRA registration

- Refusal to obtain professional services

- Financial penalties

As KYC requirements in Singapore organizations deal with illegal business activities and compliance with the Constitution, below are some relevant rules Persons or investors found guilty will impose subject to the following restrictions. Penalties and requirements may vary depending on the evidence.

- The ACRA Act and the Singapore Company Constitution.

- The Terrorism Act.

- The Corruption, Drug Trafficking, and Serious Crimes Act.

- Other anti-money laundering and anti-terrorism laws.

Bottom Line

KYC standards are important to the security and dependability of Singapore’s financial sector. Compliance with these standards allows banks and businesses to prevent financial crimes and safeguard themselves and their clients. This commitment to KYC not only saves money for everyone but also gives Singapore a reputation as a top global financial center. Staying abreast of regulatory changes and effectively leveraging new technologies is essential to staying on top of things. As a KYC/AML Guide, we specialize in offering services of research-based KYC technology buying and vendor analysis to help banks and businesses make informed decisions. Our tailored recommendations empower organizations to select the right KYC solution, increase compliance, and build customer confidence.