What is a Customer Identification Program (CIP)?

The US Congress decided that verifying identities in banks would fight against terrorism and money laundering after the terrorist attacks on September 11, 2001. The CIP became law on June 9, 2003, as part of the USA PATRIOT Act. Financial institutions, for example, banks and credit unions, must incorporate CIP into their AML compliance programs. Failure to do so can result in a fine of up to $250,000 or imprisonment of up to five years.

Definition

“A customer identification system (CIP) is a legal requirement of financial institutions, including banks, credit unions, etc. It aims to create and maintain a system to identify and verify the identity of its customers. This increases transparency and security in the financial sector and prevents illegal activities”

According to the Financial Times, penalties related to KYC and CIP rose to 50% by 2022, and banks paid nearly $5 billion for financial violations

How Should Organizations Implement a Customer Identification Program?

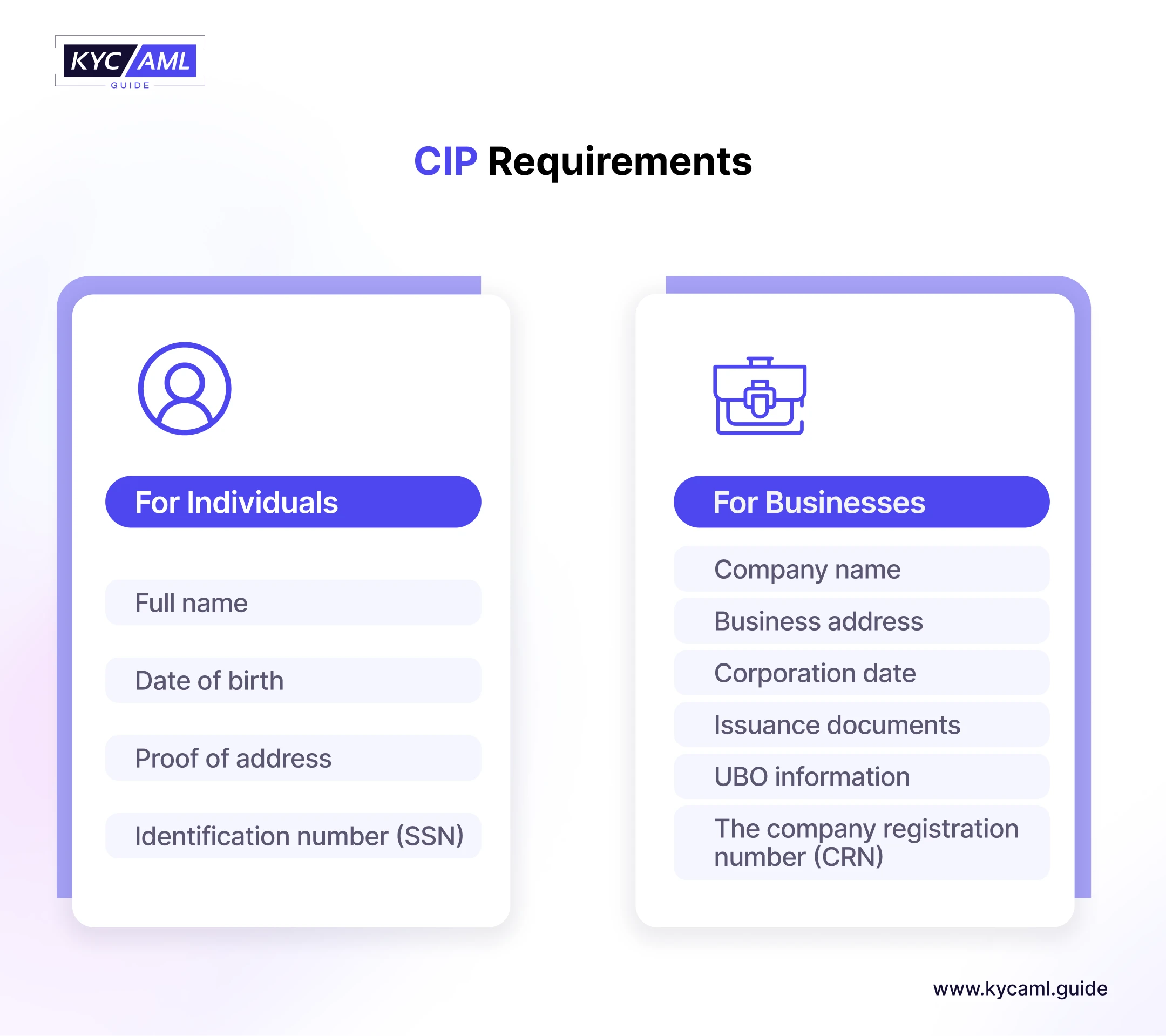

First, the organization has to collect some information before the customer can use the services. This information includes:

- First and last name of the customer

- Date of birth

- Proof of address documents

- Identification number

After collecting all data the organization must:

- Verify– An organization cannot accept the information it receives. To ensure that the organization receives accurate information data must be regularly validated.

- Record– To follow the CIP rules, the organization will save and retain the information received for at least 5 years after the account closure.

- Check– to make sure that financial institutions are not supporting criminals they should double-check their information against government blacklists such as PEP lists, sanction lists, and global watchlists.

- Monitor– It is important to monitor customers regularly. In this way, risky transactions can be identified and avoided.

Difference Between CIP and KYC

Although CIP and KYC are often confused, they are not the same. Think of CIP as a piece of a larger KYC puzzle that focuses on the verification of customer data such as name and address. KYC, on the other hand, goes deeper. It includes CIP but also includes other measures such as customer due diligence (CDD) and continuous monitoring. CDD helps assess customer risk by using a standard method for low-risk cases. For high-risk cases, it uses a detailed approach known as enhanced due diligence (EDD). at the same time, continuous monitoring is done to monitor consumers’ financial activities and to identify suspicious activity. It ensures that any red flags are promptly reported to FinCEN and other regulatory authorities.

Benefits of Implementing a Customer Identification Program

Implementing a customer identification program (CIP) provides significant benefits for financial institutions, including increased transparency, lower risk exposure, and protection of equal interests across multiple accounts.

1)Financial Institutions

The (CIP) is a significant component in financial institutions. It helps to enhance safety efforts and promote transparency. CIP plays a key role in preventing identity theft and money laundering in financial institutions just by verifying customers’ identities. For example, the National Credit Union Administration (NCUA) requires financial organizations to keep up with exact records of customer’s identities to facilitate monitoring and reporting of suspicious activities.

2)Anti-Money Laundering (AML) Compliance

The CIP plays a significant part in AML compliance. To combat money laundering it helps to align with regulatory directives from organizations, like the Securities and Exchange Commission (SEC). The SEC has implemented strict AML regulations to prevent money laundering through the strict control measures used by financial institutions globally. In 2020, EU regulators fined financial institutions €10.4 million for not following CIP and AML rules.

3)Regulatory Requirements

Compliance with the CIP law means more than implementing regulatory compliance. As reported by Globalscape, The average cost for compliance stood at $5.47 million, whereas non-compliance averaged $14.82 million. It strengthens the trust and security of financial institutions. Meeting the CIP standard confirms the organization’s commitment not only to AML compliance but also to diligent efforts to protect itself from the risks of money laundering. Such compliance demonstrates a commitment to fair and safe procedures.

4)Protection against Identity Theft

The purpose of CIP is not only to protect the financial system but also to protect people from identity theft. According to the U.S. Treasury Department’s latest Money Laundering Risk Assessment, criminals often create a false identity to defraud financial institutions of large sums of money. In 2022, the FTC received 5.1 million reports of financial theft, with 1.1 million being identity theft cases. Requiring strict verification of customers’ documents and information will make it harder for crooks to misuse someone’s identity or create fake identities for illegal activities. Also, it shields consumers from the emotional distress and financial losses that frequently accompany fraud.

Also Read: How to prevent identity theft with KYC?

5)Increases Customer Confidence

Trust is the foundation of a financial institution. Implementation of a customer identification program is essential to building that trust. Consumers feel better knowing that their financial institutions take identity verification seriously and work hard to prevent fraud. CIP’s advanced insights enable financial institutions to better understand their customers, financial behavior, and business processes. This contributes to stronger customer relationships.

Challenges in Implementing Customer Identification Program

The implementation of CIP comes with challenges despite its benefits. The challenges are related to

- Compliance with the final regulations,

- A strict verification process, and

- The integration of advanced technology into the existing work process.

Financial institutions have to ensure compliance with the final rule to avoid fines and remain compliant. A rigorous verification process in CIP implementation requires careful attention to detail and accuracy. Adding advanced technologies, such as biometrics or artificial intelligence, can improve the efficiency and security of the identity verification process. However, the adoption of advanced technologies often requires significant investment and expertise.

The Power of CIP for Your Business

If your company operates in the financial sector, it is important to have a strong and effective customer identification program that meets the requirements of the CIP Regulation. But even if your business doesn’t need to identify customers, it can provide many benefits, including increased trust in your platform or community. At KYC AML guide we understand the important role CIP plays in your business. Our KYC technology buying consultancy helps you choose the right customer identification program for your business.