What is AML Ongoing Monitoring?

AML Ongoing monitoring is a critical component of Anti-Money Laundering (AML) compliance, in which businesses update client information regularly to detect changes in risk factors. Client names are checked against sanction and watchlists, connections to politically exposed persons (PEPs) and sanctioned entities are checked, and transactions are closely monitored for suspicious activity. For example, if a client’s name appears on a global sanction list or as a politically exposed person, further investigation is initiated. Businesses must conduct ongoing monitoring to ensure compliance with regulatory standards and to mitigate the risks associated with money laundering and terrorist financing.

What is the Significance of AML Ongoing Monitoring?

The most important aspect for financial sector businesses is AML’s ongoing monitoring, which serves as a safeguard against the risk of money laundering and terrorist financing. Analyzing customer data regularly enables businesses to detect changes in risk and take appropriate action, such as conducting due diligence or filing a suspicious activity report (SAR).

Ongoing monitoring has increased in today’s world, with activities such as restrictions and investigations of illegal money from regions such as Russia. Investors must maintain a continuous monitoring system to maintain compliance with regulations and reduce the risks associated with money laundering and terrorist financing. This diligence not only protects the company but also helps combat money laundering in general.

From the perspective of small businesses, the US Treasury Department (FINCEN) is taking steps to assist them in understanding and complying with new obligations related to reporting beneficial ownership information. This includes the soon-to-be-enacted Corporate Transparency Act (CTA), which will go into effect on January 1, 2024. Many small businesses have expressed concern about a lack of understanding and education about these requirements. The Treasury Department intends to issue “Compliance Guidance” in plain English to explain the rules and provide tools to help businesses comply. They also create a point of contact to assist small business owners and lessen the legal burden. This cautious approach aims to ensure that even small businesses are well-informed and capable of meeting reporting requirements while protecting sensitive information.

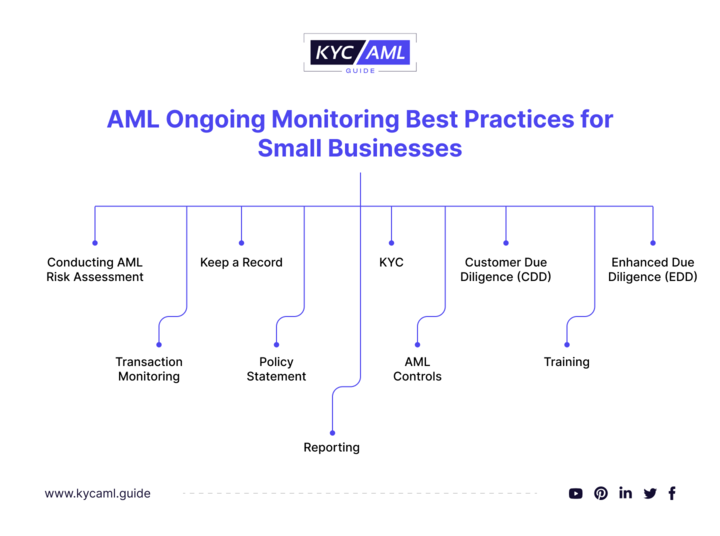

AML Ongoing Monitoring Best Practices for Small Businesses

Conducting an AML Risk Assessment

It entails evaluating the money laundering risks that your organization may face. For example, if your small law firm handles real estate transactions in a jurisdiction with tax laws, this could pose a significant risk. Similarly, dealing with international clients regularly, particularly those from countries with a history of bankruptcy, raises your risk profile.

Your company’s scope and location may evolve. For example, if your practice begins to offer new services and capabilities, or if regulatory requirements change, it is critical to update your risk assessment. Regular audits ensure that your AML program is still effective and up to date.

In addition to risk assessment, consumer research at the subject level is important. For example, if you represent a PEP in a complex financial transaction, the risk is much higher than in a typical commercial transaction for a local client. Aligning your due diligence with an assessment of each client’s and issue’s unique risks

Keep a record:

Your practices must adhere to data retention limits. If the customer agrees to keep their data for a while longer than the standard five years, this agreement must be included in the commitment letter. For example, if a customer is involved in an ongoing dispute, their data may be kept for legal purposes.

Maintaining records of your AML risk assessment is essential for transparency and accountability. Assume that your firm considers the client to be a high risk due to the company’s involvement in critical rights. This assessment document gives administrators a clear picture of future compliance and assists them in understanding their decision-making process.

KYC:

In AML ongoing monitoring, and implementing Know Your Customer (KYC) procedures is a fundamental best practice. KYC entails gathering detailed information about clients to establish their identity, assess their risk profile, and comprehend their transaction patterns. A financial institution, for example, may identify an individual who frequently transfers large sums to high-risk jurisdictions without a clear business justification.

Customer Due Diligence (CDD):

CDD processes should be aligned with each client’s and matter’s assessed risk. Consider the following scenario: You are representing a foreign company in a merger with a local company. The CDD process for this high-value, complex transaction would be far more thorough than it would be for a routine contract review for a local client.

Also Read: Customer Due Diligence vs Enhanced Due Diligence for Effective Risk Monitoring

Enhanced Due Diligence (EDD)

In certain circumstances, such as international transactions or dealings with high-risk customers, enhanced due diligence (EDD) is required. EDD entails going above and beyond standard due diligence procedures to thoroughly assess the risks associated with a customer or transaction. When dealing with a client from a country known for financial irregularities, for example, EDD measures may entail conducting extensive background checks and scrutinizing financial transactions more closely.

Transaction Monitoring:

This involves going over transactions regularly to ensure they match the client’s known profile. For example, if you’ve identified a client as high-risk because of their involvement in a politically sensitive matter, you should constantly monitor their transactions for any unusual or suspicious activity. If the client’s circumstances change, such as the acquisition of new business interests, it is necessary to update their CDD information.

Also Read: Monitoring of Transactions in KYC 2023

Policy Statement

Businesses must maintain a documented anti-money laundering policy statement to maintain strong anti-money laundering practices. This statement declares the company’s commitment to combating money laundering and details the preventive and investigative measures in place. This policy statement must be reviewed and updated regularly to ensure its effectiveness.

AML Controls

It is critical to implement AML controls that are appropriate for the size and nature of your business. For example, if you are a small business with a few employees and serve low-risk customers, you may not require an independent audit function. However, if you begin to do a lot of risky business, such controls will be required to ensure compliance.

Training:

Training ensures that your employees are prepared to comprehend and deal with money laundering situations. If you run a small payroll company, for example, training your employees to spot suspicious patterns in customer financial statements can help you spot irregularities like large deposits.

Reporting:

It is a legal requirement to investigate and report any suspicious transactions or behaviors to appropriate authorities. Importantly, you do not need concrete evidence of money laundering or terrorist financing to file a report; the mere presence of suspicious activity is sufficient reason to file a report. This proactive approach contributes to the early detection and prevention of potential financial crimes in small businesses.

Also Read: Machine Learning and Effective AML Ongoing Monitoring

Conclusion

AML Ongoing monitoring is not a one-time task, but rather an essential component of your small business’s AML compliance strategy. Your company can reduce the risk of financial fraud and money laundering by implementing these best practices and staying up to date on regulatory changes. You protect your reputation, your customers, and your bottom line by doing so. Remember that in the world of AML, vigilance is your most valuable asset.