What is Smurfing?

Smurfing is a financial practice in which large sums of money are divided into smaller transactions in order to avoid detection by regulatory authorities. This is accomplished by dividing the illegally obtained funds among various individuals known as “smurfs” who deposit the funds into the account. Different in various financial institutions. It is difficult to establish direct links between smurfs, deposits, and accounts by spreading deposits across multiple accounts and possibly using different identities, making it difficult for authorities to detect illegal activity. This process is what distinguishes structuring from smurfing in money laundering i.e. the use of smurfs, the movement of money, and the fact that the money’s source is illegal.

Financial institutions must be especially vigilant against “cuckoo smurfing,” a smurfing method that could involve or implicate their own employees in illegal activities. Here is an example:

Suppose Criminal A in the United States owes Criminal B in the United Kingdom $5000. Coincidentally, London Merchant A in the United Kingdom owes Vendor B in the United States the same amount. The London merchant transfers the owed funds to their UK bank account and instructs the bank to pay Vendor B in the United States. Now, the UK banker works with the US criminals to deposit $5000 into Vendor B’s account before transferring the same amount from Merchant A’s account to Criminal B’s account. The vendors and merchants are unaware of this intricate scheme, and the illicit money appears to be legitimate.

Smurfing Occurs in What Stage of Money Laundering

Like money laundering, smurfing occurs in three stages: placement, layering, and integration.

Placement:

A gambler can physically receive money from a country and deposit it in the legal financial system through the purchase of foreign currency, gambling, or other means.

Layering:

Smurfs use digital money to transfer money from one country to another, then divide it into smaller amounts or investments to break the trail and cut the link to the original crime. This can be accomplished by dividing the funds into a series of deposits or by purchasing money.

Also Read: Money Laundering Layering: Exposing the Hideout of Financial Criminals

Integration:

The Smurf acquires valuables such as property, artwork, precious metals, or automobiles, which are then passed on to the criminal. Because the funds appear to be legitimate, they can frequently avoid detection by authorities.

Also Read: From Concealment to Legitimacy: Understanding the Final Stage of Integration in Money Laundering

What is Structuring?

Structuring occurs when a large sum of money is purposefully divided into smaller transactions in order to avoid AML/CTF regulations. Although the money moved is legal, the arrangement is still illegal, even if the money is legal. By structuring, the criminal intentionally keeps money below the reporting threshold. They can also use multiple accounts to keep transactions hidden and avoid receiving suspicious activity reports (SARs).

The Money Laundering Control Act of 1986, which became Title 31 of the United States Code, criminalized structuring. For Example, a criminal gang that runs an illegal drug trafficking ring. One of the syndicate members visits several banks, making cash deposits totaling just under $10,000 each time. They do this several times over several days, ensuring that each deposit falls below the mandatory reporting threshold to financial authorities.

As an example:

Day 1: Make a deposit of $9,500 at Bank A.

Day 2: Make a deposit of $9,700 at Bank B.

Day 3: Make a deposit of $9,800 at Bank C.

Day 4: Make a deposit of $9,900 at Bank D.

This method is used by criminal organizations to cover up their sizeable illegal earnings as a number of legal transactions, making it more difficult for law enforcement to determine where the money came from. This makes it more difficult for law enforcement and financial institutions to detect suspicious money-laundering activities. The funds can then be moved further through additional transactions, masking their criminal origins and integrating them into the regular financial flow.

Structuring Occurs in What Stage of Money Laundering

It occurs in the second stage of money laundering known as “Layering”. The layering stage (also known as structuring) follows the placement stage. The layering process is the most complicated and frequently involves international financial transactions. The primary goal of this procedure is to separate illegal money from its source. This is accomplished through the sophistication layering of the financial transaction, which covers the investigation method and disassociates it from the original crime.

During this phase, lenders, for example, can begin to move money from one country to another, and separate it from investments made in high-income options or foreign markets; always moving it to avoid detection; always exploiting legal loopholes or misunderstandings, and taking advantage of delays in judicial or police support.

What is the Difference Between Smurfing and Structuring?

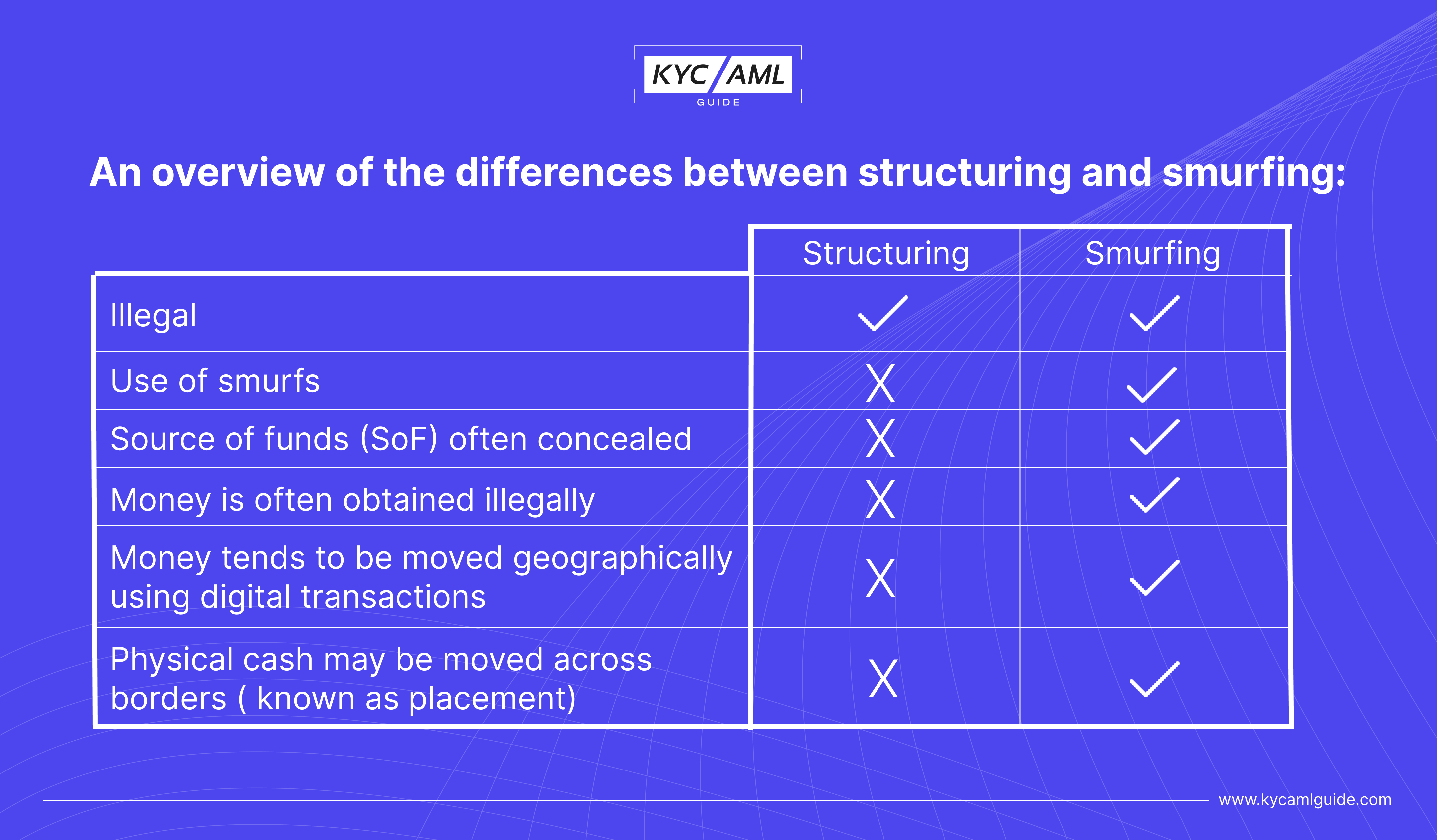

Structuring and Smurfing in money laundering are used interchangeably but there are subtle differences in them.

How To Detect Smurfing and Structuring In Your Business

Organizations and reporting entities can take several effective measures to combat structuring and smurfing in money laundering.

- It is critical to establish AML procedures, such as using risk management systems to identify and flag suspicious activities. AML regulations in the United States have evolved significantly since the 1970 Bank Secrecy Act, which initially required banks to report cash deposits exceeding $10,000. Similar measures have been implemented by the European Union and a number of other countries around the world.

- Implementation of the KYC process

- Comprehensive training programs should be provided to employees, educating them on smurfing and structuring detection and reporting channels.

- Close collaboration with financial institutions is essential to ensure diligent transaction monitoring in order to detect potential financial crimes.

- To identify smurfing instances, financial institutions can use advanced algorithms or Artificial Intelligence to identify unusual patterns or suspicious activity.